Comino PLC - Final Results

June 10 1999 - 3:31AM

UK Regulatory

RNS No 5931a

COMINO PLC

10 June 1999

COMINO PLC

FINAL RESULTS ANNOUNCEMENT

Record PBT up 39%; Diluted EPS up 27%; Total dividend up 50%;

Proposed full listing in July; Prospects "Excellent"

Comino plc (Comino), the provider of software based business solutions and

related call centre technology for occupational pensions, social housing and

local authorities, announces final results for the year ended 31 March 1999.

Comino is a market leader in each of its chosen sectors and owns its own

workflow and electronic document management software which it uses to provide

process based applications. Electronic commerce and the internet increasingly

demand workflow techniques to ensure satisfactory completion of business

processes.

1999 1998 Increase

Turnover #18.6m #13.2m +41%

Profit before tax #2.72m #1.95m +39%

Diluted EPS 14.83p 11.71p +27%

Proposed dividend 1.25p paid interim no interim

2.50p final 2.50p interim +50%

Net cash #7.4m #4.3m

* Local authority "revenue" systems up from six to forty in two years

* New Universal Pensions Management product successfully launched

* Organic growth in profits and turnover was significant in all divisions.

Regarding the Results, in the Chairman and Chief Executive's Statement, Gordon

Skinner, Chairman, said:

"Group revenues arose from recurring revenues from support contracts, sales of

upgrades and services to the installed base and sales of 'new name' business.

Recurring revenues accounted for 35% of turnover and covered 49% of overheads.

Upgrades and services to the customer base accounted for approximately another

third of revenues."

Regarding Prospects, in the Chairman and Chief Executive's Statement, Garth

Selvey, Chief Executive, said:

"Comino enters the millennium year with sound customer bases and products,

well balanced revenues, strong order books and active market sectors. The

prospects for the future are excellent."

Enquiries:-

Garth Selvey, Chief Executive

Paul Clifford, Finance Director

Comino plc: 01628 - 525433

Editor's note:

Comino's operating companies are based in the Home Counties and Yorkshire.

Chairman and Chief Executive's Statement

Comino's main market sectors are social housing, local government and

occupational pensions. All of these require high customer service levels and

effective cost control driven by legislation, public accountability and a

resultant need to use electronic commerce effectively. In this environment,

Comino has achieved excellent results for both its customers and shareholders.

Turnover of #18.6m has increased by 41% over last year. Gross profit margins

have been maintained at 69% and overheads as a percentage of gross profit have

held steady at 81%. This has produced a profit before taxation of #2.7m up by

39%, an outstanding performance from Comino prior to a proposed full listing

in July of this year.

Group revenues arise from three sources. These are recurring revenues from

support contracts, sales of upgrades and services to the installed base and

sales of 'new name' business. Recurring revenues account for 35% of turnover

and cover 49% of overheads. Upgrades and services to the customer base

account for approximately another third of revenues. This balanced revenue

mix is particularly invaluable in the millennium year.

Cash balances of #7.4m compared to last year's #4.3m reflect Comino's ability

to turn its profit into cash. Net assets have increased from #1.7m to #3.3m.

An interim dividend of 1.25 pence per share was paid and a final dividend of

2.50 pence per share is proposed which represents an overall increase in

dividend of 50%. Diluted earnings per share increased 27% from 11.71 pence to

14.83 pence.

All operations finished the year strongly with firm order books. Tight

control was maintained on operating overheads, whilst investment in

development continued, leaving all products well positioned for the future

within their respective market sectors.

There were no acquisitions during the year, with the increase in profit

stemming from organic growth. Quality acquisitions which fit the Group's

'business to public' strategy and use Comino's technology and skills remain a

clear objective. Meanwhile, Comino has strong organic growth opportunities to

improve shareholder value.

Comino's markets are all driven by strong external influences which generate

business for the Group. Local authorities need to manage high customer

service levels whilst under pressure to deliver best value. Many pension

schemes, in addition to increasing regulation, face change from final-salary

to money-purchase schemes with corresponding increases in administration.

Housing operations have traditionally been subjected to high levels of

accountability and this process continues. A Comino solution which improves

service and saves money is clearly a desirable solution.

Call centres are a growing phenomenon. They are often perceived as a large

number of operators in a single location, and whilst many of these do exist,

others are 'virtual' and often more complex in their dealings. These comprise

a number of people with different skills linked by electronic commerce

techniques across a number of locations. In the context of occupational

pensions for example, these can be people with clerical, sales, accounting or

actuarial skills working at the office, on the road or from home. Comino's

solutions for occupational pensions, housing and local authority departments

include these facilities. In the future, we expect that second generation

'virtual' call centres will outnumber centralised operations.

In May 1999, Comino announced its Universal Pensions Management (UPM) product.

This replaces a separate workflow-based service layer and a third party

pensions calculation product. UPM has been designed as a single product which

is totally seamless and process driven: a concept which will extend to other

Group markets, notably housing.

In technology terms Comino remains strategically well placed for the future,

and the significance of owning our own workflow and electronic document

management is greater than ever. Workflow produces effective process

management and is particularly appropriate if the people involved in bringing

the process to the customer operate from different locations or are mobile.

Electronic commerce and the internet increasingly demand workflow techniques

to ensure satisfactory completion of business processes. As the internet

further penetrates traditional business processes, Comino is particularly well

positioned to benefit.

In January 1999, Gordon Skinner was appointed as Chairman and Michael Greig,

Finance Director of RM plc, joined the Board as a non-executive Director.

They replace Mike Brooke and Simon Acland, both of whom were founder Directors

of the Company.

All Comino's operations have performed well throughout the year, and this is

largely due to the continued efforts of a professional staff. We wish once

again to thank staff and fellow directors for their efforts and commitment.

Our thanks also extend to our customers who work with us and invest much time

and effort to make our products a success within their organisations.

Comino enters the millennium year with sound customer bases and products,

well- balanced revenues, strong order books and active market sectors. The

Group continues to employ technology profitably to the benefit of its

customers and shareholders; the prospects for the future are excellent.

Gordon Skinner Chairman

Garth Selvey Chief Executive

Consolidated Profit and Loss Account

for the year ended 31 March 1999

1999 1998

#'000 #'000

Total Total

Turnover 18,595 13,151

Cost of sales (5,784) (4,089)

--------- ---------

Gross profit 12,811 9,062

Administrative costs (10,377) (7,285)

--------- ---------

Operating profit 2,434 1,777

Interest receivable 288 176

Interest payable (4) (3)

--------- ---------

Profit on ordinary activities before taxation 2,718 1,950

Tax on profit on ordinary activities (676) (453)

--------- ---------

Profit on ordinary activities after taxation 2,042 1,497

Minority interest - equity - (56)

--------- ---------

Profit for the financial year 2,042 1,441

Dividends (513) (330)

--------- ---------

Retained profit for the financial year 1,529 1,111

===== =====

Basic earnings per share 15.21p 12.33p

===== =====

Diluted earnings per share 14.83p 11.71p

===== =====

The Group had no recognised gains or losses during the year ended 31 March

1999 other than the profit for the year.

Consolidated Balance Sheet

as at 31 March 1999

1998

1999 as restated

#000 #000

Fixed assets

Tangible assets 649 714

Current assets

Stocks 859 291

Debtors 6,596 5,449

Cash at bank and in hand 7,449 4,329

-------- --------

14,904 10,069

Creditors: amounts falling due within one year (5,678) (4,245)

-------- --------

Net current assets 9,226 5,824

-------- --------

Total assets less current liabilities 9,875 6,538

Creditors: amounts falling due

after more than one year (55) (118)

Deferred income (6,545) (4,705)

-------- --------

3,275 1,715

===== =====

Capital and reserves

Share capital 678 657

Share premium reserve 4,334 4,324

Profit and loss account (1,737) (3,266)

-------- ---------

Shareholders' funds 3,275 1,715

===== =====

Consolidated Cash Flow Statement

for the year ended 31 March 1999

1999 1998

#000 #000

Net cash inflow from operating activities 4,134 3,344

Returns on investment and servicing of finance

Interest received 288 176

Interest paid (4) (3)

-------- --------

Net cash inflow from returns on investments and

servicing of finance 284 173

-------- --------

Taxation (451) (299)

-------- --------

Capital expenditure

Purchase of tangible fixed assets (341) (441)

Sale of tangible fixed assets 29 3

-------- --------

Net cash outflow from capital expenditure (312) (438)

-------- --------

Acquisitions and disposals

Purchase of business and subsidiary undertakings - (1,688)

-------- --------

Net cash outflow from acquisitions and disposals - (1,688)

-------- --------

Equity dividends paid (502) (201)

-------- --------

Management of liquid resources *

Decrease/(increase) in short term deposits 2,200 (1,200)

-------- --------

Financing

Issue of shares 31 1,521

(Repayment)/increase in borrowings (64) 62

-------- --------

Net cash (outflow)/inflow from financing (33) 1,583

-------- --------

Increase in cash 5,320 1,274

===== =====

* Comino plc includes as liquid resources term deposits of less than a year.

Notes

1. Earnings per ordinary share have been calculated on the profit for the

financial year of #2,042,000 after taxation and minority interest and on

the weighted number of ordinary shares in issue during the year. The

calculation of diluted earnings per share takes account of share options

that do not currently rank for dividends but may do so in the future.

2. The financial information set out above does not constitute the statutory

accounts for the period ended 31 March 1999 within the meaning of Section

240 of the Companies Act 1985. Statutory accounts for the year will be

delivered to the Registrar of Companies following the Company's Annual

General Meeting.

3. The annual report and accounts will be posted to shareholders on 10 June

1999 and will also be available on request from the Company's registered

office, 2 The Courtyard, Meadowbank, Furlong Road, Bourne End,

Buckinghamshire, SL8 5AJ.

4. The directors are recommending a final dividend of 2.50p per share which,

if approved, will be paid on 29 July 1999 to shareholders on the register

on 25 June 1999.

5. The Annual General Meeting will be held at Binns & Co, 16 St Helen's

Place, London, EC3A 6DF on Friday 9 July 1999 at 11:30 am.

END

FR SSSFUUUUUFSM

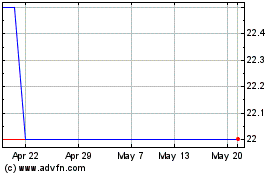

Cmo (LSE:CMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

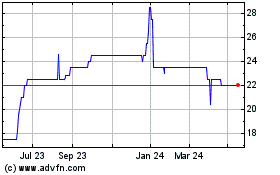

Cmo (LSE:CMO)

Historical Stock Chart

From Nov 2023 to Nov 2024