TIDMCRV

RNS Number : 0318G

Craven House Capital PLC

27 February 2015

27 February 2015

Craven House Capital Plc ("Craven House" or "the Company")

Interim Report for the period ended 30 November 2014

Highlights

* NAV of holdings decreased from GBP5.5m to GBP5.0m in

the six-month period. This was primarily the result

of a mark to market adjustment of our shareholding in

Pressfit Holdings Plc.

* The period was relatively quiet as management focused

on improving operations at existing portfolio

companies and evaluating larger transactions.

For further information please contact:

Craven House Capital Plc Tel: 07590 831 323

Alexandra Eavis

Non-Executive Director

and Company Secretary

www.Cravenhousecapital.com

SPARK Advisory Partners Tel: 0203 368 3550

Limited

Nominated Adviser

Matt Davis/Mark Brady

Overview

During the 6 months to 30 November 2014, Craven House focused on improving the

operational aspects of its portfolio companies as well as the evaluation of

several new opportunities.

We are disappointed to report a decrease in our NAV. This adjustment is primarily

as a result of the mark to market effects of Pressfit Holdings Plc, which was

listed on the AIM Market during the period. While we do not believe the market

value represents the intrinsic value of Pressfit, we do believe it was appropriate

and prudent to write down the holding on our books.

During the period, the Company evaluated several potential investments and we

continue to look at several transformational acquisitions. We spent significant

time and considerable effort on one particular transaction, which did not materialise,

as we simply could not get comfortable with the margin of safety we require

to commit capital. We are especially conservative when issuing new shares that

have a dilutive effect on existing shareholders. We remain firm in our stated

policy of using our shares as consideration in the acquisition only at 1.25p

or higher. If an acquisition does not increase the NAV on a per share basis,

except in very exceptional circumstances, we will not invest. While it is frustrating

for the board and shareholders alike that management time and resource is expended

without tangible result, we would rather err on the side of conservatism and

caution. In the period several of our holdings have undergone significant restructuring.

We believe this will result in enhanced earnings and increased valuations in

future periods.

Investment Activity

There were no new investments in the period.

Selected Performance Updates

* Pressfit Holdings Plc ('Pressfit') is a UK holding

company with subsidiaries manufacturing specialist

stainless steel pipe fittings in China. Craven

House's shareholding at the period end represented

25.3% ownership of Pressfit, through investments

totalling GBP516,648 with a further 2.1% of the

shares in Pressfit being available to the Company in

the event that an outstanding convertible loan is

exercised. The company listed on the AIM market

during the period and suffered from both a lack of

operational performance, mismanagement and market

apathy. Subsequent to the period, Pressfit was

de-listed from the AIM market after its Nominated

Adviser ("NOMAD"), Daniel Stewart & Company, lost its

NOMAD authorisation and Pressfit was unable to secure

a new NOMAD in the specified time period. We were

very frustrated with these events. We have voiced our

frustration and displeasure to the company and are

presently working with the other large shareholders,

one of which is an industry leader, to restructure

the management and move the company forward.

* Farm Lands of Africa. Farm Lands of Africa Ltd is a

private farming company with access to large-scale

farmland in Guinea. We remain intensely optimistic

about African farmland operations in general and

believe that Africa will become self sufficient in

food production. However, the outbreak of Ebola in

the area where our leases were located made

operations impossible. As our leases were contingent

on continuous operations we found it prudent to write

off our investment to zero at the prior year-end in

May 2014. We do believe once the country begins to

recover from the Ebola outbreak there will be

opportunity to renegotiate the leases and resume

operations. We cannot be certain any developments

will materialize but we are optimistic.

Working Capital

Operating and overhead costs continue to be managed very prudently. On-going

monthly operating costs were c.GBP15,000 (inclusive of all management fees),

during the period.

Immediate working capital needs will be met by cash in the bank, and the continued

support of the Company's major shareholder and Investment Manager, Desmond Holdings

Ltd. Desmond Holdings has confirmed it will continue to evaluate the extension

of existing loan facilities and to provide additional working capital loans

if and when required.

Interest and capital repayments of the mortgage over the Green Isle Hotel, and

cash generated by other existing investments, are expected to significantly

reduce the Company's requirement for additional working capital facilities going

forward.

Outlook

We are patient and opportunistic investors. We continue to be of the view that

our continuing focus on real assets in emerging markets and special situations

in developed markets will offer the best returns over the medium to longer term

particularly in the current global economic environment. We do not believe that

the Company's current stock market valuation accurately reflects the inherent

value of the investment portfolio nor the potential of our investment strategy.

We believe in creating long-term value for our shareholders and will not be

diverted by seeking short-term share price accretion with continual newsflow.

Our firm view is that risk is presently mispriced in the capital markets. Both

Bonds and Equities are overvalued and a reversal of capital flows will provide

a substantial opportunity for patient investors such as ourselves.

We are constantly seeking transformational acquisitions that would materially

enhance the valuation of your company and welcome introductions to new opportunities.

In particular we target businesses that balance high growth potential with the

risk mitigation that arises from being cash flow positive and having strong

management. We are particularly interested in generational transitions in family

businesses.

Conclusion

The board believes that Craven House Capital is an attractive acquisition vehicle

with increasing potential. When and where capital is scarce we will find the

best opportunities. Where capital is abundant and inexpensive, we will struggle

to find good value. Until such time as we find deep value we shall remain patient.

Our investment manager, Desmond Holdings, remains the largest shareholder of

Craven House Capital and has never sold a share. We are appreciative of the

support received from our shareholders to date and are committed to creating

value for the enterprise, and wealth for shareholders.

INCOME STATEMENT

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue - 249 249

Gross Portfolio return (469) 374 (845)

Other operating income - - -

Administrative expenses (96) (101) (307)

OPERATING PROFIT/(LOSS) (565) 522 (903)

Finance costs 2 (8) (10) (16)

Finance income 28 6 39

------------ ------------ ----------

PROFIT/(LOSS) BEFORE

INCOME TAX (545) 518 (880)

Income tax - - -

------------ ------------ ----------

PROFIT/(LOSS) FOR

THE PERIOD (545) 518 (880)

============ ============ ==========

Earnings per share

expressed

In pence per share:

Basic 6 (0.07) 0.09 (0.13)

Diluted 6 (0.06) 0.08 (0.13)

------------ ------------ ----------

STATEMENTS OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

PROFIT/(LOSS) FOR

THE PERIOD (545) 518 (880)

OTHER COMPREHENSIVE - - -

INCOME

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD (545) 518 (880)

============ ============ ==========

TOTAL COMPREHENSIVE

INCOME ATTRIBUTABLE

TO:

Owners of the company (545) 518 (880)

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS AT 30 NOVEMBER 2014

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Investments at fair

value through

profit or loss 4 5,626 6,114 6,095

------------ ------------ ----------

5,626 6,114 6,095

------------ ------------ ----------

CURRENT ASSETS

Trade and other receivables 116 76 114

Cash and cash equivalents 296 6 -

------------ ------------ ----------

412 82 114

------------ ------------ ----------

TOTAL ASSETS 6,038 6,196 6,209

============ ============ ==========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 5 8,519 8,423 8,519

Share premium 7,310 6,206 7,310

Retained earnings (10,844) (8,901) (10,299)

------------ ------------ ----------

TOTAL EQUITY 4,985 5,728 5,530

------------ ------------ ----------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 678 192 339

Financial liabilities-borrowings

interest bearing

loans and borrowings 7 375 276 340

------------ ------------ ----------

1,053 468 679

------------ ------------ ----------

TOTAL LIABILITIES 1,053 468 679

------------ ------------ ----------

TOTAL EQUITY AND

LIABILITIES 6,038 6,196 6,209

============ ============ ==========

STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

Called Profit

up share and loss Share Total

capital account premium equity

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 June 2013 8,313 (9,419) 4,948 3,842

Changes in equity

Issue of share capital 110 - 1,258 1,368

Total comprehensive

income - 518 - 518

---------- ---------- ---------- ----------

Balance at 30 November

2013 8,423 (8,901) 6,206 5,728

Changes in equity

Issue of share capital 96 - 1,104 1,200

Total comprehensive

income - (1,398) - (1,398)

---------- ---------- ---------- ----------

Balance at 31(st) May

2014 8,519 (10,299) 7,310 5,530

---------- ---------- ---------- ----------

Changes in equity

Issue of share capital - - - -

Total comprehensive

income - (545) - (545)

---------- ---------- ---------- ----------

Balance at 30 November

2014 8,519 (10,844) 7,310 4,985

---------- ---------- ---------- ----------

STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from

operations 257 10 (103)

Interest paid (8) (10) (16)

Net cash used in operating

activities 249 - (119)

Cash used in investing

activities

Purchase of fixed asset

investments - (1,182) (2,382)

Sale of fixed asset - - -

investments

Other loans 35 (187) (123)

Exchange variance re - - -

investments

Interest received 28 6 39

------------ ------------ ----------

Net cash used in investing

activities 63 (1,363) (2,466)

Cash from financing

activities

Share issue - 1,368 2,568

------------ ------------ ----------

Net cash from financing

activities - 1,368 2,568

------------ ------------ ----------

Increase/(Decrease)

in cash and cash equivalents 312 5 (17)

Cash and cash equivalents

at the beginning (16) 1 1

of period

Cash and cash equivalents

at the end of the 296 6 (16)

============ ============ ==========

period

Cash and cash equivalents

consist of: 296 6 (16)

Cash and cash equivalents

included in current

assets/(Trade and other

payables)

NOTES TO THE FINANCIAL INFORMATION

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

1. ACCOUNTING POLICIES

General Information

Craven House Capital plc is a company incorporated in the United

Kingdom under the Companies Act. The address of the registered

office is given on the company information page. The Company is

listed on the AIM Market of the London Stock Exchange (code:

CRV).

The next annual financial statements of Craven House Capital plc

will be prepared in accordance with applicable International

Financial Reporting Standards (IFRS) as adopted for use by the

European Union. Accordingly, the interim financial information in

this report has been prepared using accounting policies consistent

with IFRS. IFRS are subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the

International Financial Reporting Interpretations Committee (IFRIC)

and there is an on-going process of review and endorsement by the

European Commission. The financial information has been prepared on

the basis of the IFRS that the directors expect to be applicable as

at 31(st) May 2015.

Changes in accounting standards

IFRS 10, 11 and 12 are effective for the year ended 31 May 2015,

therefore these standards have been adopted as part of the

preparation of the results for the period ended 30 November 2014.

The principal changes as a result of these standards arise from

IFRS 10, as well as "Investment Entities"(Amendments to IFRS 10,

IFRS 12 and IAS 27).

Under IFRS 10, companies are able to consider whether they are

classed as an investment entity. An investment entity is an entity

that:

(a) obtains funds from one or more investors for the purpose of

providing those investor(s) with investment management

services;

(b) commits to its investor(s) that its business purpose is to

invest funds solely for returns from capital appreciation,

investment income, or both; and

(c) measures and evaluates the performance of substantially all

of its investments on a fair value basis.

In assessing whether a company meets the definition of an

investment entity, the following characteristics must be

considered:

(a) it has more than one investment;

(b) it has more than one investor;

(c) it has investors that are not related parties of the entity;

and

(d) it has ownership interests in the form of equity or similar

interests.

The directors have considered the definition of an investment

entity in IFRS 10 as well as the

associated application guidance. The directors considered that

Craven House Capital met the definition of an investment

entity.

Previously, the financial information presented included that of

Craven House Capital plc and its subsidiary undertaking, Craven

House Industries Limited ('CHI'). With effect from the current

accounting period ending 30 November 2014,the investment in CHI

will be accounted for at fair value through profit and loss and CRV

will present information for them as an individual entity and not

as a group. This has had no impact on the net assets reported in

prior periods.

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

1. ACCOUNTING POLICIES (continued)

The financial information has been prepared under

the historical cost convention except in relation

to the fair value adjustments required by accounting

standards. The principal accounting policies have

been applied to all periods presented.

This financial information is unaudited and does

not constitute statutory financial statements within

the meaning of Section 434 of the Companies Act

2006. The financial statements of the Company for

the year ended 31 May 2014, which were prepared

in accordance with IFRS as adopted for use by the

European Union, have been reported on by the Company's

auditors and delivered to the Registrar of Companies.

The report of the auditors was unqualified and did

not include any statement under Section 498 of the

Companies Act 2006.

This financial information is presented in pounds

sterling, rounded to the nearest GBP'000. Pounds

sterling is the currency of the primary economic

environment in which the company operates.

The directors do not propose the issuance of a dividend.

The interim financial information for the six months

ended 30 November 2014 was approved by the directors

on 27 February 2015.

Going concern

At the balance sheet date, the Company had drawn down

non-interest bearing loans from Desmond to enable it to make

qualifying investments under its Investing Policy and to provide

working capital for the Company. Although amounts drawn down are

repayable within 12 months of the balance sheet date, Desmond has

agreed that it will not seek repayment of outstanding balances in

respect of both facilities unless the Company is in a position to

make the repayment. Of the initial amount drawn down, GBP299,000

remained outstanding at the period end. The Directors also aim to

generate cash from yield-based investments; and full / partial

exits of the Company's more liquid investments (if required).

Further to the successful private placing; the ongoing working

capital facility provided by Desmond; and income generated by

investments, the Board is pleased to report that the Company can

prepare accounts on the going concern basis.

2. Finance expense

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Loan interest 8 10 16

8 10 16

-------------- ------------ ----------

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

3. Taxation

No tax charges arose in the period or in comparative

periods as a result of losses incurred.

4. Investments at fair value through profit or

loss

Quoted Unquoted

Investments Investment Total

GBP'000 GBP'000 GBP'000

At 1 June 2014 (audited) 11 6,084 6,095

Additions - - -

Revaluations (573) 104 (469)

Reclassification 1,182 (1,182) -

At 30(th) November

2014 (unaudited) 620 5,006 5,626

============= ============ =========

Quoted investments at 30 November 2014 are as

follows;

Shares held in Farm Lands of Africa Inc, a company

listed on the OTC markets in New York are valued

at GBP12,407. The shares in Farm Lands of Africa

Inc have been measured on a Level 3 basis due

to these not being traded in an active market.

Shares held in Pressfit Holdings Plc, a company

listed on the AIM Market of the London Stock Exchange,

are valued at GBP516,648. These have been measured

on a Level 1 basis due to these being traded in

an active market.

A convertible loan to Pressfit Holdings Plc valued

at GBP91,376. This has been valued based on the

number of shares that Craven House Capital would

receive on conversion at the market price of the

shares at the date of its IPO as the Directors

belive this is the best indication of the fair

value of the loan at the reporting date.

Unquoted investments at 30 November 2014 have

been measured on a Level 3 basis as no observable

market data was available. These investments are

as follows:

Shares in Ceniako Limited valued at GBP796,061,

representing a 49% holding. These have been valued

at the price paid by Craven House Capital as the

Directors believe that the price of recent investment

continues to represent the best indication of

the fair value at the period end.

Shares in Finishtec Acabamento Tecnicos em Matais

Ltda valued at GBP639,551. This is held through

a 95% subsidiary Craven House Industries Limited

giving the group a 50.1% stake. These have been

valued at the price paid by Craven House Capital,

as the Directors believe that the price of recent

investment continues to represent the best indication

of the fair value at the period end.

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

4. Investments at fair value through profit or loss

(continued)

Shares in EmVest Barvale (Pty) Ltd valued at GBP438,735,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the period end.

Shares in EmVest Evergreen (Pty) Ltd valued at GBP0,

representing a 49% holding. These have not been attributed a value

as the Directors believe that this is the best indication of the

value at the period end.

Shares in EmVest Evergreen Properties (Pty) Ltd valued at

GBP493,514, representing a 49% holding. These have been valued at

the price paid by Craven House Capital as the Directors believe

that this is the best indication of the value at the period

end.

Shares in EmVest Foods (Pty) Ltd valued at GBP164,505,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the period end.

Shares in Royalty Sports Brands Ltd valued at GBP1,279,019,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the period end.

Shares in Farm Lands of Africa Ltd valued at GBP311,966,

representing a 50% holding. The value of the shares have been

written down to zero as the Directors believe that this is the best

indication of the value at the period end considering the recent

Ebola outbreak in Guinea.

A loan with Greentel Limited valued at GBP1,194,090. The period

end valuation is based on the agreed conversion of the loan into a

facility of EUR1,500,000 on 28 November 2013, which the Directors

believe is the most appropriate indicator of the period end

valuation based on the information available to them.

5. CALLED UP SHARE CAPITAL

The Company's authorised share capital is as follows:

Number Class: Nominal 30 Nov 31May

Value 2014 2014

(Unaudited) (Audited)

GBP'000 GBP'000

2,280,038,212 Ordinary 0.001 2,280 2,280

77,979,412 Deferred 0.09 7,018 7,018

77,979,412 Deferred 0.009 702 702

------------ ----------

10,000 10,000

============ ==========

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

5. CALLED UP SHARE CAPITAL (continued)

Issued and fully paid share capital as at 30 November

2014 are as follows:

Number Class: Nominal 30 Nov 31 May

Value 2014 2014

(Unaudited) (Audited)

GBP'000 GBP'000

798,466,557 Ordinary 0.001 799 799

(2013: 702,466,557)

77,979,412 Deferred 0.09 7,018 7,018

77,979,412 Deferred 0.009 702 702

-------------- ----------

8,519 8,519

============== ==========

The deferred shares carry no entitlement to receive

notice of any general meeting, to attend, speak

or vote at such general meeting. Holders are not

entitled to receive dividends, and on a winding

up of the Company holders of deferred shares are

entitled to a return of capital only after the

holder of each Ordinary share has received a return

of capital together with a payment of GBP1 million

per share. The deferred shares may be cancelled

at any time for no consideration by way of a reduction

in capital.

There was no movement in share capital in the six

months ended 30 November 2014.

6. EARNINGS PER SHARE

The calculation of basic earnings per share is based on the loss

attributable to the equity holders for the period of GBP545,000 and

on weighted average number of shares in issue of 798,466,557 (Six

months ended 30 November 2013: profit of GBP518,000 and 606,865,654

shares; Year ended 31 May 2014 loss of GBP880,000 and 673,998,159

shares) being the weighted average number of shares, in issue

during the period.

The calculation of diluted earnings per share is based on the

loss attributable to the equity holders for the period of

GBP545,000 and on weighted average number of shares and warrants in

issue of 880,692,823 (Six months ended 30 November 2013: profit of

GBP518,000 and 689,091,920 shares; Year ended 31 May 2014 loss of

GBP880,000 and 710,752,399 shares) being the weighted average

number of shares and warrants, in issue during the period.

7. LOANS

Other loans of GBP375,000 comprise advances made by Desmond

Holdings Ltd ("Desmond") totalling GBP299,000 and loans made by

Wise Star Capital Investment Limited totalling GBP76,000, both

being Hong Kong investment companies. The loans were provided to

enable the Company to make qualifying investments under its

Investing Policy and to provide working capital for the

Company.

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2014

7. LOANS (continued)

The terms of the loans provided by Desmond are as follows:

a) Investment facility

Non-interest bearing loan facility of up to GBP700,000,

originally provided in December 2010. The majority of this has now

been repaid and as at 30 November 2014, the Company's borrowings

under this facility totalled GBP47,000.

b) Working capital loans

Interest-bearing loans provide financial support to enable the

Company to meet its reasonable working capital requirements. The

facility will remain in place for at least 12 months from the date

of approval of the financial statements. Desmond has agreed that it

will not seek repayment of outstanding balances in respect of both

facilities unless the Company is in a position to make the

repayment.

The loan provided by Wise Star Capital Investment Limited

includes interest payable at a rate of 6% per annum. The loan was

provided for 12 months dated 1st September 2011; however this loan

has since been extended. The amount owed to Wise Star Capital

Investment Limited at the balance sheet date was GBP76,000.

7. RELATED PARTY DISCLOSURES

During the period, the Company entered into the following

transactions with related parties and connected parties:

Loans from Desmond Holdings Limited

At the period end the Company owed GBP299,000 to Desmond

Holdings Limited, the Company's Investment Manager and major

shareholder in the Company.

Management fees payable to Desmond Holdings Limited

At the period end, included in trade creditors, is an amount of

GBP35,000 payable to Desmond Holdings Limited, in respect of

management services provided. The total amount owed to Desmond in

respect of unpaid invoices at the balance sheet date was

GBP227,500.

Investment in Pressfit Holdings Plc

At the period end the Company held shares in Pressfit Holdings

Plc and a convertible loan was owed to the Company, both of which

were included in quoted investments. During the period Mark Pajak

was Chairman of Pressfit Holdings Plc.

8. EVENTS AFTER THE REPORTING PERIOD

No reportable events occurred after the reporting period.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BQLLLELFXBBD

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

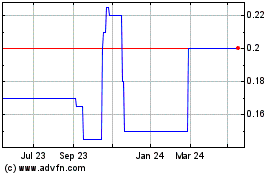

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jul 2023 to Jul 2024