Current Report Filing (8-k)

January 10 2023 - 9:01AM

Edgar (US Regulatory)

0001463208

false

0001463208

2023-01-04

2023-01-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 4, 2023

Transportation

and Logistics Systems, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-34970 |

|

26-3106763 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

(Address

of Principal Executive Offices)

(833)

764-1443

(Issuer’s

telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward

Looking Statements

Statements

in this report regarding Transportation and Logistics Systems, Inc. (the “Company”) that are not historical facts

are forward-looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ

materially from such statements. Any such forward-looking statements, including, but not limited to, financial guidance, are made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements

that do not directly or exclusively relate to historical facts. In some cases, you can identify forward-looking statements by terms such

as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“anticipates,” “intend,” “plan,” “goal,” “seek,” “strategy,”

“future,” “likely,” “believes,” “estimates,” “projects,” “forecasts,”

“predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology.

These include, but are not limited to, statements relating to future events or our future financial and operating results, plans, objectives,

expectations, and intentions. Although we believe that the expectations reflected in these forward-looking statements are reasonable,

these expectations may not be achieved. Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they represent our intentions, plans, expectations, assumptions, and beliefs about future events and are subject to known and

unknown risks, uncertainties and other factors outside of our control that could cause our actual results, performance or achievement

to differ materially from those expressed or implied by these forward-looking statements. In addition to the risks described above, these

risks and uncertainties include: our ability to successfully execute our business strategies, including integration of acquisitions and

the future acquisition of other businesses to grow our company; customers’ cancellation on short notice of master service agreements

from which we derive a significant portion of our revenue or our failure to renew such master service agreements on favorable terms or

at all; our ability to attract and retain key personnel and skilled labor to meet the requirements of our labor-intensive business or

labor difficulties which could have an effect on our ability to bid for and successfully complete contracts; the ultimate geographic

spread, duration and severity of the coronavirus outbreak and the effectiveness of actions taken, or actions that may be taken, by governmental

authorities to contain the outbreak or ameliorate its effects; our failure to compete effectively in our highly competitive industry

could reduce the number of new contracts awarded to us or adversely affect our market share and harm our financial performance; our ability

to adopt and master new technologies and adjust certain fixed costs and expenses to adapt to our industry’s and customers’

evolving demands; our history of losses, deficiency in working capital and stockholders’ equity and our ability to achieve sustained

profitability; remaining weaknesses in our internal control over financial reporting and our ability to maintain effective controls over

financial reporting in the future; our remaining liabilities and indebtedness could adversely affect our business, financial condition

and results of operations and our ability to meet our payment obligations; unanticipated and materially adverse developments in our few

remaining litigations; the impact of new or changed laws, regulations or other industry standards that could adversely affect our ability

to conduct our business; and changes in general market, economic and political conditions in the United States and global economies or

financial markets, including those resulting from natural or man-made disasters.

These

forward-looking statements represent our estimates and assumptions only as of the date of this report and, except as required by law,

we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future

events or otherwise after the date of this report. Given these uncertainties, you should not place undue reliance on these forward-looking

statements and should consider various factors, including the risks described, among other places, in our most recent Annual Report on

Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the Securities and Exchange Commission.

Item

1.01 Entry into a Material Definitive Agreement.

Transportation

and Logistics Systems, Inc. (OTC PINK: TLSS), (“TLSS” or the “Company”), a logistics service provider, announced

that, on January 4, 2023, its wholly-owned subsidiary, TLSS Acquisition, Inc. (the “Acquisition Sub”), entered into a stock

purchase agreement (“SPA”) to acquire all of the outstanding stock of Massachusetts-based Severance Trucking, Inc., and certain

affiliated warehousing and vehicle leasing entities, offering an array of logistical services in New England, upstate New York and Canada

(collectively, “Severance”).

The

sellers of the stock are Kathryn Boyd, Clyde Severance, and Robert Severance, all individuals (the “Sellers”). None of the

Sellers are affiliated with the Company or its affiliates.

Severance

is a full-service transportation business that has been in operation for over 100 years specializing in LTL trucking that provides next

day service to major cities in New England and New York, with cartage and interline agreements with respected carriers that ensure reliable

deliveries anywhere in the United States and Canada.

Severance

utilizes its own fleet of trucks, driver and office personnel at two convenient and secure Massachusetts and Connecticut locations.

The

SPA provides for a purchase price equal to $2,250,000, payable in cash, at Closing, subject to a reduction for debt assumed in connection

with the transaction and a post-closing adjustment up or down determined by the amount by which Severance working capital at closing

exceeds or falls short of the target working capital on which the purchase price is calculated.

The

transaction is scheduled to close on January 31, 2023, subject to the completion of satisfactory due diligence by TLSS to confirm the

accuracy of Severance’s representations and warranties in the SPA and that Severance has not suffered a material adverse change

in its business. It is also subject to procuring acceptable landlords’ consents to Severance’s assignment of the leases for

its operating facilities to the Acquisition Sub and to TLSS’s securing financing for the cash portion of the acquisition.

The

Company’s primary strategy has been to become a leader in the transportation industry in providing on-time, high-quality pick-up,

transportation and delivery services. The Company expects to accomplish this goal, in part, by pursuing strategic acquisitions as a means

of adding new markets in the United States, expanding its transportation and logistics service offerings, adding talented management

and operational employees, expanding and upgrading its technology platform and developing operational best practices. Moreover, one factor

in assessing acquisition opportunities is the potential for subsequent organic growth post-acquisition.

The

Company believes that the acquisition of Severance is an excellent fit with its current business given its demographic location, services

offered, and diversified customer base, and given that it would provide the Company with a long-standing, well-run profitable operation.

Furthermore, the Company believes that, because Severance is strategically based in Connecticut and Massachusetts and serves New England,

upstate New York and Canada, it will transition the Company into more of a regional carrier, which the Company believes, will create

greater opportunities for organic growth.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description |

| |

|

|

| 10.1+

|

|

Stock Purchase and Sale Agreement, dated as of January 4, 2023, by and among TLSS Acquisition, Inc., a Delaware corporation; Severance Trucking Co., Inc., a Massachusetts corporation,Severance Warehousing, Inc., a Massachusetts corporation, and McGrath Trailer Leasing, Inc., a Maine corporation (collectively, the “Companies”); The Shareholders of the Companies; Kathryn Boyd, as the Shareholders’ Representative; and R|A Feingold Law & Consulting, P.A., as Closing Agent and Escrow Agent. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

+

Disclosure Schedules and other related Schedules are omitted.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

January 10, 2023 |

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

| |

|

|

| |

By: |

/s/

Sebastian Giordano |

| |

Name: |

Sebastian

Giordano |

| |

Title: |

Chief

Executive Officer |

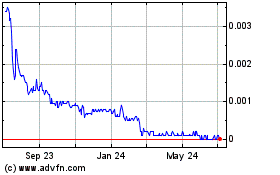

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

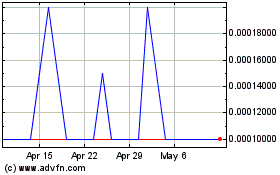

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Nov 2023 to Nov 2024