Antofagasta Falls After Copper Output, Guidance Misses Views -Update

October 26 2016 - 5:48AM

Dow Jones News

By Alex MacDonald

LONDON--Antofagasta PLC (ANTO.LN) shares fell Wednesday after

the Chilean copper producer reported a lower than expected rise in

third-quarter copper output, spurring analyst jitters that the

company may struggle to meet its full-year guidance.

Analysts also said they were disappointed by the

weaker-than-expected 2017 copper output guidance, prompting

Antofagasta's shares to fall 7.6% to 499.6 pence a share as of 0818

GMT, making the miner the worst performer out of the FTSE 100

index.

Antofagasta, like many of its peers, has struggled recently to

meet production targets. Last year protests, heavy rainfall and

setbacks in mining high grade ore resulted in Antofagasta losing a

chunk of is copper production. This year, the company has already

warned that output would be towards the lower end of its original

guidance due to inherent risks in ramping up new production

capacity.

The miner, which was first incorporated in London in 1888, said

copper production rose 8.7% to 180,600 tons in the three months

ended Sept. 30, 2016 compared with the previous quarter. This

missed Citigroup's forecast of 191,900 tons despite the ramp up of

the new Antucoya mine to full production in August.

Antofagasta had previously said it expected stronger output in

second half of the year compared with the first half and on

Wednesday said it now expects this year's copper output to be close

to the lower end of its guidance of 710,000-740,000 tons.

This means the company will have to produce at least 206,100

tons of copper in the fourth quarter to meet the lower end of its

guidance range after producing 503,900 tons in the first nine

months of the year.

"In our view, management is softly guiding to 2016 production

coming in below the guided range without officially downgrading

guidance," said Berenberg analyst Fawzi Hanano. The guidance "looks

a bit stretched" Citigroup added.

The miner also said it expects to produce between 685,000 to

720,000 tons of copper in 2017 due in part to a decline in copper

grades at the Centinela mine and the processing of harder ore at it

flagship Los Pelambres mine. This compares with consensus forecast

copper output of 750,000 tons for 2017, according to Liberum

Capital.

Gold output rose 33% on the quarter to 70,300 ounces in the

third quarter due to higher gold grades at its Centinela mine,

while net cash costs fell 5.6% on the quarter to $1.18 a pound due

to improved cost effiencies, higher metal output, and higher gold

prices. This prompted the company to lower its 2016 net cash cost

guidance to $1.25 a pound from $1.30/lb.

Antofagasta also noted that its working to address new charges

levied against its Los Pelambres mine by the Chilean environmental

authority. The charges aren't related to the water dispute court

cases already settled and are unlikely to result in any significant

fines or the mine being closed, even temporarily, the company

said.

Antofagasta, however, noted its considering alternative energy

options for Los Pelambres given a 10% to 20% cost overrun at a

hydroelectric power plant project.

Antofagasta also lowered its annual capital expenditure to below

$900 million for both 2016 and 2017 compared with $1.1 billion

previously forecast for this year.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

October 26, 2016 05:33 ET (09:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

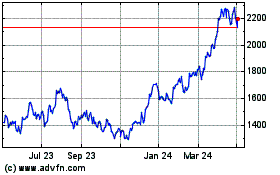

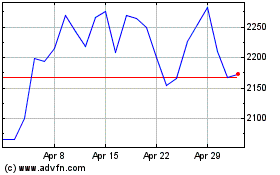

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2024 to May 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From May 2023 to May 2024