TIDMBOOM

RNS Number : 7583B

Boomerang Plus PLC

24 February 2011

Date: 24 February 2011

On behalf of: Boomerang Plus plc ('Boomerang', 'the Company', or

'the Group')

Embargoed until: 0700hrs

Boomerang Plus plc

Interim Results

Boomerang Plus plc (AIM: BOOM.L), a profitable and vertically

integrated, multi-genre, independent television production group,

today announces its unaudited results for the six months ended 30

November 2010.

Financial Highlights

-- Turnover increased by 84% to GBP16.29 million (2009: GBP8.87

million)

-- Gross profit margin of 15.2% (year to May 2010: 16.3%)

-- Operating profit increased 74% to GBP0.86 million (2009:

GBP0.49 million)

-- Cash and cash equivalents of GBP3.76 million (2009: GBP2.82

million)

-- Basic earnings per share increased by 69% to 6.21p

(2009:3.67p)

Operational Highlights

-- Good progress on diversification strategy:

- Successful integration of Indus Films (acquired October

2009)

- Organic Network success

- Continued growth in advertiser funded programming ('AFP')

-- 659 hours of programming for calendar year 2010 (2009: 428

hours)

-- Continued critical acclaim for the Group's programmes

Outlook

-- Full year revenues and profits expected to be considerably

first half weighted

-- Strong visibility over future revenues and commissions

-- Increase in Network productions

-- Current trading in line with the Board's expectations

-- Continue to examine acquisition opportunities

Huw Eurig Davies, Chief Executive Officer of Boomerang Plus,

commented:

"These interim results demonstrate the Group's continued

progress in diversifying its operations. We have made successful

inroads with Network broadcasters and seen further strong growth in

our AFP business. With good visibility over future revenues and

commissions, together with a strong balance sheet, the Group is

very well placed to exploit the considerable opportunities

presented by a fast-changing media marketplace"

- Ends -

For further information, please contact:

Boomerang Plus plc Via Redleaf Communications

Huw Eurig Davies, Chief Executive

Mark Fenwick, Finance Director

Redleaf Communications 020 7566 6700

Anna Dunkin/Rebecca Sanders-Hewett boomerang@redleafpr.com

Altium Capital

Tim Richardson/Melanie Szalkiewicz 020 7484 4040

Boomerang Plus

-- Boomerang, founded in 1994, has extensive experience in

producing content in a variety of genres, including entertainment,

factual, sport, music, drama, and children's programming for

television, radio and the web.

-- The Group operates across the whole spectrum of creative

industry activities including content production, post-production

services, television facilities, and talent management.

-- Boomerang aims to be independent television production

company of choice to the Network broadcasters looking to fill their

Ofcom quotas from the 'Nations and Regions' (broadcasters must

source between 10% and 50% of qualifying programme hours from

outside the M25 boundary).

-- Boomerang is ranked in the top five independent television

production companies, by revenue, in the Nations and Regions

according to the Broadcast Survey 2010.

-- Boomerang's strategy is to continue to produce high quality

content across a breadth of genres and to become a leading producer

of AFP and digital content and services. The Group also aims to

achieve strong organic growth by leveraging its existing customer

base and making strategic acquisitions, with a view to becoming a

major supplier to UK networks looking to satisfy their Nations and

Regions quotas.

Chief Executive's Statement

I am pleased to present the Group's results for the six months

ended 30 November 2010 (the 'period').

Overview

This has been a period of continued progress by the Group. Our

strategy of diversifying the Group's operations and, in particular,

investing in IP strong businesses with global footprints, has

contributed to a period of strong growth in revenue and

profitability. The period under review has also benefited from a

number of the Group's projects being delayed in the previous

year.

The period includes a full six months trading from Indus Films

(acquired in October 2009) and the other businesses we acquired in

the first half of last year. The addition of Indus to the Group has

brought the world renowned and award winning expertise of the

producers of "Amazon" and "Arctic" (with Bruce Parry), "Living with

Monkeys", "Coal House" and "Snowdonia 1890".

We also experienced strong growth in our Advertiser Funded

Programming ('AFP') business and made significant organic inroads

into Network broadcasters. We are among the market leaders in AFP

and continue to see growth and opportunities with a broad range of

UK and global clients such as Red Bull, Nissan, Sony Playstation,

Sony Ericsson and Quiksilver. Changes to product placement rules,

pressure on programming budgets and widening distribution platforms

are providing a strong base for growth, which our talented team are

well placed to exploit.

Financial Review

As highlighted above, the impact of acquisitions and delayed

commissions from 2009/10 has helped revenues for the period

increase by 83.8 per cent to GBP16.29 million (2009: GBP8.87

million). Overall gross profit margins in the period reduced to

15.2 per cent (six months to 30 November 2009: 19.1 per cent; 12

months to 31 May 2010 16.3 per cent) due to a higher proportion of

lower margin drama and children's production.

As a result, operating profit was up 74 per cent to GBP0.86

million (2009: GBP0.49 million) and profit before tax was up 67.7

per cent to GBP0.79 million (2009: GBP0.47 million).

Basic earnings per share for the period were up 69.2 per cent to

6.21 pence (2009: 3.67 pence).

As at 30 November 2010, the Group had cash and cash equivalents

of GBP3.76 million (2009: GBP2.82 million) after outflows for

acquisitions, including deferred consideration payments in respect

of acquisitions in prior periods, of GBP0.21 million (2009: GBP1.22

million), the purchase of fixed assets of GBP0.39 million (2009:

GBP0.58 million), and debt repayments of GBP0.29 million (2009:

GBP0.16 million) during the period. Net assets at 30 November 2010

were GBP9.5 million (2009: GBP8.9 million).

Programming

The Group's content production businesses: Boomerang, Indus,

Fflic, Alfresco and Apollo, contributed towards a strong,

multi-genre portfolio of programmes for our broadcast customers

during the period.

We have had noted success in increasing our organic Network

presence during the period. For Channel 4, we are currently in

production of "The Secret Supper Club", a ten part food and wine

series with Olly Smith, and the second series of "That Paralympic

Show", a multi-platform magazine series introducing the London 2012

Paralympics.

In AFP, highlights included our first 3D commission to produce a

Skateboard Documentary with legendary American Skateboarder, Tony

Hawk. Filming for Quiksilver's Tony Hawk's European Tour wrapped in

July 2010 following a three-week tour across Berlin, Rome,

Barcelona and Brighton. Other AFP productions during the period

included Roxy Jam Biarritz, the annual Women's World Longboard

Championships; the third series of Sony Ericsson World B-boy

Championships, the global search for the best breakdancing crew in

the world, filmed on location in New York, Japan, Korea, Europe and

concluding in Brixton for the competition final; and Sony

Playstation GT Academy, the virtual-to-reality motor racing

competition once again hosted by F1 luminaries Eddie Jordan and

Johnny Herbert and filmed across Australia, New Zealand, Europe and

the UK. This organic growth has been complemented through continued

investment into the "Freeze" winter sports and music festival and

the acquisition last year of "Method", the multimedia snowboarding

publisher.

Complementing this organic success, Indus has been extremely

busy during the period on a raft of commissions including "Arctic"

(with Bruce Parry) and "Snowdonia 1890".

We have again produced a range of multi-genre programming for

S4C during the period. These include the "Stwnsh" and "Cyw"

children's services; drama series "Teulu" and "Alys"; factual

entertainment series "3 Lle", "Gwlad Beirdd", "Cartrefi Cefn Gwlad

Cymru" and "Cyfnewid"; music series "Bandit" and "Nodyn"; youth

series "Gofod;" and sports series "Chwa", "Rasus" and "Ras i

Lundain" amongst others.

Post-production and Facilities

The Group continued to invest during the period in expanding its

post-production, camera, studio and outside broadcast facilities.

The Group currently operates approximately 70 edit suites, four

pro-tools dub suites and four studios together with an outside

broadcast truck. Our editing facilities now include a Baselight

grading system, two DS Nitris systems and two Symphony Nitris

systems.

Digital media

With our digital media partner, Cube Interactive, we continue to

explore and develop opportunities in digital media, including

websites, web streaming and interactive media. This includes

content creation for the "Royal Welsh", "Stwnsh" and "Cyw"

contracts whilst multi-platform distribution is also at the

forefront of most of our AFP content.

Radio

The Group continues to supply a diverse range of radio

programmes, particularly for BBC Radio Wales, Radio Cymru and Radio

4.

Talent management

Boom Talent, a management company representing singers, actors

and presenters in film, television, theatre, radio, corporate and

voice-over work, continues to establish itself.

Outlook

As previously highlighted, following the Government's

Comprehensive Spending Review in October 2010, S4C will have a

reduced programming budget in the future and this will inevitably

impact production companies based in Wales. However, the Board

believes that the Group's position as one of the largest

multi-genre Nations and Regions production companies in the UK and

accelerating diversification will allow it to mitigate the impact

of S4C's changed circumstances and will bring considerable benefits

to the Company over the coming years as the increased Ofcom quota

requirements for broadcasters come in to force.

Organic Network growth, the acquisition of Indus and growth in

AFP programming have all contributed to diversifying the Group's

customer base and widening its intellectual product base. This will

continue to drive further growth in an increasingly global market

and provide us with opportunities to increase our profit

margins.

Our success in securing new contracts and our track record on

recommissions provide the Group with good visibility over revenues

for the second half of the current financial year and the first

half of 2011/12. Full year results are expected to be considerably

first half weighted and current trading is in line with the Board's

expectations.

We will also continue to look for further acquisitions that can

add value for shareholders in a fast-changing media

marketplace.

Huw Eurig Davies

Chief Executive

23 February 2011

Condensed Consolidated Income Statement

Six months ended 30 November 2010 (unaudited)

Six months Six months

ended 30 ended 30 Year ended

November November 31 May

Note 2010 2009 2010

GBP'000 GBP'000 GBP'000

Revenue 16,295 8,866 21,409

Cost of sales (13,811) (7,176) (17,912)

Gross profit 2,484 1,690 3,497

Administrative expenses

Other administrative expenses (1,631) (1,320) (2,928)

Professional fees in relation to

unsuccessful corporate

transactions (10) - (73)

Provision for impairment of

investments - - (70)

Amortisation of intangibles

arising on business acquisitions (10) (6) (20)

Equity settled share based

payments - (4) (7)

Total administrative expenses (1,651) (1,330) (3,098)

Other operating income 37 112 227

Loss on disposal of fixed assets - (3) -

Share of results of joint ventures

and associates (12) 24 (18)

Operating profit 858 493 608

Investment income 3 - 3

Finance costs (73) (23) (76)

Profit before tax 788 470 535

Tax on profit on ordinary

activities 2 (234) (143) (218)

Profit for the period 554 327 317

Earnings per share 3

Basic 6.21p 3.67p 3.56p

Diluted 6.13p 3.60p 3.50p

Adjusted - basic 6.44p 3.78p 5.47p

Adjusted - diluted 6.35p 3.71p 5.38p

All activities derive from continuing operations.

The Group has no other items of comprehensive income and as such

has not presented a separate condensed consolidated statement of

comprehensive income.

Condensed Consolidated Balance Sheet

As at 30 November 2010 (unaudited)

30 30 31

November November May

2010 2009 2010

GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Goodwill 3,039 2,102 3,049

Other intangible assets 2,430 3,802 2,444

Property, plant and equipment 3,401 1,613 2,931

Investments 360 496 371

9,230 8,013 8,795

CURRENT ASSETS

Inventories - - 9

Trade and other receivables 3,461 3,423 4,158

Current tax assets 219 219 219

Cash and cash equivalents 3,761 2,818 3,070

7,441 6,460 7,456

TOTAL ASSETS 16,671 14,473 16,251

CURRENT LIABILITIES

Trade and other payables 4,256 2,945 4,615

Current tax liabilities 374 595 84

Interest-bearing loans and borrowings 735 250 492

Deferred consideration 109 268 333

5,474 4,058 5,524

NON-CURRENT LIABILITIES

Interest-bearing loans and borrowings 634 90 742

Other payables 76 14 47

Deferred tax liabilities 219 109 232

Deferred consideration 734 1,212 722

1,663 1,425 1,743

TOTAL LIABILITIES 7,137 5,483 7,267

NET ASSETS 9,534 8,990 8,984

Condensed Consolidated Balance Sheet

As at 30 November 2010 (unaudited)

30 30 31

November November May

2010 2009 2010

GBP'000 GBP'000 GBP'000

EQUITY

Share capital 89 89 89

Share premium account 3,934 3,933 3,934

Merger reserve 1,217 1,217 1,217

Retained earnings 4,294 3,751 3,744

Equity attributable to equity holders

of the parent 9,534 8,990 8,984

These condensed consolidated interim statements were approved by

the Board of Directors on 23 February 2011.

Signed on behalf of the Board of Directors

H E Davies M W Fenwick

Director Director

Condensed Consolidated Cash Flow Statement

Six months ended 30 November 2010 (unaudited)

Six

Six months months

ended 30 ended 30

November November Year ended 31 May

Note 2010 2009 2010

NET CASH INFLOW FROM

OPERATING ACTIVITIES 4 1,473 1,745 2,615

INVESTING ACTIVITIES

Interest received 3 - 3

Purchase of property, plant

and equipment (393) (97) (544)

Acquisition of subsidiaries

- net cash outflow arising

on acquisition - (768) (768)

Acquisition of subsidiaries -

deferred consideration

payments (211) (128) (326)

Acquisition of associates - (326) (209)

Acquisition of intangible

fixed assets - (480) (458)

Proceeds on disposal of

property, plant and

equipment 7 - 1

NET CASH USED IN INVESTING

ACTIVITIES (594) (1,799) (2,301)

FINANCING ACTIVITIES

Repayments of obligations

under finance leases (288) (155) (372)

Proceeds on issue of shares - - 1

Grants received 100 - 100

NET CASH USED IN FINANCING

ACTIVITIES (188) (155) (271)

NET INCREASE/(DECREASE) IN

CASH AND CASH EQUIVALENTS 691 (209) 43

CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD 3,070 3,027 3,027

CASH AND CASH EQUIVALENTS AT

END OF PERIOD 3,761 2,818 3,070

Condensed Consolidated Statement of Changes in Equity

Six months ended 30 November 2010 (unaudited)

Share

Share premium Merger Retained

capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 June

2009 89 3,933 1,217 3,420 8,659

Profit for the financial

period - - - 327 327

Equity-settled

share-based payments - - - 4 4

Balance at 30 November

2009 89 3,933 1,217 3,751 8,990

Loss for the financial

period - - - (10) (10)

New shares issued - 1 - - 1

Equity-settled

share-based payments - - - 3 3

Balance at 31 May

2010 89 3,934 1,217 3,744 8,984

Profit for the financial

period - - - 554 554

Foreign exchange - - - (4) (4)

Balance at 30 November

2010 89 3,934 1,217 4,294 9,534

The Group has taken advantage of section 612 of the Companies

Act 2006 and so the excess over the nominal value of shares issued

other than for cash has been allocated to the merger reserve.

1. BASIS OF PREPARATION AND ACCOUNTING

The interim financial information does not constitute statutory

accounts for the purpose of section 434 of the Companies Act 2006.

The figures for the year ended 31 May 2010 have been extracted from

the Group's audited accounts for that year. Those accounts have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The interim financial information for the six months ended 30

November 2010 and 30 November 2009 has not been audited or reviewed

by the auditors. The interim results have been prepared using the

same accounting policies and estimation techniques that are

expected to apply at the year-end and is consistent with the

accounting policies disclosed in the Group's annual report for the

year ended 31 May 2010.

2. tax

Taxation for the six-month period is charged at the best

estimate of the average annual effective income tax rate expected

for the full year, applied to the pre-tax income of the six-month

period.

31

30 November 30 November May

2010 2009 2010

GBP'000 GBP'000 GBP'000

UK taxation at standard rate 275 155 103

Deferred taxation (41) (12) 115

234 143 218

3. earnings per share

31

30 November 30 November May

2010 2009 2010

Earnings GBP'000 GBP'000 GBP'000

Profit for the period 554 327 317

Professional fees in relation to

unsuccessful corporate transactions 10 - 73

Amortisation of intangibles arising on

business acquisitions 10 6 20

Provision for impairment of investments - - 70

Equity settled share based payments - 4 7

Adjusted profit 574 337 487

Number of shares No. No. No.

Weighted average number of

ordinary shares 8,914,731 8,911,231 8,911,902

Dilutive weighted average

number of shares 9,036,676 9,079,154 9,065,700

Earnings per ordinary share - 6.21p 3.67p 3.56p

basic

Earnings per ordinary share - 6.13p 3.60p 3.50p

diluted

Adjusted earnings per share - 6.44p 3.78p 5.47p

basic

Adjusted earnings per share - 6.35p 3.71p 5.38p

diluted

4. notes to the condensed consolidated cash flow statement

31

30 November 30 November May

2010 2009 2010

GBP'000 GBP'000 GBP'000

Profit from operations 858 493 608

Adjustment for:

Amortisation of intangible fixed assets 29 27 61

Depreciation of property, plant and

equipment 339 207 446

Profit on property, plant and equipment

disposals - 4 2

Government grants (33) (60) (117)

Results of joint ventures and associates 12 (24) 20

Provision for impairment of investment - - 70

Foreign exchange (9) - -

Equity-settled share-based payments - 4 7

Operating cash flows before movement in

working capital 1,196 651 1,097

Decrease/(increase) in receivables 724 640 (79)

(Decrease)/increase in payables (397) 457 2,109

Increase/(decrease) in inventory 9 - (9)

Cash generated from operations 1,532 1,748 3,118

Income taxes received/(paid) 14 20 (451)

Interest paid (73) (23) (52)

Net cash inflow from operating

activities 1,473 1,745 2,615

5. AVAILABILITY OF INTERIM RESULTS

A copy of the interim report will be available for members of

the public by application to the Company's Registered Office or on

the Company's website at www.boomerang.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEUFUDFFSESE

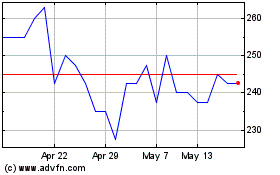

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

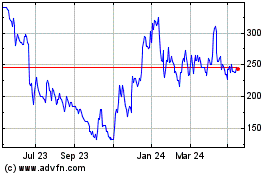

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024