May 5, 2021

Undoubtedly, the growth of companies like Airbnb and VRBO has

helped to change the vacation property rental industry. They

transformed what was once a visit to a small, sometimes stuffy

hotel room into a stay at resort-style accommodations. But, as is

the case with many fast-growing businesses, phenomenal growth often

brings logistical pain. And these two powerhouse property rental

companies are in dire need of a most needed asset- host inventory.

An answer to their problems could come from Vaycaychella, a

wholly-owned subsidiary of World Series of Golf, Inc.(OTC

Pink: WSGF) that is preparing to launch what they believe

will be a game-changing vacation property real estate investment

app.

Just last month, Airbnb (NASDAQ: ABNB)

CEO Brian Chesky made it clear that despite his company’s

impressive growth, it needs millions more host properties to keep

up with demand. Well before his pitch, though, WSGF has been well

on its way to help a new class of investors become property owners

by making real estate purchases more accessible through what they

describe as a Peer to Peer (P2P), Fintech, Alternative Short-Term

Rental Purchase Finance Application (App). Now, with Airbnb making

no secrets about the supply and demand imbalance, Vaycaychella

could indeed become the industry-changing app it’s expected to be.

The results could be a boon for the entire sector, not just WSGF

investors.

The excellent news is that the Vaycaychella app is preparing to

launch. The innovative app was purchased by WSGF last year and has

since embarked on a relatively quick journey to get its technology

to market. Beta testing launched in February and is expected to be

completed this month, with user participation during the testing

said to be far more extensive than originally planned. Nonetheless,

after a few expected tweaks in the app’s functionality, WSGF said

it remains on schedule to launch the full production scale into the

market as early as May of this year.

Even better from an investor’s perspective, Vaycaychella has

proven it can accomplish its primary goals through a pilot

alternative finance business for short-term rental vacation

properties backing a portfolio of beach rentals in the Caribbean.

The results speak for themselves.

Vaycaychella was instrumental in helping to build a portfolio

valued at $1.2 million. More appealing to this conversation, it

added properties into the host rental inventories and is generating

investment and property appreciation income to investors and

owners. Simply said, Vaycaychella offers a win-win-win

proposition.

https://www.youtube.com/embed/jkef-9j999Y

Focused On Exploiting Vacation Market

Opportunity

Notably, Vaycaychella will also be in a great position to extend

its focus to target global markets where investment and renovation

opportunities are abundant. Cuba, as an example, may offer

substantial opportunities.

Despite Americans not having access to invest in Cuba, the rest

of the world does. And tourism and investment opportunities in that

country are much more significant than most US residents would

expect.

Vaycaychella knows this and is taking advantage of opportunities

in that country through investments into properties located in that

market. Better yet, the app is expected to be embraced by users by

empowering local entrepreneurs, offering host accommodations, and

creating jobs.

With the app’s functionality proven and with beta-testing almost

complete, Vaycaychella intends to extend its alternative financial

services to empower even more entrepreneurs in developing economies

worldwide while empowering entrepreneurs everywhere. By the way,

for those that can visit Cuba, Vaycaychella’s Boutique Hotel in

Havana, Cuba, is expected to open soon. Check the app for

listings.

Okay, What Does Vaycaychella Do…

You’re probably wondering how the app works. Great question,

easy answer.

Vaycaychella is a peer-to-peer (P2P) application designed to

globally scale its alternative real estate purchase and investment

model. It enables entrepreneurs seeking investment to post their

target property purchases and/or property renovation projects for

consideration by private investors. In addition to posting their

project, the Vaycaychella app enables entrepreneurs to post their

own personal profiles so investors can consider both the experience

and character of the entrepreneur in addition to the fundamentals

of the property or renovation project. Forecasts project the app to

have enormous near-term potential to penetrate the markets.

In fact, WSGF management believes Vaycaychella can provide

upwards of $100 million in revenues within its first 12-months in

the market. Yes, it’s an ambitious target, but keep in mind that

investment apps like Robinhood have reached

billion-dollar valuations in less than five years in the market.

There’s no reason Vaycaychella can’t enjoy a similar rate of

growth. After all, they are creating an entirely new market space.

At the same time, they are streamlining the investment

process.

Already, Vaycaychella has provided alternative financing to

support multiple short-term vacation rental properties and a

boutique hotel. Those deals provide capital to owners and

attractive returns to the investor. Better yet, the barriers to

making a deal are low. In fact, far different from conventional

property investment, Vaycaychella facilitates agreements that

require no credit checks, no income to debt ratios, and no income

verification. In short, just like buying stocks, if an investor has

capital, a deal can be made.

Even better is that Vaycaychella is building additional features

into its app that could create even more flexibility in financing

investment opportunities. Taking advantage of alternative ways to

finance properties, Vaycaychella will integrate cryptocurrency and

crowdfunding functions into the platform. That addition provides an

alternative financing fintech application as a resource for

individuals who might not have access to a traditional mortgage. In

short, the app is bringing investment opportunities to almost any

person with a smart device and virtually eliminates obstacles that

would have customarily excluded them from investing.

Better still, it’s expected to be the perfect tool to finance

income-producing rental properties with potentially better terms

compared to conventional lenders.

Vaycaychella Prepares To Launch

The excellent news for WSGF investors and those wanting to use

Vaycaychella to either buy, list, sell, or invest is that its

launch is less than a month away.

The timing could be excellent. Analysts covering the sector

expect that the post-Covid-19 convergence of an increase in

vacation demand and housing supply could result in an ideal buying

opportunity for the would-be short-term vacation property

owner/operator entrepreneurs.

Companies in the sector are starting to see their valuations

appreciate as an expected surge in demand could significantly

impact the industry from an easing pandemic. With vaccines making

their way across the world, that could happen sooner rather than

later.

Still, don’t lump Vaycaychella in with these billion-dollar

competitors just yet. Instead, understand that Vaycaychella targets

an enormous niche by seizing upon an investment market that has

been neglected by trading-app developers. As it stands,

Vaycaychella is the only known app that targets retail investors

and offers a unique opportunity to build a property portfolio

through just a few clicks on a smart device.

Better yet, the app is especially appealing since its

Peer-To-Peer functionality quickly and securely connects short-term

rental property buyers to sellers. And, because deals can be made

allowing for fractional ownership or investment interest in

multiple properties across the world, it creates an opportunity for

those that might not have had the resources before to make a

purchase on their own. Thus, Vaycaychella brings with it the

potential to create a new breed of alternative investors.

More importantly, through its secure and feature-rich platform,

Vaycaychella closes the distance between the parties involved by

making global transactions possible through a few touches on a

smart device. Perhaps the best part of the app, though, is that it

allows parties to do away with almost every obstacle associated

with traditional real estate investment. As noted, Vaycaychella is

designed to close transactions quickly and eliminate credit checks,

lengthy applications, and even property surveys.

In short, similar to not having a brokerage house run a credit

check or require income verification for each stock purchase,

Vaycaychella intends to bring the same ease of investment processes

to millions of investment property investors. It might be the only

means to create a global real estate portfolio for an entire

generation of new investors.

Q2 Could be Transformational

Anticipation is building, and the launch could ignite a rally

for WSGF stock. In February, shares jumped by more than 70%

intraday on the news that its final beta testing had started. A

full-scale production release will likely have a more significant

impact. It makes sense that it would.

A second catalyst could be from a post-release update telling

about the app’s adoption. If user adoption stays on track with its

modeled projections, analysts could revisit current forecasts and

revise accordingly. Already, Goldman Small Cap Research has a price

target of $0.20, representing a potential 900% increase from

current levels.

Admittedly, the recent weakness in the stock is underwhelming

investors. However, its current share price may expose a massive

opportunity. And with Airbnb and Expedia (NASDAQ: EXPE)

stock consolidating as well, the softness in price appears to be

sector, not company-specific. Thus, WSGF stock may grab its footing

and reverse course ahead of Vaycaychella’s launch.

Indeed, Q2 could be a transformative period for Vaycaychella and

WSGF stock. The app’s planned launch in May could be the first of

several catalysts. Enrollment, the addition of crowdfunding

features, and a growing book of listings and investment

opportunities could be several that follow. If that’s the case, at

less than three cents per share, the promise of Vaycaychella does

not look to be even remotely priced into the stock.

That apparent disconnect alone makes investment consideration in

WSGF compelling. But adding the other factors that make this app a

potentially industry-changing investment tool into the equation

exposes a value-play opportunity that could deliver exponential

near and long-term returns. The risk/reward on this one appears to

significantly favor WSGF.

Disclaimers: Hawk Point Media is responsible for the

production and distribution of this content. Hawk Point Media is

not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The

information made available by Hawk Point Media is not intended to

be, nor does it constitute, investment advice or recommendations.

The contributors may buy and sell securities before and after any

particular article, report and publication. In no event shall Hawk

Point Media be liable to any member, guest or third party for any

damages of any kind arising out of the use of any content or other

material published or made available by Hawk Point Media,

including, without limitation, any investment losses, lost profits,

lost opportunity, special, incidental, indirect, consequential or

punitive damages. Past performance is a poor indicator of future

performance. The information in this video, article, and in its

related newsletters, is not intended to be, nor does it constitute,

investment advice or recommendations. Hawk Point

Media strongly urges you conduct a complete and

independent investigation of the respective companies and

consideration of all pertinent risks. Readers are advised to review

SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports,

Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point Media, its

authors, contributors, or its agents, may be compensated for

preparing research, video graphics, and editorial content. As part

of that content, readers, subscribers, and website viewers, are

expected to read the full disclaimers and financial disclosures

statement that can be found by clicking HERE.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in

micro-cap and growth securities is highly speculative and carries

an extremely high degree of risk. It is possible that an investors

investment may be lost or impaired due to the speculative nature of

the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: KL Feigeles

Email: editorial@hawkpointmedia.com

City: Miami Beach

State: Florida

Country: United States

Website: https://www.greenlightstocks.com

Source - https://www.benzinga.com/pressreleases/21/05/ab20962168/millions-of-host-vacation-properties-needed-asap-vaycaychella-may-be-the-savior

Other stocks on the move include

MVES,

MSRT and

GGII.

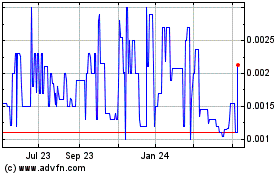

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

From Dec 2024 to Jan 2025

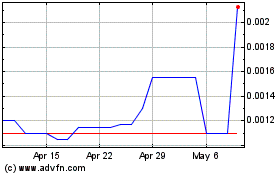

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

From Jan 2024 to Jan 2025