PC Giant Lenovo Plans China Listing, Sending Stock Soaring

January 13 2021 - 5:13AM

Dow Jones News

By Joanne Chiu and Yifan Wang

Lenovo Group Ltd. is capitalizing on two booming markets,

Chinese stocks and the global PC industry, to list in Shanghai.

The company is the world's largest maker of personal computers

and is well-known for acquiring IBM's ThinkPad unit and the

Motorola Mobility smartphone business. The news that Lenovo would

join the STAR Market, China's answer to the Nasdaq, boosted its

Hong Kong-traded shares, which on Wednesday hit their highest level

since 2015.

A series of Chinese technology companies have recently listed in

mainland China or in Hong Kong, amid heightened tensions with the

U.S. Beijing has also encouraged companies to join the fledgling

STAR Market, also known as the Science and Technology Innovation

Board, by introducing more relaxed listing rules and other

requirements compared with other Chinese markets.

Lenovo and Megvii Technology Ltd., an artificial-intelligence

startup specializing in facial recognition, will be among the first

companies to make use of a structure known as a Chinese depositary

receipt to raise funds.

In a filing late Tuesday, Lenovo said it planned to sell stock

equivalent to up 10% of its enlarged ordinary share count. Its

shares jumped 9.7% on Wednesday, giving the company a market value

of nearly $14 billion.

Chairman Yuanqing Yang said that with the offering, Lenovo was

"leveraging the booming China capital market" and making it easier

for Chinese investors to buy into the company.

Lenovo plans to use the funds for research and development,

strategic investments and to replenish working capital. It didn't

give a time frame and said the offering remains subject to market

conditions and needs approval from shareholders, exchanges and

regulators.

Lenovo, which bought ThinkPad in 2005, now accounts for one in

four of the world's PC shipments, and its PC revenues hit a record

high in the three months through September.

Like rivals, Lenovo has benefited from the pandemic, which has

led to a surge in remote work and study, and in home entertainment.

PC sales growth hit a decade-high last year, with global PC

shipments rising 13%, according to International Data Corp.

Lenovo will issue Chinese depositary receipts, or CDRs, to new

investors. Much like an American depositary receipt, these

securities are certificates backed by foreign shares. CDRs are one

way for Chinese companies that are incorporated overseas to list

domestically. However, regulators have also recently allowed some

companies that are incorporated offshore, such as Semiconductor

Manufacturing International Corp., to sell ordinary shares within

China.

Megvii, the AI company, is also planning to issue CDRs, and is

working with Citic Securities, according to a statement uploaded

this week by the Beijing branch of China's securities regulator.

Megvii had previously filed for a Hong Kong listing but let that

application lapse.

In October Ninebot Ltd., which makes Segway e-scooters, listed

the first CDRs on the STAR Market. Overall, the STAR Market was

China's biggest onshore market by funds raised from new listings

last year, hosting nearly $32 billion of initial public offerings

and secondary listings, according to Dealogic.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

January 13, 2021 04:58 ET (09:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

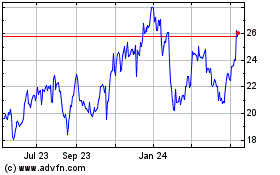

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

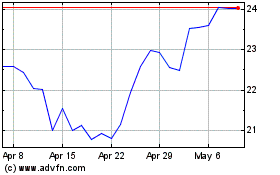

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From Jan 2024 to Jan 2025