SCHEDULE 14C

(Rule 14c-101)

Information Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

Check the appropriate box:

|

þ

|

|

Preliminary Information Statement

|

|

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

o

|

|

Definitive Information Statement

|

NORTHWEST BIOTHERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Persons) Filing Information Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

þ

|

|

No fee required.

|

|

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the

filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

(4)

|

|

Date Filed:

|

NORTHWEST BIOTHERAPEUTICS, INC.

7600 Wisconsin Ave.

Suite 750

Bethesda, MD 20814

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT OF

THE MAJORITY STOCKHOLDERS

TO BE EFFECTIVE ON OR ABOUT DECEMBER

, 2007

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholder:

We are writing to give you notice of, and the attached Information Statement is being

distributed in connection with, an action by written consent of the majority stockholders of

Northwest Biotherapeutics, Inc., a Delaware corporation (the “Company”), taken on June 13, 2007,

which will be effective on or about December

, 2007.

The purpose of this Information Statement is to inform the holders of record of shares of

common stock, par value $0.001 per share (the “Common Stock”) as of the close of business on the

record date, November 14, 2007, that our board of directors (the “Board”) has approved and

recommended, and a majority of our stockholders have consented to, resolutions to amend the

Company’s Seventh Amended and Restated Certificate of Incorporation, as amended (the “Certificate

of Incorporation”) to:

|

|

(1)

|

|

decrease the number of authorized shares of Common Stock of the Company from

800,000,000 shares to 100,000,000 shares and decrease the number of authorized shares

of preferred stock, par value $0.001 per share (the “Preferred Stock”), of the Company

from 300,000,000 shares to 20,000,000 shares; and

|

|

|

(2)

|

|

eliminate redundancies in Article VI, Section (A) of the Certificate of

Incorporation that require vacancies on the Board of Directors that result from an

increase in the number of directors to be filled by the affirmative vote of a majority

of the Company’s “continuing directors,” voting separately and as a subclass of

directors, and the affirmative vote of a majority of the directors then in office, and

to otherwise correct certain minor typographical errors in Article VI, Section (A) of

the Certificate of Incorporation.

|

The details of the amendments to the Certificate of Incorporation and other important

information are set forth in the accompanying Information Statement. The Board has unanimously

approved the amendments, which are expected to become effective on or about December

,

2007.

Under Section 228 of the General Corporation Law of the State of Delaware, stockholders may

take action by written consent without a meeting and without prior notice, so long as the holders

giving written consent own outstanding common stock in excess of the minimum number of votes that

would be necessary to authorize the action at a meeting at which all shares entitled to vote

thereon were present and voted. On that basis, the stockholders holding a majority of the

outstanding shares of common stock entitled to vote approved the foregoing amendments to the

Certificate of Incorporation. No other vote or stockholder action is required. You are hereby

being provided with notice of the approval of the foregoing amendments to the Certificate of

Incorporation by less than unanimous written consent of the stockholders of the Company.

You are not required to take any action. The accompanying Information Statement is furnished

only to inform you of the action described above before it takes effect in accordance with Rule

14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This

Information Statement is being mailed to you on or about December

, 2007.

By order of the Board of Directors,

/s/ Alton L. Boynton, PhD

Alton L. Boynton

Chief Executive Officer

Bethesda, Maryland

November

, 2007

INFORMATION STATEMENT

(PRELIMINARY)

NORTHWEST BIOTHERAPEUTICS, INC.

7600 Wisconsin Ave.

Suite 750

Bethesda, MD 20814

November

, 2007

GENERAL INFORMATION

This Information Statement is being mailed on or about December

, 2007 to all stockholders

of record as of November 14, 2007.

This Information Statement has been filed with the Securities and Exchange Commission and is being

furnished, pursuant to Section 14(c) of the Exchange Act to the holders of the Common Stock of the

Company (the “Stockholders”) to notify such Stockholders that on June 13, 2007, the Company

received a written consent in lieu of a meeting of Stockholders from the holder of shares

representing 77.5% of the total then issued and outstanding shares of capital stock of the Company

voting together as a single class and 100% of each of the total then issued and outstanding Series

A Convertible Preferred Stock, par value $0.001 per share (“Series A Stock”) and Series A-1

Convertible Preferred Stock, par value $0.001 per share (“Series A-1 Stock”) of the Company voting

each as a separate class (collectively, the “Majority Stockholder”) approving amendments to the

Company’s Seventh Amended and Restated Certificate of Incorporation, as amended (the “Certificate

of Incorporation”), to:

|

|

(1)

|

|

decrease the number of authorized shares of Common Stock of the Company from

800,000,000 shares to 100,000,000 shares and decrease the number of authorized shares

of preferred stock, par value $0.001 per share (the “Preferred Stock”), of the Company

from 300,000,000 shares to 20,000,000 shares; and

|

|

|

(2)

|

|

eliminate redundancies in Article VI, Section (A) of the Certificate of

Incorporation that require vacancies on the Board of Directors that result from an

increase in the number of directors to be filled by the affirmative vote of a majority

of the Company’s “continuing directors,” voting separately and as a subclass of

directors, and the affirmative vote of a majority of the directors then in office, and

to otherwise correct certain minor typographical errors in Article VI, Section (A) of

the Certificate of Incorporation.

|

A copy of the Certificate of Amendment to the Certificate of Incorporation is attached hereto as

Annex A.

Following the date of the consent of the Majority Stockholder, all such shares of Series A Stock

and Series A-1 Stock were converted into shares of Common Stock and are no longer outstanding.

On June 13, 2007, the Board of Directors of the Company approved the foregoing amendments to the

Certificate of Incorporation and the filing of the proposed Certificate of Amendment with the

Secretary of State of the State of Delaware, subject to Stockholder approval. The Majority

Stockholder approved the actions by written consent in lieu of a meeting on June 13, 2007 in

accordance with the Delaware General Corporation Law (“DGCL”). Accordingly, your consent is not

required and is not being solicited in connection with the approval of the above actions.

The proposed Certificate of Amendment, attached hereto as Annex A, will become effective when we

file it with the Secretary of the State of Delaware. We anticipate such filing will occur not less

than twenty (20) days following the mailing to our Stockholders of this Information Statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The entire cost of furnishing this Information Statement will be borne by the Company. The Company

will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward

this Information Statement to the beneficial owners of the Common Stock held of record by them.

The Board of Directors has fixed the close of business on November 14, 2007, as the record date

(the “Record Date”) for the determination of stockholders who are entitled to receive this

Information Statement.

Each share of our Common Stock entitles its holder to one vote on each matter submitted to the

Stockholders. However, because Stockholders holding at least a majority of the voting rights of

all outstanding shares of capital stock as of the Record Date have voted in favor of the foregoing

actions by resolution; and having sufficient voting power to approve such proposals through their

ownership of the capital stock, no other consents will be solicited in connection with this

Information Statement.

You are being provided with this Information Statement pursuant to Section 14(c) of the Exchange

Act and Regulation 14C and Schedule 14C thereunder and, in accordance therewith, the foregoing

actions will not become effective until at least 20 calendar days after the mailing of this

Information Statement.

HOUSEHOLDING

Stockholders of record who reside at the same address will receive a single copy of the Information

Statement. Any stockholder who would like to receive a separate Information Statement may call or

write us at the address below, and we will promptly deliver it.

If you received multiple copies of the Information Statement and would wish to receive a single

copy in the future, please contact us at the address below. Stockholders who hold their shares in

“street name” — in an account with a broker or a bank — should contact their broker or bank

regarding combining mailings.

Northwest Biotherapeutics, Inc.

7600 Wisconsin Ave.

Suite 750

Bethesda, MD 20814

(240) 497-9024

ADDITIONAL INFORMATION

The Company is subject to the information requirements of the Exchange Act and in accordance

therewith files reports, proxy statements and other information, including annual and quarterly

reports on Forms 10-K and 10-Q (the “1934 Act Filings”), with the Securities and Exchange

Commission (the “Commission”). Reports and other information filed by the Company can be inspected

and copied at the public reference facilities maintained at the Commission at 100 F Street, N.E.,

Washington, DC 20549. Copies of such material can be obtained upon written request addressed to

the Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549, at prescribed

rates. The Commission maintains a web site on the Internet (http://www.sec.gov) that contains

reports, proxy and information statements and other information regarding issuers that file

electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval

System (“EDGAR”).

OUTSTANDING VOTING SECURITIES

As of the date of the consent by the Majority Stockholder, June 13, 2007, the Company had

65,241,286 shares of Common Stock issued and outstanding, 32,500,000 shares of Series A Stock

issued and outstanding and 4,816,863 shares of Series A-1 Stock issued and outstanding. Each share

of outstanding Common Stock is entitled to one vote on matters submitted for stockholder approval.

In addition, on all matters submitted to a vote by holders of Common Stock, holders of Preferred

Stock voted on an as-converted basis along with the holders of Common Stock. Holders of Series A

Stock converted on a one-for-one basis. Holders of Series A-1 Stock converted on a one-for-40 basis

(that is one share of Series A-1 Stock for 40 shares of Common Stock). Following the date of the

Majority Stockholder’s consent, the Company effected a 1 for 15 reverse split of its outstanding

Common Stock, reducing the number of shares outstanding to 4,349,419, converted all shares of

Series A Stock and Series A-1 stock into an aggregate of 15,011,635 shares of Common Stock, issued

6,860,561 shares as consideration for the elimination of the Series A Stock and Series A-1 Stock

preferences and issued

15,789,473 new shares of Common Stock in a public offering of stock on the Alternative Investment

Market of the London Stock Exchange in London, England.

2

On June 13, 2007, the holder of shares representing 77.5% of the shares of Common Stock then

outstanding and 100% of the then outstanding shares of each class of Preferred Stock executed and

delivered to the Company a written consent approving the actions described in this Information

Statement. Since the actions described herein have been approved by the Majority Stockholder, no

proxies are being solicited in connection with this Information Statement.

The DGCL provides that, unless a company’s certificate of incorporation provides otherwise,

stockholders may take action without a meeting of stockholders and without prior notice if a

consent or consents in writing, setting forth the action so taken, is signed by the holders of

outstanding stock having not less than the minimum number of votes that would be necessary to take

such action at a meeting at which all shares entitled to vote thereon were present and voted.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables present information regarding the beneficial ownership of our Common

Stock as of November 15, 2007 by:

|

|

•

|

|

each person, or group of affiliated persons, who is known by us to own

beneficially 5% or more of any class of our equity securities;

|

|

|

•

|

|

each of our named executive officers, as defined in Item 402(a)(3) of Regulation

S-K; and

|

|

|

•

|

|

our directors and executive officers as a group.

|

The applicable percentages of ownership are based on an aggregate of 42,346,088 shares (post-split)

of Common Stock issued and outstanding on November 15, 2007. In computing the number of shares of

Common Stock beneficially owned by a person and the percentage ownership of that person, we deemed

shares of Common Stock subject to options, warrants, convertible preferred stock or convertible

notes held by that person that are currently exercisable or exercisable within 60 days of November

15, 2007 as outstanding. We did not deem these shares outstanding, however, for the purpose of

computing the percentage ownership of any other person.

We have determined beneficial ownership in accordance with the rules of the Commission. Except

as indicated by the footnotes below, we believe, based on the information furnished to us, that the

persons and the entities named in the table below have sole voting and investment power with

respect to all shares of Common Stock that they beneficially own, subject to applicable community

property laws.

Except as otherwise noted, the address of the individuals below is c/o Northwest Biotherapeutics,

Inc., 7600 Wisconsin Avenue, Suite 750, Bethesda, MD 20814.

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

|

|

|

|

|

|

Beneficially

|

|

|

Percentage

|

|

|

Name of Beneficial Owner

|

|

Owned

|

|

|

(1)

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

Alton L. Boynton, Ph.D.(2)

|

|

|

203,067

|

|

|

|

0.3

|

|

|

Anthony P. Deasey

|

|

|

—

|

|

|

|

—

|

|

|

Marnix L. Bosch, Ph.D., M.B.A.(3)

|

|

|

76,041

|

|

|

|

0.1

|

|

|

Linda F. Powers (4)

|

|

|

56,063,791

|

|

|

|

73.2

|

|

|

R. Steve Harris

|

|

|

—

|

|

|

|

—

|

|

|

All executive officers and directors as a group (5 persons)(5)

|

|

|

279,108

|

|

|

|

0.7

|

|

|

5% Security Holders

|

|

|

|

|

|

|

|

|

|

Toucan Capital Fund II, L.P.(6)

|

|

|

41,334,575

|

|

|

|

54.0

|

|

|

7600 Wisconsin Avenue, Suite 700, Bethesda, MD 20814

|

|

|

|

|

|

|

|

|

|

Toucan Partners, LLC (7)

|

|

|

14,729,216

|

|

|

|

19.2

|

|

|

7600 Wisconsin Avenue, Suite 700, Bethesda, MD 20814

|

|

|

|

|

|

|

|

|

|

Al Rajhi Holdings

|

|

|

4,500,000

|

|

|

|

5.8

|

|

|

Rue Maurice 3

1204 Geneve, Switzerland

|

|

|

|

|

|

|

|

|

|

IS Partners Investment Solutions AG

|

|

|

2,302,632

|

|

|

|

3.0

|

|

|

Helium Special Situations Fund

Limmatquai 2 — 8001 Zurich

PO Box 463 — 8024 Zurich, Switzerland

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

(1)

|

|

Percentage represents beneficial ownership percentage of Common Stock

calculated in accordance with SEC rules and does not equate to voting

percentages.

|

|

|

|

(2)

|

|

Includes 22,967 shares of Common Stock issuable upon exercise of

options that are exercisable within 60 days of November 15

,

2007.

|

|

|

|

(3)

|

|

Includes 10,611 shares of Common Stock issuable upon exercise of

options that are exercisable within 60 days of November 15

,

2007.

|

|

|

|

(4)

|

|

Includes (i) 19,299,486 shares of Common Stock held by Toucan Capital

Fund II, L.P. (“Toucan Capital”); (ii) 22,035,089 shares of Common

Stock currently issuable upon exercise of warrants that are

exercisable within 60 days of November 15, 2007 held by Toucan

Capital; (iii) 12,156,506 shares of Common Stock issuable upon

conversion of promissory notes in aggregate principal and related

interest in the amount of $2.0 million and related warrants that are

exercisable within 60 days of November 15, 2007 held by Toucan

Partners, LLC (“Toucan Partners”), a Toucan Capital affiliate; and

(iv) 2,572,710 shares of Common Stock held by Toucan Partners. Ms.

Powers is a managing member of Toucan Management, LLC, which is the

manager of Toucan Capital, and is a managing member of Toucan

Partners. Ms. Powers disclaims beneficial ownership as to all such

shares of Common Stock.

|

|

|

|

(5)

|

|

Includes 33,578 shares issuable upon exercise of options that are

exercisable within 60 days of November 15

,

2007. Excludes 56,063,791

shares of Common Stock as to which Ms. Powers disclaims beneficial

ownership. See Note 4 above.

|

|

|

|

(6)

|

|

Includes 22,035,089 shares of Common Stock currently issuable upon

exercise of warrants that are exercisable within 60 days of November

15, 2007.

|

|

|

|

(7)

|

|

Includes 12,156,506 shares of Common Stock issuable upon conversion of

promissory notes in aggregate principal and related interest in the

amount of $2.0 million and related warrants that are exercisable

within 60 days of November 15, 2007.

|

DISSENTER’S RIGHTS OF APPRAISAL

The Stockholders have no right under the DGCL, the Company’s Certificate of Incorporation or its

Bylaws to dissent from any of the provisions adopted as set forth in this Information Statement.

APPROVAL AND ADOPTION OF AMENDMENTS TO THE CERTIFICATE OF INCORPORATION

On June 13, 2007, the Majority Stockholder approved amendments to the Certificate of Incorporation

to (a) decrease the number of authorized shares of Common Stock from 800,000,000 shares to

100,000,000 shares and decrease the number of authorized shares of Preferred Stock from 300,000,000

shares to 20,000,000 shares; and (b) eliminate redundancies in Article VI, Section (A) of the

Certificate of Incorporation that require vacancies on the Board of Directors that result from an

increase in the number of directors to be filled by the affirmative vote of a majority of the

Company’s “continuing directors,” voting separately and as a subclass of directors, and the

affirmative vote of a majority of the directors then in office, and to otherwise correct certain

minor typographical errors in Article VI, Section (A) of the Certificate of Incorporation. The

Majority Stockholder also approved the filing of the Certificate of Amendment to the Certificate of

Incorporation with the Secretary of State of the State of Delaware in order to effect these

amendments under Delaware law. The Company anticipates filing the Certificate of Incorporation

with the State of Delaware not less than 20 days after the date this Information Statement is

mailed to Stockholders. A copy of the Certificate of Amendment is attached hereto as Annex A. The

amendments approved by the Majority Stockholder on June 13, 2007 will not take effect until after

the 20th day following the date on which this Information Statement is mailed to Stockholders.

4

Decrease in the Number of Authorized Shares of Common Stock and Preferred Stock

Upon the approval and recommendation of the Board of Directors, the Majority Stockholder approved

an amendment to the Certificate of Incorporation to reduce the number of authorized shares of

Common Stock and Preferred Stock. The Company’s Certificate of Incorporation currently authorizes

for issuance 1,100,000,000 shares of capital stock, consisting of 800,000,000 of Common Stock and

300,000,000 share of Preferred Stock. This amendment to the Certificate of Incorporation will

decrease the Company’s number of authorized shares of Common Stock to 100,000,000 and the number of

authorized shares of Preferred Stock to 20,000,000. As of the Record Date, the Company had

42,346,088 shares of Common Stock issued and outstanding and no shares of Preferred Stock

outstanding. The Company has reserved an aggregate of 5,480,868 shares in connection with its 2007

Stock Option Plan.

The primary purpose for the decrease in the number of authorized shares of Common Stock and

Preferred Stock is to increase the marketability of our Common Stock. By decreasing the number of

authorized shares of our capital stock, we decrease significantly the ability of the Board of

Directors to issue authorized and unissued shares without further Stockholder action. We believe

that this reduces the potential for dilution, through future issuances of Common Stock, of the

earnings per share and book value per share, as well as the stock ownership and voting rights, of

the currently outstanding shares of Common Stock. In addition, we believe that the decrease in the

number of authorized but unissued shares of Common Stock may reduce the perceived impediment to an

acquisition or takeover of the Company of having a large number of authorized but unissued shares.

The reduction reduces the Board’s ability to issue shares to purchasers who might oppose a hostile

takeover bid or oppose any efforts to amend or repeal certain provisions of our Certificate of

Incorporation or Bylaws.

A further reason for the decrease in the number of authorized shares of Common Stock and Preferred

Stock is to reduce the Company’s annual Delaware franchise tax, which is based, in part, on the

number of authorized shares of capital stock of a company. By reducing the Company’s number of

authorized shares of capital stock, the Company will reduce its Delaware franchise tax in the

future.

Other Amendments to the Certificate of Incorporation

Upon the approval and recommendation of the Board of Directors, the Majority Stockholder also

approved amendments to the Certificate of Incorporation to eliminate redundancies in Article VI,

Section (A) of the Certificate of Incorporation that require vacancies on the Board of Directors

that result from an increase in the number of directors to be filled by the affirmative vote of a

majority of the Company’s “continuing directors,” voting separately and as a subclass of directors,

and the affirmative vote of a majority of the directors then in office, and to otherwise correct

certain minor typographical errors in Article VI, Section (A) of the Certificate of Incorporation.

Currently, Article VI, Section (A) of the Certificate of Incorporation provides that vacancies on

the Board of Directors that have resulted from an increase in the number of directors on the Board

may be filled by “the affirmative vote of a majority of the Directors then in office and a majority

of the Continuing Directors, voting separately and as a subclass of Directors...” We believe that

this language is redundant because, on its face, it requires that the votes of the same group of

directors (those continuing in office) be counted in two different ways in order to fill a Board

vacancy. As amended, Article VI, Section (A) of the Certificate of Incorporation requires only the

affirmative vote of a majority of the Directors then in office to fill a Board vacancy that has

resulted from an increase in the number of directors on the Board, which we believe clarifies the

existing intent of that section.

The amendments to Article VI, Section (A) of the Certificate of Incorporation also correct certain

minor typographical errors that currently exist in that section.

5

ANNEX A

CERTIFICATE OF AMENDMENT

OF THE SEVENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF NORTHWEST BIOTHERAPEUTICS, INC.

Pursuant to Section 242 of the

General Corporation Law of the

State of Delaware

Northwest Biotherapeutics, Inc., a corporation organized and existing under the laws of the State

of Delaware (the “

Corporation

”),

DOES HEREBY CERTIFY:

That, by written action of the Board of Directors of the Corporation, a resolution was duly

adopted, pursuant to Section 242 of the General Corporation Law of the State of Delaware, setting

forth an amendment to the Certificate of Incorporation, as amended, of the Corporation and

declaring such amendment to be advisable. The stockholders of the Corporation duly approved said

proposed amendment by written consent in accordance with Sections 228 and 242 of the General

Corporation Law of the State of Delaware, and written notice of such consent has been given to all

stockholders who have not consented in writing to such amendment. The resolution setting forth the

amendment is as follows:

RESOLVED: That Article IV, Section 1(a) of the Seventh Amended and Restated Certificate of

Incorporation of the Corporation, be and hereby is replaced in its entirety with the following:

ARTICLE IV

(a) The total number of shares of stock of the Corporation shall have the authority to issue is

120,000,000 shares of capital stock, consisting of (i) 100,000,000 shares of common stock, par

value $0.001 per share (the “

Common Stock

”) and (ii) 20,000,000 shares of preferred stock, par

value $0.001 per share (the “

Preferred Stock

”).

RESOLVED: That Article VI, Section (A) of the Seventh Amended and Restated Certificate of

Incorporation of the Corporation, be and hereby is replaced in its entirety with the following:

ARTICLE VI

(A)

Board of Directors

. The business and affairs of the Corporation shall be managed under

the direction of the Board of Directors, the number of which shall be fixed from time to time

exclusively by the Board of Directors pursuant to a resolution adopted by a majority of the total

number of authorized directors (whether or not there exist any vacancies in previously authorized

directorships a the time any such resolution is presented to the Board for adoption) (the “

Whole

Board

”). The Directors shall be classified with respect to the time for which they shall severally

hold office by dividing them into three classes, Class I, Class II and Class III, each consisting

as nearly as possible of one-third of the Whole Board. All Directors shall hold office until their

successors are elected and qualified, or until their earlier death, resignation, disqualification

or removal. Class I Directors shall be elected for a term of one year; Class II Directors shall be

elected for a term of three years; and Class III Directors shall be elected for a term of three

years; and at each annual stockholders’ meeting thereafter, successors to the Directors whose terms

shall expire that year shall be elected to hold office for a term of three years, so that the term

of office of one class of Directors shall expire in each year. Any vacancy on the Board of

Directors that results from an increase in the number of Directors may be filled by the affirmative

vote of a majority of the Directors then in office and any other vacancy on the Board of Directors

may be filled by the affirmative vote of a majority of the Directors then in office, although less

than a quorum, or by a sole remaining Director. Any Director elected to fill a vacancy not

resulting from an increase in the number of Directors shall serve for a term equivalent to the

remaining unserved portion of the term of such newly elected Director’s predecessor.

Notwithstanding the foregoing, whenever the holders of any one or more classes or series of capital

stock of the Corporation vote to elect Directors at an annual or special meeting of stockholders,

the election term of office, filling of vacancies and other features of such Directorships shall be

governed by the

terms of this Amended and Restated Certificate of Incorporation applicable thereto, and such

Directors shall not be divided into classes pursuant to this Section (A) unless expressly provided

by such terms.

[

Signature Page Follows

]

A-1

Executed at Bethesda, Maryland, on

_____

, 2007.

|

|

|

|

|

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

|

|

|

|

|

Title:

|

|

|

A-2

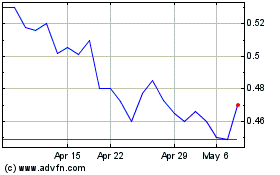

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jul 2023 to Jul 2024