TIDMACC

RNS Number : 2188P

Access Intelligence PLC

17 June 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Access Intelligence plc

("Access Intelligence" or the "Company")

Trading Update

Access Intelligence (AIM: ACC), the technology innovator

delivering Software-as-a-Service (SaaS) solutions for the global

marketing and communications industries, is pleased to announce an

update on trading for the six months ended 31 May 2022.

Financials

The Group has made good progress in the period with a robust

performance in the core business and continued progress being made

on the integration of Isentia:

-- The Board anticipates total revenue for the period to be not

less than GBP32.7m, a year-on-year increase of over 195%. Excluding

the acquisition of Isentia, revenue grew by 16%;

-- The Group's Annual Recurring Revenue(1) ("ARR") was GBP59.6m

at the period end, delivering ARR growth of GBP0.7m in the six

months;

-- Adjusted EBITDA is anticipated to be not less than GBP0.2m

for the period, in line with the Board's expectations; and

-- Cash at 31 May 2022 was at least GBP9.2m, ahead of Board

expectations due to better than anticipated working capital

management.

EMEA & North America growth

The Board remains very encouraged by the progress made in the

EMEA and North America market which has demonstrated continued

growth. ARR in EMEA and North America at the period end was

GBP28.1m, showing growth of GBP1.2m.

The business continues to expand well in North America with an

encouraging pipeline and, as a result, the Board expects ARR growth

in the region to accelerate during the second half of the year as

the pipeline converts.

In addition, the Company has recently agreed a new global

referral partnership arrangement with global social media

management platform, Hootsuite, which is expected to open

additional new business opportunities, particularly in North

America.

New client wins in the region during the first half include:

Allianz, Department for Business Energy and Industrial Strategy,

E.ON, Itsu, John Lewis, Hasbro, High Speed Two (HS2), KPMG,

McCann-Erickson, NHS Property Services, Pan MacMillan, Procter

& Gamble, Reddit, Skanska, SmartNews Inc, The Premier League,

Trustpilot, VCCP, and Wateraid.

APAC stabilisation and optimisation

The integration of Isentia continues to progress well. The Group

launched Pulsar into the Australia and New Zealand ("ANZ") market

in the period and the Board is pleased by the customer engagement

with the expanded global product offering. ARR in the ANZ region

remains broadly stable, with a minimal reduction in ARR (2.4%) in

the region post-acquisition.

As described previously, South East Asia ("SEA") has experienced

a period of on-going socio-economic challenges. The focus of the

Group is on ensuring it can optimise the opportunity in the region

within the context of the economic climate and further analysis

continues. Given the backdrop in SEA, ARR in the APAC region at the

period end was GBP31.5m, a decline of GBP0.5m. This remains a

marked improvement to the performance from the region

pre-acquisition where the rate of decline was significantly higher

and reflects the Company's focus on winning long-term recurring

revenue contracts.

The Group has won a number of new clients (including client win

backs) in the region during the first half, including: ABC,

Bulgari, Ausgrid, Chevron, Country Garden Pacific, Estee Lauder,

H&M, Huawei, Lifeline Australia, National Gallery of Australia,

Netflix, Nestle, NHFIC, Northern Land Council, Ogilvy, Public

Service Commission NZ, SAS Group, Savills Management Services,

Special Olympics Australia, StudioCanal, Tiffany & Co, and

Woodside Energy. During the period, the Company also delivered its

first deal combining media monitoring and insights services

alongside Access Intelligence's audience intelligence offering to

win back a significant ANZ customer.

Christopher Satterthwaite, Non-Executive Chairman of the

Company, said:

"The first half of the year has seen the Group trade in line

with expectations. We have delivered strong growth in the core

business with a good performance being delivered by the Group's

EMEA and North America region including a significant number of

blue-chip customers won in the period. The launch of Pulsar in ANZ

has been well received and we expect the integration of the

Company's global product suite to support further progress in APAC

with continued new customer wins.

The Company continues to make good progress on the integration

of Isentia and has been assessing its current business operations

to ensure that it can fully optimise its market positioning to

capture the undoubted market opportunity. This includes a

comprehensive analysis of the current market dynamics across its

regional presence. The Board remains highly confident about

realising the cost synergies identified at the time of the

acquisition.

Overall, the Board is pleased with the progress being made by

the Group and remains positive about the outlook."

(1) ARR is the annual recurring revenue generated from deployed

contracts. The Group has decided to use ARR as its new KPI and is

broadly equivalent to the previously disclosed metric of Annual

Contract Value ("ACV")

For further information:

Access Intelligence plc 020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker)

020 7220 0500

Corporate Finance:

Marc Milmo / Kate Bannatyne / Fergus Sullivan

Corporate Broking:

Alice Lane / Sunila de Silva

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFAESMEESEEM

(END) Dow Jones Newswires

June 17, 2022 02:00 ET (06:00 GMT)

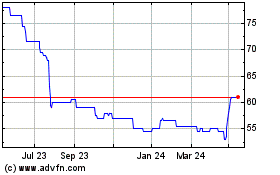

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Nov 2024 to Dec 2024

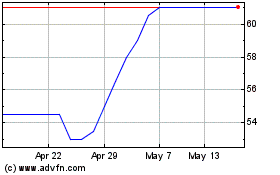

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Dec 2023 to Dec 2024