By Saabira Chaudhuri

Nestlé SA's chairman is facing mounting opposition from some

shareholders who say the former chief executive isn't helping his

successor's efforts to reinvigorate growth at the world's largest

packaged-foods maker.

The maker of Nescafe coffee and Purina pet food has been under

pressure since activist investor Daniel Loeb's Third Point LLC

disclosed a $3.5 billion stake in the company last year and called

for a raft of changes.

Billionaire Mr. Loeb, who is working to rally support from other

shareholders, has asked Nestlé to sell its 23% stake in beauty

company L'Oréal SA. He has also criticized Chairman Paul

Bulcke--appointed in 2017 after eight years as CEO--for being "too

comfortable with the status quo."

Nestlé has in turn sought to boost returns by investing in

higher-growth categories like coffee, while selling underperforming

units such as U.S. confectionery.

However, a survey of investors by Exane BNP Paribas, a research

firm, indicates dissatisfaction extends beyond Third Point,

suggesting the hedge fund could find support if it pushed Nestlé

further.

Exane analyst Jeff Stent said the survey was independently

conducted and wasn't commissioned by Nestlé, Third Point or anyone

else.

Of respondents, 65% said they would vote against the re-election

of Mr. Bulcke if Third Point campaigned against him, 80% said they

thought Nestlé should be more active on disposals and 70% said it

should sell its L'Oréal stake.

The survey, conducted over the past month, had 61 respondents,

67% of whom said they were current Nestlé shareholders. Full

results, reviewed by The Wall Street Journal, were only shared with

those who took the survey.

Respondents only represent a fraction of Nestlé's investors and

95% of shareholders voted in favor of Mr. Bulcke at the last

vote.

Nestlé declined to comment.

A Third Point spokeswoman said the firm has "no present plans to

oppose Mr. Bulcke."

Third Point would like its adviser on the Nestlé stake, Jan

Bennink, to be added to the board, according to people familiar

with the matter. The firm, which has criticized Nestlé as insular,

declined to comment on whether it would nominate him.

Mr. Bennink, a former Royal Numico NV and Sara Lee Corp.

executive has a reputation as a turnaround specialist. As CEO of

Numico he cut costs, sold assets and boosted sales before the

baby-food company was sold to Danone. As executive chairman of Sara

Lee he oversaw its split into two companies.

Growth slowed sharply during Mr. Bulcke's tenure as CEO, which

some former executives attribute to strategic missteps, as well as

tough economic conditions.

He took the helm in 2008 as the financial crisis unfolded, but

also presided over a series of deals that have dragged on growth,

including the 2010 purchase of Kraft Heinz Co.'s frozen-pizza

operations in North America and two Chinese deals in 2011.

Nestlé has said it didn't act fast enough when consumers began

opting for fresh food over frozen meals, hitting brands like Lean

Cuisine and Stouffer's.

"Bulcke is associated with a failed strategy," said Dan O'Keefe,

who as head of the global-value team at Artisan Partners oversees a

$300 million position in Nestlé. "You send a certain tone when the

architect of that strategy sits at the top of the organization. By

putting someone else in that role you send a strong signal

externally and internally that you aren't wedded to the past."

In the Exane survey, 41 of the 61 respondents said they would

like to see Nestlé sell its U.S. frozen-foods business, 32

respondents said they would like to see U.S. ice cream sold off and

28 said they would like to see European confectionery sold.

"We have some concerns that the strategy he proposed in the past

causes maybe some turbulence at the present time," said Ingo

Speich, a portfolio manager at Union Investment Group, speaking of

Mr. Bulcke. The Frankfurt-based firm owns more than EUR720 million

($826 million) in Nestlé shares.

Mr. Speich said new Nestlé CEO Mark Schneider was the right

person to lead the company and that he "should not be constrained

by a person who had a significantly different strategy."

Mr. Schneider last year scrapped Nestlé's long-held target of

boosting organic sales by 5% to 6% each year after the company

failed to achieve the goal for the fourth straight year.

Nestlé has said it would reach mid-single-digit organic growth

by 2020, but just 37% of investors in the Exane survey think this

will happen.

Artisan's Mr. O'Keefe said he would like to see Mr. Bennink

become Nestlé's chairman, while Union's Mr. Speich said he would

support him being added to the board, despite the addition of three

new members by Nestlé this year.

In Exane's survey, 75% of respondents said they would vote for

Mr. Bennink if Third Point nominated him for the board.

"The board seems to be a closed system; it's very stable," said

Mr. Speich. "Nestlé has to move faster, not just operationally but

with changing the board structure."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 23, 2018 07:51 ET (11:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

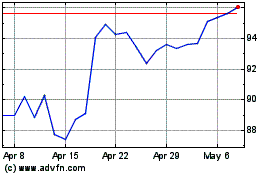

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Nov 2023 to Nov 2024