Trending: Nippon Steel Buys United States Steel

December 18 2023 - 2:29PM

Dow Jones News

1359 ET -- United States Steel is one of the most mentioned

companies in the U.S. across all news items in the last 12 hours,

according to Factiva data. U.S. Steel agreed to be acquired by

Nippon Steel in a $14.1 billion deal that would give the Japanese

steel giant a major role in U.S. steelmaking. A takeover of

122-year-old U.S. Steel would make Nippon Steel one of the top

suppliers to the auto industry in the U.S. The deal, which is

likely to face regulatory scrutiny, also would give Nippon Steel

access in the U.S. to specialized steel used in electric vehicles.

Shares of U.S. Steel surged 27% on Monday. The agreement ends a

monthslong sales process for U.S. Steel, a bastion of American

industry that was created by J.P. Morgan, Andrew Carnegie and

others, and played an integral role in the country's

industrialization in the 20th century. Following the close of the

transaction, U.S. Steel will retain its name, brand and

headquarters in Pittsburgh. The deal has been unanimously approved

by the boards of both companies and is expected to close by

October, pending approval from U.S. Steel's shareholders and

regulators. Dow Jones & Co. owns Factiva.

(matthew.walker@dowjones.com)

(END) Dow Jones Newswires

December 18, 2023 14:14 ET (19:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

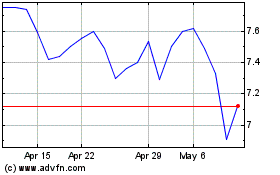

Nippon Steel (PK) (USOTC:NPSCY)

Historical Stock Chart

From Nov 2024 to Dec 2024

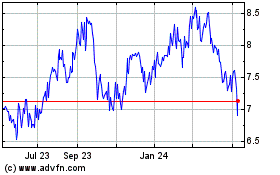

Nippon Steel (PK) (USOTC:NPSCY)

Historical Stock Chart

From Dec 2023 to Dec 2024