TIDMBKG

RNS Number : 3562D

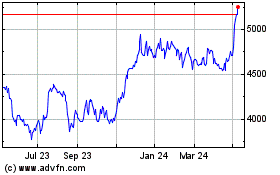

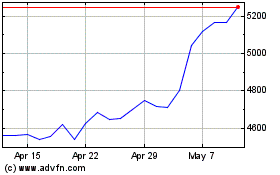

Berkeley Group Holdings (The) PLC

21 June 2023

PRESS RELEASE 21 JUNE 2023

YEAR RESULTS ANNOUNCEMENT

Strong operating performance in challenging environment

On target to meet guidance for next two years and maintain

shareholder returns

86% of homes delivered on brownfield land with highest ever

investment in socio-economic benefits

Future delivery of new homes jeopardised by planning environment

and regulatory uncertainty unless urgently resolved

The Berkeley Group Holdings plc ("Berkeley") today announces its

audited results for the year ended 30 April 2023.

Rob Perrins, Chief Executive, said:

"Berkeley has delivered pre-tax profits in line with the

guidance provided at the start of the financial year, maintained

our shareholder returns programme and increased the net cash

position. This is a very strong performance by our sales and

construction teams, given market conditions and changing building

regulations, and reflects the resilience of Berkeley's business

model with its focus on the country's most undersupplied

markets.

We continue to see good levels of enquiry for well-located homes

built to a high standard of design and quality but recognise that

the market is likely to lack urgency until there is more certainty

over the trajectory of interest rates.

Berkeley's focus on regenerating long-term brownfield sites has

driven lasting positive change within some of the country's most

deprived communities and differentiates Berkeley as the only

large-scale UK developer aligned with Government's brownfield first

agenda. A deeper understanding and recognition of the benefits of,

and challenges to, this highly sustainable form of development is

required within the planning system to ensure the tremendous

opportunity it presents for society, communities and the economy is

not missed for future generations.

The challenge is increased when set alongside the uncertainty

from a continually evolving and increasingly burdensome regulatory

environment. While well-intended, this is constraining investment

into brownfield regeneration and homebuilding. If housing delivery

is to be maintained the planning system needs to respond to these

challenges and certainty is needed in the regulatory environment as

a matter of immediate priority.

Looking forward, we are well placed to meet our guidance for the

next two financial years and continue investing in our existing

regeneration sites, but will remain cautious in committing to new

investment until the conditions for growth are in place.

We remain focused on meeting our long-term pre-tax ROE target of

15% across the cycle and delivering against our shareholder returns

programme. At the same time, w e will continue to serve our

customers and the communities in which we work, delivering

individually designed, well-connected, nature-rich neighbourhoods

with quality new homes across all housing tenures."

Summary of Earnings, Shareholder Returns and Financial

Position

Change

Earnings 30-Apr-23 30-Apr-22 %

--------------------------------- ------------- ----------- -----------

Profit before tax GBP604.0m GBP551.5m +9.5%

Earnings per share - basic 426.8p 417.8p +2.1%

Pre-tax return on equity 18.7% 17.5%

---------------------------------- ------------- ----------- -----------

Shareholder Returns 30-Apr-23 30-Apr-22

--------------------------------- ------------- -----------

Share buy-backs undertaken GBP155.4m GBP63.7m

B-Share capital return - GBP451.5m

Dividends paid GBP98.5m -

Shareholder returns GBP253.9m GBP515.2m

------------- -----------

Share buy-backs - volume 4.0m 1.5m

Average price paid for GBP38.25 GBP41.81

share buy-backs

Dividends / B-Share Return GBP0.91 GBP3.71

per share

--------------------------------- ------------- ----------- -----------

As at As at Change

Financial Position 30-Apr-23 30-Apr-22 absolute

--------------------------------- ------------- ----------- -----------

Net cash GBP410m GBP269m +GBP141m

Net asset value per share GBP31.01 GBP28.18 +GBP2.83

Cash due on forward sales GBP2,136m GBP2,171m -GBP35m

(1)

Land Holdings - future GBP7,629m GBP8,258m -GBP629m

gross margin

Pipeline sites / (plots

(approx.)) 14 (14,000) 6 (8,000) +8 (6,000)

---------------------------------- ------------- ----------- -----------

(1) Cash due on private exchanged forward sales

completing within the next three years

See Note 8 of the condensed consolidated financial information

for a reconciliation of alternative performance measures

-- Forward sales sustained at a healthy GBP2.1 billion, with the

value of reservations for the financial year around 15% lower than

the comparative financial year.

-- Net cash increased to GBP410 million, with GBP1.2 billion of

borrowing capacity providing total liquidity of GBP1.6 billion.

-- Sales pricing remains firm and above business plan levels

with build cost inflation moderating.

-- Berkeley reiterates its guidance of delivering pre-tax

profits of at least GBP1.05 billion across its next two financial

years (FY24 and FY25) combined, which is likely to be slightly

weighted to the FY24, in line with market consensus and the

objective of delivering a sustainable pre-tax ROE of 15% through

the cycle.

-- Berkeley reaffirms its commitment to GBP283 million (GBP2.63

per share) per annum Shareholder Returns up to 30 September

2025.

-- Berkeley will continue to be cautious on new investment and

sales launches given the volatile operating environment, which

includes the current macro-economic, political and regulatory

environments.

-- One site added to the long-term pipeline and approximately

5,500 plots on future sites transferred from the land holdings to

the long-term pipeline due to uncertainty in the planning system;

the majority of these sites are at appeal or subject to a

call-in.

-- 26 of 32 long-term complex regeneration sites in production,

sustaining delivery profile for the next 10 years.

DELIVERING FOR ALL STAKEHOLDERS

-- 4,043 homes delivered, plus 594 in joint ventures (2022:

3,760, plus 872) - 86% of which are on regenerated brownfield

land.

-- Approximately GBP560 million of subsidies provided to deliver

affordable housing and committed to wider community and

infrastructure benefits in the year.

-- Berkeley is delivering some 10% of London's new private and

affordable homes - supporting an average of approximately 27,000 UK

jobs per annum directly and indirectly through its supply chain

over the last five years.

-- Industry leading Net Promoter Score (> 70) and customer satisfaction ratings maintained.

-- Since 2017/18 all new planning applications have committed to

biodiversity net gain, in total 54 developments which together will

create more than 550 acres of new or measurably improved natural

habitats.

-- Scopes 1 and 2 emissions reduction target met well ahead of

the 2030 science-based target and 23 embodied carbon assessments

completed as we progress our Climate Action programme and journey

towards net zero.

-- Rated "A-" by CDP for climate action and transparency and AAA

rated in the MSCI global ESG index.

-- Gold membership of The 5% Club, with 10% of direct employees

in 'earn and learn' positions as graduates, apprentices or

sponsored students within the year.

Investor and Analyst Presentation:

A pre-recorded presentation by the Directors of Berkeley on the

results will be made available on the Company's website at 11:00

today -

https://www.berkeleygroup.co.uk/investors/results-and-announcements

.

For further information please contact:

The Berkeley Group Holdings plc Novella Communications

R J Stearn (01932 868555) Tim Robertson (020 3151 7008)

CHIEF EXECUTIVE'S REVIEW

Purpose, Long-term Strategy and Capital Allocation

Berkeley's purpose is to build quality homes, strengthen

communities and improve lives, using its sustained commercial

success to make valuable and enduring contributions to society, the

economy and natural world.

Berkeley is the only large UK homebuilder to align with

Government on prioritising brownfield land, as we progress 32 of

the country's most challenging regeneration projects, 26 of which

are in delivery. Each of these neighbourhoods is uniquely designed

in partnership with local councils and communities and includes

valuable public amenities alongside tenure-blind private and

affordable homes.

It has been hugely exciting to see more of these complex sites

transform into popular, inclusive and low carbon communities,

including Oval Village in Lambeth, an 8-acre brownfield site which

brings together four derelict gasholders and an adjacent

supermarket and warehouse. We welcomed our first residents to this

emerging mixed use neighbourhood in 2022, which will grow to

provide more than 1,300 private and affordable homes and over 1,000

permanent jobs across 160,000 square feet of commercial and

community space. All this is set around car-free streets, public

squares and biodiverse landscaping. The development was awarded

Housing Scheme of the Year at the 2023 Planning Awards.

White City Living also made great progress in the year, where St

James has transformed an 11-acre isolated warehouse site into a

beautiful open neighbourhood, with a hugely popular community park,

pedestrian routes to Westfield Shopping Centre and an Amazon Fresh

convenience store. The site will deliver around 2,500 private and

affordable homes, with more than 950 delivered so far, of which 400

are affordable homes. The development won Best Regeneration Scheme

at the 2022 WhatHouse? Awards.

Alongside this, Berkeley's financial strategy reflects the

cyclical nature and complexity of brownfield development,

protecting and enhancing long-term value for shareholders and using

its development expertise to maximise the returns from its assets,

creating the right development solution for each site. Our capital

allocation policy is therefore clear and remains unchanged: first,

ensure financial strength is appropriate to the prevailing

operating environment; second, invest in the business (land and

work-in-progress) at the right time; and third, make returns to

shareholders through dividends and share buy-backs.

This disciplined approach allows Berkeley to deliver

sustainable, risk-adjusted returns over the cycle, targeting a

sustained pre-tax return on equity of 15%.

Strategy positioning for today's environment

From the strong trading period that followed the Global

Financial Crisis, Berkeley invested strongly in its land holdings,

which will sustain the Group's delivery profile for the next ten

years, spending some GBP6 billion on its development activities in

the last three years alone. We are forecast to continue investing

in our existing regeneration sites with implementable planning

consents.

In the near-term, Berkeley has a clear strategy to focus on

matching production on existing sites to demand and delivering its

forward sales whilst protecting operating margins. We will only

invest in new sites very selectively or in partnership with

landowners, such as retailers, utilities, local authorities and

housing associations or with its joint venture partners. This

strategy is centred on cash generation that will provide the

optionality to invest further in the business or reassess the level

of returns to shareholders, depending upon the characteristics of

the prevailing operating environment.

Beyond the near-term, the current operating environment,

characterised by record levels of planning tariff within an

increasingly complex, uncertain and slow planning system, at a time

of high build costs, increased regulation and higher corporation

tax, alongside the Residential Property Developer Tax ("RPDT") and

proposed new Building Safety Levy, will inevitably continue to see

a reduction in supply of new homes in London and the South

East.

The delivery of new homes during a year in which there were no

new land additions, coupled with the transfer of 5,500 plots to

Berkeley's pipeline, offset to some degree by new planning consents

and market movements, has led to a reduction in the land holdings

future gross margin from GBP8.26 billion to GBP7.63 billion at 30

April 2023. This is likely to further moderate in the near-term as

Berkeley continues to deliver new homes, without new investment

fully replacing production.

Shareholder Returns

Berkeley has in place a shareholder returns programme, based

upon an ongoing annual return of GBP283 million planned through to

September 2025. This is delivered through two equal tranches of

GBP141.4 million in the six month periods from 1 October to 31

March and 1 April 30 September each year. It is measured on a

cumulative basis and can be made through either dividends or share

buy-backs. Shareholder returns during the financial year totalled

GBP253.9 million:

Shareholder Returns 2023 2022

GBP'm GBP'm

---------------------------- ------ ------

Dividends paid 98.5 -

B-Share capital return - 451.5

Share buy-backs undertaken 155.4 63.7

---------------------------- ------ ------

Shareholder return in the

financial year 253.9 515.2

============================ ====== ======

Dividends paid during the financial year (from 1 May to 30

April) of GBP98.5 million comprised:

-- A GBP23.3 million dividend in September 2022 (21.25 pence per

share) which completed the return of GBP141.4 million that was due

in respect of the six months ended 30 September 2022; and

-- A GBP75.2 million dividend in March 2023 (69.44 pence per

share) which completed the return of GBP141.4 million that was due

in respect of the six months ended 31 March 2023.

Berkeley has committed to the next ongoing scheduled shareholder

return, which is GBP141.4 million in respect of the six months

ending 30 September 2023, against which GBP35.2 million has been

returned via share buy-backs to date. The total amount returned via

share buy-backs in the year is GBP155.4 million across 4.0 million

shares, at an average price of GBP38.25 per share.

The ongoing annual return of GBP283 million currently equates to

GBP2.63 per share compared to the initial GBP2.00 per share

initiated in 2016.

Summary of Performance

Berkeley has delivered pre-tax profits of GBP604.0 million for

the year:

Year ended 30 April 2023 2022 Change

GBP'm GBP'm GBP'm %

---------------------------- -------- -------- ------- -------

Revenue 2,550.2 2,348.0 +202.2 +8.6%

---------------------------- -------- -------- ------- -------

Gross profit 696.8 664.8 +32.0 +4.8%

Operating expenses (178.5) (156.9) -21.6 +13.8%

---------------------------- -------- -------- ------- -------

Operating profit 518.3 507.9 +10.4 +2.0%

Net finance costs (10.6) (12.5) +1.9

Share of joint ventures 96.3 56.1 +40.2

---------------------------- -------- -------- ------- -------

Profit before tax 604.0 551.5 +52.5 +9.5%

============================ ======== ======== ======= =======

Pre-tax return on equity 18.7% 17.5% +1.2%

Earnings per share - basic 426.8p 417.8p +9.0p +2.1%

Based upon current trading, Berkeley reiterates its guidance of

delivering pre-tax profits of at least GBP1.05 billion across its

next two financial years (FY24 and FY25) combined, which is likely

to be slightly weighted to the FY24, in line with market consensus.

Operating margins are expected to be at normal historical

levels.

Housing Market and Operating Environment

Sales

Overall, the value of Berkeley's underlying private sales

reservations for 2022/23 was around 15% lower than 2021/22 on a

like-for-like basis, assuming St William had been owned throughout

2021/22. Berkeley's sales were strong during the first part of the

financial year, slightly ahead of the levels secured throughout

2021/22. However, the market weakened markedly following the sharp

rise in interest rates in September 2022.

We immediately positioned the business for the prevailing market

conditions, adopting a more considered approach to new sales

launches and being more cautious on the pace of investment in our

ongoing sites. We have been disciplined on pricing, which has

remained above business plan levels as we protect operating margins

in what has been a highly inflationary cost environment for the

past two years.

More recently we have seen expectations for the pace of

reduction in inflation and interest rates slow with a consequential

rise to mortgage rates. The near-term market outlook is therefore

uncertain, much the same as it has been since September 2022. In

this type of market there is a lack of urgency and transactions

typically stem from owner occupiers with a current motivation to

move or investors with immediately available funds, with demand

therefore weighted to product which is closer to delivery, as

opposed to off-plan sales that do not complete for two to four

years. On this basis, at current sales rates, sales for 2023/24

will be around 20% lower than 2022/23.

Berkeley's response to the rapid change to market conditions is

facilitated by the healthy forward sales position which, at GBP2.14

billion at 30 April 2023 (2022: GBP2.17 billion), is anticipated to

moderate over the coming twelve months until sales rates return to

more normal levels.

Berkeley has continued to sell to both owner occupiers and

investors throughout the year, with investors benefitting from

strong rental growth. Cancellation rates have been in the normal

range, apart from in the couple of months after September 2022.

The long-term fundamentals of the housing sector and, more

importantly, Berkeley's core markets in London and the South East

remain compelling. Key to this are London's position as a leading

global city and the systemic under-supply in our markets. The

latest quarterly Department for Levelling Up, Housing and

Communities ("DLUHC") data show new starts in London for the

calendar year 2022 of just over 20,000 (including private, PRS and

affordable homes), which is broadly consistent with the long-run

average over the last ten years. This is substantially below both

the current London Plan target of 52,000 new homes per annum and

the Government's identified local housing need of 94,000 per

annum.

Land and planning

Berkeley has not added any new sites to its land holdings during

the year, while one long-term site contracted on a conditional

basis in Motspur Park has been added to the pipeline.

On the planning front, Berkeley has secured one new consent in

the year, at our site in Worthing, Sussex for around 190 homes and

has achieved a number of revisions to existing consents in the year

as we continue to progress our sites; most notably at The Green

Quarter (Ealing), White City Living, Hartland Village (Fleet),

Hareshill (Crookham), The Eight Gardens (Watford) and Lombard

Square (Plumstead).

The Levelling Up and Regeneration Bill is now in its final

stages, having evolved as it progressed through Parliament with a

number of significant amendments tabled in December 2022. These

amendments were tabled alongside a commitment from the Secretary of

State to launch a review into what further measures could help

prioritise the use of brownfield land for housing development and

we look forward to seeing these.

We support the core aims of the Government's reform agenda,

which are to improve the quality of new homes and places, better

engage communities in plans for their area, as well as a renewed

focus on brownfield housing delivery. These aims do need to be

balanced with the societal need for more homes and the wider

benefits they bring.

Like many, we are concerned that December's proposed changes to

the NPPF would weaken the presumption in favour of sustainable

development and the status of five-year land supply targets will

materially reduce the pace of delivery of new homes. Sadly, this

has already come to fruition with 55 Local Authorities pausing or

abandoning their local plan making process as a consequence of the

uncertainty within the planning process.

While the Government's "brownfield first" strategy is

unquestionably the right way to deliver the homes the country needs

where they are needed most, the planning system is yet to recognise

the challenges of this most sustainable form of home-building and

is not taking account of today's evolving regulatory

environment.

Construction

Build cost inflation has peaked and is beginning to moderate,

despite certain materials and trades remaining under pressure,

particularly where energy costs are a high component of the input

cost. There is improved competition in the supply chain, especially

on larger packages, and we continue to anticipate build cost

inflation falling to negligible levels by the end of the year, but

remain mindful of the cost of ongoing regulatory change.

We are seeing signs of some financial distress in the supply

chain as contractors continue to deal with the tail of impacts from

Brexit, the pandemic and the ongoing conflict in Ukraine, as well

as the current economic backdrop. We are actively working with and

supporting our established supply chain partners to ensure

sustainability of the supply chain and delivery on our development

sites.

The manufacture of Berkeley Modular's first modules for the

urban house at Kidbrooke Village is complete with all 96 modules

installed on-site. Noting the decision of other parties to exit the

industry due to the costs and efficiency impact of regulatory and

planning uncertainty on a stable production pipeline, Berkeley's

immediate focus is on evolving the product to remove cost, weight

and complexity whilst continuing to work with the numerous

statutory bodies to achieve the various regulatory approvals

required for efficient future delivery. We will not be putting the

factory into full production until this is achieved.

Fire Safety

Berkeley has been very supportive of Government in its

determination both to ensure buildings are fire-safe for people to

live in and mortgageable so they can move home and re-mortgage

their properties when they wish. Historically, Berkeley's focus in

this area has been on ensuring its buildings achieve the required

EWS 1 form certification for mortgage purposes and it has obtained

this on 99% of its relevant freehold buildings. Further, on 5(th)

April 2022, Berkeley signed the Pledge Letter prepared by

DLUHC.

On 13(th) March 2023 Berkeley entered into the Self-Remediation

Terms and Contract with DLUHC. This formalised the Pledge

commitments, requiring signatories to assume responsibility for

remediating relevant life critical fire-safety matters in buildings

they had constructed over the previous 30 years and to meet certain

historic funding commitments made by Government, even where these

funded works exceed those necessary to remediate life critical

fire-safety matters. It is Berkeley's preference to take full

responsibility for all its relevant buildings and to complete any

required works itself as this will speed up the overall process of

remediation.

Government has undertaken to ensure that all developers and

house-builders are treated equally and that all parties involved in

the development process are held to account and pay their fair

share. Berkeley believes this is fair and equitable, is fully

supportive of this approach and looks forward to seeing its

implementation. By their commitments under the Self-Remediation

Terms and Contract and 4% RPDT Berkeley believes that UK

house-builders have played a very full part in resolving this issue

and further levies on the industry would be unjust and constrain

delivery and innovation. We are therefore concerned that Government

is still considering plans to introduce an additional Building

Safety Levy with the target of raising an additional GBP3 billion

from the industry.

Looking forward, Berkeley is ensuring its procedures are

compliant with new legislation and is supportive of the Building

Safety Act which, together with the actions taken to date, should

restore trust and confidence to the housing market, enabling it to

operate efficiently, effectively and be fair for all.

Pace and impact of regulatory change

We remain concerned over the extent and pace with which new

regulation is being consulted upon and subsequent regulatory

changes, are being made. These cover important and complex areas,

such as planning (NPPF revisions and the Levelling Up and

Regeneration Bill), building regulations (including new Parts F, L,

O and S) and carbon reduction, which have multiple

inter-dependencies. While well-intended, all aspects must be fully

considered and balanced with the objective of increasing the supply

of quality new homes. The current position is creating uncertainty

and delays in the construction of much needed homes, delays for

people trying to move and increased barriers to entry for SME

developers.

Most recently, the consultation on the incorporation of second

staircases into buildings over 30 metres lacked detail on the

technical parameters of how this is to be achieved and is requiring

many tall buildings, yet to be put into construction, to be

redesigned. While the consultation document notes that there is no

evidence that existing tall buildings are unsafe, it also notes

that this redesign will affect the viability of certain buildings,

which will result in lower levels of affordable housing.

Outlook

Berkeley ends the year in a robust position with good visibility

of earnings for the next two years, underpinned by GBP2.1 billion

of cash due on secured private sales. We have unrivalled land

holdings in the most fantastic city in the world that suffers from

a systemic under-supply of new homes, providing resilience to the

sales market.

In these uncertain times, Berkeley has a very clear strategy:

realising its forward sales; matching supply to demand; adding

value to its existing land holdings and pipeline sites; protecting

operating margins; and focusing on cash generation ahead of the

Income Statement.

These results underline the essential role brownfield land has

to play in solving the housing crisis, tackling inequality and

re-energising our towns and cities to meet the challenges of

tomorrow. The delivery of new private and affordable homes on these

sites is a force for good, generating better health outcomes, new

jobs and skills, economic growth and social mobility which benefits

the whole of society. We are proud to be the country's leading

regeneration specialist and I want to thank our fantastic people

and partners for their commitment over the last 12 months.

At a time when our colleagues, customers and communities

continue to be faced with ongoing volatility in the domestic and

international economy and political landscape, the business is well

placed to continue serving all our stakeholders in the years to

come.

Rob Perrins

Chief Executive

TRADING AND FINANCIAL REVIEW

Trading performance

Revenue of GBP2,550.2 million in the year (2022: GBP2,348.0

million) arose primarily from the sale of new homes in London and

the South East. This included GBP2,508.3 million of residential

revenue (2022: GBP2,302.0 million) and GBP41.9 million of

commercial revenue (2022: GBP46.0 million).

4,043 new homes (2022: 3,760) were sold across London and the

South East at an average selling price of GBP608,000 (2022:

GBP603,000) reflecting the mix of properties sold in the year.

The gross margin percentage is 27.3% (2022: 28.3%), reflecting

the mix of developments on which homes were completed in the year.

Overheads of GBP178.5 million (2022: GBP156.9 million) include St

William overhead following the acquisition in March 2022. The

operating margin has decreased to 20.3% (2022: 21.6%), which is

within the historic range.

Berkeley's share of the results of joint ventures is a profit of

GBP96.3 million (2022: GBP56.1 million), with St Edward's profits

arising predominately from completions at Royal Warwick Square and

Millbank.

Berkeley has remained cash positive on a net basis throughout

the year. Interest earned from gross cash holdings slightly

outweighed the interest cost of borrowings, with the net finance

costs of GBP10.6 million for the year (2022: GBP12.5 million)

arising due to amortisation of borrowing fees and imputed interest

on land creditors.

The taxation charge for the year is GBP138.3 million (2022:

GBP69.1 million) at an effective tax rate of 22.9% (2022: 12.5%),

which incorporates the additional 4% RPDT and the increase to

corporation tax from 19% to 25% from 1 April 2023.

Pre-tax return on equity for the year is 18.7% (2022: 17.5%), in

line with Berkeley's objective of delivering a sustainable 15%

through the cycle.

Basic earnings per share has increased by 2.1% from 417.8 pence

to 426.8 pence, which takes account of the buy-back of 4.0 million

shares at a cost of GBP155.4 million under the Shareholder Returns

Programme.

Financial Position

The Group's net assets increased by GBP196.2 million during the

year to GBP3,332.3 million (2022: GBP3,136.1 million):

Summarised Balance Sheet

as at 30 April 2023 2022 Change

GBP'm GBP'm GBP'm

---------- ---------- -------

Non-current assets 394.9 374.6 +20.3

Inventories 5,302.1 5,134.0 +168.1

Debtors 92.3 150.2 -57.9

Creditors (2,867.4) (2,791.6) -75.8

------------------------------ ---------- ---------- -------

Capital employed 2,921.9 2,867.2 +54.7

Net cash 410.4 268.9 +141.5

------------------------------ ---------- ----------

Net assets 3,332.3 3,136.1 +196.2

============================== ========== ========== -------

Shares, net of treasury and

EBT 107.5m 111.3m -3.8m

Net asset value per share 3,101p 2,818p +283p

Inventory

Inventories of GBP5,302.1 million include GBP927.1 million of

land not under development (2022: GBP738.1 million), GBP4,249.2

million of work in progress (2022: GBP4,255.1 million) and GBP125.8

million of completed stock (2022: GBP140.8 million).

The increase in land not under development in the year arises

primarily from the completion during May and June of the

acquisition of a further 11 sites into St William as part of the

transaction in March 2022, which are represented by land creditors.

There is one further St William site which will complete in 2025.

No sites have been moved into production during the year.

Creditors

Total creditors of GBP2,867.4 million include GBP921.3 million

of on-account receipts from customers (2022: GBP931.4 million) and

land creditors of GBP900.7 million (2022: GBP800.7 million), with

the latter's increase represented by the completion of the

acquisition of the St William sites noted above. Of the total

GBP900.7 million land creditor balance, GBP37.3 million is

short-term and GBP863.4 million is spread over the following nine

years.

Creditors also include provisions of GBP193.6 million (30 April

2022: GBP161.0 million) which represents post-completion

development obligations, including those related to building

fire-safety matters, and other provisions.

Net cash

The Group ended the year with net cash of GBP410.4 million (30

April 2022: GBP268.9 million), an increase of GBP141.5 million

during the year (2022: net decrease of GBP859.3 million):

Abridged Cash Flow for year

ended 30 April 2023 2022

GBP'm GBP'm

-------- --------

Profit before taxation 604.0 551.5

Taxation paid (133.7) (142.6)

Net investment in working

capital (50.1) (132.6)

Net investment in joint ventures (33.0) (82.8)

Other movements 8.2 3.0

Shareholder returns (253.9) (515.2)

Acquisition of St William - (540.6)

----------------------------------- -------- --------

Increase/ (decrease) in net

cash 141.5 (859.3)

Opening net cash 268.9 1,128.2

Closing net cash 410.4 268.9

=================================== ======== ========

The net cash of GBP410.4 million consists of gross cash holdings

of GBP1,070.4 million, net of GBP660.0 million of long-term

borrowings.

Net assets and NAVPS

Net assets increased over the year by GBP196.2 million, or 6.3%

to GBP3,332.3 million (2022: GBP3,136.1 million) primarily due to

the profit after tax for the year of GBP465.7 million outweighing

the shareholder returns of GBP253.9 million (comprising GBP155.4

million share buy backs and GBP98.5 million dividends) and other

movements in reserves of GBP15.6 million.

The shares in issue, net of treasury and EBT shares, closed at

107.5 million compared to 111.3 million at the start of the year.

The net reduction of 3.8 million shares comprises two

movements:

-- The 4.0 million share buy-backs undertaken during the year

for GBP155.4 million (GBP38.25 per share);

-- The issue of 0.2 million shares under the 2011 LTIP.

Consequently, the net asset value per share is 3,101 pence, up

10% from the 2,818 pence at 30 April 2022.

Funding

The Group's borrowing capacity of GBP1,200 million is unchanged

over the course of the year and comprises:

-- GBP400 million unsecured 10-year Green Bonds which mature in

August 2031 at a fixed coupon of 2.5% per annum; and

-- GBP800 million bank facility, including a GBP260 million

Green Term loan and a GBP540 million undrawn revolving credit

facility ("RCF").

In February 2023, Berkeley exercised the first of two one-year

extensions on its GBP800 million bank facility, which extended the

term thereof to February 2028, with one remaining extension option

available.

Berkeley has allocated the proceeds of the Green Bonds and Green

Term Loan to its ongoing development activities in accordance with

its Green Financing Framework (available on its website).

With total borrowings of GBP660 million, the Group's gross cash

holdings of around GBP1.1 billion are placed on deposit with its

relationship banks.

Joint Ventures

Included within non-current assets are investments in joint

ventures accounted for using the equity method which are at

GBP223.4 million at 30 April 2023 (2022: GBP190.4 million). The net

GBP33.0 million increase in the year arises from Berkeley's 50%

share of three movements:

-- Profits earned in joint ventures of GBP96.3 million;

-- Dividend distribution from St Edward of GBP74.9 million; and

-- Cash contributions (loans) to site specific joint ventures of GBP11.6 million.

In St Edward, 594 homes were completed in the year at an average

selling price of GBP885,000 (2022: 303 homes at GBP898,000). The

completions occurred at Royal Warwick Square and Millbank in

London, Hartland Village in Fleet, Green Park Village in Reading

and Highcroft in Wallingford.

In total, 2,435 plots (30 April 2022: 5,317 plots) in Berkeley's

land holdings relate to five St Edward developments, two in London

(Westminster and Kensington) and three outside the capital

(Reading, Fleet and Wallingford ).

The majority of homes on the two sites in London are expected to

complete in the year ending 30 April 2024, following which the

three sites outside London remain under development. During the

year, two sites without planning in Brentford and Guildford, both

contracted on a conditional basis, have been transferred to the

long-term pipeline as these are subject to a call-in and appeal

process, respectively.

Land Holdings and Pipeline

Berkeley's land holdings comprise 58,045 plots at 30 April 2023

(2022: 66,163 plots), including the St Edward joint venture. The

three sites (3,165 homes) that were contracted on a subject to

planning basis at 30 April 2022 have been transferred to the

pipeline during the year to reflect the long-term nature of these

sites, particularly in the current planning environment.

Consequently, all of the current land holdings of 58,045 plots

across 73 sites that are owned and included on the Balance Sheet of

the Group or its joint venture. Berkeley started the year with 86

owned sites (62,998 plots). During the year no new sites have been

acquired on an unconditional basis, while nine sites have finished

and four owned sites have been transferred to the long-term

pipeline.

The pipeline comprises approximately 14,000 plots across 14

sites at 30 April 2023 (2022: 8,000 plots on 6 sites). The increase

during the year comprises the transfer from the land holdings of

the four owned and three conditionally contracted sites, as noted

above, as well as the addition of a long-term site in Motspur Park

which has been conditionally contracted in the year.

The plots in the land holdings at 30 April 2023 have an

estimated future gross profit of GBP7.63 billion (30 April 2022:

GBP8.26 billion), which includes the Group's 50% share of the

anticipated profit on St Edward's joint venture developments. This

is a net reduction in gross profit of GBP0.63 billion over the

course of the year. With over GBP0.8 billion of gross profit taken

through the Income Statement (including St Edward share), the value

added through new planning consents and other market movements has

more than offset the impact of the seven sites which have

transferred to the pipeline.

The estimated future gross margin is 26.2% (2022: 26.5%), a

resilient position in the context of the operating and

macro-economic environment.

The status of the 73 owned sites is:

-- 51 sites (plots: 42,748) have an implementable planning consent and are in production;

-- 13 sites (plots: 9,888) have a consent but are not in

production, in some cases as they are not yet implementable, due to

practical technical constraints and challenges surrounding, for

example, vacant possession, CPO requirements or utilities

provision; and

-- 9 sites (plots: 5,409) do not have a planning consent.

The estimated future gross margin represents management's

risk-adjusted assessment of the potential gross profit for each

site, taking account of a wide range of factors, including: current

sales and input prices; the political and economic backdrop; the

planning regime; and other market forces; all of which could have a

significant effect on the eventual outcome.

Our Vision 2030: Transforming Tomorrow

Our Vision 2030 is Berkeley's ambitious long-term strategy,

which sets 10 strategic priorities for the business over the

current decade. It is designed to drive our performance, spur

innovation and reinforce our position as the country's most

sustainable developer through maximising our positive impacts on

society, the economy and the natural world.

External recognition of our strategy includes:

-- A- Leadership rating for Climate Action and Transparency from CDP;

-- Prime status from the ISS ESG Corporate Rating which is

reserved for "industry leaders who fulfil demanding performance

expectations";

-- Low risk rating with Sustainalytics;

-- AAA MSCI rating held for more than five years; and

-- Continual FTSE4Good Index listing since 2003.

In May 2023 we were delighted to win Management Today's award

for 'Long-Term Business Success' for demonstrating long-term growth

not just in financial terms, but culture, values and product. The

cross-sector judging panel said Berkeley was a "worthy winner",

praising the emphasis and commitment to measuring and improving

customer satisfaction, as well as a strong commitment to ESG.

Delivering for our customers

Our independently verified Net Promoter Score (NPS) of +79.2

significantly outperforms the industry average of 42 (HBF, March

2023). 97.5% of our customers said they would 'recommend us to a

friend' in 2023. We retain the Investor in Customers Gold rating

and this year won In-House Research's Outstanding Achievement

Award.

From exceptional service to the quality of our homes, we aim to

delight our customers in every last detail. This year, our

customers reported that 60% of our homes had zero defects, compared

to only 5% of homes on average across the industry (HBF, March

2023). On average, our customers report fewer than three defects

which reflects our detailed handover checks, underpinned by our

build quality assurance arrangements, with robust training and

audit programmes in place.

Driving ambitious climate action

Tackling climate change has been a priority for Berkeley since

2007 and we are proud to be a 1.5 degree aligned business working

towards validated science-based targets ("SBTs") for reducing our

emissions.

We are pleased to report that we have achieved our absolute

scopes 1 and 2 (market-based) emissions target well ahead of the

2030 target, exceeding our 50% reduction target with a 76% decrease

since the baseline year of 2019. This reduction has largely been

driven by a transition to the use of biodiesel HVO (Hydrotreated

Vegetable Oil) on our construction sites, with 95% of fuel directly

purchased for use in the year being this low carbon

alternative.

We have purchased 100% renewable electricity in the UK since May

2017, backed by Renewable Energy Guarantees of Origin ("REGOs"). We

voluntarily offset the remainder of our scopes 1 and 2 emissions

through certified schemes. This year our offset payments have

supported the new RetrofitCredits programme which utilises funds to

decarbonise existing UK affordable housing through the installation

of energy efficient measures such as improved insulation.

We recognise that our most significant impacts, around 99%,

occur across our value chain (scope 3), including the activities of

our supply chain ('embodied carbon') and the energy used by our

customers in homes once sold ('low carbon homes'). We have

continued to improve our understanding and the data accuracy of

these impacts, including undertaking detailed life-cycle

assessments of individual buildings to identify materials and

processes which drive embodied carbon. We have used this data to

create internal guidance on how to design-out these emissions from

future developments and set quantitative reduction targets to drive

progress. This pioneering approach to tackling embodied carbon was

recognised with the Carbon Reduction Award at the National

Sustainability Awards in October 2022.

Berkeley continues to implement the requirements of the 2021

Building Regulations (effective June 2022 with a 12-month

transitional arrangements) through a fabric-first design approach

in combination with the most appropriate technology and

infrastructure solution for each site. We continue to engage with

industry on this important topic, particularly through the UKGBC's

Advancing Net Zero Programme and the Future Homes Hub.

Supporting nature's recovery

As the first homebuilder to commit to delivering a measurable

biodiversity net gain on every new site back in 2017 we were

delighted to co-host the industry-wide Biodiversity Conference in

March 2023 with Natural England and the Local Government

Association. This aimed to prepare developers and local authority

professionals for the forthcoming mandatory requirement for

biodiversity net gain from autumn 2023 and was attended by more

than 500 delegates from across the public, private and voluntary

sectors.

Since we set our commitment in May 2017 all new planning

applications have committed to a biodiversity net gain, with each

site targeting a gain in excess of 10% since May 2021. Overall, 54

sites have committed to an on-site biodiversity net gain, which

together are set to deliver more than 550 acres of new or

measurably improved natural habitats. These natural landscapes are

all being delivered on our development sites rather than off-site,

helping to improve the areas in which we work and to connect our

customers and future residents with nature at their doorstep.

We continue to evolve our approach to biodiversity net gain to

include an even more challenging and valuable combination of

measurable environmental benefits. Our approach to 'environmental

net gain' will focus on four areas where the pressures on the

environment are greatest and where we can have most impact:

climate, pollution, ecology and water. This year, our Royal

Exchange development in Kingston upon Thames is believed to be the

first of its kind to achieve water neutrality in a trial completed

with Thames Water through retrofitting and upgrading local

businesses, homes and schools.

Developing skills for the future and a working environment where

people can thrive

During the year Berkeley released a new competency framework for

our people to ensure that we are training and upskilling our

workforce to meet evolving needs. Our in-house Berkeley Academy,

which is an Approved Training Organisation by the Construction

Industry Training Board (CITB), has delivered 4,400 trainer hours

in the year to upskill our employees.

This year we have developed a new People Framework that fosters

a positive working environment defined by respect, support,

wellbeing, safety and inclusivity. This is supported by our

approach to Equity, Diversity and Inclusion (EDI), which set out a

number of action areas including strong leadership, awareness,

allyship and celebration. Our efforts are particularly focused on

women, ethnicity, disability and LGBTQ+ and work alongside our

commitments to social mobility. We are pleased to have expanded our

partnerships to support our progress in this area with pledges to

the Race at Work Charter and Disability Confident employer scheme.

This year 31% of managers are female, together with 37% of our

employees.

Berkeley is pleased to have been awarded Gold member status of

The 5% Club, and this year have exceeded our pledge with 10% of our

workforce consisting of 'earn and learn' roles including

apprentices, graduates and sponsored students. On average, we have

had 160 direct apprentices and 70 graduates throughout the year and

are now listed 16(th) in TheJobCrowd's Top 50 Graduate Employers in

the country.

Championing safer homes and operations

Our Annual Injury Incidence Rate for the year is 79 per 100,000

people, compared to an industry average of 326 (HSE, October 2022).

We continue to target zero harm on every site, as we champion

health and safety for every employee and contractor working with

us. We were proud to have once again been recognised by RoSPA in

2023, winning the Construction Housebuilding and Property

Development Industry Sector award.

We aim to extend our influence beyond our direct operations and

to make new homes safer places to live, especially for young

children and the elderly. Following the co-writing of RoSPA's Safer

by Design framework, we have now rolled this out as standard for

all new sites and achieved Gold status for 17 developments.

The Berkeley Foundation ("Foundation")

The Foundation continues to be deeply embedded at Berkeley and

during the year launched a new Volunteering Hub, encouraging more

employees to volunteer their time. Our employees organised 26 major

fundraising events and donated through payroll giving, with more

than half of our workforce choosing to get involved in the

Foundation's work over the last 12 months. We have offered work

placements and job opportunities, held careers days to help young

people about to start their journey into employment, and shared our

expertise.

Over the year, the Foundation contributed GBP3.9 million to its

charity partnerships and programmes through grants and staff

fundraising and Give as You Earn. Highlights include the commitment

of a further GBP300,000 for the second year of the Foundation's

three-year GBP900,000 Resilience Fund, aiming to help small to

medium sized charities and Community Interest Companies to develop

their organisational resilience - whether through improved

governance, strengthened people power, better financial planning or

stronger systems and strategies. 10 new organisations will receive

these funds over two years, alongside a programme of learning and

development support.

The Foundation also launched a number of new partnerships,

including a new three-year partnership with Groundwork London,

supporting young people to kick-start their careers in the green

economy through a youth leadership programme.

- End -

Principal risks and uncertainties

The Board is conscious of the ongoing elevated volatility in the

operating environment and the Group's business model and risk

management approach ensures we are agile and responsive to evolving

market conditions. As such, our risk appetite remains dynamic and

is respectful of the cyclical nature or our industry and the risks

and opportunities this presents.

Financial risk

The financial risks to which Berkeley is exposed include:

-- Liquidity risk - the risk that the funding required for the

Group to pursue its activities may not be available.

-- Market credit risk - the risk that counterparties (mainly

customers) will default on their contractual obligations, resulting

in a loss to the Group. The Group's exposure to credit risk is

comprised of cash and cash equivalents and trade and other

receivables.

-- Market interest rate risk - the risk that Group financing

activities are affected by fluctuations in market interest

rates.

-- Other financial risks - Berkeley contracts all of its sales

and the vast majority of its purchases in sterling, and so has no

significant exposure to currency risk, but does recognise that its

credit risk includes receivables from customers in a range of

jurisdictions who are themselves exposed to currency risk in

contracting in sterling.

Management of financial risks

Berkeley adopts a prudent approach to managing these financial

risks.

-- Treasury policy and central overview - The Board approves

treasury policy and senior management control day-to-day

operations. Relationships with banks and cash management are

co-ordinated centrally as a Group function. The treasury policy is

intended to maintain an appropriate capital structure to manage the

financial risks identified and provide the right platform for the

business to manage its operating risks.

-- Low gearing - the Group is currently financing its operations

through shareholder equity, supported by GBP410 million of net cash

on the Balance Sheet and debt facilities. This in turn has

mitigated its current exposure to interest rate risk.

-- Headroom provided by bank facilities - the Group now has

GBP800 million of committed credit facilities maturing in February

2028, with an optional extension to February 2029. This comprises a

term loan of GBP260 million and the revolving credit facility of

GBP540 million. In addition, the Group has listed debt in the form

of Green Bonds to the value of GBP400 million maturing in August

2031. Berkeley has a strong working partnership with the six banks

that provide the facilities and this is key to Berkeley's approach

to mitigating liquidity risk.

-- Forward sales - Berkeley's approach to forward selling new

homes to customers provides good visibility over future cash flows,

as expressed in cash due on forward sales which stands at GBP2.14

billion at 30 April 2023. It also helps mitigate market credit risk

by virtue of customers' deposits held from the point of

unconditional exchange of contracts with customers.

-- Land holdings - by investing in land at the right point in

the cycle, holding a clear development pipeline in our land

holdings and continually optimising our existing holdings, we are

not under pressure to buy new land when it would be wrong for the

long-term returns for the business.

-- Detailed appraisal of spending commitments - a culture which

prioritises an understanding of the impact of all decisions on the

Group's spending commitments and hence its Balance Sheet, alongside

weekly and monthly reviews of cash flow forecasts at operating

company, divisional and Group levels, recognises that cash flow

management is central to the continued success of Berkeley.

Risk Description and Impact Approach to Mitigating Risk

Economic Outlook

As a property developer, Berkeley's Recognition that Berkeley operates

business is sensitive to wider in a cyclical market is central to

economic factors such as changes our strategy and maintaining a strong

in interest rates, employment financial position is fundamental to

levels and general consumer our business model and protects us

confidence. against adverse changes in economic

conditions.

Some customers are also sensitive

to changes in the sterling exchange Land investment in all market conditions

rate in terms of their buying is carefully targeted and underpinned

decisions or ability to meet by demand fundamentals and a solid

their obligations under contracts. viability case.

Changes to economic conditions Levels of committed expenditure are

in the UK, Europe and worldwide carefully monitored against forward

may lead to a reduction in demand sales secured, cash levels and headroom

for housing which could impact against our available bank facilities,

on the Group's ability to deliver with the objective of keeping financial

its corporate strategy. risk low to mitigate the operating

risks of delivery in uncertain markets.

Production programmes are continually

assessed, depending upon market conditions.

The business is committed to operating

at an optimal size, with a strong Balance

Sheet, through autonomous businesses

to maintain the flexibility to react

swiftly, when necessary, to changes

in market conditions.

Political Outlook

Significant political events Whilst we cannot directly influence

in the UK and overseas, may political events, the risks are taken

impact Berkeley's business through, into account when setting our business

for example, supply chain disruption strategy and operating model. In addition,

or the reluctance of customers we actively engage in the debate on

to make purchase decisions due policy decisions.

to political uncertainty and,

subsequently, policies and regulation

may be introduced that directly

impact our business model.

Regulation

Berkeley is primarily focused geographically

Adverse changes to Government on London, Birmingham and the South

policy on areas such as taxation, East of England, which limits our risk

design requirements and the when understanding and determining

environment could restrict the the impact of new regulation across

ability of the Group to deliver multiple locations and jurisdictions.

its strategy.

The effects of changes to Government

Failure to comply with laws policies at all levels are closely

and regulations could expose monitored by operating businesses and

the Group to penalties and reputational the Board, and representations made

damage. to policy-setters where appropriate.

Berkeley's experienced teams are well

placed to interpret and implement new

regulations at the appropriate time

through direct lines of communication

across the Group, with support from

internal and external legal advisors.

Land Availability

Understanding the markets in which

An inability to source suitable we operate is central to Berkeley's

land to maintain the Group's strategy and, consequently, land acquisition

land holdings at appropriate is primarily focused on Berkeley's

margins in a highly competitive core markets of London, Birmingham

market could impact on the Group's and the South East of England, markets

ability to deliver its corporate in which it believes the demand fundamentals

strategy. are strong.

Berkeley has experienced land teams

with strong market knowledge in their

areas of focus, which gives us the

confidence to buy land without an implementable

planning consent and, with an understanding

of local stakeholders' needs, positions

Berkeley with the best chance of securing

a viable planning consent.

Berkeley's land holdings mean that

it has the land in place for its immediate

business plan requirements and can

therefore always acquire land at the

right time in the cycle.

Planning Process

The Group's strategic geographical

Delays or refusals in obtaining focus and expertise place it in the

commercially viable planning best position to conceive and deliver

permissions could result in the right consents for the land acquired.

the Group being unable to develop

its land holdings. Full detailed planning and risk assessments

are performed and monitored for each

This could have a direct impact site without planning permission, both

on the Group's ability to deliver before and after purchase. The planning

its product and on its profitability. status of all sites is reviewed at

both monthly divisional Board meetings

and Main Board meetings.

The Group works closely with local

communities in respect of planning

proposals and strong relationships

are maintained with local authorities

and planning officers.

Retaining People

An inability to attract, develop, Two commitments within Our Vision 2030

motivate and retain talented are designed to help recruit and retain

employees could have an impact a high calibre work force.

on the Group's ability to deliver

its strategic priorities. The first is 'Employee Experience'

which places a specific focus on areas

Failure to consider the retention including employee experience and diversity

and succession of key management and inclusion, and the second focuses

could result in a loss of knowledge on 'Future Skills' looking at how we

and competitive advantage. can create tangible long-term change

within the industry.

Succession planning is regularly reviewed

at both divisional and Main Board level.

Close relationships and dialogue are

maintained with key personnel.

Remuneration packages are constantly

benchmarked against the industry to

ensure they remain competitive.

Securing Sales

An inability to match supply The Group has experienced sales teams

to demand in terms of product, both in the UK and within our overseas

location and price could result sales offices, supplemented by market-leading

in missed sales targets and/or agents.

high levels of completed stock

which in turn could impact on Detailed market demand assessments

the Group's ability to deliver of each site are undertaken before

its corporate strategy. acquisition and regularly during delivery

of each scheme to ensure that supply

is matched to demand in each location.

Design, product type and product quality

are all assessed on a site-by-site

basis to ensure that they meet the

target market and customer aspirations

in that location.

The Group's ability to forward sell

reduces the risk of the development

cycle where possible, thereby justifying

and underpinning the financial investment

in each of the Group's sites. Completed

stock levels are reviewed regularly.

Liquidity

Reduced availability of the The Board approves treasury policy

external financing required and senior management control day-to-day

by the Group to pursue its activities operations. Relationships with banks

and meet its liabilities. and cash management are co -- ordinated

centrally as a Group function.

Failure to manage working capital

may constrain the growth of The treasury policy is intended to

the business and ability to maintain an appropriate capital structure

execute the business plan. to manage the Group's financial risks

and provide the right platform for

the business to manage its operating

risks.

Cash flow management is central to

the continued success of Berkeley.

There is a culture which prioritises

an understanding of the impact of all

decisions on the Group's spending commitments

and hence its Balance Sheet, alongside

weekly and monthly reviews of cash

flow forecasts at operating company,

divisional and Group levels.

Mortgages

An inability of customers to Berkeley has a broad product mix and

secure sufficient mortgage finance customer base which reduces the reliance

now or in the future could have on mortgage availability across its

a direct impact on the Group's portfolio.

transaction levels.

Deposits are taken on all sales to

mitigate the financial impact on the

Group in the event that sales do not

complete due to a lack of mortgage

availability.

Climate Change

The effects of climate change Climate action is a strategic priority

could impact Berkeley in different within our business strategy, Our Vision

ways. Climate Scenario Analysis 2030, and we have set ambitious SBTs

has been undertaken to evaluate to mitigate our impact, alongside continuing

climate related risks and opportunities. to incorporate adaptation measures

within our developments to make them

Identified risks and opportunities more resilient to the expected future

relating to the transition to impacts of climate change.

a lower carbon economy include:

carbon pricing and emissions We have energy efficiency standards

offsets; evolving planning and in place that cover the activities

design requirements; skills of our sites, offices and sales suites

shortage impacting ability to and encourage the identification and

install low carbon technology; investment in measures to take action

technology evolution; increasing under our scopes 1 and 2 GHG emissions

raw material cost; and demand reduction target. In addition, our

supply imbalance. scope 3 SBT commits us to working with

our supply chain to reduce the embodied

Risks relating to the physical carbon within the materials and services

impacts of climate change include: we procure, and building more efficient

heat stress, drought stress, homes.

subsidence, windstorm and flood.

To build resilience into our homes

and developments, we consider climate

change risks and incorporate measures

to reduce these through minimum Sustainability

Standards. These cover areas such as

energy efficiency, water efficiency,

rainwater harvesting, sustainable drainage

systems (SuDS) and leaving space for

nature.

Sustainability

Berkeley is aware of the environmental The strategic direction for sustainability

and social impact of the homes is set at a Group level within a dedicated

and places that it builds, both Sustainability Strategy. Three areas

throughout the development process of the Sustainability Strategy have

and during occupation and use been identified as being of material

by customers and the wider community. importance and integrated within our

business strategy, Our Vision 2030;

Failure to address sustainability communities, climate action and nature.

issues could affect the Group's We have specific commitments to enhance

ability to acquire land, gain environmental and social value in the

planning permission, manage operation of our business and the delivery

sites effectively and respond of our homes and places.

to increasing customer demands

for sustainable homes and communities, Dedicated sustainability teams are

with access to green spaces in place at Group's Head Office and

and nature. within each division of the business,

providing advice, driving improvement

and monitoring performance.

Sustainability Standards set out the

minimum Berkeley requirements for new

developments and the operation of our

construction sites, divisional offices

and sales suites. These are supported

by more detailed procedures within

our Sustainability Management System,

including a requirement for environmental

risk registers for each site and the

completion of at least quarterly site

sustainability assessments by our internal

sustainability professionals.

Health and Safety

Berkeley's operations have a

direct impact on the health Berkeley considers this to be an area

and safety of its people, contractors of critical importance. Berkeley's

and members of the public. health and safety strategy is set by

the Board. Dedicated health and safety

A lack of adequate procedures teams are in place in each division

and systems to reduce the dangers and at Head Office.

inherent in the construction

process increases the risk of Procedures, training and reporting

accidents or site related catastrophes, are all regularly reviewed to ensure

including fire and flood, which that high standards are maintained

could result in serious injury and comprehensive accident investigation

or loss of life leading to reputational procedures are in place. Insurance

damage, financial penalties is held to cover the risks inherent

and disruption to operations. in large scale construction projects.

The Group continues to implement initiatives

to improve health and safety standards

on site.

Product Quality and Customers

Berkeley has a reputation for Detailed reviews are undertaken of

high standards of quality in the product on each scheme both during

its product. the acquisition of the site and throughout

the build process to ensure that product

If the Group fails to deliver quality is maintained.

against these standards and

its wider development obligations, The Group has detailed quality assurance

it could be exposed to reputational procedures in place surrounding both

damage, as well as reduced sales design and build to ensure the adequacy

and increased cost. of build at each key stage of construction.

Customer satisfaction surveys are undertaken

on the handover of our homes, and feedback

incorporated into the specification

and design of subsequent schemes.

Build Cost and Programme

Build costs are affected by A procurement and programming strategy

the availability of skilled for each development is agreed by the

labour and the price and availability divisional Board before site acquisition,

of materials, suppliers and whilst a further assessment of procurement

contractors. and programming is undertaken and agreed

by the divisional Board prior to the

Declines in the availability commencement of construction.

of a skilled workforce, and

changes to these prices could Build cost reconciliations and build

impact on our build programmes programme dates are presented and reviewed

and the profitability of our in detail at divisional cost review

schemes. meetings each month.

Our Vision 2030 strategy includes ongoing

commitments to training and support

across both our employees and our indirect

workforce.

Cyber and Data Risk

The Group acknowledges that Berkeley's systems and control procedures

it places significant reliance are designed to ensure that confidentiality,

upon the availability, accuracy availability and integrity are not

and confidentiality of all of compromised.

its information systems and

the data contained therein. Our Information Security Programme

focuses primarily on the detection

The Group could suffer significant and prevention of security incidents

financial and reputational damage and potential data breaches.

because of the corruption, loss

or theft of data, whether inadvertent An IT Security Committee meets monthly

or via a deliberate, targeted to address all cyber security matters.

cyber attack.

The Group operates multiple physical

data centres supported by cloud based

services thereby reducing centralised

risk exposure. An IT disaster recovery

plan is regularly assessed.

The Group has cyber insurance in place

to reduce any potential financial impact.

Condensed Consolidated Income Statement

For the year ended 30 April 2023 2022

Notes GBPm GBPm

------------------------------------- ------ ---------- ----------

Revenue 2,550.2 2,348.0

Cost of sales (1,853.4) (1,683.2)

------------------------------------- ------ ---------- ----------

Gross profit 696.8 664.8

Net operating expenses (178.5) (156.9)

------------------------------------- ------ ---------- ----------

Operating profit 518.3 507.9

Finance income 3 23.1 2.5

Finance costs 3 (33.7) (15.0)

Share of results of joint ventures

using the equity method 96.3 56.1

---------- ----------

Profit before taxation for the year 604.0 551.5

Income tax expense 4 (138.3) (69.1)

------------------------------------- ------ ---------- ----------

Profit after taxation for the year 465.7 482.4

------------------------------------- ------ ---------- ----------

Earnings per share (pence):

Basic 5 426.8 417.8

Diluted 5 422.4 411.4

------------------------------------- ------ ---------- ----------

Condensed Consolidated Statement of Comprehensive Income

2023 2022

GBPm GBPm

------------------------------------------- ------ ------

Profit after taxation for the year 465.7 482.4

-------------------------------------------- ------ ------

Other comprehensive expense

Items that will not be reclassified

to profit or loss

Actuarial loss recognised in the pension

scheme (1.3) (1.6)

Total items that will not be reclassified

to profit or loss (1.3) (1.6)

-------------------------------------------- ------ ------

Other comprehensive expense for the

year (1.3) (1.6)

-------------------------------------------- ------ ------

Total comprehensive income for the

year 464.4 480.8

-------------------------------------------- ------ ------

Condensed Consolidated Statement of Financial Position

As at 30 April 2023 2022

Notes GBPm GBPm

-------------------------------------- ------ ---------- ----------

Assets

Non-current assets

Intangible assets 17.2 17.2

Property, plant and equipment 34.6 40.5

Right-of-use assets 5.2 5.8

Investments accounted for using the

equity method 223.4 190.4

Deferred tax assets 114.5 120.7

394.9 374.6

-------------------------------------- ------ ---------- ----------

Current assets

Inventories 6 5,302.1 5,134.0

Trade and other receivables 92.3 145.7

Current tax assets - 4.5

Cash and cash equivalents 7 1,070.4 928.9

-------------------------------------- ------ ---------- ----------

6,464.8 6,213.1

-------------------------------------- ------ ---------- ----------

Total assets 6,859.7 6,587.7

-------------------------------------- ------ ---------- ----------

Liabilities

Non-current liabilities

Borrowings 7 (660.0) (660.0)

Trade and other payables (863.4) (719.8)

Lease liability (2.9) (3.8)

Provisions for other liabilities and

charges (115.1) (98.5)

-------------------------------------- ------ ---------- ----------

(1,641.4) (1,482.1)

-------------------------------------- ------ ---------- ----------

Current liabilities

Trade and other payables (1,801.6) (1,904.9)

Current tax liabilities (3.7) -

Lease liability (2.2) (2.1)

Provisions for other liabilities and

charges (78.5) (62.5)

-------------------------------------- ------ ---------- ----------

(1,886.0) (1,969.5)

Total liabilities (3,527.4) (3,451.6)

-------------------------------------- ------ ---------- ----------

Total net assets 3,332.3 3,136.1

-------------------------------------- ------ ---------- ----------

Equity

Shareholders' equity

Share capital 6.3 6.5

Share premium 49.8 49.8

Capital redemption reserve 25.2 25.0

Other reserve (961.3) (961.3)

Retained earnings 4,212.3 4,016.1

-------------------------------------- ------ ---------- ----------

Total equity 3,332.3 3,136.1

-------------------------------------- ------ ---------- ----------

Condensed Consolidated Statement of Changes in Equity

Capital

Share Share redemption Other Retained Total

capital premium reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------------------------ -------- -------- ----------- -------- --------- --------

At 1 May 2022 6.5 49.8 25.0 (961.3) 4,016.1 3,136.1

Profit after taxation for the year - - - - 465.7 465.7

Other comprehensive expense for the year - - - - (1.3) (1.3)

Purchase of own shares (0.2) - 0.2 - (155.4) (155.4)

Transactions with shareholders:

- Charge in respect of employee share schemes - - - - (4.5) (4.5)

- Deferred tax in respect of employee share schemes - - - - (9.8) (9.8)

- Dividends to equity holders of the Company - - - - (98.5) (98.5)

------------------------------------------------------ -------- -------- ----------- -------- --------- --------

At 30 April 2023 6.3 49.8 25.2 (961.3) 4,212.3 3,332.3

------------------------------------------------------ -------- -------- ----------- -------- --------- --------

At 1 May 2021 6.6 49.8 24.9 (961.3) 4,055.4 3,175.4

Profit after taxation for the year - - - - 482.4 482.4

Other comprehensive expense for the year - - - - (1.6) (1.6)

Purchase of own shares (0.1) - 0.1 - (63.7) (63.7)

Transactions with shareholders:

- Charge in respect of employee share schemes - - - - (8.7) (8.7)

- Deferred tax in respect of employee share schemes - - - - 3.8 3.8

- Capital Return to equity holders of the Company - - - - (451.5) (451.5)

------------------------------------------------------ -------- -------- ----------- -------- --------- --------