0001393772false--12-31Q220240.00120000000012348268512348268500000013937722024-01-012024-06-3000013937722023-01-012023-12-310001393772weed:CommonStocksMember2024-01-012024-03-310001393772weed:CommonStocksMember2024-01-012024-06-300001393772weed:ConsultantForServicesMember2024-01-012024-06-300001393772weed:CommonStocksMember2023-01-012023-12-3100013937722014-12-050001393772us-gaap:StockOptionMember2024-06-300001393772us-gaap:StockOptionMember2023-01-012023-12-310001393772us-gaap:StockOptionMember2024-01-012024-06-300001393772us-gaap:StockOptionMember2022-12-310001393772us-gaap:StockOptionMember2023-12-310001393772weed:PatrickBrodnikMember2024-06-300001393772weed:PatrickBrodnikMember2023-12-310001393772weed:RelatedPartiesMember2023-01-012023-06-300001393772weed:RelatedPartiesMember2024-01-012024-06-300001393772weed:NotesPayableJeffreyMillerMember2024-06-300001393772weed:NotesPayableJeffreyMillerMember2023-12-310001393772weed:NotesPayable2Member2024-06-300001393772weed:NicoleBreenMember2024-06-300001393772weed:NotesPayable2Member2023-12-310001393772weed:NicoleBreenMember2023-12-310001393772weed:NotesPayable1Member2024-06-300001393772weed:NotesPayable1Member2023-12-310001393772srt:MaximumMemberus-gaap:TrademarksMember2024-01-012024-06-300001393772srt:MinimumMemberus-gaap:TrademarksMember2024-01-012024-06-300001393772weed:USMemberus-gaap:TrademarksMember2018-01-012018-12-310001393772srt:EuropeMemberus-gaap:TrademarksMember2018-01-012018-12-310001393772us-gaap:LicenseMember2024-06-300001393772us-gaap:LicenseMember2023-12-310001393772us-gaap:TrademarksMember2024-06-300001393772us-gaap:TrademarksMember2023-12-310001393772weed:LaVetaMember2023-07-012023-07-240001393772us-gaap:LandAndBuildingMember2024-06-300001393772us-gaap:LandAndBuildingMember2023-12-310001393772us-gaap:LandMember2024-06-300001393772us-gaap:LandMember2023-12-310001393772us-gaap:EquipmentMember2024-06-300001393772us-gaap:EquipmentMember2023-12-310001393772us-gaap:FurnitureAndFixturesMember2024-06-300001393772us-gaap:FurnitureAndFixturesMember2023-12-310001393772us-gaap:OfficeEquipmentMember2024-06-300001393772us-gaap:OfficeEquipmentMember2023-12-310001393772us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001393772us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001393772us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001393772us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001393772us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001393772us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001393772weed:GlennMartinMember2024-01-012024-06-300001393772weed:NicoleBreenMember2024-01-012024-06-300001393772weed:NicoleBreenMember2023-04-012023-06-300001393772weed:PatrickBrodnikMember2022-07-012022-09-300001393772weed:GlennMartinMember2023-12-310001393772weed:GlennMartinMember2024-06-300001393772weed:NicoleBreenMember2022-01-012022-03-310001393772weed:NicoleBreenMember2023-07-012023-09-300001393772weed:GlennMartinMember2022-01-012022-03-310001393772weed:HempiricalGeneticsLLCMember2024-01-012024-06-300001393772weed:SangreATLLCMember2024-01-012024-06-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001393772us-gaap:RetainedEarningsMember2024-06-300001393772weed:SubscriptionsPayableMember2024-06-300001393772us-gaap:AdditionalPaidInCapitalMember2024-06-300001393772us-gaap:CommonStockMember2024-06-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001393772us-gaap:RetainedEarningsMember2024-04-012024-06-300001393772weed:SubscriptionsPayableMember2024-04-012024-06-300001393772us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001393772us-gaap:CommonStockMember2024-04-012024-06-3000013937722024-03-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001393772us-gaap:RetainedEarningsMember2024-03-310001393772weed:SubscriptionsPayableMember2024-03-310001393772us-gaap:AdditionalPaidInCapitalMember2024-03-310001393772us-gaap:CommonStockMember2024-03-3100013937722024-01-012024-03-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001393772us-gaap:RetainedEarningsMember2024-01-012024-03-310001393772weed:SubscriptionsPayableMember2024-01-012024-03-310001393772us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001393772us-gaap:CommonStockMember2024-01-012024-03-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001393772us-gaap:RetainedEarningsMember2023-12-310001393772weed:SubscriptionsPayableMember2023-12-310001393772us-gaap:AdditionalPaidInCapitalMember2023-12-310001393772us-gaap:CommonStockMember2023-12-3100013937722023-10-012023-12-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-310001393772us-gaap:RetainedEarningsMember2023-10-012023-12-310001393772weed:SubscriptionsPayableMember2023-10-012023-12-310001393772us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-310001393772us-gaap:CommonStockMember2023-10-012023-12-3100013937722023-09-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001393772us-gaap:RetainedEarningsMember2023-09-300001393772weed:SubscriptionsPayableMember2023-09-300001393772us-gaap:AdditionalPaidInCapitalMember2023-09-300001393772us-gaap:CommonStockMember2023-09-3000013937722023-07-012023-09-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001393772us-gaap:RetainedEarningsMember2023-07-012023-09-300001393772weed:SubscriptionsPayableMember2023-07-012023-09-300001393772us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001393772us-gaap:CommonStockMember2023-07-012023-09-3000013937722023-06-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001393772us-gaap:RetainedEarningsMember2023-06-300001393772weed:SubscriptionsPayableMember2023-06-300001393772us-gaap:AdditionalPaidInCapitalMember2023-06-300001393772us-gaap:CommonStockMember2023-06-300001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001393772us-gaap:RetainedEarningsMember2023-04-012023-06-300001393772weed:SubscriptionsPayableMember2023-04-012023-06-300001393772us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001393772us-gaap:CommonStockMember2023-04-012023-06-3000013937722023-03-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001393772us-gaap:RetainedEarningsMember2023-03-310001393772weed:SubscriptionsPayableMember2023-03-310001393772us-gaap:AdditionalPaidInCapitalMember2023-03-310001393772us-gaap:CommonStockMember2023-03-3100013937722023-01-012023-03-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001393772us-gaap:RetainedEarningsMember2023-01-012023-03-310001393772weed:SubscriptionsPayableMember2023-01-012023-03-310001393772us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001393772us-gaap:CommonStockMember2023-01-012023-03-3100013937722022-12-310001393772us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001393772us-gaap:RetainedEarningsMember2022-12-310001393772weed:SubscriptionsPayableMember2022-12-310001393772us-gaap:AdditionalPaidInCapitalMember2022-12-310001393772us-gaap:CommonStockMember2022-12-3100013937722023-01-012023-06-3000013937722023-04-012023-06-3000013937722024-04-012024-06-3000013937722023-12-3100013937722024-06-3000013937722024-08-14iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________.

Commission file number: 333-219922

WEED, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 83-0452269 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

4920 N. Post Trail Tucson, AZ | | 85750 |

(Address of principal executive offices) | | (Zip Code) |

(520) 818-8582

Registrant’s telephone number, including area code

(Former address, if changed since last report) |

|

(Former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

None | | None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of August 14, 2024, there were 123,482,685 shares of common stock, $0.00001 par value, issued and outstanding.

WEED, INC.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

This Quarterly Report includes forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward-looking statements include the information concerning our possible or assumed future results of operations set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties, and assumptions. Our future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements.

ITEM 1 Consolidated Financial Statements

The consolidated balance sheets as of June 30, 2024, (unaudited) and December 31, 2023, the consolidated statements of operations and comprehensive loss for the three and six months ended June 30, 2024 and 2023, the consolidated statement of changes in stockholders’ equity (deficit) for the three and six months ended June 30, 2024 and 2023, and the consolidated statements of cash flows for the three and six months ending June 30, 2024 and 2023, follow. The unaudited interim financial statements reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. All such adjustments are of a normal and recurring nature.

WEED, INC. AND SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2024

TABLE OF CONTENTS

WEED, INC. |

CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

| | June 30, | | | December 31, | |

| | 2024 | | | 2023 | |

ASSETS | | | | | | |

| | | | | | |

CURRENT ASSETS: | | | | | | |

Cash | | $ | 15,171 | | | $ | 290,409 | |

Prepaid expenses | | | 17,635 | | | | 24,622 | |

Other current asset | | | 4,133 | | | | 4,855 | |

| | | | | | | | |

TOTAL CURRENT ASSETS | | | 36,939 | | | | 319,886 | |

| | | | | | | | |

Land | | | 258,319 | | | | 258,319 | |

Building | | | 218,681 | | | | 218,681 | |

Computers & Equipment | | | 147,771 | | | | 147,771 | |

Property and equipment, gross | | | 624,771 | | | | 624,771 | |

| | | | | | | | |

Less: Accumulated depreciation | | | (118,474 | ) | | | (108,431 | ) |

| | | | | | | | |

Property and equipment, net | | | 506,297 | | | | 516,340 | |

| | | | | | | | |

Grower License | | | 667 | | | | 667 | |

Trademark | | | 50,000 | | | | 50,000 | |

Intangible assets, gross | | | 50,667 | | | | 50,667 | |

Less: Accumulated amortization | | | (15,784 | ) | | | (14,484 | ) |

| | | | | | | | |

Intangible assets, net | | | 34,883 | | | | 36,183 | |

| | | | | | | | |

ROU asset | | | 25,177 | | | | 31,653 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 603,296 | | | $ | 904,062 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| | | | | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accounts payable | | $ | 176,776 | | | $ | 183,565 | |

Accrued expense | | | 77,344 | | | | 64,778 | |

Accrued officer compensation | | | 139,500 | | | | 182,500 | |

Accrued interest | | | 13,598 | | | | 13,000 | |

Notes payable, related parties | | | 123,200 | | | | 133,073 | |

Notes payable - in default | | | 3,661 | | | | 3,661 | |

Asset retirement obligation | | | 35,800 | | | | 35,800 | |

Lease liability | | | 25,177 | | | | 31,653 | |

Due to officer | | | 723 | | | | 723 | |

| | | | | | | | |

TOTAL CURRENT LIABILITIES | | | 595,779 | | | | 648,753 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 595,779 | | | | 648,753 | |

| | | | | | | | |

STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

Common stock, $0.001 par value, 200,000,000 authorized, 123,482,685 and 123,482,685 issued and outstanding, respectively | | | 125,433 | | | | 123,483 | |

Additional paid-in capital | | | 84,166,001 | | | | 83,818,351 | |

Subscription payable | | | 386,250 | | | | 701,250 | |

Accumulated deficit | | | (84,674,168 | ) | | | (84,392,563 | ) |

Accumulated other comprehensive loss: | | | | | | | | |

Foreign currency translation | | | 4,001 | | | | 4,788 | |

| | | | | | | | |

TOTAL STOCKHOLDERS’ EQUITY | | | 7,517 | | | | 255,309 | |

| | | | | | | | |

TOTAL LIABILITIES & STOCKERHOLDERS’ EQUITY | | $ | 603,296 | | | $ | 904,062 | |

The accompanying notes are an integral part of the consolidated financial statements

WEED, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

(Unaudited) |

| | For the Three Months | | | For the Six Months | |

| | Ended June 30, | | | Ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

REVENUE | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

General and administrative expenses | | | 85,296 | | | | 108,730 | | | | 221,861 | | | | 242,512 | |

Professional fees | | | 51,474 | | | | 24,077 | | | | 76,677 | | | | 50,173 | |

Depreciation & amortization | | | 8,185 | | | | 23,356 | | | | 16,470 | | | | 47,386 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 144,955 | | | | 156,163 | | | | 315,008 | | | | 340,071 | |

| | | | | | | | | | | | | | | | |

NET OPERATING LOSS | | | (144,955 | ) | | | (156,163 | ) | | | (315,008 | ) | | | (340,071 | ) |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSE) | | | | | | | | | | | | | | | | |

Interest expense | | | (599 | ) | | | (17,280 | ) | | | (1,198 | ) | | | (30,386 | ) |

Other income (expense) | | | 35,000 | | | | - | | | | 35,000 | | | | - | |

TOTAL OTHER EXPENSE, NET | | | 34,401 | | | | - | | | | 33,802 | | | | - | |

| | | | | | | | | | | | | | | | |

INCOME TAX EXPENSE | | | 399 | | | | - | | | | 399 | | | | - | |

| | | | | | | | | | | | | | | | |

NET INCOME (LOSS) | | | (110,953 | ) | | | (173,443 | ) | | | (281,605 | ) | | | (370,458 | ) |

| | | | | | | | | | | | | | | | |

OTHER COMPREHENSIVE INCOME (LOSS) | | | (804 | ) | | | 2,733 | | | | (787 | ) | | | 2,620 | |

| | | | | | | | | | | | | | | | |

COMPREHENSIVE LOSS | | $ | (111,757 | ) | | $ | (170,710 | ) | | $ | (281,992 | ) | | $ | (367,838 | ) |

| | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE NUMBER OF COMMON SHARES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Outstanding - basic and fully diluted | | | 126,270,894 | | | | 123,482,685 | | | | 125,176,789 | | | | 123,482,685 | |

| | | | | | | | | | | | | | | | |

Net loss per share - basic and fully diluted | | $ | (0.001 | ) | | $ | (0.001 | ) | | $ | (0.002 | ) | | $ | (0.003 | ) |

The accompanying notes are an integral part of the consolidated financial statements

WEED, INC. |

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) |

|

For the Three and Six Months ended June 30, 2024 |

(Unaudited) |

| | | | | Additional | | | | | | | | | | | | Total | |

| | Common Stock | | | Paid-In | | | Subscriptions | | | Accumulated | | | Other | | | Stockholders’ | |

| | Shares | | | Amount | | | Capital | | | Payable | | | Deficit | | | Comprehensive | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2022 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,796,857 | | | $ | 611,250 | | | | (84,361,006 | ) | | | (788 | ) | | $ | 169,796 | |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | | - | | | | - | | | | - | | | | 22,500 | | | | - | | | | - | | | | 22,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 5,942 | | | | - | | | | - | | | | - | | | | 5,942 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | (197,014 | ) | | | - | | | | (197,014 | ) |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | (113 | ) | | | (113 | ) |

Balance, March 31, 2023 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,802,799 | | | $ | 633,750 | | | | (84,558,020 | ) | | | (901 | ) | | $ | 1,111 | |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | | - | | | | - | | | | - | | | | 22,500 | | | | - | | | | - | | | | 22,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 10,444 | | | | - | | | | - | | | | - | | | | 10,444 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | (197,014 | ) | | | - | | | | (197,014 | ) |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | (113 | ) | | | (113 | ) |

Balance, June 30, 2023 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,813,243 | | | $ | 656,250 | | | | (84,731,463 | ) | | | 1,832 | | | $ | (136,655 | ) |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | | - | | | | - | | | | - | | | | 22,500 | | | | - | | | | - | | | | 22,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 300 | | | | - | | | | - | | | | - | | | | 300 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | 734,248 | | | | - | | | | 734,248 | |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,364 | | | | 1,364 | |

Balance, September 30, 2023 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,813,543 | | | $ | 678,750 | | | | (83,997,215 | ) | | | 3,196 | | | $ | 621,757 | |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | | - | | | | - | | | | - | | | | 22,500 | | | | - | | | | - | | | | 22,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 4,808 | | | | - | | | | - | | | | - | | | | 4,808 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | (395,348 | ) | | | - | | | | (395,348 | ) |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,592 | | | | 1,592 | |

Balance, December 31, 2023 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,818,483 | | | $ | 701,250 | | | | (84,392,563 | ) | | | 4,788 | | | $ | 255,309 | |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | | - | | | | - | | | | - | | | | 22,500 | | | | - | | | | - | | | | 22,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 300 | | | | - | | | | - | | | | - | | | | 300 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | (170,652 | ) | | | - | | | | (170,652 | ) |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | 17 | | | | 17 | |

Balance, March 31, 2024 | | | 123,482,685 | | | $ | 123,483 | | | $ | 83,818,651 | | | $ | 723,750 | | | | (84,563,215 | ) | | | 4,805 | | | $ | 107,474 | |

Common stock sold for cash | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Common stock issued for services | | 1,950,000 | | | 1,950 | | | 347,050 | | | | (337,500 | ) | | | - | | | | - | | | | 11,500 | |

Imputed Interest on RP Loans | | | - | | | | - | | | | 300 | | | | - | | | | - | | | | - | | | | 300 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | (110,953 | ) | | | - | | | | (110,953 | ) |

Other comprehensive income, net | | | - | | | | - | | | | - | | | | - | | | | - | | | | (804 | ) | | | (804 | ) |

Balance, June 30, 2024 | | | 123,482,685 | | | $ | 125,433 | | | $ | 84,166,001 | | | $ | 386,250 | | | | (84,674,168 | ) | | | 4,001 | | | $ | 7,517 | |

The accompanying notes are an integral part of the consolidated financial statements

WEED, INC. |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

(Unaudited) |

| | For the Six | |

| | Months Ended June 30, | |

| | 2024 | | | 2023 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| | | | | | |

Net loss | | $ | (281,605 | ) | | $ | (370,458 | ) |

Adjustments to reconcile to net loss to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | | 11,343 | | | | 47,386 | |

Debt discount amortization | | | 5,127 | | | | 4,293 | |

Imputed Interest on RP Loans | | | 600 | | | | 16,386 | |

Estimated fair value of stock based compensation | | | 20,000 | | | | - | |

Estimated fair value of shares issued for services | | | 14,000 | | | | 45,000 | |

Decrease (increase) in assets | | | | | | | | |

Prepaid expenses and deposits | | | 7,709 | | | | 3,750 | |

Increase (decrease) in liabilities | | | | | | | | |

Accounts Payable | | | (6,789 | ) | | | (38,696 | ) |

Accrued expenses | | | (29,836 | ) | | | 9,341 | |

| | | | | | | | |

NET CASH USED IN OPERATING ACTIVITIES | | | (259,451 | ) | | | (282,998 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Purchases of property and equipment | | | - | | | | (10,000 | ) |

| | | | | | | | |

NET CASH PROVIDED BY INVESTING ACTIVITIES | | | - | | | | (10,000 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Repayments on notes payable - related party | | | - | | | | 50,000 | |

| | | | | | | | |

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | | | (15,000 | ) | | | (42,979 | ) |

| | | | | | | | |

NET CHANGE IN CASH | | | (274,451 | ) | | | (285,977 | ) |

| | | | | | | | |

EFFECT OF EXCHANGE RATE ON CASH | | | 787 | | | | 2,620 | |

| | | | | | | | |

CASH, BEGINNING OF PERIOD | | | 290,409 | | | | 315,826 | |

| | | | | | | | |

CASH, END OF PERIOD | | $ | 15,171 | | | $ | 32,469 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | |

| | | | | | | | |

Cash paid during the years ended December 31: | | | | | | | | |

| | | | | | | | |

Income taxes | | $ | 399 | | | $ | - | |

Interest paid | | $ | 13,598 | | | $ | 5,113 | |

The accompanying notes are an integral part of the consolidated financial statements

WEED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2024

(Unaudited)

Note 1 – Nature of Business and Significant Accounting Policies

Nature of Business

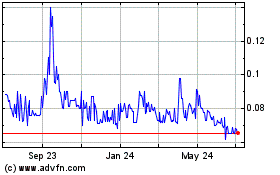

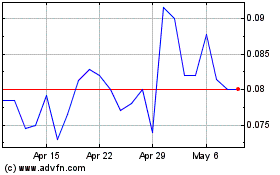

WEED, Inc. (the “Company”), (formerly United Mines, Inc.) was incorporated under the laws of the State of Arizona on August 20, 1999 (“Inception Date”) as Plae, Inc. to engage in the exploration of gold and silver mining properties. On November 26, 2014, the Company was renamed from United Mines, Inc. to WEED, Inc. and was repurposed to pursue a business involving the purchase of land, and building Commercial Grade “Cultivation Centers” to consult, assist, manage & lease to Licensed Dispensary owners and organic grow operators on a contract basis, with a concentration on the legal and medical marijuana sector. The Company’s plan is to become a True “Seed-to-Sale” company providing infrastructure, financial solutions and real estate options in this new emerging market. The Company, under United Mines, was formerly in the process of acquiring mineral properties or claims located in the State of Arizona, USA. The name was previously changed on February 18, 2005 to King Mines, Inc. and then subsequently changed to United Mines, Inc. on March 30, 2005. The Company trades on the OTC Pink Sheets under the stock symbol: BUDZ.

On April 20, 2017, the Company acquired Sangre AT, LLC, a Wyoming company doing business as Sangre AgroTech. (“Sangre”). Sangre is a plant genomic research and breeding company comprised of top-echelon scientists with extensive expertise in genomic sequencing, genetics-based breeding, plant tissue culture, and plant biochemistry, utilizing the most advanced sequencing and analytical technologies and proprietary bioinformatics data systems available. No work is being conducted now until further funds are available.

On May 2, 2022, the Company acquired Hempirical Genetics, LLC, a Arizona company.

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. These statements reflect all adjustments, consisting of normal recurring adjustments, which in the opinion of management are necessary for fair presentation of the information contained therein.

The Company has a calendar year end for reporting purposes.

Basis of Presentation:

The accompanying consolidated balance sheet at December 31, 2023, has been derived from audited consolidated financial statements and the unaudited condensed consolidated financial statements as of June 30, 2024 and 2023 ( the “financial statements”), have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the audited consolidated financial statements and related footnotes. It is management’s opinion, however, that all material adjustments (consisting of normal recurring adjustments), have been made which are necessary for a fair financial statements presentation. The consolidated financial statements include all material adjustments (consisting of normal recurring accruals) necessary to make the consolidated financial statements not misleading as required by Regulation S-X, Rule 10-01. Interim result are not necessarily indicative of results for a full year.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the following entities, all of which are under common control and ownership:

| | State of | | | | Abbreviated |

Name of Entity | | Incorporation | | Relationship (1&3) | | Reference |

WEED, Inc. | | Nevada | | Parent | | WEED |

Sangre AT, LLC (2) | | Wyoming | | Subsidiary | | Sangre |

Hempirical Genetics, LLC (3) | | Arizona | | Subsidiary | | Hempirical Generics |

(1) Sangre is a wholly-owned subsidiary of WEED, Inc.

(2) Sangre AT, LLC is doing business as Sangre AgroTech.

(3) Hempirical Genetics, LLC is a wholly-owned subsidiary of WEED, Inc.

Note 1 – Nature of Business and Significant Accounting Policies (continued)

Principles of Consolidation (continued)

The consolidated financial statements herein contain the operations of the wholly-owned subsidiary listed above. All significant inter-company transactions have been eliminated in the preparation of these financial statements. The parent company, WEED and subsidiaries will be collectively referred to herein as the “Company”, or “WEED”. The Company's headquarters are located in Tucson, Arizona and its operations are primarily within the United States, with minimal operations in Australia.

These statements reflect all adjustments, consisting of normal recurring adjustments, which in the opinion of management are necessary for fair presentation of the information contained therein.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

Under FASB ASC 820-10-05, the Financial Accounting Standards Board establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This Statement reaffirms that fair value is the relevant measurement attribute. The adoption of this standard did not have a material effect on the Company’s financial statements as reflected herein. The carrying amounts of cash, prepaid expenses and accrued expenses reported on the balance sheet are estimated by management to approximate fair value primarily due to the short term nature of the instruments.

Impairment of Long-Lived Assets

Long-lived assets held and used by the Company are reviewed for possible impairment whenever events or circumstances indicate the carrying amount of an asset may not be recoverable or is impaired. Recoverability is assessed using undiscounted cash flows based upon historical results and current projections of earnings before interest and taxes. Impairment is measured using discounted cash flows of future operating results based upon a rate that corresponds to the cost of capital. Impairments are recognized in operating results to the extent that carrying value exceeds discounted cash flows of future operations.

Basic and Diluted Loss Per Share

The basic net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss adjusted on an “as if converted” basis, by the weighted average number of common shares outstanding plus potential dilutive securities. For the periods presented, potential dilutive securities had an anti-dilutive effect and were not included in the calculation of diluted net loss per common share.

Stock-Based Compensation

Under FASB ASC 718-10-30-2, all share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values.

Revenue Recognition

The Company is using the revenue recognition standard ASU 2014-09, “Revenue from Contracts with Customers (Topic 606)”, and using the cumulative effect (modified retrospective) approach. Modified retrospective adoption requires entities to apply the standard retrospectively to the most current period presented in the financial statements, requiring the cumulative effect of the retrospective application as an adjustment to the opening balance of retained earnings at the date of initial application. No cumulative-effect adjustment in retained earnings was recorded as the Company’s has no historical revenue. The impact of the adoption of the new standard was not material to the Company’s consolidated financial statements. The Company did not earn revenue during the periods ended June 30, 2024 and 2023. When the Company earns revenue, it will be recognized in accordance with FASB ASC 606 – Revenue from Contracts with Customers.

The primary change under the new guidance is the requirement to report the allowance for uncollectible accounts as a reduction in net revenue as opposed to bad debt expense, a component of operating expenses. The adoption of this guidance did not have an impact on our condensed consolidated financial statements, other than additional financial statement disclosures. The guidance requires increased disclosures, including qualitative and quantitative disclosures about the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

The Company operates as one reportable segment.

Note 1 – Nature of Business and Significant Accounting Policies (continued)

Revenue Recognition (continued)

Sales on fixed price contracts are recorded when services are earned, the earnings process is complete or substantially complete, and the revenue is measurable and collectability is reasonably assured. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. The Company will defer any revenue from sales in which payment has been received, but the earnings process has not occurred. Sales have not yet commenced.

Advertising and Promotion

All costs associated with advertising and promoting products are expensed as incurred. The Company recognized $78 and $2,911 of advertising and promotion costs for six months ended June 30, 2024 and 2023.

Asset Retirement Obligations

The Company acquired a gas well on February 23, 2023, with a cost of $41,400. We are required to record a liability for the present value of our asset retirement obligation (“ARO”) to plug and abandon inactive-non-producing wells, facilities, and equipment, and to restore the land at the end of oil production operations. As a result, we accrued the full value of the cost amounting to $35,800 for plug and abandon non-operating well on the consolidated balance sheet as of June 30, 2024 and December 31, 2023.

Foreign Currency Transactions

Expenses are translated at the exchange rates in effect at the date of the transaction. Foreign currency denominated payables are translated at the rates of exchange at the balance sheet date. The resulting transaction gains and losses are recorded in the statement of income in the period incurred.

Assets and liabilities of those operations are translated at exchange rates in effect at the balance sheet date. Income and expenses are translated using the exchange rates on the transaction date for the reporting period. Translation adjustments, if any, are reported as a separate component of accumulated other comprehensive income. Transaction gain (loss) on foreign currency exchange rate was $787 and ($2,620) for six months ended June 30, 2024 and 2023. For all significant foreign operations, the functional currency is the local currency.

Note 2 – Going Concern

As shown in the accompanying financial statements, the Company has no revenues, incurred net losses from operations resulting in an accumulated deficit of $84,674,168 and negative working capital of $558,840 at June 30, 2024. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management is actively pursuing new products and services to begin generating revenues. In addition, the Company is currently seeking additional sources of capital to fund short term operations. The Company, however, is dependent upon its ability to secure equity and/or debt financing and there are no assurances that the Company will be successful; therefore, without sufficient financing it would be unlikely for the Company to continue as a going concern.

The financial statements do not include any adjustments that might result from the outcome of any uncertainty as to the Company’s ability to continue as a going concern. The financial statements also do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

Note 3 – Related Party

Notes Payable

From time to time, the Company has received short term loans from officers and directors as disclosed in Note 7 below. The Company has a total of $123,200 and $133,073 of note payable on the consolidated balance sheet as of June 30, 2024 and December 31, 2023, respectively. From January 2022 to March 31, 2022, the Company received $4,000 and $500,000 loans from Nicole Breen and Glenn Martin, respectively. The $500,000 loan from Glenn Martin replaced the $300,000 loan. On May 2, 2022, the Company acquired the Hempirical Genetics, LLC from Jeffrey Miller, and then Jeffrey Miller became the executive officer of WEED, Inc. Based on the agreement, the Company owed Jeffrey Miller $160,000 as of June 30, 2024. On July 1, 2022, Patrick Brodnik signed executive employee agreement with the Company, and become one of the related parties since that. On various dates during the third quarter 2022, the Company received advance of $3,787 from Patrick Brodnik at no interest. From January 2023 to March 31, 2023, the Company paid off the remaining balance of the loan from Nicole Breen that originally was $37,500. From April 2023 to June 30, 2023, the Company received $50,000 from Nicole Breen. From July 2023 to September 30, 2023, the company paid off Glenn Marten’s loan of $500,000 and Nicole Breen’s loan of $50,000.

Note 3 – Related Party (continued)

Services

Nicole M. Breen receives $1,500 a week in cash compensation for her services rendered to the Company.

Glenn E. Martin receives $8,000 a month in cash compensation for his services rendered to the Company.

Accrued Compensation

A total of $139,500 and $182,500 of officer compensation was unpaid and outstanding at June 30, 2024 and December 31, 2023, respectively.

Note 4 – Fair Value of Financial Instruments

Under FASB ASC 820-10-5, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at fair value.

The Company has certain financial instruments that must be measured under the new fair value standard. The Company’s financial assets and liabilities are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs).

Level 3 - Unobservable inputs that reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability.

The following schedule summarizes the valuation of financial instruments at fair value on a recurring basis in the balance sheets as of June 30, 2024 and December 31, 2023, respectively:

Fair Value Measurements at December 31, 2023

| | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | |

Cash | | $ | 290,409 | | | $ | - | | | $ | - | |

Intangible assets, net | | $ | - | | | $ | 36,183 | | | $ | - | |

Total assets | | $ | 290,409 | | | $ | 36,183 | | | $ | - | |

Liabilities | | | | | | | | | | | | |

Notes payable, related parties | | | | | | $ | 133,073 | | | | | |

Notes payable | | $ | - | | | $ | 3,661 | | | $ | - | |

Total liabilities | | $ | - | | | $ | 136,734 | | | $ | - | |

Fair Value Measurements at June 30, 2024

| | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | |

Cash | | $ | 15,171 | | | $ | - | | | $ | - | |

Intangible assets, net | | $ | - | | | $ | 34,883 | | | $ | - | |

Total assets | | $ | 15,171 | | | $ | 34,883 | | | $ | - | |

Liabilities | | | | | | | | | | | | |

Notes payable, related parties | | | | | | $ | 123,200 | | | | | |

Notes payable | | $ | - | | | $ | 3,661 | | | $ | - | |

Total liabilities | | $ | - | | | $ | 126,861 | | | $ | - | |

Note 4 – Fair Value of Financial Instruments (continued)

The fair values of our related party debts are deemed to approximate book value and are considered Level 2 inputs as defined by ASC Topic 820-10-35.

There were no transfers of financial assets or liabilities between Level 1, Level 2 and Level 3 inputs for the six months ended June 30, 2024 and the year ended December 31, 2023.

Note 5 – Property and Equipment

Property and equipment consist of the following at June 30, 2024 and December 31, 2023, respectively:

| | June 30, | | | December 31, | |

| | 2024 | | | 2023 | |

| | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Office equipment | | | 8,667 | | | | 8,667 | |

Furniture & Fixtures | | | 5,478 | | | 5,478 | |

Lab equipment | | | 133,626 | | | | 133,626 | |

| | | | | | | | |

Land | | | 258,319 | | | | 258,319 | |

Property | | | 218,681 | | | 218,681 | |

Property and equipment, gross | | | 624,771 | | | | 624,771 | |

Less accumulated depreciation | | | (118,474 | ) | | | (108,431 | ) |

Property and equipment, net | | $ | 506,297 | | | $ | 516,340 | |

On July 24, 2023, the Company sold another La Veta property for $1,800,000 and $988,375 was record as gain on sale.

Depreciation expense totaled $10,043 and $40,959 for the six months June 30, 2024 and 2023, respectively.

Note 6 – Intangible Assets

Intangibles

In accordance with FASB ASC 350, “Intangibles-Goodwill and Other”, the Company evaluates the recoverability of identifiable intangible assets whenever events or changes in circumstances indicate that an intangible asset’s carrying amount may not be recoverable. The impairment loss would be calculated as the amount by which the carrying value of the asset exceeds its fair value. The US and Europe trademarks were acquired for $40,000 and $50,000, respectively, for the year ended December 31, 2018. Trademarks are initially measured based on their fair value and amortized by 10 and 25 years.

Acquisition intangible assets arising out of the acquisition of Hempirical Genetics, LLC. That should, in accordance with GAAP, be classified as intangibles, include goodwill.

Note 6 – Intangible Assets (continued)

Intangibles (continued)

On June 30, 2024 and December 31, 2023, Intangibles consists of the following:

| | June 30, 2024 | | | December 31, 2023 | |

Trademark | | | 50,000 | | | | 50,000 | |

Grower License | | | 667 | | | | 667 | |

Less: Accumulated amortization | | | (15,784 | ) | | | (14,484 | ) |

Total other intangibles, Net | | | 34,883 | | | | 36,183 | |

| | | | | | | | |

-Total Intangibles, Net | | | 34,883 | | | | 36,183 | |

Amortization expense totaled $1,300 and $1,300 for the six months ended June 30, 2024 and 2023, respectively.

Note 7 – Notes Payable, Related Parties

Notes payable, related parties consist of the following at June 30, 2024 and December 31, 2023, respectively:

| | June 30, 2024 | | | December 31, 2023 | |

On April 12, 2010, the Company received an unsecured, non-interest-bearing loan in the amount of $2,000, due on demand from Robert Leitzman. Interest is being imputed at the Company’s estimated borrowing rate, or 10% per annum. The largest aggregate amount outstanding was $2,000 during the periods ended December 31, 2019 and December 31, 2018. Mr. Leitzman owns less than 1% of the Company’s common stock, however, the Mr. Leitzman is deemed to be a related party given the non-interest-bearing nature of the loan and the materiality of the debt at the time of origination. | | $ | 2,000 | | | | 2,000 | |

| | | | | | | | |

Over various dates in 2011 and 2012, the Company received unsecured loans in the aggregate amount of $10,000, due on demand, bearing interest at 10%, from Sandra Orman. The largest aggregate amount outstanding was $10,000 during the periods ended December 31, 2019 and December 31, 2018. Mrs. Orman owns less than 1% of the Company’s common stock, however, Mrs. Orman is deemed to be a related party given the nature of the loan and the materiality of the debt at the time of origination. | | $ | 10,000 | | | | 10,000 | |

| | | | | | | | |

On May 31, 2023, the company received $50,000 of advances, bearing interest at 5%, from Nicole Breen. Such amount has been fully paid off in August 2023 through cash transfer. | | $ | - | | | $ | - | |

Note 7 – Notes Payable, Related Parties (continued)

| | June 30, 2024 | | | December 31, 2023 | |

| | | | | | |

On May 2, 2022, the company acquired Hempirical Genetics, LLC with a note payable to the executive officer Jeffrey Miller with no interest. Payments of $15,000 and $60,000 were made toward the note in 2024 and 2023, respectively. | | $ | 130,000 | | | $ | 145,000 | |

| | | | | | | | |

Notes payable, related parties | | $ | 142,000 | | | $ | 157,000 | |

Less: Loan fee, net of amortization | | | 18,800 | | | | 23,927 | |

Notes payable, related parties | | $ | 123,200 | | | $ | 133,073 | |

The Company recorded interest expense in the amount of $1,198 and $30,386 for the six months ended June 30, 2024 and 2023, respectively, including imputed interest expense in the amount of $600 and $14,098 during such periods related to notes payable, related parties.

Note 8 – Notes Payable

Note payable consist of the following at June 30, 2024 and December 31, 2023, respectively:

| | June 30, 2024 | | | December 31, 2023 | |

| | | | | | |

On various dates, the Company received advances from consultant, Patrick Brodnik, with 0% interest in 2022. | | $ | 3,661 | | | | 3,661 | |

| | | | | | |

| | $ | 3,661 | | | $ | 3,661 | |

The Company recognized interest expense of $0 and $0 related to the note payables for the six months ended June 30, 2024 and 2023, respectively.

Note 9 – Commitments and Contingencies

Operating Leases

We account for our lease under ASC 842. Under this guidance, arrangements meeting the definition of a lease are classified as operating and are recorded on the consolidated balance sheet as both a right of use asset and lease liability, calculated by discounting fixed lease payments over the lease term at the rate implicit in the lease. Lease liabilities are increased by interest and reduced by payments each period, and the right of use asset is amortized over the lease term.

The rate implicit in lease is not readily determinable, and we therefore use incremental borrowing rate to determine the present value of the lease payments. The incremental borrowing rate used to determine the initial value of right-of-use (“ROU”) assets and lease liabilities during the period ended June 30, 2024, was 5.0%.

In May, 2022, we entered into a lease agreement of a hemp drying facility in Huachuca City, Arizona for $1,200 per month. The lease term began May 2, 2022 and ends May 2, 2026. As of June 30, 2024, we had lease liability of $25,177, and ROU assets of $25,177.

Note 9 – Commitments and Contingencies (continued)

Legal Proceedings

The Company may be subject to legal proceedings and claims arising from contracts or other matters from time to time in the ordinary course of business. Management is not aware of any pending or threatened litigation where the ultimate disposition or resolution could have a material adverse effect on its financial position, results of operations or liquidity.

Note 10 – Stockholders’ Equity

Preferred Stock

On December 5, 2014, the Company amended the Articles of Incorporation, pursuant to which 20,000,000 shares of “blank check” preferred stock with a par value of $0.001 were authorized. No series of preferred stock has been designated to date.

Common Stock

On December 5, 2014, the Company amended the Articles of Incorporation, and increased the authorized shares to 200,000,000 shares of $0.001 par value common stock.

Note 10 – Stockholders’ Equity (continued)

2024 Common Stock Activity

Common Stock Sales (2024)

No stocks were issued during the quarter ended June 30, 2024.

Common Stock Issued for Services (2024)

During the period ended June 30, 2024, 1,750,000 shares of common stocks valued at $335,000 were issued for the services, and such amount has been included in subscriptions payable. During the period ended March 31, 2024, 22,250 shares of common stocks valued at $22,500 were not issued for the services, and such amount has been included in the subscriptions payable.

During the period ended June 30, 2024, the Company agreed to issue an aggregate of 200,000 shares to consultants for services performed. The total fair value of common stock was $14,000 based on the closing price of the Company’s common stock earned on the measurement date.

Common Stock Cancellations

No common stocks were cancelled during the quarter ended June 30, 2024.

2023 Common Stock Activity

Common Stock Sales (2023)

No stocks were issued during the year ended December 31, 2023.

Common Stock Issued for Services (2023)

During the year ended December 31, 2023, 600,000 shares of common stocks valued at $90,000 were not issued for the services, and such amount has been included in subscriptions payable.

Common Stock Cancellations

No common stocks were cancelled during the year ended December 31, 2023.

Common Stock Warrants and Options

2024 Common Stock Warrant Activity

Common Stock Warrants Granted (2024)

No common stock warrants were granted during the quarter ended June 30, 2024.

Warrants Exercised (2024)

No warrants were exercised during the quarter ended June 30, 2024.

2023 Common Stock Warrant Activity

Common Stock Warrants Granted (2023)

No common stock warrants were granted during the year ended December 31, 2023.

Warrants Exercised (2023)

No warrants were exercised during the year ended December 31, 2023.

Note 10 – Stockholders’ Equity (continued)

The stock option will expire on the tenth anniversary of the granted date, which is February 1, 2028. As of June 30, 2024, the stock option will expire in 43 months.

A summary of the Company’s stock option activity and related information is as follows:

| | For the year ended December 31, 2023 | |

| | Number of | | | Average | |

| | Shares | | | Price | |

Outstanding at the beginning of period | | $ | 6,000,000 | | | $ | 10.55 | |

Granted | | | | | | | - | |

Exercised/Expired/Cancelled | | | - | | | | - | |

Outstanding at the end of period | | | 6,000,000 | | | $ | 10.55 | |

Exercisable at the end of period | | | 6,000,000 | | | $ | 10.55 | |

| | For the year quarter ended June 30, 2024 | |

| | Number of | | | Average | |

| | Shares | | | Price | |

Outstanding at the beginning of period | | $ | 6,000,000 | | | $ | 10.55 | |

Granted | | | - | | | | - | |

Exercised/Expired/Cancelled | | | - | | | | - | |

Outstanding at the end of period | | | 6,000,000 | | | $ | 10.55 | |

Exercisable at the end of period | | | 6,000,000 | | | $ | 10.55 | |

Note 11 – Other Income

During the period ended June 30, 2024, the Company received a $35,000 settlement fund from the Titan Labs deal, which was not finalized in 2023.

Note 12 – Income Tax

The Company accounts for income taxes under FASB ASC 740-10, which requires use of the liability method. FASB ASC 740-10-25 provided that deferred tax assets and liabilities, are recorded based on the differences between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes, referred to as temporary differences.

For the six months ended June 30, 2024 and year ended December 31, 2023, the Company incurred a net operating loss and, accordingly, no provision for income taxes has been recorded. In addition, no benefit for income taxes has been recorded due to the uncertainty of the realization of any tax assets. At June 30, 2024 and December 31, 2023, the Company had approximately $281,606 and $30,577 of loss of federal net operating losses, respectively. The net operating loss carry forwards, if not utilized, will begin to expire in 2031.

The components of the Company’s deferred tax assets are as follows:

| | June 30, 2024 | |

Deferred tax assets: | | | |

Net operating loss carry forward as of 12/31/2023 | | $ | 17,900,966 | |

Estimate Tax Loss June 30, 2024 | | | 281,606 | |

| | | | |

NOL Carry Forward Cumulative as of 6/30/2024 | | | 18,182,172 | |

Statutory Tax Rate | | | 21 | % |

Deferred Tax Asset | | | 3,818,256 | |

Valuation | | | (3,818,256 | ) |

Net Deferred Tax Asset | | | 0 | |

Based on the available objective evidence, including the Company’s history of losses, management believes it is more likely than not that the net deferred tax assets will not be fully realizable. Accordingly, the Company provided for a full valuation allowance against its net deferred tax assets at June 30, 2024 and December 31, 2023, respectively.

Note 13 – Subsequent Events

We have evaluated subsequent events through the filing date of this Form 10-Q and determined that no subsequent events have occurred that would require recognition in the consolidated financial statements or disclosures in the notes thereto.

ITEM 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations Disclaimer Regarding Forward Looking Statements

Our Management’s Discussion and Analysis or Plan of Operations contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission.

Although the forward-looking statements in this Quarterly Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Overview

Currently, WEED and its subsidiaries are working on or planning for several different business opportunities in the cannabis & hemp field, including, but not limited to: both indoor and outdoor “grows”, cultivations & harvest for research, product development, processing and manufacturing of both Pharma & non-Pharma products, services, therapeutics, and treatments on a global basis for both the Medical Cannabis & Hemp (<.03 thc) global market space. Long terms goals include hopeful cures for many diseases and ailments for both man & animals utilizing the Cannabaceae plant and its derivatives. We will need additional financing to attempt to accomplish these goals.

Second, on November 22, 2021, WEED completed the purchase of the Sugar Hill Golf course property located in the town of Portland, New York. WEED’s acquisition of this ~43 acre property with ~2000 ft. of Lake Erie waterfront also comes with the “unlimited water extractions rights” from Lake Erie related to the property, along with a complete wastewater management plant. WEED’s initial plan is to utilize the property to access the hemp and infused beverage markets as our property in the middle of the largest concord grape producing region of the United States. In the future, WEED may look to use the unique property infrastructure to build a luxury condos & resort development in the most natural settings to be ESG compliant in conjunction to WEEDs forming its Social Equity Advisory Council (SEAC) to create Diversity & Equality in our industry. This project is only in its conceptual stage, no funding or plans have been developed other than the proposed name: The Four Winds Luxury condos & resort to be “Cannabis Friendly” which would be a “FIRST” in the nation. The New York property is now owned by Four Winds of Lake Erie, LLC, a wholly-owned subsidiary of WEED, Inc.

Third, WEED established WEED Australia Ltd. and it’s wholly owned Cannabis Institute of Australia (C.I.A.) in Australia in March of 2017, for the purpose of conducting cannabis and hemp research and potentially developing products and educational services in and for Australians as stated above. C.I.A. is a non-profit entity formed for the purpose of conducting cannabis and hemp research with universities and other non-profits to protect all intellectual rights, properties and usage in our highly regulated industry. The C.I.A. has the potential to develop products in Australia for domestic research and development of products, services and educational purposes to all seven States and territories, including Tasmania, to be marketed globally. WEED Australia is also our gateway to the Oceania & Asia emerging legal cannabis marketplace.

Fourth, on May 2, 2022, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with Hempirical Genetics, LLC, an Arizona limited liability company (“Hempirical”), under which we acquired all of the issued and outstanding membership interests of Hempirical from Jeffery Miller in exchange for $603,284 payable in Two Million (2,000,000) shares of our common stock (the “WEED Shares”), valued at $394,302 based on the value of our common stock, and $250,000 in cash to be paid over four years. With this acquisition, our newly acquired inventory includes over 200 High THC strains plus 15 “PURE” Landrace strains including Panama Red, Acapulco Gold, Red Bud Colombian, Santa Marta Gold, and ThaiSticks. Along with 30+ CBD & CBG strains. WEED believes that multiple combinations of precise cannabinoid strains will achieve the precise medical outcome desired.

Our first business opportunity was, and continues to be, through our wholly-owned subsidiary, Sangre AT, LLC (“Sangre”), where we are focused on the development and application of cannabis-derived compounds for the treatment of human disease and animal ailments. To that end Sangre, was working on a planned five-year Cannabis Genomic Study to complete a genetic blueprint of the Cannabis plant genus, by creating a global genomic classification of the entire plant. Sangre completed a 1-2 year Pilot Study in 2017 & 2018 at the University of Texas-Galveston thru Industrial Metagenomics at a cost of nearly $1 million USD. Sangre completed the pilot study with 30 cultivars from strains collected worldwide that included 30 strains (twenty-four female and six male). These results are highly proprietary and the basis of future studies to come. We need to raise additional funds to continue the next steps in our Cannabis Genomic Study.

On May 14th, 2018, the 70th Anniversary of the statehood of Israel, WEED formed its wholly owned subsidiary, WEED Israel Cannabis Ltd., with the goal of completing and adding to the noted studies above. As such, WEED Israel worked with the Hebrew University in Jerusalem and with the top scientists globally in the field of Cannabis & hemp. To that effect, WEED Israel looked to conduct clinical trials and product development that would be the quality and acceptability of the FDA in the United States. Due to current laws and conditions in the USA, all research results and product development for both Pharma & Non-Pharma products, cannot be introduced the United States marketplace. Since starting in 2018, the USA has made vast improvements and advancements in the legalization of both Cannabis and hemp. As of the end of 2021 there are 37 States that have approved a State level medical cannabis and hemp programs, along with the District of Colombia. In addition, there are 17 States that have implemented or approved the “Adult Use” i.e. recreational psychoactive aspects of high THC usage of cannabis.

In conjunction with WEED Israel Cannabis Ltd., we made arrangements with Professor Elka Touitou to be available to be the head of WEEDs Israeli Advisory Board to lead and assist us with clinical trials in cannabis & hemp research studies in Israel. Professor Touitou was the Head of the Innovative Dermal, Transdermal and Transmucosal Delivery Lab at the Institute of Drug Research, The School of Pharmacy, HUJ, now retired but still has HUJ clinical trial & independent studies/lab privileges. Professor Touitou is an internationally renowned authority in the field of drug delivery and design of new technologies for efficient administration of drugs and development of new products. Professor Touitou has been involved in Cannabinoid research since 1988 at The Hebrew University of Jerusalem, (HUJ) Jerusalem, Israel. Previously, WEED was in the process of buying Professor Touitou’s various patents to include the bioavailability aspects of the cannabaceae plant. However, after expending over $500,000 USD to acquire the Professor Touitou’s patents, we had to terminate the agreement in 2019 due to the downturn of the Cannabis marketplace, and specifically as to public cannabis companies, which could not be resumed due to the Covid pandemic that was/is still ongoing globally. We have kept in constant contact with Professor Touitou thru our Managing Director of WEED Israel, Mr. Elliot Kwestel. As of 2022, Dr. Touitou still has interest in working with WEED to complete the purchase of her patents and begin clinical trials upon proper funding. WEED looks to achieve that funding thru offerings of our securities.

Corporate Overview

We were originally incorporated under the name Plae, Inc., in the State of Arizona on August 20, 1999. At the time we operated under the name Plae, Inc., no business was conducted. No books or records were maintained and no meetings were held. In essence, nothing was done after incorporation until Glenn E. Martin took possession of Plae, Inc. in January 2005. On February 18, 2005, the corporate name was changed to King Mines, Inc. and then subsequently changed to its current name, United Mines, Inc., on March 30, 2005. No shares were issued until the Company became United Mines, Inc. From 2005 until 2015, we were an exploration stage mineral exploration company that owned a number of unpatented mining claims and Arizona State Land Department claims.

On November 26, 2014, our Board of Directors approved the redomestication of our company from Arizona to Nevada (the “Articles of Domestication”), and approved Articles of Incorporation in Nevada, which differed from then-Articles of Incorporation in Arizona, primarily by (a) changing our name from United Mines, Inc. to WEED, Inc., (b) authorizing Twenty Million (20,000,000) shares of preferred stock, with blank check rights granted to our Board of Directors, and (c) authorizing Two Hundred Million (200,000,000) shares of common stock (the “Nevada Articles of Incorporation”). On December 19, 2014, the holders of a majority of our outstanding common stock approved the Articles of Domestication and the Nevada Articles of Incorporation at a Special Meeting of Shareholders. On January 16, 2015, the Articles of Domestication and the Nevada Articles of Incorporation went effective with the Secretary of State of the State of Nevada. On February 2, 2015, our name change to WEED, Inc., and a corresponding ticker symbol change to “BUDZ” went effective with FINRA and was reflected on the quotation of our common stock on OTC Markets.

These changes were affected in order to make our corporate name and ticker symbol better align with our short-term and long-term business focus. Our current, short-term goals relate to the Cannabis Genomic Study and the resulting development of a variety of new cannabis strains, and, over the next 5 years, we plan to process those results in order to become an international cannabis research and product development company, with a globally-recognized brand focusing on building and purchasing labs, land and building commercial grade “Cultivation Centers” to consult, assist, manage & lease to universities, state governments, licensed dispensary owners and organic grow operators on a contract basis with a concentration on the legal and medical cannabis sector.

Our long-term plan is to become a true “Seed-to-Sale” global holding company providing infrastructure, financial solutions, product development, and real estate options in this new emerging market. Our long term growth may also come from the acquisition of synergistic businesses, such as distilleries, to make anything from infused beverages to super oxygenated water with CBD and THC. Currently, we have formed WEED Australia Ltd., registered as an unlisted public company in Australia to address this Global demand. We have also formed WEED Israel Cannabis Ltd., an Israeli corporation, to address future global demand. We will look to conduct future research, marketing, import/exporting, and manufacturing of our proprietary products on an international level.

On April 20, 2017, we entered into a Share Exchange Agreement with Sangre AT, LLC, a Wyoming limited liability company, under which we acquired all of the issued and outstanding limited liability company membership units of Sangre in exchange for Five Hundred Thousand (500,000) shares of our common stock, restricted in accordance with Rule 144. As a result of this agreement, Sangre is a wholly-owned subsidiary of WEED, Inc.

This discussion and analysis should be read in conjunction with our financial statements included as part of this Quarterly Report.

Three Months Ended June 30, 2024 Compared to Three Months Ended June 30, 2023

Results of Operations

| | Three Months Ended | |

| | June 30, | |

| | 2024 | | | 2023 | |

Revenue | | $ | - | | | $ | - | |

| | | | | | | | |

Cost of goods sold | | | - | | | | - | |

| | | | | | | | |

Gross Profit | | | - | | | | - | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

| | | | | | | | |

General and administrative | | | 85,296 | | | | 108,730 | |

Professional fees | | | 51,474 | | | | 24,077 | |

Depreciation and amortization | | | 8,185 | | | | 23,356 | |

Total operating expenses | | | 144,955 | | | | 156,163 | |

| | | | | | | | |

Net operating loss | | | (144,955 | ) | | | (156,163 | ) |

| | | | | | | | |

Other income (expense) | | | | | | | | |

Interest expense | | | (599 | ) | | | (17,280 | ) |

Other Income | | | 35,000 | | | | - | |

Total other income (expense) | | $ | 34,401 | | | $ | (17,280 | ) |

| | | | | | | | |

Income Tax Expense | | $ | 399 | | | $ | - | |

| | | | | | | | |

Net Income (Loss) | | $ | (110,953 | ) | | $ | (173,443 | ) |

| | | | | | | | |

Other Comprehensive Income (Loss) | | | (804 | ) | | | 2,733 | |

| | | | | | | | |

Comprehensive Income (Loss) | | $ | (111,757 | ) | | $ | (170,710 | ) |

Operating Loss; Net Income

Our net income increased by $62,490, from $(173,443) to $(110,953), from the three months ended June 30, 2023, compared to the three months ended June 30, 2024. Our net operating loss decreased by $11,208, from $(156,163) to $(144,995) for the same period.

Revenue

We have not had any revenues since our inception. Once we have sufficient funding, we plan to research and possibly enter the hemp and infused beverage industry through our newly acquired property in New York, and conduct Sangre’s Cannabis Genomic Study and process those result. In the long-term we plan to be a company focused on purchasing land and building commercial grade “Cultivation Centers” to consult, assist, manage & lease to licensed dispensary owners and organic grow operators on a contract basis, with a concentration on the legal and medical marijuana (Cannabis) sector. Our long-term plan is to become a True “Seed-to-Sale” company providing infrastructure, financial solutions and real estate options in this new emerging market, worldwide. We plan to make our brand global and therefore we will look for opportunities to conduct future research, marketing, import and exporting, and manufacturing of any proprietary products on an international level.

General and Administrative Expenses

General and administrative expenses decreased by $23,434, from $108,730 for the three months ended June 30, 2023, to $85,296 for the three months ended June 30, 2024.

Professional Fees

Our professional fees increased by $27,397 during the three months ended June 30, 2024, compared to the three months ended June 30, 2023. Our professional fees were $51,474 for the three months ended June 30, 2024, and $24,077 for the three months ended June 30, 2023. These fees are largely related to fees paid for legal and accounting services, along with compensation to independent contractors. We expect these fees to vary quarter-to-quarter as our business and stock price fluctuate if we continue to use stock-based compensation. In the event we undertake an unusual transaction, such as an acquisition, securities offering, or file a registration statement, we would expect these fees to substantially increase during that period.

Depreciation and Amortization

During the three months ended June 30, 2024, we had depreciation and amortization expense of $8,185, compared to $23,356 in the three months ended June 30, 2023. Our depreciation and amortization expense primarily relates to our property and trademark acquisitions.

Interest Expense

Interest expense decreased from $(17,280) for the three months ended June 30, 2023, to $(599) for the three months ended June 30, 2024. Our interest expense primarily relates to notes payable from related parties.

Liquidity and Capital Resources

Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

Results of Operations

| | Six Months Ended June 30, | |

| | 2024 | | | 2023 | |

Revenue | | $ | - | | | $ | - | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

| | | | | | | | |

General and administrative | | | 221,861 | | | | 242,512 | |

Professional fees | | | 76,677 | | | | 50,173 | |

Depreciation and amortization | | | 16,470 | | | | 47,386 | |

Total operating expenses | | | 315,008 | | | | 340,071 | |

| | | | | | | | |

Net operating loss | | | (315,008 | ) | | | (340,071 | ) |

| | | | | | | | |

Other income (expense) | | | | | | | | |

Interest expense | | | (1,198 | ) | | | (30,386 | ) |

Other income | | | 35,000 | | | | - | |

Total other income (expense) | | $ | 33,802 | | | $ | (30,386 | ) |

| | | | | | | | |

Net Income (Loss) | | $ | (281,206 | ) | | $ | (370,458 | ) |

| | | | | | | | |

Income Tax Expense | | | 399 | | | | - | |

| | | | | | | | |

Net Loss | | $ | (281,605 | ) | | | (370,458 | ) |

| | | | | | | | |

Other Comprehensive Income (Loss) | | | (787 | ) | | | 2,620 | |

| | | | | | | | |

Comprehensive Loss | | $ | (281,992 | ) | | $ | (367,838 | ) |

Operating Loss; Net Loss

Our comprehensive net loss decreased by $85,846, from ($367,838) to ($281,992), from the six months ended June 30, 2023, compared to the six months ended June 30, 2024. Our operating loss decreased by $25,063, from ($340,071) to ($315,008) for the same period. These changes are detailed below.

Revenue

We have not had any revenues since our inception. Once we have sufficient funding, we plan to research and possibly enter the hemp and infused beverage industry through our newly acquired property in New York, and conduct Sangre’s Cannabis Genomic Study and process those result. In the long-term we plan to be a company focused on purchasing land and building commercial grade “Cultivation Centers” to consult, assist, manage & lease to licensed dispensary owners and organic grow operators on a contract basis, with a concentration on the legal and medical marijuana (Cannabis) sector. Our long-term plan is to become a True “Seed-to-Sale” company providing infrastructure, financial solutions and real estate options in this new emerging market, worldwide. We plan to make our brand global and therefore we will look for opportunities to conduct future research, marketing, import and exporting, and manufacturing of any proprietary products on an international level.

General and Administrative Expenses

General and administrative expenses decreased by $20,651, from $242,512 for the six months ended June 30, 2023 to $221,861 for the six months ended June 30, 2024, primarily due to slight decreases in marketing expense.

Professional Fees

Our professional fees increased by $26,504, from $50,173 for the six months ended June 30, 2023 to $76,677 for the six months ended June 30, 2024, primarily due to reduced consulting activities. These fees are largely related to fees paid for legal and accounting services, along with compensation to independent contractors, and decreased significantly primarily as a result of decreases in the value of stock-based compensation awards due to issuing shares for services during the period. We expect these fees to vary quarter-to-quarter as our business and stock price fluctuate if we continue to use stock-based compensation. In the event we undertake an unusual transaction, such as an acquisition, securities offering, or file a registration statement, we would expect these fees to substantially increase during that period.

Depreciation and Amortization

During the six months ended June 30, 2024 we had depreciation and amortization expense of $16,470, compared to $47,386 in the six months ended June 30, 2023. Our depreciation and amortization expense primarily relates to our property and trademark acquisitions.

Interest Expense

Interest expense decreased from ($30,386) for the six months ended June 30, 2023 to ($1,198) for the six months ended June 30, 2024. Our interest expense primarily relates to notes payable from related parties.

Liquidity and Capital Resources

Introduction

During the six months ended June 30, 2024, because of our operating losses, we did not generate positive operating cash flows. Our cash on hand as of June 30, 2024, was $15,171 and our monthly cash flow burn rate was approximately $46,000. We currently do not believe we will be able to satisfy our cash needs from our revenues for many years to come.

Our cash, current assets, total assets, current liabilities, and total liabilities as of June 30, 2024, and December 31, 2023, respectively, are as follows:

| | June 30, 2024 | | | December 31, 2023 | | | Change | |

| | | | | | | | | |