UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended March 31, 2009

or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number 333-136492

VERIFY SMART CORP.

(Exact name of registrant as specified in its charter)

Nevada 20-5005810

(State or other jurisdiction (IRS Employer Identification No.)

of incorporation or organization)

|

Fort Legend Towers, Suite 2002 - 3rd Avenue corner 31st Street E-Square,

Fort Bonifacio Global City, Taguig Metro Manila, Philippines

(Address of principal executive offices) (Zip Code)

011.632.755.8870

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year,

if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. [X] YES [ ] NO

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a small reporting company. See

the definitions of "large accelerated filer", "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act [X] YES [ ] NO

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and reports required to be

filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of

securities under a plan confirmed by a court. [ ] YES [ ] NO

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date.

60,000,000 common shares issued and outstanding as of May 20, 2009

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

These financial statements have been prepared by Verify Smart Corp. without

audit, pursuant to the rules and regulations of the Securities and Exchange

Commission ("SEC"). Certain information and footnote disclosures normally

included in financial statements prepared in accordance with generally accepted

accounting principles have been omitted in accordance with such SEC rules and

regulations. In the opinion of management, the accompanying statements contain

all adjustments necessary to present fairly the financial position of our

company as of March 31, 2009, and our results of operations, and our cash flows

for the nine month period ended March 31, 2009. The results for these interim

periods are not necessarily indicative of the results for the entire year. The

accompanying financial statements should be read in conjunction with the

financial statements and the notes thereto filed as a part of our company's Form

10-K.

2

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Balance Sheets

(unaudited)

As of As of

March 31, June 30,

2009 2008

-------- --------

ASSETS

CURRENT ASSETS

Cash $ 10,916 $ 19,231

Deposits -- 2,000

-------- --------

TOTAL CURRENT ASSETS 10,916 21,231

-------- --------

TOTAL ASSETS $ 10,916 $ 21,231

======== ========

LIABILITIES & STOCKHOLDERS' EQUITY

CURRENT LIABILITIES

Accounts Payable $ -- $ 163

-------- --------

TOTAL CURRENT LIABILITIES -- 163

-------- --------

TOTAL LIABILITIES -- 163

-------- --------

STOCKHOLDERS' EQUITY

Common stock, ($0.001 par value, 250,000,000 shares

authorized; 60,000,000 shares issued and outstanding

as of March 31, 2009 and June 30, 2008 60,000 60,000

Discount of Common Stock (10,000) (10,000)

Additional paid-in capital --

Deficit accumulated during development stage (39,084) (28,932)

-------- --------

TOTAL STOCKHOLDERS' EQUITY 10,916 21,068

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY $ 10,916 $ 21,231

======== ========

|

3

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Statements of Operations (unaudited)

May 31, 2006

Nine Months Nine Months Three Months Three Months (inception)

Ended Ended Ended Ended through

March 31, March 31, March 31, March 31, March 31,

2009 2008 2009 2008 2009

----------- ----------- ----------- ----------- -----------

REVENUES

Revenues $ -- $ -- $ -- $ -- $ --

----------- ----------- ----------- ----------- -----------

TOTAL REVENUES -- -- -- -- --

PROFESSIONAL FEES 8,000 6,500 2,000 2,000 24,700

GENERAL & ADMINISTRATIVE EXPENSES 2,152 5,217 761 693 14,384

----------- ----------- ----------- ----------- -----------

TOTAL GENERAL & ADMINISTRATIVE EXPENSES 10,152 11,717 2,761 2,693 39,084

----------- ----------- ----------- ----------- -----------

NET INCOME (LOSS) $ (10,152) $ (11,717) $ (2,761) $ (2,693) $ (39,084)

=========== =========== =========== =========== ===========

BASIC EARNING (LOSS) PER SHARE $ (0.00) $ (0.00) $ (0.00) $ (0.00)

=========== =========== =========== ===========

WEIGHTED AVERAGE NUMBER OF

COMMON SHARES OUTSTANDING 60,000,000 60,000,000 60,000,000 60,000,000

=========== =========== =========== ===========

|

4

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Statements of Cash Flows (unaudited)

May 31, 2006

Nine Months Nine Months (inception)

Ended Ended through

March 31, March 31, March 31,

2008 2007 2008

-------- -------- --------

CASH FLOWS FROM OPERATING ACTIVITIES

Net income (loss) $(10,152) $(11,717) $(39,084)

Adjustments to reconcile net loss to net cash

provided by (used in) operating activities:

Changes in operating assets and liabilities:

Deposits 2,000 3,000 --

Accounts Payable (163) 163 --

-------- -------- --------

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES (8,315) (8,554) (39,084)

CASH FLOWS FROM INVESTING ACTIVITIES

NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES -- -- --

CASH FLOWS FROM FINANCING ACTIVITIES

Issuance of common stock -- -- 50,000

-------- -------- --------

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES -- -- 50,000

-------- -------- --------

NET INCREASE (DECREASE) IN CASH (8,315) (8,554) 10,916

CASH AT BEGINNING OF PERIOD 19,231 32,570 --

-------- -------- --------

CASH AT END OF PERIOD $ 10,916 $ 24,016 $ 10,916

======== ======== ========

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid during the period for:

Interest $ -- $ -- $ --

======== ======== ========

Income Taxes $ -- $ -- $ --

======== ======== ========

|

5

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Verify Smart Corp. (formerly Treasure Explorations Inc. (the Company)) was

incorporated under the laws of the State of Nevada on May 31, 2006. The Company

was originally formed to engage in the acquisition, exploration and development

of natural resource properties. Effective March 25, 2009, we entered into a

joint venture agreement with Verified Capital Corp. and Verified Transactions

Corp. relating to the formation and operation of a joint venture corporation

that will sell internet security software for credit card fraud prevention.

Effective March 19, 2009, the Company changed the name from Treasure

Explorations Inc. to Verify Smart Corp.

The Company is in the exploration stage. Its activities to date have been

limited to capital formation, organization and development of its business plan.

The Company has commenced limited exploration activities.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF ACCOUNTING

The Company's financial statements are prepared using the accrual method of

accounting. The Company has elected a June 30, year-end.

BASIC EARNINGS (LOSS) PER SHARE

In February 1997, the FASB issued SFAS No. 128, "Earnings Per Share", which

specifies the computation, presentation and disclosure requirements for earnings

(loss) per share for entities with publicly held common stock. SFAS No. 128

supersedes the provisions of APB No. 15, and requires the presentation of basic

earnings (loss) per share and diluted earnings (loss) per share. The Company has

adopted the provisions of SFAS No. 128 effective May 31, 2006 (date of

inception).

Basic net earnings (loss) per share amounts is computed by dividing the net

earnings (loss) by the weighted average number of common shares outstanding.

Diluted earnings (loss) per share are the same as basic earnings (loss) per

share due to the lack of dilutive items in the Company.

CASH EQUIVALENTS

The Company considers all highly liquid investments purchased with an original

maturity of three months or less to be cash equivalents.

6

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

USE OF ESTIMATES AND ASSUMPTIONS

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates. In accordance with FASB 16 all

adjustments are normal and recurring.

INCOME TAXES

Income taxes are provided in accordance with Statement of Financial Accounting

Standards No. 109 (SFAS 109), "Accounting for Income Taxes". A deferred tax

asset or liability is recorded for all temporary differences between financial

and tax reporting and net operating loss carryforwards. Deferred tax expense

(benefit) results from the net change during the year of deferred tax assets and

liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of

management, it is more likely than not that some portion or all of the deferred

tax assets will not be realized. Deferred tax assets and liabilities are

adjusted for the effects of changes in tax laws and rates on the date of

enactment.

RECENT ACCOUNTING PRONOUNCEMENTS

In May 2008, the Financial Accounting Standards Board ("FASB") issued SFAS No.

163, "Accounting for Financial Guarantee Insurance Contracts-and interpretation

of FASB Statement No. 60". SFAS No. 163 clarifies how Statement 60 applies to

financial guarantee insurance contracts, including the recognition and

measurement of premium revenue and claims liabilities. This statement also

requires expanded disclosures about financial guarantee insurance contracts.

SFAS No. 163 is effective for fiscal years beginning on or after December 15,

2008, and interim periods within those years. SFAS No. 163 has no effect on the

Company's financial position, statements of operations, or cash flows at this

time.

In May 2008, the Financial Accounting Standards Board ("FASB") issued SFAS No.

162, "The Hierarchy of Generally Accepted Accounting Principles". SFAS No. 162

sets forth the level of authority to a given accounting pronouncement or

document by category. Where there might be conflicting guidance between two

categories, the more authoritative category will prevail. SFAS No. 162 will

become effective 60 days after the SEC approves the PCAOB's amendments to AU

Section 411 of the AICPA Professional Standards. SFAS No. 162 has no effect on

the Company's financial position, statements of operations, or cash flows at

this time.

7

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

In March 2008, the Financial Accounting Standards Board, or FASB, issued SFAS

No. 161, Disclosures about Derivative Instruments and Hedging Activities--an

amendment of FASB Statement No. 133. This standard requires companies to provide

enhanced disclosures about (a) how and why an entity uses derivative

instruments, (b) how derivative instruments and related hedged items are

accounted for under Statement 133 and its related interpretations, and (c) how

derivative instruments and related hedged items affect an entity's financial

position, financial performance, and cash flows. This Statement is effective for

financial statements issued for fiscal years and interim periods beginning after

November 15, 2008, with early application encouraged. The Company has not yet

adopted the provisions of SFAS No. 161, but does not expect it to have a

material impact on its financial position, results of operations or cash flows.

In December 2007, the SEC issued Staff Accounting Bulletin (SAB) No. 110

regarding the use of a "simplified" method, as discussed in SAB No. 107 (SAB

107), in developing an estimate of expected term of "plain vanilla" share

options in accordance with SFAS No. 123 (R), Share-Based Payment. In particular,

the staff indicated in SAB 107 that it will accept a company's election to use

the simplified method, regardless of whether the company has sufficient

information to make more refined estimates of expected term. At the time SAB 107

was issued, the staff believed that more detailed external information about

employee exercise behavior (e.g., employee exercise patterns by industry and/or

other categories of companies) would, over time, become readily available to

companies. Therefore, the staff stated in SAB 107 that it would not expect a

company to use the simplified method for share option grants after December 31,

2007. The staff understands that such detailed information about employee

exercise behavior may not be widely available by December 31, 2007. Accordingly,

the staff will continue to accept, under certain circumstances, the use of the

simplified method beyond December 31, 2007. The Company currently uses the

simplified method for "plain vanilla" share options and warrants, and will

assess the impact of SAB 110 for fiscal year 2009. It is not believed that this

will have an impact on the Company's financial position, results of operations

or cash flows.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in

Consolidated Financial Statements--an amendment of ARB No. 51. This statement

amends ARB 51 to establish accounting and reporting standards for the

noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an

ownership interest in the consolidated entity that should be reported as equity

in the consolidated financial statements. Before this statement was issued,

limited guidance existed for reporting noncontrolling interests. As a result,

considerable diversity in practice existed. So-called minority interests were

reported in the consolidated statement of financial position as liabilities or

in the mezzanine section between liabilities and equity. This statement improves

comparability by eliminating that diversity. This statement is effective for

fiscal years, and interim periods within those fiscal years, beginning on or

after December 15, 2008 (that is, January 1, 2009, for entities with calendar

year-ends). Earlier adoption is prohibited. The effective date of this statement

is the same as that of the related Statement 141 (revised 2007).. It is not

believed that this will have an impact on the Company's financial position,

results of operations or cash flows.

8

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

In December 2007, the FASB, issued FAS No. 141 (revised 2007), Business

Combinations.'This Statement replaces FASB Statement No. 141, Business

Combinations, but retains the fundamental requirements in Statement 141. This

Statement establishes principles and requirements for how the acquirer: (a)

recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, and any noncontrolling interest in the

acquiree; (b) recognizes and measures the goodwill acquired in the business

combination or a gain from a bargain purchase; and (c) determines what

information to disclose to enable users of the financial statements to evaluate

the nature and financial effects of the business combination. This statement

applies prospectively to business combinations for which the acquisition date is

on or after the beginning of the first annual reporting period beginning on or

after December 15, 2008. An entity may not apply it before that date. The

effective date of this statement is the same as that of the related FASB

Statement No. 160, Noncontrolling Interests in Consolidated Financial

Statements. It is not believed that this will have an impact on the Company's

financial position, results of operations or cash flows.

In February 2007, the FASB, issued SFAS No. 159, The Fair Value Option for

Financial Assets and Liabilities--Including an Amendment of FASB Statement No.

115. This standard permits an entity to choose to measure many financial

instruments and certain other items at fair value. This option is available to

all entities. Most of the provisions in FAS 159 are elective; however, an

amendment to FAS 115 Accounting for Certain Investments in Debt and Equity

Securities applies to all entities with available for sale or trading

securities. Some requirements apply differently to entities that do not report

net income. SFAS No. 159 is effective as of the beginning of an entities first

fiscal year that begins after November 15, 2007. Early adoption is permitted as

of the beginning of the previous fiscal year provided that the entity makes that

choice in the first 120 days of that fiscal year and also elects to apply the

provisions of SFAS No. 157 Fair Value Measurements. The Company will adopt SFAS

No. 159 beginning March 1, 2008 and is currently evaluating the potential impact

the adoption of this pronouncement will have on its financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements This

statement defines fair value, establishes a framework for measuring fair value

in generally accepted accounting principles (GAAP), and expands disclosures

about fair value measurements. This statement applies under other accounting

pronouncements that require or permit fair value measurements, the Board having

previously concluded in those accounting pronouncements that fair value is the

relevant measurement attribute. Accordingly, this statement does not require any

new fair value measurements. However, for some entities, the application of this

statement will change current practice. This statement is effective for

financial statements issued for fiscal years beginning after November 15, 2007,

and interim periods within those fiscal years. Earlier application is

encouraged, provided that the reporting entity has not yet issued financial

statements for that fiscal year, including financial statements for an interim

period within that fiscal year. The Company will adopt this statement March 1,

2008, and it is not believed that this will have an impact on the Company's

financial position, results of operations or cash flows.

NOTE 3. GOING CONCERN

The accompanying financial statements are presented on a going concern basis.

The Company had limited operations during the period from May 31, 2006 (date of

inception) to March 31, 2009 and generated a net loss of $39,084. This condition

raises substantial doubt about the Company's ability to continue as a going

concern. Because the Company is currently in the development stage and has

minimal expenses, management believes that the company's current cash and cash

equivalents of $10,916 is sufficient to cover the expenses they will incur

during the next twelve months in a limited operations scenario or until they

raise additional funding.

9

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

NOTE 4. WARRANTS AND OPTIONS

There are no warrants or options outstanding to acquire any additional shares of

common.

NOTE 5. RELATED PARTY TRANSACTIONS

The officers and directors of the Company may, in the future, become involved in

other business opportunities as they become available, they may face a conflict

in selecting between the Company and their other business opportunities. The

Company has not formulated a policy for the resolution of such conflicts.

NOTE 6. INCOME TAXES

As of March 31, 2009

--------------------

Deferred tax assets:

Net operating tax carryforwards $ 39,084

Tax rate 34%

--------

Gross deferred tax assets 13,289

Valuation allowance (13,289)

--------

Net deferred tax assets $ 0

========

|

Realization of deferred tax assets is dependent upon sufficient future taxable

income during the period that deductible temporary differences and carryforwards

are expected to be available to reduce taxable income. As the achievement of

required future taxable income is uncertain, the Company recorded a valuation

allowance.

NOTE 7. NET OPERATING LOSSES

As of March 31, 2009, the Company has a net operating loss carryforwards of

approximately $39,084. Net operating loss carryforwards expires twenty years

from the date the loss was incurred.

NOTE 8. STOCK TRANSACTIONS

Transactions, other than employees' stock issuance, are in accordance with

paragraph 8 of SFAS 123. Thus issuances shall be accounted for based on the fair

value of the consideration received. Transactions with employees' stock issuance

are in accordance with paragraphs (16-44) of SFAS 123. These issuances shall be

accounted for based on the fair value of the consideration received or the fair

value of the equity instruments issued, or whichever is more readily

determinable.

On May 31, 2006, the Company issued a total of 30,000,000 shares of common stock

to one director for cash in the amount of $0.00033 per share for a total of

$10,000.

On October 13, 2006, the Company issued a total of 30,000,000 shares of common

stock to twenty seven unrelated investors for cash in the amount of $0.0013 per

share for a total of $40,000.

On March 19, 2009 the Company effected a 15 for 1 forward split of its issued

and outstanding share capital such that every one share of common stock issued

and outstanding prior to the split was exchanged for fifteen post-split shares

of common stock. The number of shares referred to in the previous paragraphs is

post-split number of shares.

10

VERIFY SMART CORP.

(FORMERLY TREASURE EXPLORATIONS INC.)

(A Development Stage Company)

Notes to Financial Statements (Unaudited)

March 31, 2009

The Company's post-split authorized capital increased to 250,000,000 shares of

common stock with a par value of $0.001 per share. All share amounts have been

retroactively adjusted for all periods presented.

As of March 31, 2009 the Company had 60,000,000 shares of common stock issued

and outstanding.

NOTE 9. STOCKHOLDERS' EQUITY

The stockholders' equity section of the Company contains the following classes

of capital stock as of March 31, 2009:

Common stock, $ 0.001 par value: 250,000,000 shares authorized; 60,000,000

shares issued and outstanding.

NOTE 10. JOINT VENTURE AGREEMENT

Effective March 25, 2009, we entered into a joint venture agreement with

Verified Capital Corp. and Verified Transactions Corp. relating to the formation

and operation of a joint venture corporation that will sell internet security

software for credit card fraud prevention.

Upon the satisfaction of customary closing conditions, the Company will

contribute an aggregate of $5,000,000 to the joint venture corporation, payable

as to $2,000,000 by May 1, 2009 and $3,000,000 by July 1, 2009, for a 70%

interest in the joint venture corporation.

By amendment of May 19, 2009, the Companies have agreed as follows:

"We confirm that it is our mutual understanding and agreement that the Joint

Venture has been satisfactorily performed by us, VerifySmart Corp. ("VSC")

(Nevada) and that we have performed the required financial obligations of

Section 5.01 through both fund raising and joint venture cost sharing and

accordingly, VSC's obligations of Section 5.01 are fully satisfied, the Joint

Venture agreement is in full force and effect in good standing and VSC's revenue

sharing right to 70% of the Joint Venture's revenue commences this date."

In addition to the foregoing, Verified Transactions Corp. will grant to the

joint venture corporation a 25 year worldwide exclusive license to market and

sell Verified Transaction Corp.'s internet security software and all other

internet business of whatsoever nature and including all future developments of

such business for a 25 % interest in the joint venture corporation. Verified

Capital Corp. will be granted a 5% interest in joint venture corporation upon

the transfer of certain assets.

Upon the closing of the joint venture agreement, the Company will be the

operator of the joint venture corporation and will contract with Verified

Capital Corp. to be the sub-operator.

11

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements. These statements

relate to future events or our future financial performance. In some cases, you

can identify forward-looking statements by terminology such as "may", "should",

"expects", "plans", "anticipates", "believes", "estimates", "predicts",

"potential" or "continue" or the negative of these terms or other comparable

terminology. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, that may cause our or our industry's

actual results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statements. Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking

statements to conform these statements to actual results.

Our unaudited financial statements are stated in United States dollars and are

prepared in accordance with United States Generally Accepted Accounting

Principles. The following discussion should be read in conjunction with our

financial statements and the related notes that appear elsewhere in this

quarterly report. The following discussion contains forward-looking statements

that reflect our plans, estimates and beliefs. Our actual results could differ

materially from those discussed in the forward looking statements. Factors that

could cause or contribute to such differences include, but are not limited to,

those discussed below and elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all dollar amounts are

expressed in United States dollars. All references to "common stock" refer to

the common shares in our capital stock.

As used in this quarterly report, the terms "we", "us", "our", "our company" and

"Verify" mean Verify Smart Corp., unless otherwise stated.

CORPORATE OVERVIEW

The address of our principal executive office is Fort Legend Towers, Suite 2002

- 3rd Avenue corner 31st Street E-Square, Fort Bonifacio Global City, Taguig

Metro Manila, Philippines. Our telephone number is 011-632-755-8870.

Effective March 19, 2009, we effected a fifteen (15) for one (1) forward stock

split of our authorized and issued and outstanding common stock. and the

reduction of our authorized common stock As a result, our authorized capital has

changed to 250,000,000 shares of common stock with a par value of $0.001 and our

issued and outstanding shares have increased from 4,000,000 shares of common

stock to 60,000,000 shares of common stock.

Also effective March 19, 2009, we have changed our name from "Treasure

Explorations Inc." to "Verify Smart Corp".

The name change and forward stock split became effective with the

Over-the-Counter Bulletin Board at the opening for trading on March 24, 2009

under the new stock symbol "VSMR".

GENERAL OVERVIEW

We were incorporated in the state of Nevada on May 31, 2006. Since our

incorporation, we had been in the business of the exploration and development of

a mineral property in New Westminster, Simalkameen Mining Division of British

Columbia, consisting of 336 hectares included with 16 mineral title cells. Our

property was without known reserves and our program was exploratory in nature.

We completed the Phase 1 exploration program in our property, the results of

which were not promising and did not justify further expense. Because we were

not successful in our exploration program, we abandoned the mineral claims and

focused on the identification of suitable businesses with which to enter into a

business opportunity or business combination.

12

Effective March 19, 2009, we effected a fifteen (15) for one (1) forward stock

split of our authorized and issued and outstanding common stock. As a result,

our authorized capital has changed to 250,000,000 shares of common stock with a

par value of $0.001 and our issued and outstanding shares have increased from

4,000,000 shares of common stock to 60,000,000 shares of common stock.

Also effective March 19, 2009, we have changed our name from "Treasure

Explorations Inc." to "Verify Smart Corp". The change of name was approved by

our directors and a majority of our shareholders.

On March 24, 2009, Ralph Santos was appointed as a director of our company.

On March 24, 2009 Manly Shore resigned as president, chief executive officer and

chief financial officer of our company and Ralph Santos was appointed president,

chief executive officer and chief financial officer of our company.

On April 14, 2009, Adi Muljo was appointed as a director of our company.

Our board of directors now consists of Manly Shore, Ralph Santos and Adi Muljo.

On March 25, 2009, we entered into a joint venture agreement with Verified

Capital Corp. and Verified Transactions Corp. relating to the formation and

operation of a joint venture corporation that will sell internet security

software for credit card fraud prevention. Upon the satisfaction of customary

closing conditions, we earned a 70% interest in the joint venture corporation.

We are required to contribute $2,000,000 by May 1, 2009, of which $250,000 will

be paid to Verified Transactions Corp. as a license fee. Until such time as we

have raised the $2,000,000, we will not be entitled to receive any revenue from

the joint venture corporation. We are further required to contribute $3,000,000

to the joint venture corporation by July 1, 2009, of which $500,000 will be paid

to Verified Transactions Corp. as a license fee. As of the date of this

quarterly report, we have not yet contributed the $2,000,000 owed to the joint

venture corporation. However, the joint venture corporation has been formed and

as per the joint venture agreement we are the operator of the joint venture

corporation. We have contracted the operator rights to Verified Capital Corp. as

the sub-operator.

By amendment of May 19, 2009, the Companies have agreed as follows:

"We confirm that it is our mutual understanding and agreement that the Joint

Venture has been satisfactorily performed by us, VerifySmart Corp. ("VSC")

(Nevada) and that we have performed the required financial obligations of

Section 5.01 through both fund raising and joint venture cost sharing and

accordingly, VSC's obligations of Section 5.01 are fully satisfied, the Joint

Venture agreement is in full force and effect in good standing and VSC's revenue

sharing right to 70% of the Joint Venture's revenue commences this date."

Pursuant to the joint venture agreement, Verified Transactions Corp. has

provided to the joint venture corporation an exclusive world-wide license to

use, sell and sub-license its internet security software and all other internet

business of such nature and including all future development of such business.

The term of the license is for a period of 25 years with an option to renew for

an additional 25 years for a payment of $5,000,000. In consideration for the

granting of the license, Verified Transactions Corp. will receive the license

fees disclosed above, 10% of the revenue of the joint venture corporation to a

maximum of $1,250,000 and a 3% royalty on the gross revenue of the joint venture

corporation.

We have the right to acquire all of Verified Capital Corp.'s interest in the

joint venture corporation and all of Verified Transactions Corp.'s interest in

the joint venture corporation, excluding the royalty as set out in the joint

venture agreement, at market value at the earlier of the joint venture

corporation generating $100 million in aggregate revenue per year with a minimum

net margin of 25% or 5 years. Market value shall be determined by an agreed

valuator or, failing agreement, we may hire a top-five chartered accountancy

firm to prepare a market value report and, absent material error of standard

calculation, such report shall be final.

Pursuant to the terms of the joint venture agreement, we have agreed to permit

and have the right to tender to all shareholders and creditors of each of

Verified Capital Corp. and Verified Transactions Corp. to convert their debts

13

and shares into shares of our company on a one for one basis subject to our

company raising the $2,000,000 (as set out above) and the joint venture

corporation earning gross cash flow of not less than $100,000 per week.

Under the license, Ralph Santos, our president, will receive a 10% carried

equity interest in the Gateway internet business of the joint venture

corporation. Mr. Santos is also a significant equity owner in Verified

Transactions Corp. and Verified Capital Corp.

DESCRIPTION OF THE JOINT VENTURE BUSINESS

The joint venture business will market and sell its licensed software which

provides a comprehensive solution to credit card fraud by addressing the

security needs of consumer clients, credit card companies, banks and merchants

through instant verification that is inexpensive to implement and simple to use.

The software operates through the use of a cellular phone for secured

verification of monetary transactions. The software has been developed to

include debit card purchases, internet purchases, ATM, passport and mortgage

verification.

We have also entered into preliminary discussions with Verified Capital Corp.

wherein we would acquire either the assets or outstanding shares of common stock

of Verified Capital Corp. The parties will jointly determine the optimum

structure for the acquisition in order to best satisfy tax planning, regulatory

and other considerations, including mutually agreed upon performance based

milestones.

The acquisition contemplated by the preliminary discussions is subject to the

fulfillment of certain conditions precedent, due diligence and the negotiation

of a definitive agreement.

On April 3, 2009, the joint venture corporation into an agreement with China

Trust to launch our first credit card "VeriSmart(TM) Platinum Visa".

Under the terms of the agreement, China Trust will distribute, for pilot, 2,500

co-branded VeriSmart(TM) Platinum Visa Cards linked to our patent-pending

Authentication system, VerifyNGo(TM), to serve as enterprise payroll, payout and

remittance solutions affording centralized control and management of fund

disbursement globally, anytime, anywhere.

On April 6, 2009, we entered into a services agreement with European hosting and

infrastructure provider Prime Interactive S.R.O. The services agreement with

Prime Interactive accelerates the European leg of our expansion plan and

compliments our company's existing capabilities.

Under the terms of the agreement Prime Interactive will be providing the

following services to our company:

* Web and Mobile Application Development

* Data Centre infrastructure servicing Europe and located in Slovakia

* Marketing access to a legacy worldwide customer base of 130,000

* Marketing access to established European Financial Industry vertical

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED MARCH 31, 2009 AND 2008

The following summary of our results of operations should be read in conjunction

with our financial statements for the three month period ended March 31, 2009

and 2008.

We have not generated any revenue since inception and are dependent upon

obtaining financing to pursue our business activities. For these reasons, our

auditors believe that there is substantial doubt that we will be able to

continue as a going concern.

14

Our operating results for the three month period ended March 31, 2009 and 2008

and the changes between those periods for the respective items are summarized as

follows:

Change Between

Three Month Three Month Three Month Period Ended

Period Ended Period Ended March 31, 2009 and

March 31, 2009 March 31, 2008 March 31, 2008

-------------- -------------- --------------

Revenue $ Nil $ Nil $ Nil

Professional Fees $ 2,000 $ 2,000 $ Nil

General and Administrative Expenses $ 761 $ 693 $ 68

Net loss $ 2,761 $ 2,693 $ 68

|

RESULTS OF OPERATIONS FOR THE NINE MONTHS ENDED MARCH 31, 2009 AND 2008

The following summary of our results of operations should be read in conjunction

with our financial statements for the nine month period ended March 31, 2009 and

2008.

We have not generated any revenue since inception and are dependent upon

obtaining financing to pursue our business activities. For these reasons, our

auditors believe that there is substantial doubt that we will be able to

continue as a going concern.

Our operating results for the nine month period ended March 31, 2009 and 2008

and the changes between those periods for the respective items are summarized as

follows:

Change Between

Nine Month Nine Month Nine Month Period Ended

Period Ended Period Ended March 31, 2009 and

March 31, 2009 March 31, 2008 March 31, 2008

-------------- -------------- --------------

Revenue $ Nil $ Nil $ Nil

Professional Fees $ 8,000 $ 6,500 $ 1,500

General and Administrative Expenses $ 2,152 $ 5,217 $ (3,065)

Net loss $ 10,152 $ 11,717 $ (1,565)

|

LIQUIDITY AND FINANCIAL CONDITION

WORKING CAPITAL

Nine month Change between

Period Ended Year Ended March 31, 2009 and

March 31, 2009 June 30, 2008 June 30, 2008

-------------- ------------- -------------

($) ($) ($)

Current Assets 10,916 21,231 (10,315)

Current Liabilities Nil 163 (163)

Working Capital/(Deficit) 10,916 21,068 (10,152)

|

15

CASH FLOWS

Change Between

Nine Month Nine Month Nine Month Period Ended

Period Ended Period Ended March 31, 2009 and

March 31, 2009 March 31, 2008 March 31, 2008

-------------- -------------- --------------

($) ($) ($)

Net Cash (used in) Operating Activities (8,315) (8,554) 239

Net Cash provided by Financing Activities Nil Nil Nil

Net cash used for Investing Activities Nil Nil Nil

------- ------- -------

Net Increase (Decrease) in Cash During Period (8,315) (8,554) 239

======= ======= =======

|

As of March 31, 2009, our total assets were $10,916 and our total liabilities

were $Nil and we had a working capital surplus of $10,916. Our financial

statements report a net loss of $10,152 for the nine months ended March 31,

2009, and a net loss of $39,084 for the period from May 31, 2006 (inception) to

March 31, 2009.

GOING CONCERN

Due to the uncertainty of our ability to meet our current operating and capital

expenses, in their report on the annual financial statements for the year ended

June 30, 2008, our independent auditors included an explanatory paragraph

regarding concerns about our ability to continue as a going concern.

We anticipate that additional funding will be required in the form of equity

financing from the sale of our common stock. At this time, we cannot provide

investors with any assurance that we will be able to raise sufficient funding

from the sale of our common stock or through a loan from our directors to meet

our obligations over the next twelve months. We do not have any arrangements in

place for any future debt or equity financing.

CONTRACTUAL OBLIGATIONS

As a "smaller reporting company", we are not required to provide tabular

disclosure obligations.

GOING CONCERN

We anticipate that additional funding will be required in the form of equity

financing from the sale of our common stock. At this time, we cannot provide

investors with any assurance that we will be able to raise sufficient funding

from the sale of our common stock or through a loan from our directors to meet

our obligations over the next twelve months. We do not have any arrangements in

place for any future debt or equity financing.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to

have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

BASIS OF ACCOUNTING

The Company's financial statements are prepared using the accrual method of

accounting. The Company has elected a June 30, year-end.

16

BASIC EARNINGS (LOSS) PER SHARE

In February 1997, the FASB issued SFAS No. 128, "Earnings Per Share", which

specifies the computation, presentation and disclosure requirements for earnings

(loss) per share for entities with publicly held common stock. SFAS No. 128

supersedes the provisions of APB No. 15, and requires the presentation of basic

earnings (loss) per share and diluted earnings (loss) per share. The Company has

adopted the provisions of SFAS No. 128 effective May 31, 2006 (date of

inception).

Basic net earnings (loss) per share amounts is computed by dividing the net

earnings (loss) by the weighted average number of common shares outstanding.

Diluted earnings (loss) per share are the same as basic earnings (loss) per

share due to the lack of dilutive items in the Company.

CASH EQUIVALENTS

The Company considers all highly liquid investments purchased with an original

maturity of three months or less to be cash equivalents.

USE OF ESTIMATES AND ASSUMPTIONS

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates. In accordance with FASB 16 all

adjustments are normal and recurring.

INCOME TAXES

Income taxes are provided in accordance with Statement of Financial Accounting

Standards No. 109 (SFAS 109), "Accounting for Income Taxes". A deferred tax

asset or liability is recorded for all temporary differences between financial

and tax reporting and net operating loss carryforwards. Deferred tax expense

(benefit) results from the net change during the year of deferred tax assets and

liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of

management, it is more likely than not that some portion or all of the deferred

tax assets will not be realized. Deferred tax assets and liabilities are

adjusted for the effects of changes in tax laws and rates on the date of

enactment.

RECENT ACCOUNTING PRONOUNCEMENTS

In May 2008, the Financial Accounting Standards Board ("FASB") issued SFAS No.

163, "Accounting for Financial Guarantee Insurance Contracts-and interpretation

of FASB Statement No. 60". SFAS No. 163 clarifies how Statement 60 applies to

financial guarantee insurance contracts, including the recognition and

measurement of premium revenue and claims liabilities. This statement also

requires expanded disclosures about financial guarantee insurance contracts.

SFAS No. 163 is effective for fiscal years beginning on or after December 15,

2008, and interim periods within those years. SFAS No. 163 has no effect on the

Company's financial position, statements of operations, or cash flows at this

time.

In May 2008, the Financial Accounting Standards Board ("FASB") issued SFAS No.

162, "The Hierarchy of Generally Accepted Accounting Principles". SFAS No. 162

sets forth the level of authority to a given accounting pronouncement or

document by category. Where there might be conflicting guidance between two

categories, the more authoritative category will prevail. SFAS No. 162 will

become effective 60 days after the SEC approves the PCAOB's amendments to AU

Section 411 of the AICPA Professional Standards. SFAS No. 162 has no effect on

the Company's financial position, statements of operations, or cash flows at

this time.

17

In March 2008, the Financial Accounting Standards Board, or FASB, issued SFAS

No. 161, Disclosures about Derivative Instruments and Hedging Activities--an

amendment of FASB Statement No. 133. This standard requires companies to provide

enhanced disclosures about (a) how and why an entity uses derivative

instruments, (b) how derivative instruments and related hedged items are

accounted for under Statement 133 and its related interpretations, and (c) how

derivative instruments and related hedged items affect an entity's financial

position, financial performance, and cash flows. This Statement is effective for

financial statements issued for fiscal years and interim periods beginning after

November 15, 2008, with early application encouraged. The Company has not yet

adopted the provisions of SFAS No. 161, but does not expect it to have a

material impact on its financial position, results of operations or cash flows.

In December 2007, the SEC issued Staff Accounting Bulletin (SAB) No. 110

regarding the use of a "simplified" method, as discussed in SAB No. 107 (SAB

107), in developing an estimate of expected term of "plain vanilla" share

options in accordance with SFAS No. 123 (R), Share-Based Payment. In particular,

the staff indicated in SAB 107 that it will accept a company's election to use

the simplified method, regardless of whether the company has sufficient

information to make more refined estimates of expected term. At the time SAB 107

was issued, the staff believed that more detailed external information about

employee exercise behavior (e.g., employee exercise patterns by industry and/or

other categories of companies) would, over time, become readily available to

companies. Therefore, the staff stated in SAB 107 that it would not expect a

company to use the simplified method for share option grants after December 31,

2007. The staff understands that such detailed information about employee

exercise behavior may not be widely available by December 31, 2007. Accordingly,

the staff will continue to accept, under certain circumstances, the use of the

simplified method beyond December 31, 2007. The Company currently uses the

simplified method for "plain vanilla" share options and warrants, and will

assess the impact of SAB 110 for fiscal year 2009. It is not believed that this

will have an impact on the Company's financial position, results of operations

or cash flows.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in

Consolidated Financial Statements--an amendment of ARB No. 51. This statement

amends ARB 51 to establish accounting and reporting standards for the

noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an

ownership interest in the consolidated entity that should be reported as equity

in the consolidated financial statements. Before this statement was issued,

limited guidance existed for reporting noncontrolling interests. As a result,

considerable diversity in practice existed. So-called minority interests were

reported in the consolidated statement of financial position as liabilities or

in the mezzanine section between liabilities and equity. This statement improves

comparability by eliminating that diversity. This statement is effective for

fiscal years, and interim periods within those fiscal years, beginning on or

after December 15, 2008 (that is, January 1, 2009, for entities with calendar

year-ends). Earlier adoption is prohibited. The effective date of this statement

is the same as that of the related Statement 141 (revised 2007).. It is not

believed that this will have an impact on the Company's financial position,

results of operations or cash flows.

In December 2007, the FASB, issued FAS No. 141 (revised 2007), Business

Combinations.'This Statement replaces FASB Statement No. 141, Business

Combinations, but retains the fundamental requirements in Statement 141. This

Statement establishes principles and requirements for how the acquirer: (a)

recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, and any noncontrolling interest in the

acquiree; (b) recognizes and measures the goodwill acquired in the business

combination or a gain from a bargain purchase; and (c) determines what

information to disclose to enable users of the financial statements to evaluate

the nature and financial effects of the business combination. This statement

applies prospectively to business combinations for which the acquisition date is

on or after the beginning of the first annual reporting period beginning on or

after December 15, 2008. An entity may not apply it before that date. The

effective date of this statement is the same as that of the related FASB

Statement No. 160, Noncontrolling Interests in Consolidated Financial

Statements. It is not believed that this will have an impact on the Company's

financial position, results of operations or cash flows.

In February 2007, the FASB, issued SFAS No. 159, The Fair Value Option for

Financial Assets and Liabilities--Including an Amendment of FASB Statement No.

115. This standard permits an entity to choose to measure many financial

instruments and certain other items at fair value. This option is available to

all entities. Most of the provisions in FAS 159 are elective; however, an

amendment to FAS 115 Accounting for Certain Investments in Debt and Equity

Securities applies to all entities with available for sale or trading

securities. Some requirements apply differently to entities that do not report

18

net income. SFAS No. 159 is effective as of the beginning of an entities first

fiscal year that begins after November 15, 2007. Early adoption is permitted as

of the beginning of the previous fiscal year provided that the entity makes that

choice in the first 120 days of that fiscal year and also elects to apply the

provisions of SFAS No. 157 Fair Value Measurements. The Company will adopt SFAS

No. 159 beginning March 1, 2008 and is currently evaluating the potential impact

the adoption of this pronouncement will have on its financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements This

statement defines fair value, establishes a framework for measuring fair value

in generally accepted accounting principles (GAAP), and expands disclosures

about fair value measurements. This statement applies under other accounting

pronouncements that require or permit fair value measurements, the Board having

previously concluded in those accounting pronouncements that fair value is the

relevant measurement attribute. Accordingly, this statement does not require any

new fair value measurements. However, for some entities, the application of this

statement will change current practice. This statement is effective for

financial statements issued for fiscal years beginning after November 15, 2007,

and interim periods within those fiscal years. Earlier application is

encouraged, provided that the reporting entity has not yet issued financial

statements for that fiscal year, including financial statements for an interim

period within that fiscal year. The Company will adopt this statement March 1,

2008, and it is not believed that this will have an impact on the Company's

financial position, results of operations or cash flows.

ITEM 3. QUANTITATIVE DISCLOSURES ABOUT MARKET RISKS

As a "smaller reporting company", we are not required to provide the information

required by this Item.

ITEM 4(T). CONTROLS AND PROCEDURES

MANAGEMENT'S REPORT ON DISCLOSURE CONTROLS AND PROCEDURES

We maintain disclosure controls and procedures that are designed to ensure that

information required to be disclosed in our reports filed under the SECURITIES

EXCHANGE ACT OF 1934, as amended, is recorded, processed, summarized and

reported within the time periods specified in the Securities and Exchange

Commission's rules and forms, and that such information is accumulated and

communicated to our management, including our president, chief executive officer

and chief financial officer (who is acting as our principal executive officer,

principal financial officer and principle accounting officer) to allow for

timely decisions regarding required disclosure.

As of March 31, 2009, the end of our quarter covered by this report, we carried

out an evaluation, under the supervision and with the participation of our

president, chief executive officer and chief financial officer (who is acting as

our principal executive officer, principal financial officer and principle

accounting officer), of the effectiveness of the design and operation of our

disclosure controls and procedures. Based on the foregoing, our president, chief

executive officer and chief financial officer (who is acting as our principal

executive officer, principal financial officer and principle accounting officer)

concluded that our disclosure controls and procedures were not effective as of

the end of the period covered by this quarterly report.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There have been no changes in our internal controls over financial reporting

that occurred during our quarter ended March 31, 2009 that have materially or

are reasonably likely to materially affect, our internal controls over financial

reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our

company, nor are we involved as a plaintiff in any material proceeding or

pending litigation. There are no proceedings in which any of our directors,

19

officers or affiliates, or any registered or beneficial shareholder, is an

adverse party or has a material interest adverse to our interest.

ITEM 1A. RISK FACTORS

Our business operations are subject to a number of risks and uncertainties,

including, but not limited to those set forth below:

WE HAVE A LIMITED OPERATING HISTORY, AND IT IS DIFFICULT TO EVALUATE OUR

FINANCIAL PERFORMANCE AND PROSPECTS. THERE IS NO ASSURANCE THAT WE WILL ACHIEVE

PROFITABILITY OR THAT WE WILL NOT DISCOVER PROBLEMS WITH OUR BUSINESS MODEL.

We have a limited operating history. As such, it is difficult to evaluate our

future prospects and performance, and therefore we cannot ensure that we will

operate profitably in the future.

WE HAVE LIMITED FUNDS AVAILABLE FOR OPERATING EXPENSES. IF WE DO NOT OBTAIN

FUNDS WHEN NEEDED, WE WILL HAVE TO CEASE OUR OPERATIONS.

Currently, we have limited operating capital. As of March 31, 2009, our cash

available was approximately $10,916. In the foreseeable future, we expect to

incur significant expenses if we acquire and develop our new business. We may be

unable to locate sources of capital or may find that capital is not available on

terms that are acceptable to us to fund our additional expenses. There is the

possibility that we will run out of funds, and this may affect our operations

and thus our profitability. If we cannot obtain funds when needed, we may have

to cease our operations.

WE DEPEND ON ATTRACTING AND RETAINING QUALIFIED EMPLOYEES, THE FAILURE OF WHICH

COULD RESULT IN A MATERIAL DECLINE IN OUR REVENUES.

We intend to become a provider of identity protection/secured transaction

services. Our revenues and future growth will depend on our ability to attract

and retain qualified employees. This is especially crucial to our proposed

business, as these employees will generate revenue by providing the services

that are the staple product that we offer. We may face difficulties in

recruiting and retaining sufficient numbers of qualified employees because the

market may not have enough of such personnel. In addition, we compete with other

companies for qualified employees. If we are unable to retain such employees, we

could face a material decline in our revenue.

U.S. INVESTORS MAY EXPERIENCE DIFFICULTIES IN ATTEMPTING TO ENFORCE JUDGMENTS

BASED UPON U.S. FEDERAL SECURITIES LAWS AGAINST US AND OUR NON-U.S. RESIDENT

DIRECTORS.

All of our operations and our assets are located outside the United States and

some of our directors and officer are foreign citizens. As a result, it may be

difficult or impossible for U.S. investors to enforce judgments of U.S. courts

for civil liabilities against any of our individual directors or officers.

RISKS RELATING TO OUR COMMON SHARES

TRADING ON THE OTC BULLETIN BOARD MAY BE VOLATILE AND SPORADIC, WHICH COULD

DEPRESS THE MARKET PRICE OF OUR COMMON SHARES AND MAKE IT DIFFICULT FOR OUR

SHAREHOLDERS TO RESELL THEIR SHARES.

Our common shares are quoted on the OTC Bulletin Board service. Trading in

shares quoted on the OTC Bulletin Board is often thin and characterized by wide

fluctuations in trading prices, due to many factors that may have little to do

with our operations or business prospects. This volatility could depress the

market price of our common shares for reasons unrelated to operating

performance. Moreover, the OTC Bulletin Board is not a stock exchange, and

trading of securities on the OTC Bulletin Board is often more sporadic than the

trading of securities listed on a quotation system like Nasdaq or a stock

exchange like Amex. Accordingly, shareholders may have difficulty reselling any

of the shares.

OUR SHARE IS A PENNY STOCK. TRADING OF OUR SHARE MAY BE RESTRICTED BY THE SEC'S

PENNY STOCK REGULATIONS WHICH MAY LIMIT A SHAREHOLDER'S ABILITY TO BUY AND SELL

OUR SHARES.

20

Our share is a penny stock. The Securities and Exchange Commission has adopted

Rule 15g-9 which generally defines "penny stock" to be any equity security that

has a market price (as defined) less than $5.00 per share or an exercise price

of less than $5.00 per share, subject to certain exceptions. Our securities are

covered by the penny stock rules, which impose additional sales practice

requirements on broker-dealers who sell to persons other than established

customers and "accredited investors". The term "accredited investor" refers

generally to institutions with assets in excess of $5,000,000 or individuals

with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or

$300,000 jointly with their spouse. The penny stock rules require a

broker-dealer, prior to a transaction in a penny stock not otherwise exempt from

the rules, to deliver a standardized risk disclosure document in a form prepared

by the SEC which provides information about penny stocks and the nature and

level of risks in the penny stock market. The broker-dealer also must provide

the customer with current bid and offer quotations for the penny stock, the

compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in

the customer's account. The bid and offer quotations, and the broker-dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer's confirmation. In addition, the penny stock

rules require that prior to a transaction in a penny stock not otherwise exempt

from these rules; the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the

purchaser's written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary

market for the shares that are subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in and limit the marketability of our common shares.

FINRA SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT A SHAREHOLDER'S ABILITY TO BUY

AND SELL OUR SHARE.

In addition to the "penny stock" rules promulgated by the Securities and

Exchange Commission, the Financial Industry Regulatory Authority, or FINRA, has

adopted rules that require that in recommending an investment to a customer, a

broker-dealer must have reasonable grounds for believing that the investment is

suitable for that customer. Prior to recommending speculative low priced

securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer's financial status,

tax status, investment objectives and other information. Under interpretations

of these rules, the FINRA believes that there is a high probability that

speculative low priced securities will not be suitable for at least some

customers. The FINRA requirements make it more difficult for broker-dealers to

recommend that their customers buy our common shares, which may limit your

ability to buy and sell our share.

TRENDS, RISKS AND UNCERTAINTIES

We have sought to identify what we believe to be the most significant risks to

our business, but we cannot predict whether, or to what extent, any of such

risks may be realized nor can we guarantee that we have identified all possible

risks that might arise. Investors should carefully consider all of such risk

factors before making an investment decision with respect to our common shares.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

21

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

Exhibits required by Item 601 of Regulation S-K.

Exhibit

Number Description

------ -----------

(3) ARTICLES OF INCORPORATION AND BY-LAWS

3.1 Articles of Incorporation (incorporated by reference from our

Registration Statement on Form SB-2 filed on August 10, 2006)

3.2 Bylaws (incorporated by reference from our Registration Statement on

Form S-1 filed on July 21, 2008)

3.3 Certificate of Change (incorporated by reference from our Current

Report on Form 8-K filed on March 26, 2009)

3.4 Certificate of Amendment (incorporated by reference from our Current

Report on Form 8-K filed on March 26, 2009)

(10) MATERIAL CONTRACTS

10.1 Joint Venture Agreement among Verified Capital Corp., Verified

Transactions Corp. and our company dated effective March 25, 2009

(incorporated by reference from our Current Report on Form 8-K filed

on March 26, 2009)

(31) RULE 13A-14(D)/15D-14(D) CERTIFICATIONS

31.1* Section 302 Certification of Principal Executive Officer and

Principal Financial Officer.

(32) SECTION 1350 CERTIFICATIONS

32.1* Section 906 Certification of Principal Executive Officer and

Principal Financial Officer.

----------

|

* Filed herewith

22

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

VERIFY SMART CORP.

(Registrant)

Dated: May 20, 2009 /s/ Ralph Santos

---------------------------------------------------

Ralph Santos

President, Chief Executive Officer,

Chief Financial Officer and Director

(Principal Executive Officer, Principal

Accounting Officer and Principal Financial Officer)

|

23

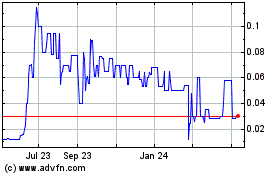

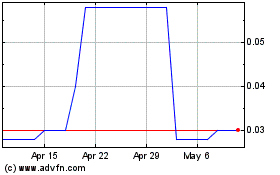

Verify Smart (PK) (USOTC:VSMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Verify Smart (PK) (USOTC:VSMR)

Historical Stock Chart

From Jul 2023 to Jul 2024