TIDMCOD

RNS Number : 4852U

Compagnie de Saint-Gobain

29 July 2015

Paris, July 29, 2015

First-half 2015 results

Upswing in results

Following the signature of the agreement with Apollo and in accordance

with IFRS 5, the Packaging business (including Verallia North America)

was reclassified within "Net income from discontinued operations" in the

2014 and 2015 income statement.

* Organic growth at 0.5% (including a positive 0.5%

price impact)

* Strong 4.6% positive currency impact on sales and

0.3% negative Group structure impact

* Operating income up 7.8% on a reported basis and up

1.2% like-for-like before the reclassification of

Verallia

* Net debt reduced by EUR0.5 billion compared to June

30, 2014

* Repurchase of around 4.6 million shares over the last

3 months

(EURm) H1 2014 H1 2015 Change

(restated)

Sales 18,946 19,860 +4.8%

EBITDA 1,767 1,886 +6.7%

Operating income 1,183 1,275 +7.8%

Recurring(1) net income 441 552 +25.2%

Net income(2) 671 558 -16.8%

Free cash flow(3) 647 728 +12.5%

Pierre-André de Chalendar, Chairman and Chief Executive Officer of

Saint-Gobain, commented:

"After a first quarter marked by a tough basis for comparison, second-quarter

sales returned to volume growth, driven by the rebound in North America

on the back of an upturn in Roofing and by good momentum in Asia, emerging

countries and Western Europe except France and Germany. First-half operating

income and our outlook for the rest of the year confirm our objective

of a further like-for-like improvement in operating income in 2015 along

with continuing high levels of free cash flow."

1. Recurring net income from continuing operations, excluding capital

gains and losses on disposals, asset write-downs and material non-recurring

provisions.

2. Consolidated net income attributable to the Group.

3. Free cash flow from continuing operations, excluding the tax impact

of capital gains and losses on disposals, asset write-downs and material

non-recurring provisions.

Operating performance

First-half sales were up 4.8% to EUR19,860 million, after

reclassification of the Packaging business (including Verallia

North America) within "Net income from discontinued operations" in

the income statement.

After this restatement (IFRS 5), changes in Group structure had

a negative 0.3% impact on sales. Exchange rates continued to have a

strong positive impact (4.6%), chiefly driven by the US dollar and

pound sterling.

On a like-for-like basis, sales edged up 0.5%. Volumes were

stable over the first half and rose 1.5% in the second quarter

alone. Amid low raw material cost inflation and energy cost

deflation, prices continued to rise slightly, up 0.5% over the

first half.

After a slight decline in the first quarter, the three months to

June 30 saw growth in all regions except France and Germany. By

business, the first half confirmed the upturn in Flat Glass and the

expected contraction in Exterior Solutions, related mainly to price

levels in the Roofing business.

The Group's operating income climbed 7.8% on a reported basis

and remained stable like-for-like versus first-half 2014 due to the

absence of volume growth. Before the reclassification of the

Packaging business and on a like-for-like basis, operating income

moved up 1.2%. The Group's operating margin widened 0.2 points

year-on-year, to 6.4%.

Performance of Group Business Sectors

Innovative Materials like-for-like sales continued to improve,

up 2.6% thanks to Flat Glass. The Business Sector's operating

margin moved up to 10.2% versus 9.1% in first-half 2014.

-- The second quarter confirmed the upbeat trends seen early in

the year in Flat Glass, which posted 5.6% organic growth over the

six months to June 30. Automotive Flat Glass continued to report

strong gains in all regions, excluding Brazil. Construction markets

remained upbeat in Asia and emerging countries, but retreated in

Western Europe where prices remained stable.

Rising volumes, together with the full impact of cost savings

and an improved product mix, helped drive renewed growth in the

operating margin at 7.4%.

-- High-Performance Materials (HPM) like-for-like sales slipped

0.8% over the first half, hit mainly by the downturn in ceramic

proppants. Other HPM businesses continued to deliver organic

growth.

Despite this decline in organic growth, the operating margin

came in at 13.5% versus 13.3% in the same period one year

earlier.

Construction Products (CP) like-for-like sales advanced 0.9%

over the first half. The operating margin narrowed to 8.7% versus

9.0% in first-half 2014, affected by Exterior Solutions.

-- Interior Solutions posted 2.2% organic growth over the

six-month period. In Western Europe, despite a slight improvement

in volumes, trading continued to be affected by the market

situation in France and Germany, coupled with a slight downward

pressure on prices. The US, Asia and emerging countries continued

to grow.

The operating margin moved up to 9.0% versus 8.5% in first-half

2014.

-- Exterior Solutions slipped 0.4% despite a 5.7% rally in the

second quarter, due mainly to the Roofing business, where volumes

rose sharply after a very weak start to the year. Prices for this

business were down significantly on the same year-ago period,

despite stabilizing quarter-on-quarter. Pipe continued to be buoyed

by export contracts, but was affected by anemic demand in

infrastructure markets in Western Europe and Brazil. Mortars

enjoyed good organic growth in Asia and emerging countries,

although growth continued to be hindered by Western Europe.

The operating margin fell to 8.3% from 9.5% in first-half 2014,

due chiefly to prices for Exterior Products in the US: Roofing

benefited from falling asphalt prices, mainly in the second

quarter.

Building Distribution like-for-like sales stabilized in the

second quarter, up 0.1%, limiting the decline over the six-month

period to 1.1%. France was once again impacted by the sharp

contraction in new-builds and by a renovation market yet to show

signs of improvement. Germany declined over the first half,

although the pace of decline slowed in the second quarter. In

contrast, the UK reported further organic growth and a particularly

upbeat trend emerged in the Nordic countries, the Netherlands,

Southern Europe and Brazil. Overall, despite the downturn in France

and Germany which together account for around half of the Business

Sector's sales, the operating margin proved resilient, at 2.6%

versus 2.9% in first-half 2014, thanks to the advances reported in

all other regions.

Analysis by region

The Group's organic growth and margins advanced, lifted by Asia

and emerging countries, and by countries in the "Other Western

Europe" region.

-- France was hit once again by the decline in the construction

market in the second quarter, reporting negative organic growth of

3.3% for the three months to June 30 and of 4.2% over the first

half. The operating margin narrowed as a result, at 2.6%.

-- Other Western European countries, up 2.4% over the quarter,

confirmed their organic growth, which came in at 1.7% for the first

half. This performance reflects good market conditions in the UK

and Scandinavia and an upturn in Southern European countries.

Germany, which was still slightly down in the second quarter,

retreated 3.7% on the back of sluggish renovation activity. The

operating margin for the region improved, at 5.4% versus 4.7% in

first-half 2014.

-- North America posted 4.9% like-for-like sales growth in the

second quarter, powered by the catch-up in Roofing volumes and to a

lesser extent by Interior Solutions. Over the six-month period, the

region posted negative organic growth of 2.2%, chiefly impacted by

subdued Roofing prices and a slower pace of growth in industrial

markets. The operating margin was therefore down, at 9.5% compared

to 10.9% in first-half 2014.

-- Asia and emerging countries continued to deliver good organic

growth, which came in at 4.8% for the first six months of the year.

Latin America advanced 8.2%, with Brazil proving resilient in a

tough macroeconomic environment. Eastern Europe was up 4.3%, buoyed

by brisk trading in the Czech Republic, while Asia advanced 0.8%,

lifted by India.

The operating margin rose to 10.0% of sales, compared to 8.8%

one year earlier.

Verallia

Packaging (Verallia) sales moved up 2.1% at constant exchange

rates excluding Verallia North America. Organic growth over the

first half was driven by small volume gains in Europe and by rising

prices in Latin America in an inflationary environment.

The operating margin came in at 9.7%.

Analysis of the consolidated financial statements for first-half

2015

The unaudited interim consolidated financial statements were

subject to a limited review by the statutory auditors. They were

approved and adopted by the Board of Directors on July 29,

2015.

Following the signature of the agreement with Apollo on June 6,

2015 (involving a firm and binding offer from Apollo regarding the

Packaging business and exclusive talks with Apollo) and in

accordance with IFRS 5, the Packaging business (including Verallia

North America) is shown within "Net income from discontinued

operations" in the income statement for 2014 and 2015.

H1 2014 H1 2015 % change H1 2014

Restated* Published

-----------

EURm (A) (B) (B)/(A)

----------- -------- --------- -----------

Sales and ancillary revenue 18,946 19,860 4.8% 20,446

Operating income 1,183 1,275 7.8% 1,330

Operating depreciation and amortization 584 611 4.6% 667

EBITDA (op.inc. + operating depr./amort.) 1,767 1,886 6.7% 1,997

Non-operating costs (12) (154) n.s. (16)

Capital gains and losses on disposals,

asset write-downs, corporate acquisition

fees and earn-out payments (51) (41) -19.6% (54)

Business income 1,120 1,080 -3.6% 1,260

Net financial expense (336) (328) -2.4% (354)

Income tax (158) (236) 49.4% (212)

Share in net income (loss) of non-core

business equity-accounted companies (1) 0 n.s. (1)

Net income from continuing operations 625 516 -17.4% 693

Net income from discontinued operations 68 69 1.5% 0

Net income before minority interests 693 585 -15.6% 693

Minority interests 22 27 22.7% (22)

Net attributable income 671 558 -16.8% 671

Earnings per share(2) (in EUR) 1.19 0.98 -17.6% 1.19

Recurring(1) net income from continuing

operations 441 552 25.2% 511

Recurring(1) earnings per share(2)

from continuing operations (in EUR) 0.78 0.97 24.4% 0.91

Cash flow from continuing operations(3) 1,045 1,195 14.4% 1,198

Cash flow from continuing operations

excl. cap. gains tax(4) 1,010 1,185 17.3% 1,162

Capital expenditure of continuing operations 363 457 25.9% 449

Free cash flow from continuing operations 647 728 12.5% 713

(excluding capital gains tax)(4)

Investments in securities of continuing

operations 48 92 91.7% 48

Net debt 8,519 7,995 -6.2% 8,519

* First-half 2014 figures have been restated to reflect the impacts of IFRS 5.

1 Excluding capital gains and losses on disposals, asset

write-downs and material non-recurring provisions.

2 Calculated based on the number of shares outstanding

(excluding treasury shares) at June 30 (569,364,905 shares in 2015,

including the increase in capital following payment of the stock

dividend on July 3, 2015, versus 564,079,733 shares in 2014).

3 Excluding material non-recurring provisions.

4 Excluding the tax impact of capital gains and losses on

disposals, asset write-downs and material non-recurring

provisions.

The comments below make reference to the restated financial

statements for 2014, after reclassification of the Packaging

business (including Verallia North America) within "Net income from

discontinued operations" in the income statement.

Consolidated sales advanced 4.8% on a reported basis. Exchange

rates had a positive 4.6% impact on sales, mainly due to gains in

the US dollar and pound sterling against the euro. Changes in Group

structure had a negative 0.3% impact, primarily reflecting sales of

small, non-core businesses. Like-for-like (comparable structure and

exchange rates), sales were up 0.5%, lifted by the price

effect.

Operating income climbed 7.8% on a reported basis, driven

chiefly by the currency effect. The operating margin improved to

6.4% of sales versus 6.2% in first-half 2014, buoyed by an improved

margin in Innovative Materials.

EBITDA (operating income + operating depreciation and

amortization) was up 6.7%. The Group's EBITDA margin came out at

9.5% of sales versus 9.3% of sales in first-half 2014.

Non-operating costs totaled EUR154 million, with a decrease in

restructuring costs compared to the same period in 2014. The

first-half 2014 basis for comparison (EUR12 million) included the

EUR202 million write-back from the provision to reflect the

reduction in the automotive Flat Glass fine. The EUR45 million

accrual to the provision for asbestos-related litigation involving

CertainTeed in the US is unchanged from the last few half-year

periods.

The net balance of capital gains and losses on disposals, asset

write-downs and corporate acquisition fees was a negative EUR41

million versus a negative EUR51 million in first-half 2014, which

had benefited from the EUR375 million capital gain on the disposal

of Verallia North America. Asset write-downs also represented

EUR452 million in first-half 2014 compared to EUR24 million in the

six months to June 30, 2015. Business income for the period fell to

EUR1,080 million (down 3.6% on first-half 2014 which included the

one-off EUR202 million provision write-back).

Net financial expense improved, down 2.4% to EUR328 million from

EUR336 million one year earlier, reflecting the decrease in the

cost of gross debt to 3.7% at June 30, 2015 (4.4% at June 30,

2014). The improvement came despite the increase in other financial

expenses mainly due to the discounting of provisions with no cash

impact.

The income tax rate on recurring net income remained stable at

30%. Income tax expense totaled EUR236 million, up from the

exceptionally low EUR158 million in first-half 2014 resulting from

asset write-downs in the period, capital gains on the disposal of

Verallia North America and the write-back of the provision for the

Flat Glass fine.

Recurring net income from continuing operations (excluding

capital gains and losses on disposals, asset write-downs and

material non-recurring provisions) jumped 25.2% to EUR552

million.

Net attributable income was down 16.8% to EUR558 million and

includes net income relating to Verallia (attributable to the

Group) for EUR65 million (EUR67 million in first-half 2014).

Capital expenditure totaled EUR457 million (EUR363 million in

first-half 2014), representing 2.3% of sales compared to a

particularly low 1.9% of sales in the same period one year

earlier.

Cash flow from operations rose 14.4% to EUR1,195 million; before

the tax impact of capital gains and losses on disposals, asset

write-downs and material non-recurring provisions, cash flow from

operations was up 17.3% to EUR1,185 million, while free cash flow

(cash flow from operations less capital expenditure) advanced 12.5%

to EUR728 million (3.7% of sales versus 3.4% of sales in first-half

2014).

The difference between EBITDA and capital expenditure improved,

up 1.8% to EUR1,429 million (EUR1,404 million in the six months to

June 30, 2014), representing 7.2% of sales (7.4% in first-half

2014).

Operating working capital requirements (WCR) totaled EUR4,448

million at June 30, 2015 (EUR4,888 million in the same year-ago

period), representing 40.8 days' sales, an improvement of 2.5 days

year-on-year (an improvement of around 1 day excluding the impact

of Verallia and exchange rates).

Investments in securities were limited, at EUR92 million (EUR48

million in first-half 2014) and correspond to small-scale

acquisitions in the three business sectors.

Net debt continues to improve gradually, down 6.2% year-on-year

to EUR8.0 billion. Net debt represents 40% of consolidated equity,

compared to 46% at June 30, 2014.

The net debt to EBITDA ratio came in at 2.1 (1.9 before the

reclassification of the Packaging business), compared to 2.0 at

end-June 2014.

Update on asbestos claims in the US

Some 2,000 claims were filed against CertainTeed in the first

half of 2015 (as in first-half 2014). At the same time, around

2,000 claims were settled (versus 3,000 in first-half 2014),

bringing the total number of outstanding claims to around 37,000 at

June 30, 2015, unchanged from December 31, 2014.

A total of USD 71 million in indemnity payments were made in the

US in the 12 months to June 30, 2015, versus USD 68 million in the

year to December 31, 2014.

2015 outlook and action plan priorities

After a first half penalized by tough prior-year comparatives,

the Group will benefit from a more favorable climate in the six

months to December 31:

- France should gradually stabilize.

- Regarding other Western European countries, the outlook in

Germany remains uncertain; the UK and Nordic countries should

continue to deliver good growth in the second half, and Spain

should continue to improve significantly.

- In North America, trading should improve in the second

half.

- In Asia and emerging countries, our businesses should continue

to post good organic growth over the full year, despite the

slowdown in Brazil.

The Group confirms its action plan priorities:

- keep its priority focus on increasing sales prices amid low

raw material cost inflation and energy cost deflation;

- unlock additional cost savings of EUR360 million excluding

Verallia (calculated on the 2014 cost base), of which EUR190

million in the first half;

- pursue a capital expenditure program of around EUR1,500

million excluding Verallia;

- renew its commitment to invest in R&D in order to support

its differentiated, high value-added strategy;

- finalize the divestment of Verallia, which should be effective

before the end of the year;

- pursue its plan to acquire a controlling interest in Sika.

In line with its long-term objectives, Saint-Gobain repurchased

4.6 million shares over the last three months. To date, this almost

entirely offsets the 2015 dilution resulting from the Group Savings

Plan and the exercise of stock options.

Lastly, Saint-Gobain confirms its objectives and expects a

further like-for-like improvement in operating income for 2015 and

a continuing high level of free cash flow.

Financial calendar

- Sales for the first nine months of 2015: October 28, 2015,

after close of trading on the Paris Bourse.

Analyst/Investor relations Press relations

--------------------------------------- ---------------------------------------------------------------

+33 1 47 62

32 52

+33 1 47 62 +33 1 47 62 30

Gaetano Terrasini 44 29 48

Vivien Dardel +33 1 47 62 Sophie Chevallon +33 1 47 62 43

Marine Huet 30 93 Susanne Trabitzsch 25

--------------------- ---------------- -------------------------------------------- -----------------

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/4852U_-2015-7-29.pdf

An information meeting for analysts and investors will be held

at 8:30am (GMT+1) on July 30, 2015 and will be broadcast live on

www.saint-gobain.com.

Important disclaimer - forward-looking statements:

This press release contains forward-looking statements with

respect to Saint-Gobain's financial condition, results, business,

strategy, plans and outlook. Forward-looking statements are

generally identified by the use of the words "expect",

"anticipate", "believe", "intend", "estimate", "plan" and similar

expressions. Although Saint-Gobain believes that the expectations

reflected in such forward-looking statements are based on

reasonable assumptions as at the time of publishing this document,

investors are cautioned that these statements are not guarantees of

its future performance. Actual results may differ materially from

the forward-looking statements as a result of a number of known and

unknown risks, uncertainties and other factors, many of which are

difficult to predict and are generally beyond the control of

Saint-Gobain, including but not limited to the risks described in

Saint-Gobain's registration document available on its website

(www.saint-gobain.com). Accordingly, readers of this document are

cautioned against relying on these forward-looking statements.

These forward-looking statements are made as of the date of this

document. Saint-Gobain disclaims any intention or obligation to

complete, update or revise these forward-looking statements,

whether as a result of new information, future events or

otherwise.

This press release does not constitute any offer to purchase or

exchange, nor any solicitation of an offer to sell or exchange

securities of Saint-Gobain.

For further information, please visit www.saint-gobain.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGZNKLVGKZM

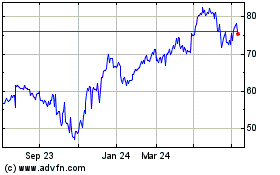

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

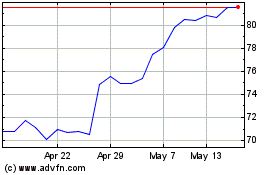

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024