AIM Schedule One - Avingtrans Plc (9414N)

August 14 2017 - 9:30AM

UK Regulatory

TIDMAVG

RNS Number : 9414N

AIM

14 August 2017

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT

PRIOR TO ADMISSION IN ACCORDANCE WITH RULE 2

OF THE AIM RULES FOR COMPANIES ("AIM RULES")

--------------------------------------------------------------------------------

COMPANY NAME:

--------------------------------------------------------------------------------

Avingtrans plc ("Avingtrans", the "Existing

Group" or the "Company")

--------------------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT,

COMPANY TRADING ADDRESS (INCLUDING POSTCODES)

:

--------------------------------------------------------------------------------

Chatteris Business Park, Chatteris, Cambridgeshire

PE16 6SA

--------------------------------------------------------------------------------

COUNTRY OF INCORPORATION:

--------------------------------------------------------------------------------

UK

--------------------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION

REQUIRED BY AIM RULE 26:

--------------------------------------------------------------------------------

www.avingtrans.plc.uk

--------------------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF

OPERATION) OR, IN THE CASE OF AN INVESTING COMPANY,

DETAILS OF ITS INVESTING POLICY). IF THE ADMISSION

IS SOUGHT AS A RESULT OF A REVERSE TAKE-OVER

UNDER RULE 14, THIS SHOULD BE STATED:

--------------------------------------------------------------------------------

Admission is being sought as a result of the

proposed reverse takeover of Hayward Tyler Group

plc ("HTG" or the "HTG Group" and, following

completion of the acquisition by Avingtrans,

the "Enlarged Group"). The Company's main country

of operation is the UK.

Information on Avingtrans

Avingtrans is a precision engineering group,

operating in differentiated, specialist niches

in the supply chains of engineering original

equipment manufacturers. Its core strategy is

to buy and build market-leading niche positions

in its chosen market sectors (currently energy

and medical) and then ultimately divest in order

to deliver shareholder value.

The Existing Group's current operations are

focused on safety critical equipment for the

energy and medical markets. The Directors are

developing the Existing Group's position as

a supplier of energy industry process modules,

vertically integrating this capability with

the vessel manufacturing capability at Metalcraft.

This same vertical integration capability lends

itself to the nuclear decommissioning, life

extension and "new nuclear" markets, as well

as a variety of other niches in the renewable

energy sector.

Information on HTG

HTG Group is focused on delivering performance-critical

solutions to meet current and future global

energy needs. It designs, engineers, manufactures

and services performance-critical motor, pumping

and power solutions across the global energy

sector. HTG Group has two businesses; Hayward

Tyler and Peter Brotherhood, which employ over

500 staff globally and trade from facilities

in the UK, the USA, China and India.

--------------------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING

ANY RESTRICTIONS AS TO TRANSFER OF THE SECURITIES

(i.e. where known, number and type of shares,

nominal value and issue price to which it seeks

admission and the number and type to be held

as treasury shares):

--------------------------------------------------------------------------------

Up to 30,706,123 ordinary shares of 5p at an

issue price of approximately 245p. No restrictions

as to the transfer of ordinary shares. No ordinary

shares held in treasury.

--------------------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

--------------------------------------------------------------------------------

Anticipated market capitalisation on admission:

c. GBP75 million (depending on the prevailing

mid-market share price of the Company immediately

prior to admission). No capital to be raised

on admission.

--------------------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS

AT ADMISSION:

--------------------------------------------------------------------------------

13.03 per cent.

--------------------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM

TO WHICH THE AIM COMPANY HAS APPLIED OR AGREED

TO HAVE ANY OF ITS SECURITIES (INCLUDING ITS

AIM SECURITIES) ADMITTED OR TRADED:

--------------------------------------------------------------------------------

The ordinary shares of Avingtrans are not admitted

to trading on any other exchange or trading

platform, nor has any such application been

made.

--------------------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED

DIRECTORS (underlining the first name by which

each is known or including any other name by

which each is known):

--------------------------------------------------------------------------------

Directors:

Roger Steven McDowell (Chairman)

Stephen (Steve) McQuillan (Chief Executive Officer)

Stephen Michael King (Chief Financial Officer)

Dr Graham Kenneth Thornton (Non-Executive Director)

Leslie James Thomas (Non-Executive Director)

Proposed director:

Ewan Wade Royston Lloyd-Baker (Non-Executive

Director)

--------------------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS

EXPRESSED AS A PERCENTAGE OF THE ISSUED SHARE

CAPITAL, BEFORE AND AFTER ADMISSION (underlining

the first name by which each is known or including

any other name by which each is known):

--------------------------------------------------------------------------------

Prior to Admission Post-Admission

No. of Percentage No. of Percentage

shares held shares held(1)

held held

Nigel Wray 3,019,553 15.8 3,019,553 9.8

Funds managed by

Unicorn Asset Management

Ltd 1,660,800 8.7 1,946,141 6.3

Roger McDowell 1,406,409 7.3 1,406,409 4.6

RBC Trustees 1,393,250 7.3 1,393,250 4.5

Philip McDowell's

pension fund 1,213,205 6.3 1,213,205 4.0

LGT Bank 1,016,950 5.3 1,016,950 3.3

Close Brothers

Asset Management 875,959 4.6 875,959 2.9

Harwood Capital Nil Nil 1,892,745 6.2

(1) Assuming up to 11,535,000 New Ordinary Shares

are issued in connection with the Acquisition

of Hayward Tyler Group plc

--------------------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE

WITH SCHEDULE 2, PARAGRAPH (H) OF THE AIM RULES:

--------------------------------------------------------------------------------

None

--------------------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION

IN THE ADMISSION DOCUMENT HAS BEEN PREPARED

(this may be represented by unaudited interim

financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST

THREE REPORTS PURSUANT TO AIM RULES 18 AND 19:

--------------------------------------------------------------------------------

(i) 31 May

(ii) 30 November 2016 in respect of Avingtrans

plc

31 March 2017 in respect of Hayward Tyler Group

plc

(iii) 30 November 2017 (in respect of the final

results of Avingtrans for the year to 31 May

2017)

28 February 2018 (in respect of the interim

results of Avingtrans for the six-months to

30 November 2017)

30 November 2018 (in respect of the final results

of Avingtrans for the year to 31 May 2018)

--------------------------------------------------------------------------------

EXPECTED ADMISSION DATE:

--------------------------------------------------------------------------------

1 September 2017

--------------------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

--------------------------------------------------------------------------------

Nplus1 Singer Advisory LLP

One Bartholomew Lane

London

EC2N 2AX

--------------------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

--------------------------------------------------------------------------------

Nplus1 Singer Advisory LLP

One Bartholomew Lane

London

EC2N 2AX

--------------------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT,

DETAILS OF WHERE (POSTAL OR INTERNET ADDRESS)

THE ADMISSION DOCUMENT WILL BE AVAILABLE FROM,

WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION

OF ITS SECURITIES:

--------------------------------------------------------------------------------

N/A

--------------------------------------------------------------------------------

DATE OF NOTIFICATION:

--------------------------------------------------------------------------------

14 August 2017

--------------------------------------------------------------------------------

NEW/ UPDATE:

--------------------------------------------------------------------------------

New

--------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

PAAOKQDKNBKDAFD

(END) Dow Jones Newswires

August 14, 2017 09:30 ET (13:30 GMT)

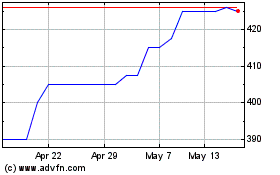

Avingtrans (LSE:AVG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avingtrans (LSE:AVG)

Historical Stock Chart

From Nov 2023 to Nov 2024