UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

| LONGWEN GROUP CORP. |

| (Exact Name of the Registrant as Specified in its Charter) |

| Nevada | | 95-3506403 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

Rm 219, No. 25 Caihe Rd.

Shangcheng Dist., Hangzhou, Zhejiang Province, 310002 China

(Address of Principal Executive Offices and Zip Code)

+86 0571-87099979

(Registrant’s Telephone Number, Including Area Code)

Corporate Creations Network Inc.

8275 SOUTH EASTERN AVENUE #200,

Las Vegas, NV, 89123, USA

(561) 694-8107

(Name, address, including zip code, and telephone number,

Including area code, of agent for service)

With copy to

William B. Barnett, Esq.

Barnett & Linn

60 Kavenish Drive

Rancho Mirage, CA 92270

(442) 599-1299

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Act:

Common Stock, Par Value $0.0001

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | | |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Act. ☐

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10 contains forward-looking statements that may be affected by matters outside our control that could cause materially different results.

Some of the information in this Form 10 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. These statements express, or are based on, our expectations about future events. Forward-looking statements give our current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology, such as, “may”, “will”, “expect”, “intend”, “project”, “estimate”, “anticipate”, “believe” or “continue” or the negative thereof or similar terminology. They include statements regarding our:

· financial position,

· business plans,

· budgets,

· amount, nature and timing of capital expenditures,

· cash flow and anticipated liquidity,

· future operations of unknown nature costs,

· acquisition and development of other technology,

· future demand for any products and services acquired,

· operating costs and other expenses.

Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Factors that could cause actual results to differ materially from expected results are described under “Risk Factors” and include:

· general economic conditions,

· our cost of operations,

· our ability to generate sufficient cash flows to operate,

· availability of capital,

· the strength and financial resources of our competitors,

· our ability to find and retain skilled personnel, and

· the lack of liquidity of our common stock.

Any of the factors listed above and other factors contained in this Form 10 could cause our actual results to differ materially from the results implied by these or any other forward-looking statements made by us or on our behalf. We cannot assure you that our future results will meet our expectations. When you consider these forward-looking statements, you should keep in mind these risk factors and the other cautionary statements in this Form 10. Our forward-looking statements speak only as of the date made.

ITEM 1: DESCRIPTION OF BUSINESS

Organization and Corporate History

Longwen Group Corp. (the “Company”), was originally incorporated as Expertelligence, Inc on March 31, 1980 and reincorporated in the State of Nevada on November 17, 2005. On January 23, 2017, after a series of various name changes, the Company amended its Articles of Incorporation (“Charter Amendment”) to affect the current name change of Longwen Group Corp with trading symbol of “LWLW”.

The Company underwent a change of control on January 21, 2016, at which time Harold Minsky resigned in all officer positions. G. Reed Petersen and White Rim Cattle Company LLC each purchased 25,000,000 shares of common stock of the Company from Harold Minsky. Mr. Petersen is the Member Manager of White Rim Cattle Company, LLC and thus can be considered a control person of all 50,000,000 shares of stock of the Company. Pursuant to a Board of Directors meeting, Mr. Petersen was elected to and accepted all the officer positions previously held by Harold Minsky.

On or about April 5, 2016, the Company affected a 1 for 750 share reverse split of its issued and outstanding common stock. On such date, the Company’s common stock was reduced from 95,164,140 to 127,061 shares outstanding.

Effective November 29, 2016, G. Reed Peterson sold 66,667 shares of common stock of the Company to Longwen Group Corp., a Cayman Island company (“Longwen Cayman”). All of the shares held by Longwen Cayman are restricted securities. As a result of the transactions, Mr. Petersen no longer owns any of the Company’s capital stock or securities and he and his affiliates waived all loans and other amounts due to the Company. In addition, on such date, Mr. Petersen resigned in all officer capacities from the Company, and Mr. Xizhen Ye, President of Longwen Cayman, was appointed as a sole Director of the Company and President and Chief Executive Officer and Chief Financial Officer of the Company. On August 22, 2018, Mr. Lizhong Lu was appointed as a director of Board.

On June 9, 2021, Anthony Lombardo (“Lombardo”) filed an Application for Appointment of Custodian (“Application”) with the Eighth Judicial District Court in Nevada to request the custodianship of the Company due to the Company’s non-response and late filing with the State of Nevada. On June 24, 2021, a hearing was held on this Application, where Lombardo was named temporary custodian of the Company. Subsequently after Lombardo’s custodianship, Deanna Johnson was appointed as the CEO, CFO and Secretary of the Company. On September 1, 2021, Deanna Johnson appointed Joseph Passalaqua (“Joseph”) as CEO, CFO and Secretary and resigned from all positions in the Company, On October 25, 2021, Mr. Xizhen Ye (“Ye”), who was the officer and director of the Company prior to Lombardo’s custodianship, and Longwen Group Corporation, a Cayman Island corporation, filed a Motion to Dissolve Custodianship (“Motion”) with the Eighth Judicial District Court of Nevada State. On January 12, 2022, in accordance with a Settlement Agreement regarding Lombardo’s custodianship, Mr. Ye was reinstated his positions as the officer and director of the Company, along with the reinstatement of the other Company’s director, Lizhong Lu, who was also in place prior to Lombardo’s custodianship. On February 9, 2022, pursuant to the Settlement Agreement, Joseph transferred 65,000,000 common stocks of the Company owned by him to Mr. Ye. On February 17, 2022, the Eighth Judicial District Court formally dismissed Lombardo’s custodianship for the Company.

On February 23, 2022, the Company entered into an Acquisition Agreement with a third-party individual to to acquire the 100% ownership of Hangzhou Longwen Enterprise Management Co., Ltd. (“Hangzhou Longwen”), a wholly Foreign-Owned Enterprise (“WOFE”) in Hangzhou, the People’s Republic of China (the “PRC”), for a total cash consideration of $1,000. As a result of the acquisition, Hangzhou Longwen became the Company’s wholly owned subsidiary in the PRC. Hangzhou Longwen was originally registered on January 4, 2012 and has minimum operations since its inception and the Company recognize $1,000 goodwill as a result of the business acquisition. The purpose of the Company’s acquisition for Hangzhou Longwen is to seek potential merger and acquisition targets in both China and other countries in Asia.

On March 15, 2022, Hangzhou Longwen entered into a Consulting Service Agreement (the “Service Agreement”) with Yunnan Yusu Import and Export Trading Co., Ltd (China) (“Yunnan Yusu”), pursuant to which, Hangzhou Longwen will provide a series of consulting services to Yunnan Yusu, including to assist in the preparation of jadeite sales and purchase agreement, assist with tax filing, assist with financial report preparation, assist with jadeite business negotiation and business website maintenance.

Currently, the Company’s revenues are mainly derived from the consulting services with Yunnan Yusu, which totaled $1,171 for the three months ended March 31, 2022. The Company is also seeking other potential merger and acquisition targets in both China and other countries in Asia.

Revenue

We have no revenues for the years ended December 31, 2021 and 2020 due to the ongoing business restructuring and Covid-19 pandemic. We had total revenues of $1,171 for our first quarter ended March 31, 2022.

General Business Plan

The Company’s primary objective is project development and acquisition in culture fields, including antique projects promotion and development, traditional magazine project cooperation and development, the marketing and development of audio and visual products and etc.

On March 15, 2022, Hangzhou Longwen, the Company’s 100% controlled subsidiary, entered into a Consulting Service Agreement (the “Service Agreement”) with Yunnan Yusu Import and Export Trading Co., Ltd (China) (“Yunnan Yusu”). Pursuant to the Service Agreement, Hangzhou Longwen will provide a series of consulting services to Yunnan Yusu including to assist in the preparation of jadeite sales and purchase agreement, assist with tax filing, assist with financial report preparation, assist with jadeite business negotiation and business website maintenance. Meanwhile, the Company is also seeking other potential merger and acquisition targets in both China and other countries in Asia.

Sales and Marketing

Currently, our main revenues are mainly derived from the consulting services with Yunnan Yusu, which totaled $1,171 for the three months ended March 31, 2022. Our President, Mr. Ye is an excellent industry professional in the cultural projects management and development field for more than 20 years. We believe he has the wealth of experience and contacts to help the Company to expand our business from the culture market.

Competition

The culture market is highlight competitive and many traditional cultural typed companies may provide more services and platforms that we do currently. In order to successfully compete in our industry, we will need to:

| | · | Retain more valuable professionals of the cultural market; |

| | | |

| | · | Raise funds to support our business plan; |

| | | |

| | · | Set up an effective platform to promote our business strategy; |

However, there can be no assurance that even if we do these things, we will be able to compete effectively with the other companies in our industry. We believe that we have the required management expertise in the cultural industry with good marketing strategy and compatible service package.

Intellectual Property

We own no intellectual property.

Employees

We presently have one employee. However, we have engaged accounting, legal, consultant and other part-time and occasional services.

Our board has two members at present. Mr. Xizhen Ye is our CEO, President, CFO and Secretary and a Director. Mr. Lizhong Lu is also a Director of the Company. Both Mr. Ye and Mr. Lu are part time and Mr. Ye devotes approximately 30 hours per week to Company affairs.

Factors Effecting Future Performance

Our goal is to obtain debt and/or equity financing to meet our ongoing operating expenses and attempt to merge with another entity with experienced management and opportunities for growth in return for shares of our common stock to create value for our shareholders.

Although there is no assurance that this series of events will be successfully completed, we believe we can successfully complete an acquisition or merger which will enable us to continue as a going concern. Any acquisition or merger will most likely be dilutive to our existing stockholders.

Jumpstart Our Business Startups Act

The disclosure contained below, discusses generally the terms of the “Jumpstart Our Business Startups Act”. Currently the Company has limited operations or revenues and as such does not anticipate that it will affect certain of the transactions covered by such Act until, if at all, the time a change in control of the Company is affected. Until at such time the Company effects a change in control it does not anticipate that it will benefit from the exemptions from certain financial disclosure required in a registration statement as well as the simplification of the sale of securities and the relaxation of general solicitation for Rule 506 offerings.

In April, 2012, the Jumpstart Our Business Startups Act (“JOBS Act”) was enacted into law. The JOBS Act provides, among other things:

Exemptions for emerging growth companies from certain financial disclosure and governance requirements for up to five years and provides a new form of financing to small companies;

Amendments to certain provisions of the federal securities laws to simplify the sale of securities and increase the threshold number of record holders required to trigger the reporting requirements of the Securities Exchange Act of 1934;

Relaxation of the general solicitation and general advertising prohibition for Rule 506 offerings;

Adoption of a new exemption for public offerings of securities in amounts not exceeding $50 million; and

Exemption from registration by a non-reporting company offers and sales of securities of up to $1,000,000 that comply with rules to be adopted by the SEC pursuant to Section 4(6) of the Securities Act and such sales are exempt from state law registration, documentation or offering requirements.

In general, under the JOBS Act a company is an emerging growth company if its initial public offering (“IPO”) of common equity securities was affected after December 8, 2011 and the company had less than $1 billion of total annual gross revenues during its last completed fiscal year. A company will no longer qualify as an emerging growth company after the earliest of

(i) the completion of the fiscal year in which the company has total annual gross revenues of $1.07 billion or more,

(ii) the completion of the fiscal year of the fifth anniversary of the company’s IPO;

(iii) the company’s issuance of more than $1 billion in nonconvertible debt in the prior three-year period, or

(iv) the company becoming a “larger accelerated filer” as defined under the Securities Exchange Act of 1934.

The Company meets the definition of an emerging growth company and will be affected by some of the changes provided in the JOBS Act and certain of the new exemptions. The JOBS Act provides additional new guidelines and exemptions for non-reporting companies and for non-public offerings. Those exemptions that impact the Company are discussed below.

Financial Disclosure. The financial disclosure in a registration statement filed by an emerging growth company pursuant to the Securities Act of 1933 will differ from registration statements filed by other companies as follows:

(i) audited financial statements required for only two fiscal years;

(ii) selected financial data required for only the fiscal years that were audited;

(iii) executive compensation only needs to be presented in the limited format now required for smaller reporting companies. (A smaller reporting company is one with a public float of less than $75 million as of the last day of its most recently completed second fiscal quarter)

However, the requirements for financial disclosure provided by Regulation S-K promulgated by the Rules and Regulations of the SEC already provide certain of these exemptions for smaller reporting companies. The Company is a smaller reporting company. Currently a smaller reporting company is not required to file as part of its registration statement selected financial data and only needs audited financial statements for its two most current fiscal years and no tabular disclosure of contractual obligations.

The JOBS Act also exempts the Company’s independent registered public accounting firm from complying with any rules adopted by the Public Company Accounting Oversight Board (“PCAOB”) after the date of the JOBS Act’s enactment, except as otherwise required by SEC rule.

The JOBS Act also exempts an emerging growth company from any requirement adopted by the PCAOB for mandatory rotation of the Company’s accounting firm or for a supplemental auditor report about the audit.

Internal Control Attestation. The JOBS Act also provides an exemption from the requirement of the Company’s independent registered public accounting firm to file a report on the Company’s internal control over financial reporting, although management of the Company is still required to file its report on the adequacy of the Company’s internal control over financial reporting.

Section 102(a) of the JOBS Act goes on to exempt emerging growth companies from the requirements in 1934 Act Section 14A(e) for companies with a class of securities registered under the 1934 Act to hold shareholder votes for executive compensation and golden parachutes.

Other Items of the JOBS Act. The JOBS Act also provides that an emerging growth company can communicate with potential investors that are qualified institutional buyers or institutions that are accredited to determine interest in a contemplated offering either prior to or after the date of filing the respective registration statement. The Act also permits research reports by a broker or dealer about an emerging growth company regardless if such report provides sufficient information for an investment decision. In addition, the JOBS Act precludes the SEC and FINRA from adopting certain restrictive rules or regulations regarding brokers, dealers and potential investors, communications with management and distribution of a research reports on the emerging growth company IPO.

Section 106 of the JOBS Act permits emerging growth companies to submit 1933 Act registration statements on a confidential basis provided that the registration statement and all amendments are publicly filed at least 21 days before the issuer conducts any road show. This is intended to allow the emerging growth company to explore the IPO option without disclosing to the market the fact that it is seeking to go public or disclosing the information contained in its registration statement until the company is ready to conduct a road show.

Election to Opt Out of Transition Period. Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a 1933 Act registration statement declared effective or do not have a class of securities registered under the 1934 Act) are required to comply with the new or revised financial accounting standard.

The JOBS Act provides a company can elect to opt out of the extended transition period and comply with the requirements that apply to non- emerging growth companies but any such an election to opt out is irrevocable. The Company has elected not to opt out of the transition period. The factors affecting our future performance are listed and explained below under the section “Risk Factors” below:

ITEM 1A: RISK FACTORS

The Company qualifies as a smaller reporting company, as defined by § 229.10(f)(1) and is not required to provide the information required by this Item.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Form 10 contains forward-looking statements. Our actual results could differ materially from those set forth as a result of general economic conditions and changes in the assumptions used in making such forward-looking statements. The following discussion and analysis of our financial condition and results of operations should be read together with the audited financial statements and accompanying notes and the other financial information appearing elsewhere in this report. The analysis set forth below is provided pursuant to applicable Securities and Exchange Commission regulations and is not intended to serve as a basis for projections of future events. Refer also to “Cautionary Note Regarding Forward Looking Statements” in Item 1 above.

Overview

Longwen Group Corp. (the “Company”), was originally incorporated as Expertelligence, Inc on March 31, 1980 and reincorporated in the State of Nevada on November 17, 2005. On January 23, 2017, after a series of various name changes, the Company amended its Articles of Incorporation (“Charter Amendment”) to affect the current name change of Longwen Group Corp with trading symbol of “LWLW”.

The Company underwent a change of control on January 21, 2016, at which time Harold Minsky resigned in all officer positions. G. Reed Petersen and White Rim Cattle Company LLC each purchased 25,000,000 shares of common stock of the Company from Harold Minsky. Mr. Petersen is the Member Manager of White Rim Cattle Company, LLC and thus can be considered a control person of all 50,000,000 shares of stock of the Company. Pursuant to a Board of Directors meeting, Mr. Petersen was elected to and accepted all the officer positions previously held by Harold Minsky.

On or about April 5, 2016, the Company affected a 1 for 750 share reverse split of its issued and outstanding common stock. On such date, the Company’s common stock was reduced from 95,164,140 to 127,061 shares outstanding.

Effective November 29, 2016, G. Reed Peterson sold 66,667 shares of common stock of the Company to Longwen Group Corp., a Cayman Island company (“Longwen Cayman”). All of the shares held by Longwen Cayman are restricted securities. As a result of the transactions, Mr. Petersen no longer owns any of the Company’s capital stock or securities and he and his affiliates waived all loans and other amounts due to the Company. In addition, on such date, Mr. Petersen resigned in all officer capacities from the Company, and Mr. Xizhen Ye, President of Longwen Cayman, was appointed as a sole Director of the Company and President and Chief Executive Officer and Chief Financial Officer of the Company. On August 22, 2018, Mr. Lizhong Lu was appointed as a director of Board.

On June 9, 2021, Anthony Lombardo (“Lombardo”) filed an Application for Appointment of Custodian (“Application”) with the Eighth Judicial District Court in Nevada to request the custodianship of the Company due to the Company’s non-response and late filing with the State of Nevada. On June 24, 2021, a hearing was held on this Application, where Lombardo was named temporary custodian of the Company. Subsequently after Lombardo’s custodianship, Deanna Johnson was appointed as the CEO, CFO and Secretary of the Company. On September 1, 2021, Deanna Johnson appointed Joseph Passalaqua (“Joseph”) as CEO, CFO and Secretary and resigned from all positions in the Company, On October 25, 2021, Mr. Xizhen Ye (“Ye”), who was the officer and director of the Company prior to Lombardo’s custodianship, and Longwen Group Corporation, a Cayman Island corporation, filed a Motion to Dissolve Custodianship (“Motion”) with the Eighth Judicial District Court of Nevada State. On January 12, 2022, in accordance with a Settlement Agreement regarding Lombardo’s custodianship, Mr. Ye was reinstated his positions as the officer and director of the Company, along with the reinstatement of the other Company’s director, Lizhong Lu, who was also in place prior to Lombardo’s custodianship. On February 9, 2022, pursuant to the Settlement Agreement, Joseph transferred 65,000,000 common stocks of the Company owned by him to Mr. Ye. On February 17, 2022, the Eighth Judicial District Court formally dismissed Lombardo’s custodianship for the Company.

On February 23, 2022, the Company entered into an Acquisition Agreement with a third-party individual to to acquire the 100% ownership of Hangzhou Longwen Enterprise Management Co., Ltd. (“Hangzhou Longwen”), a wholly Foreign-Owned Enterprise (“WOFE”) in Hangzhou, the People’s Republic of China (the “PRC”), for a total cash consideration of $1,000. As a result of the acquisition, Hangzhou Longwen became the Company’s wholly owned subsidiary in the PRC. Hangzhou Longwen was originally registered on January 4, 2012 and has minimum operations since its inception and the Company recognize $1,000 goodwill as a result of the business acquisition. The purpose of the Company’s acquisition for Hangzhou Longwen is to seek potential merger and acquisition targets in both China and other countries in Asia.

On March 15, 2022, Hangzhou Longwen entered into a Consulting Service Agreement (the “Service Agreement”) with Yunnan Yusu Import and Export Trading Co., Ltd (China) (“Yunnan Yusu”), pursuant to which, Hangzhou Longwen will provide a series of consulting services to Yunnan Yusu, including to assist in the preparation of jadeite sales and purchase agreement, assist with tax filing, assist with financial report preparation, assist with jadeite business negotiation and business website maintenance.

Currently, the Company’s revenues are mainly derived from the consulting services with Yunnan Yusu, which totaled $1,171 for the three months ended March 31, 2022. The Company is also seeking other potential merger and acquisition targets in both China and other countries in Asia.

Components of Our Results of Operations

Revenue

The Company currently only generates revenues through consulting services with Yunnan Yusu.

Professional Expense

Professional expenses principally consist of costs associated with our legal counsel, accountant and consultant.

General and Administrative Expense

General and administrative expenses include the expenses for personnel in executive and other administrative functions, other commercial costs necessary to support the commercial operation of our products and services. General and administrative expenses also include depreciation and impairments of office furniture and equipment.

Interest Expense

Interest expense primarily consists of interest expense incurred under our Revolving Loan Agreement with banks, individual third parties, and minor bank service charges.

Income taxes

The Company accounts for income taxes under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

Results of Operations

Results of Operations for the Years Ended on December 31, 2021 and 2020

The Company had earned no revenues nor realized any profits for the years ended on December 31, 2021 and 2020. During the year ended on December 31, 2021, the Company incurred $7,000 for general and administrative and interest expenses and $15,593,500 for the loss on debt settlement, compared with $500 interest expense incurred for the year ended on December 31, 2020, respectively.

Results of Operation for the Three Months Ended on March 31, 2022 and 2021

During the three months ended on March 31, 2022, the Company generated $1,171 of revenue from its consulting services with Yunnan Yusu Import and Export Trading Co., Ltd (China) (“Yunnan Yusu”) compared to $0 revenue for the period of the same quarter of year 2021. During the three months ended March 31, 2022 and 2021, the Company incurred general and administrative and professional expenses of $9,740 and $nil, respectively. The professional expenses for the three months ended March 31, 2022 mainly included consulting expenses and financial advisor fees which was amounted to $34,780. The net loss was $43,250 and $125 for the three months ended on March 31, 2022 and 2021, respectively.

Liquidity and Capital Resources

The Company had no assets as of December 31, 2021 and December 31, 2020. As of March 31, 2022, our total assets were $155,551 compared to $nil for the period ended March 31, 2021.

We had an accumulated deficit of $18,324,659 as of March 31, 2022. We had cash of $114,539 and a working capital of $53,507 as of March 31, 2022, compared to no cash balance and a deficit working capital of $13,550 at December 31, 2021. The increase in the cash and working capital was primarily due to the issuance of common stocks of the Company during the quarter.

The Company does not anticipate that it will generate revenue sufficient to cover its planned operating expenses in the foreseeable future, and the Company must obtain additional financing in order to develop and implement its business plan and proposed operations. If the Company is not successful in generating sufficient revenues and/or obtaining additional funding to develop its business plan and proposed operations, this could have a material adverse effect on its business, results of operations liquidity and financial condition.

Going Concern Assessment

The Company demonstrates adverse conditions that raise substantial doubt about the Company’s ability to continue as a going concern. These adverse conditions are negative financial trends, specifically cash outflow from operating activities, operating losses, accumulated deficit and other adverse key financial ratios.

Management’s plan to alleviate the substantial doubt about the Company’s ability to continue as a going concern include attempting to improve its business profitability, its ability to generate sufficient cash flow from its operations and execute the business plan of the Company in order to meet its operating needs on a timely basis. However, there can be no assurance that these plans and arrangements will be sufficient to fund the Company’s ongoing capital expenditures and other requirements.

The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event that the Company cannot continue as a going concern.

Off-Balance Sheet Arrangements

Under SEC regulations, we are required to disclose off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, such as changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. An off-balance sheet arrangement means a transaction, agreement or contractual arrangement to which any entity that is not consolidated with us is a party, under which we have:

| | · | Any obligation under certain guarantee contracts, |

| | | |

| | · | Any retained or contingent interest in assets transferred to an unconsolidated entity or similar arrangement that serves as credit, liquidity or market risk support to that entity for such assets, |

| | | |

| | · | Any obligation under a contract that would be accounted for as a derivative instrument, except that it is both indexed to our stock and classified in shareholder equity in our statement of financial position, and |

| | | |

| | · | Any obligation arising out of a material variable interest held by us in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to us, or engages in leasing, hedging or research and development services with us. |

We do not have any off-balance sheet arrangements that we are required to disclose pursuant to these regulations. In the ordinary course of business, we enter into operating lease commitments, and other contractual obligations. These transactions are recognized in our financial statements in accordance with generally accepted accounting principles in the United States.

Critical Accounting Policies

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires making estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis of making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The critical accounting policies are discussed in further detail in the notes to the audited consolidated financial statements appearing elsewhere in this prospectus. Management believes that the application of these policies on a consistent basis enables us to provide useful and reliable financial information about our operating results and financial condition.

ITEM 3: PROPERTIES

The Company has no properties and at this time has no agreements to acquire any properties. The Company currently uses an office provided by Mr. Ye, the President and the major shareholder of the Company, at no cost to the Company. Mr. Ye has agreed to continue this arrangement until the Company completes an acquisition or merger. We presently own one printer, one interactive intelligent tablet, three computers and one scanner for the Company’s normal business operation.

ITEM 4: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as May 5, 2022 the number and percentage of the outstanding shares of common stock, which, according to the information available to us, were beneficially owned by:

| (i) | each person who is currently a director, |

| | |

| (ii) | each executive officer, |

| | |

| (iii) | all current directors and executive officers as a group, and |

| | |

| (iv) | each person who is known by us to own beneficially more than 5% of our outstanding common stock. |

Except as indicated below, each of the stockholders listed below possesses sole voting and investment power with respect to their shares. The percentage of ownership set forth below is based upon 65,762,808 shares of common stock issued and outstanding as of June 6, 2022. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company.

| Name and Address of Beneficial Owner (1) | | Position | | Amount of Shares Beneficial Owned | | | Percent of class (2) | |

| Xizhen Ye | | President, CEO, CFO and Director | | | 54,833,877 | (3)(4) | | | 83.38 | % |

| Lizhong Lu | | Director | | | - | | | | 0.00 | % |

| Yonggang Wang | | - | | | 4,729,500 | | | | 7.19 | % |

| Officers and Directors as a Group (2) | | | | | 54,833,877 | | | | 83.38 | % |

| (1) | The principle address of the officers and directors of the Company is Rm 219, No. 25, Caihe Rd., Shangcheng Dist., Hangzhou City, Zhengjiang Province, China |

| (2) | Based upon 65,762,808 shares outstanding as of June 6, 2022. |

| (3) | Includes 54,791,570 shares owned by Mr. Xizhen Ye. |

| (4) | Includes Mr. Ye’s beneficial ownership of 63.46% of Longwen Group Corporation (Cayman Island), which owns 66,667 shares of the Company’s common stock. |

ITEM 5: DIRECTORS AND EXECUTIVE OFFICERS

Directors and Executive Officers

The following table presents information with respect to our officers, directors and significant employees as of December 31, 2021:

| Name | | Age | | Position |

| Xi Zhen Ye | | 59 | | Chief Executive Officer and Chief Financial Officer; Director |

| Lizhong Lu | | 59 | | Director |

The business background description of the officers is set forth below.

Xizhen Ye has been the Company’s Chief Executive Officer and Chief Financial Officer since November 29, 2016. Mr. Ye, a businessman in Hangzhou, China. He has operated and invested in several local companies with notable success, including news distribution network, films, mining, energy and Chinese traditional medicine. He has a BS degree in Journalism of Bijing Institute of Humanities (China). Mr. Ye’s business background led to the decision to appoint him to the Company’s Board of Directors.

Lizhong Lu has been a director of the Company since May 2, 2018. Mr. Lu has numerous years of management experience, including organizational operations and based on this experience, the Company determined to appoint Mr. Lu to its Board of Directors.

Term of Office

All of our directors are appointed for a one-year term to hold office until the next annual meeting of stockholders and until their successors are elected and qualified, or until their earlier death, retirement, resignation or removal. Executive officers serve at the discretion of the Board of Directors, and are elected or appointed to serve until the next Board of Directors meeting following the annual meeting of stockholders. Our executive officers are appointed by our Board of Directors and hold office until removed by the Board.

Family Relationships

Mr. Lizhong Lu is the brother of Mr. Xizhen Ye’s wife. Other than the foregoing, we currently do not have any officers or directors of our Company who are related to each other.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past five years, none of the following occurred with respect to a present director (or person nominated to become director), executive officer, founder, promoter or control person: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Director Independence

The Board consists of two members, none of whom meet the independence requirements of the Nasdaq Stock Market as currently in effect.

Committees and Terms

The Board of Directors (the “Board”) has not established any committees. The Company will notify its shareholders for an annual shareholder meeting and that they may present proposals for inclusion in the Company’s proxy statement to be mailed in connection with any such annual meeting; such proposals must be received by the Company at least 90 days prior to the meeting. No other specific policy has been adopted in regard to the inclusion of shareholder nominations to the Board of Directors.

Code of Ethics

To date, we have not adopted a Code of Ethics applicable to our principal executive officer and principal financial officer because the Company has no meaningful operations. The Company does not believe that a formal written code of ethics is necessary at this time. We expect that the Company will adopt a code of ethics if and when the Company successfully completes a business combination that results in the acquisition of an on-going business and thereby commences operations.

Conflicts of Interest - General

Our sole officer and two directors are, or may become, in their individual capacities, an officer, director, controlling shareholder and/or partner of other entities engaged in a variety of businesses. Thus, there exist potential conflicts of interest including, among other things, time, efforts and corporation opportunity, involved in participation with such other business entities. While our sole officer and two directors of our business are engaged in business activities outside of our business, they devote to our business such time as they believe to be necessary.

Conflicts of Interest – Corporate Opportunities

Presently no requirement contained in our Articles of Incorporation, Bylaws, or minutes which requires officers and directors of our business to disclose to us business opportunities which come to their attention. Our officers and directors do, however, have a fiduciary duty of loyalty to us to disclose to us any business opportunities which come to their attention, in their capacity as an officer and/or director or otherwise. Excluded from this duty would be opportunities which the person learns about through his involvement as an officer and director of another company. We have no intention of merging with or acquiring an affiliate, associate person or business opportunity from any affiliate or any client of any such person.

ITEM 6: EXECUTIVE COMPENSATION

During the three years ended December 31, 2021, 2020 and 2019, no salaries were paid to any officers or directors.

The following table sets forth compensation for each of the past three fiscal years with respect to each person who serves as an officer of the Company.

Summary Compensation Table

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-equity incentive plan compensation ($) | | | Non-qualified deferred compensation earnings ($) | | | All other compensation ($) | | | Total ($) | |

| Xizhen Ye | | 2021 | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | | - | |

| Chief | | 2020 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Executive Officer/Chief Financial Officer/Director | | 2019 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lizhong Lu Director | | 2021 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2020 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2019 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Employment Agreements

The Company currently has no employment agreements with its executive officers or other employees.

Director Compensation

For the years ended December 31, 2021, 2020 and 2019, the directors were not awarded any options or paid any cash compensation.

Stock Option Plan

We do not have a stock option plan and we have not issued any warrants, options or other rights to acquire our securities.

Employee Pension, Profit Sharing or other Retirement Plans

We do not have a defined benefit, pension plan, profit sharing or other retirement plan, although we may adopt one or more of such plans in the future.

ITEM 7: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Hangzhou Longwen has been provided office space by our President, Mr. Ye at no cost. The management determined that such cost is immaterial and did not recognize the rent expenses in its financial statements.

During the three months ended March 31, 2022, the Company borrowed $82,107 from the President of the Company for its normal business operations and the acquisition of Hangzhou Longwen, bearing no interest and due on demand. As of March 31, 2022 and December 31, 2021, the balance of the loan from our President was $82,107 and $nil, respectively.

ITEM 8: LEGAL PROCEEDINGS

Neither we nor any of our officers, directors or holders of five percent or more of its common stock is a party to any pending legal proceedings and to the best of our knowledge, no such proceedings by or against us or our officers, or directors or holders of five percent or more of its common stock have been threatened or is pending against us.

ITEM 9: MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Price and Stockholder Matters

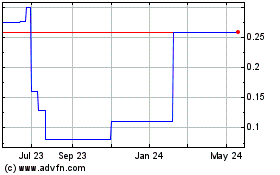

Shares of our common stock trade in the OTC pink sheets market and quotations for the common stock are listed in the “Pink Sheets” produced by the OTC Markets under the symbol “LWLW”.

The following table sets forth for the respective periods indicated the closing prices of our common stock in this market as reported and summarized by the National Quotation Bureau. Such prices are based on inter-dealer bid and asked prices, without markup, markdown, commissions, or adjustments and may not represent actual transactions. During the fiscal years ended December 31, 2021 and 2020 and for the first three months ended March 31, 2022, and through June 3, 2022, the company’s common stock had a trading history as follows:

| Fiscal Year 2020: | | High | | | Low | |

| March 31, 2020 | | $ | 0.67 | | | $ | 0.63 | |

| June 30, 2020 | | $ | 1.08 | | | $ | 0.63 | |

| September 30, 2020 | | $ | 0.85 | | | $ | 0.14 | |

| December 31, 2020 | | $ | 0.46 | | | $ | 0.04 | |

| | | | | | | | | |

| Fiscal Year 2021: | | | | | | | | |

| March 31, 2021 | | $ | 4.00 | | | $ | 0.04 | |

| June 30, 2021 | | $ | 2.97 | | | $ | 0.76 | |

| September 30, 2021 | | $ | 2.10 | | | $ | 0.10 | |

| December 31, 2021 | | $ | 1.00 | | | $ | 0.20 | |

| | | | | | | | | |

| Fiscal Year 2022: | | | | | | | | |

| March 31, 2022 | | $ | 2.89 | | | $ | 0.33 | |

| April 1 through June 3, 2022 | | $ | 1.00 | | | $ | 1.00 | |

Last Reported Price

On June 3, 2022, the closing price of our shares of common stock reported on the Pink Sheets was $1.00 per share.

Record Holders

There were 226 holders of record as of June 3, 2022; however, this figure does not include holders of shares registered in “street name” or persons, partnerships, associates, corporations or other entities identified in security position listings maintained by depositories.

Transfer Agent

Our transfer agent is Action Stock Transfer, 2469 E. Fort Union Blvd., Suite 214, Salt Lake City, UT 84121. Their telephone number is (801) 274-1088.

Dividend Policy

We have never paid cash dividends and have no plans to do so in the foreseeable future. Our future dividend policy will be determined by our board of directors and will depend upon a number of factors, including our financial condition and performance, our cash needs and expansion plans, income tax consequences, and the restrictions that applicable laws, any future preferred stock instruments, and any future credit arrangements may then impose.

Penny Stock.

Penny Stock Regulation Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00. Excluded from the penny stock designation are securities registered on certain national securities exchanges or quoted on NASDAQ, provided that current price and volume information with respect to transactions in such securities is provided by the exchange/system or sold to established customers or accredited investors.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in connection with the transaction, and the monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction.

These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. As our securities have become subject to the penny stock rules, investors may find it more difficult to sell their securities.

Equity Compensation Plans

The Company currently has no compensation plans under which the Company’s equity securities are authorized for issuance.

ITEM 10: RECENT SALES OF UNREGISTERED SECURITIES

Issuance of Common Stock

Between June 10 to July 1, 2021, the Company borrowed $6,500 from Joseph Passalaqua (“Joseph”) for attorney fee and Nevada state filing fee for the Company, and on July 15, 2021 the Company and Joseph agreed to convert the $6,500 debt into 65,000,000 shares of the Company’s common stock at par value $0.0001 (the “Debt Conversion”). As of December 31, 2021, the outstanding balance of the Borrowings was nil.

In March 2022, the Company sold 386,955 shares of common stock to fifteen investors at $0.30 per share. The investors totally paid $116,087 to the Company for the common stock subscription between March 14, 2022 and March 31, 2022. The Company relied upon Regulation S of the Securities Act of 1933, as amended, for the sale of these securities. No commissions were paid regarding the share issuance and the share certificates were issued with a Rule 144 restrictive legend.

During April 1, 2022 to May 30, 2022, the Company sold 248,792 shares of common stock to twenty-six investors for a total amount of $74,638. The Company relied upon Regulation S of the Securities Act of 1933, as amended, for the sale of these securities. No commissions were paid regarding the share issuance and the share certificates were issued with a Rule 144 restrictive legend.

ITEM 11: DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED

Description of Common Stock

We are authorized to issue 550,000,000 shares of our Common Stock, $0.0001 par value (the “Common Stock”). Each share of the Common Stock is entitled to share equally with each other share of Common Stock in dividends from sources legally available therefore, when, and if, declared by our board of directors and, upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in the assets of the Company that are available for distribution to the holders of the Common Stock. Each holder of Common Stock is entitled to one vote per share for all purposes, except that in the election of directors, each holder shall have the right to vote such number of shares for as many persons as there are directors to be elected. Cumulative voting shall not be allowed in the election of directors or for any other purpose, and the holders of Common Stock have no preemptive rights, redemption rights or rights of conversion with respect to the Common Stock. Our board of directors is authorized to issue additional shares of our Common Stock within the limits authorized by our Articles of Incorporation and without stockholder action. All shares of Common Stock have equal voting rights, and voting rights are not cumulative.

A total of 65,762,808 shares of common stock are currently outstanding on the date of this Form 10 registration statement.

Description of Preferred Stock

We are authorized to issue 50,000,000 shares of Preferred Stock with $0.0001 par value (the "Preferred Stock") with such relative rights, preferences and designations as may be determined by our Board of Directors in its sole discretion upon the issuance of any shares of Preferred Stock.

No shares of Preferred Stock are issued or outstanding on the date of this Form 10 registration statement.

ITEM 12: INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our articles provide to the fullest extent permitted by Nevada law, that our directors or officers shall not be personally liable to the Company or our stockholders for damages for breach of such director’s or officer’s fiduciary duty. The effect of this provision of our articles is to eliminate our rights and the rights of our stockholders (through stockholders’ derivative suits on behalf of the Company) to recover damages against a director or officer for breach of the fiduciary duty of care as a director or officer (including breaches resulting from negligent or grossly negligent behavior), except under certain situations defined by statute. We believe that the indemnification provisions in our articles are necessary to attract and retain qualified persons as directors and officers.

Nevada corporate law provides that a corporation may indemnify a director, officer, employee or agent made a party to an action by reason of that fact that he was a director, officer employee or agent of the corporation or was serving at the request of the corporation against expenses actually and reasonably incurred by him in connection with such action if he acted in good faith and in a manner he reasonably believed to be in, or not opposed to, the best interests of the corporation and with respect to any criminal action, had no reasonable cause to believe his conduct was unlawful.

ITEM 13: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our audited financial statements for the years ended December 31, 2021 and 2020 and unaudited financial statements for the three-month periods ended March 31, 2022 and 2021 appear at the end of this registration statement on pages F-1 though F-23.

ITEM 14: CHANGES IN AND DISAGREEMENTS WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON ACCOUNTING AND FINANCIAL DISCLOSURE

On April 13, 2022, we appointed Simon & Edward, LLP of Los Angeles, California as our new independent auditors.

There have been no disagreements with the independent registered public accounting firm regarding accounting and financial disclosure.

ITEM 15: FINANCILA STATEMENTS, AND EXHIBITS

(a) Financial Statements

Our audited financial statements for the years ended December 31, 2021 and 2020 and unaudited financial statements for the three-month periods ended March 31, 2022 and 2021 appear at the end of this registration statement on pages F-1 though F-23.

(b) Exhibits

See the Exhibit Index beginning following the signature page.

Where You Can Find More Information

For further information with respect to Longwen Group Corp. and its common stock, please refer to the registration statement, including its exhibits and schedules. Statements made in this registration statement relating to any contract or other document are not necessarily complete, and you should refer to the exhibits attached to the registration statement for copies of the actual contract or document. You may review a copy of the registration statement, including its exhibits and schedules, at the SEC’s public reference room, located at 100 F Street, NE, Washington, D.C. 20549, by calling the SEC at 1-800-SEC-0330, as well as on the Internet website maintained by the SEC at sec.report.gov. Information contained on any website referenced in this registration statement is not incorporated by reference in this registration statement.

The Company intends that it will be subject to the information and reporting requirements of the Exchange Act and, in accordance with the Exchange Act, will file periodic reports, proxy statements and other information with the SEC.

You should rely only on the information contained in this registration statement or to which this registration statement has referred you. The Company has not authorized any person to provide you with different information or to make any representation not contained in this registration statement.

LONGWEN GROUP CORP.

FINANCIAL STATEMENTS AND EXHIBITS

INDEX TO FINANCIAL STATEMENTS

Audited Financial Statements for the Years Ended December 31, 2021 and 2020

Unaudited Financial Statements for the Three Months Ended March 31, 2022 and 2021

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

Longwen Group Corp.

Hangzhou, China

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Longwen Group Corp. (the “Company”) as of December 31, 2021 and 2020, the related statements of operation and comprehensive income, stockholders’ equity, and cash flows for each of the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2021 and 2020, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Substantial Doubt About the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 3 to the financial statements, the Company has suffered recurring losses from operations, has a net capital deficiency, and has stated that substantial doubt exists about the Company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that: (i) relates to accounts or disclosures that are material to the financial statements and (ii) involved our especially challenging, subjective, or complex judgments. The communication of the critical audit matter does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

As described in Notes 4 to the financial statements, the Company and Joseph agreed to convert the $6,500 debt into 65,000,000 shares of the Company’s common stock at par value $0.0001 on June 28, 2021. The fair value of the 65 million shares of common stocks on the contract date was $15,600,000, which result in a loss on debt settlement of $15,593,500 for the year ended December 31, 2021.

Our principal considerations to determine that the valuation of shares issued for debt settlement is a critical audit matter as there was significant accounting estimates involved and significant judgment made by management when assessing the total valuation of 65,000,000 shares of common stock issued which is traded in an inactive stock market, which in turn led to significant auditor judgment, subjectivity, and effort in performing procedures and evaluating management’s assessment of the accounting estimate and disclosures related to the debt settlement.

The primary procedures we performed to address this critical audit matter included:

| · | Obtained an understanding of the management’s methodology in developing of the stock valuation for the shares issued based on the debt settlement agreement entered and board approval, including the method or model used to develop the estimate, the assumptions used by management, and the data used to develop the estimate. |

| | |

| · | Developed an independent expectation of the estimate to corroborate the reasonableness of management’s estimate. |

| | |

| · | Reviewed subsequent shares issued for cash (prior to the date of the auditor’s report) to determine whether such share issuances provide audit evidence regarding the accounting estimate management developed and used. |

/s/Simon & Edward, LLP

We have served as the Company's auditor since 2022.

Rowland Heights, CA

June 10, 2022

LONGWEN GROUP CORP.

BALANCE SHEETS

| | | As of December 31, | |

| | | 2021 | | | 2020 | |

| | | | | | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | - | | | $ | - | |

| Total current assets | | | - | | | | - | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | - | | | $ | - | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| Current liabilities | | | | | | | | |

| Current portion of long-term loan | | $ | 12,250 | | | $ | - | |

| Accrued interest | | | 1,300 | | | | - | |

| Total current liabilities | | | 13,550 | | | | - | |

| | | | | | | | | |

| Long-term loan payable | | | - | | | | 12,250 | |

| Interest payable | | | - | | | | 800 | |

| TOTAL LIABILITIES | | | 13,550 | | | | 13,050 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS EQUITY | | | | | | | | |

| Preferred stock, $0.0001 par value, 50,000,000 authorized, nil shares issued and outstanding | | | - | | | | - | |

| Common stock, $0.0001 par value, 550,000,000 authorized, 65,127,061 and 127,061 shares issued and outstanding | | | 6,513 | | | | 13 | |

| Additional paid-in capital | | | 18,261,346 | | | | 2,667,846 | |

| Accumulated deficit | | | (18,281,409 | ) | | | (2,680,909 | ) |

| TOTAL STOCKHOLDERS' DEFICIT | | | (13,550 | ) | | | (13,050 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements

LONGWEN GROUP CORP.

STATEMENTS OF OPERATIONS

| | | Years Ended December 31, | |

| | | 2021 | | | 2020 | |

| | | | | | | |

| Revenue | | $ | - | | | $ | - | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | | 6,500 | | | | - | |

| Total operating expenses | | | 6,500 | | | | - | |

| | | | | | | | | |

| Loss from operations | | | (6,500 | ) | | | - | |

| | | | | | | | | |

| Other income (expenses): | | | | | | | | |

| Interest expenses | | | (500 | ) | | | (500 | ) |

| Loss on debt settlement | | | (15,593,500 | ) | | | - | |

| Total other expenses, net | | | (15,594,000 | ) | | | (500 | ) |

| | | | | | | | | |

| Loss before income tax | | | (15,600,500 | ) | | | (500 | ) |

| | | | | | | | | |

| Income tax expense | | | - | | | | - | |

| Net loss | | $ | (15,600,500 | ) | | $ | (500 | ) |

| | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic and diluted | | | 33,123,288 | | | | 127,061 | |

| | | | | | | | | |

| Loss per share: | | | | | | | | |

| Basic and diluted | | $ | (0.47 | ) | | $ | (0.00 | ) |

The accompanying notes are an integral part of these financial statements

LONGWEN GROUP CORP.

STATEMENTS OF CASH FLOWS

| | | Years ended December 31, | |

| | | 2021 | | | 2020 | |

| | | | | | | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (15,600,500 | ) | | $ | (500 | ) |

| Adjustment to reconcile net loss used in operating activities: | | | | | | | | |

| Share issuances for debt settlement | | | 15,600,000 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accrued interest | | | 500 | | | | 500 | |

| Net cash provided by (used in) operating activities | | | - | | | | - | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Additional paid-in capital | | | - | | | | - | |

| Net cash provided by (used in) financing activities | | | - | | | | - | |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | - | | | | - | |

| Cash and cash equivalents, beginning balance | | | - | | | | - | |

| Cash and cash equivalents, ending balance | | $ | - | | | $ | - | |

| | | | | | | | | |

| SUPPLEMENTARY DISCLOSURE: | | | | | | | | |

| Interest paid | | $ | - | | | $ | - | |

| Income tax paid | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements

LONGWEN GROUP CORP.

STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

| | | Preferred Stock | | | Amount | | | Common Stock | | | Amount | | | Additional Paid-in Capital | | | Accumulated Deficit | | | Total Equity (Deficit) | |

| Balance December 31, 2019 | | | - | | | $ | - | | | | 127,061 | | | $ | 13 | | | $ | 2,667,846 | | | $ | (2,680,409 | ) | | $ | (12,550 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (500 | ) | | | (500 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance December 31, 2020 | | | - | | | $ | - | | | | 127,061 | | | $ | 13 | | | $ | 2,667,846 | | | $ | (2,680,909 | ) | | $ | (13,050 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt settlement | | | - | | | | - | | | | 65,000,000 | | | | 6,500 | | | | 15,593,500 | | | | - | | | | 15,600,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (15,600,500 | ) | | | (15,600,500 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance December 31, 2021 | | | - | | | $ | - | | | | 65,127,061 | | | $ | 6,513 | | | $ | 18,261,346 | | | $ | (18,281,409 | ) | | $ | (13,550 | ) |

The accompanying notes are an integral part of these financial statements

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

Longwen Group Corp. (the “Company”) was originally incorporated as Expertelligence, Inc on March 31, 1980 and reincorporated in the State of Nevada on November 17, 2005. On January 23, 2017, after a series of various name changes, the Company amended its Articles of Incorporation (“Charter Amendment”) to affect the current name change of Longwen Group Corp with trading symbol of “LWLW”.

On or about April 5, 2016, the Company affected a 1 for 750 share reverse split of its issued and outstanding common stocks and reduced to 127,061 shares outstanding. Effective November 29, 2016, 66,667 shares of common stock of the Company were transferred to Longwen Group Corp., a Cayman Island company (“Longwen Cayman”). All of the shares held by Longwen Cayman are restricted securities. As a result of the transactions, Mr. Xizhen Ye, President of Longwen Cayman, was appointed as a sole Director of the Company, and President and Chief Executive Officer and Chief Financial Officer of the Company. On August 22, 2018, Mr. Lizhong Lu was appointed as a director of Board.

On June 9, 2021, Anthony Lombardo (“Lombardo”) filed an Application for Appointment of Custodian (“Application”) with the Eighth Judicial District Court in Nevada to request the custodianship of the Company due to the Company’s non-response and late filing with the State of Nevada. On June 24, 2021, a hearing was held on this Application, where Lombardo was named temporary custodian of the Company. Subsequently after Lombardo’s custodianship, Deanna Johnson was appointed as the CEO, CFO and Secretary of the Company. On September 1, 2021, Deanna Johnson appointed Joseph Passalaqua (“Joseph”) as CEO, CFO and Secretary and resigned from all positions in the Company.

On October 25, 2021, Mr. Xizhen Ye (“Ye”), the ex-officer and director of the Company prior to Lombardo’s custodianship, and Longwen Cayman, filed a motion to dissolve custodianship (“Motion”) with the Eighth Judicial District Court of Nevada State. Pursuant to the Settlement Agreement entered on January 12, 2022, by Longwen Cayman, Mr. Ye, Lombardo, Joseph and Deanna Johnson regarding Lombardo’s custodianship, Mr. Ye and Mr. Lizhong Lu were reinstated as the officer and directors of the Company, and 65,000,000 common stocks of the Company was transferred from Joseph to Mr. Ye on February 9, 2022. Further on February 17, 2022, the Eighth Judicial District Court officially terminated Lombardo’s custodianship over the Company.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”).

Use of Estimates

The preparation of the Company’s financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the financial statements and footnotes thereto. Actual results may differ from those estimates and assumptions.

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, bank deposits, and highly liquid investments with maturities of three months or less at the date of origination.

Income Taxes

The Company accounts for income taxes under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

Earnings Per Share

Basic earnings per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued. As of December 31, 2021 and 2020, the Company does not have any potentially dilutive instrument.

Fair Value Measurements

Fair value accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

| | · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| | · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| | · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

As of December 31, 2021 and 2020, the Company did not have any assets or liabilities that were required to be measured at fair value on a recurring basis or on a non-recurring basis.

Related Parties

The Company follows ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Accounting Standards Issued but Not Yet Adopted

Credit Losses

In June 2016, the FASB issued ASU No. 2016-13, (FASB ASC Topic 326), Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments which amends the current accounting guidance and requires the use of the new forward-looking “expected loss” model, which requires all expected losses to be determined based on historical experience, current conditions and reasonable and supportable forecasts, rather than the “incurred loss” model. This guidance amends the accounting for credit losses for most financial assets and certain other instruments including trade and other receivables, held-to-maturity debt securities, loans and other instruments. The effective date of ASU No. 2016-13 for smaller reporting companies is postponed to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company believes the adoption of ASU No. 2016-13 will not have a material impact on its financial position and results of operations.

There were other updates recently issued. The management does not believe that other than disclosed above, accounting pronouncements the recently issued but not yet adopted will have a material impact on its financial position results of operations or cash flows.

NOTE 3 – GOING CONCERN

The Company’s financial statements have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business. During the year ended December 31, 2021, the Company incurred a net loss of $15,600,500 and had an accumulated deficit of $18,281,409 as of December 31, 2021. These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s future success is dependent upon its ability to acquire businesses with profitable operations, generate cash from operating activities and obtain additional financing. The Company intends to raise funds from the issuance of equity and/or debt securities, but there is no assurance that additional funds from the issuance of equity will be available for the Company to finance its operations on acceptable terms, or at all. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4 – DEBT SETTLEMENT