Data433 Risk Mitigations, Inc.

Shares Jumps 23%; Company Offers Hack-Free Email Resiliency

Services In Response To Ransomware Attack Of Microsoft

Exchange

March 18, 2021 -- InvestorsHub NewsWire -- via MarketWatch --

Last week was a good one for Data433 Risk Mitigations, Inc.

(OTC

Pink: ATDS). By Friday, shares rose 23% and closed at their

highs following reports of a massive hack to the

Microsoft Exchange. That attack has affected at least 30,000

users in the US and more than 250,000 worldwide. In response,

investors started bidding shares of data security companies higher,

and Data433 is one.

To its credit, Data443 Risk Mitigation, Inc. is also taking

advantage of an opportunity. On Wednesday, they offered a free

targeted trial program of its hack-free email resiliency services

that allows clients to experience the added degree of privacy,

protection, and overall upgraded services and capabilities offered

by Data443. The offer extends to organizations impacted by the hack

and those who would have an interest in potentially better security

solutions.

Already, Data443's mass privacy, discovery, and archiving

product, Data Archive Manager®, is trusted and used by hundreds of

organizations to manage and protect petabytes of stored data. And

with email security being the focus, it's notable that IT managers

have long embraced Data Archive Manager's® ability to store all

forms of data content in segregated repositories that are not

subject to the current vulnerabilities announced by Microsoft.

Further, the platform protects against the execution of any virus,

macro vulnerabilities, or ransomware packages embedded in

datasets.

The excellent news for ATDS is that the attention back to the

sector may help expose the broader products and services offered by

Data433 and send shares back toward 52-week highs of $0.24,

representing a more than 1867% increase from current levels. The

companies extensive product portfolio could help ignite the

rally.

Impressive Product And Services Portfolio

By all measures, Data443 Risk Mitigation, Inc. has become a

unique one-stop-shop that offers leading Data Privacy Solutions for

All Things Data Security™. That depth of service may be its most

attractive feature since it positions them to target massive market

opportunities through business, individual, and government market

demand. Moreover, because of its product diversification, ATDS can

exploit tremendous opportunities in multiple market

segments.

Better still, unlike some of its competitors, ATDS builds

tailored software and services solutions that enable clients to

facilitate secure data transfer across local devices, networks, the

cloud, and/or databases. That difference can be a game-changer

going forward from a revenue-generating perspective, especially as

hackers become more sophisticated in designing malware. Many of its

competitors can't make the same claim, and most offer only a one

size fits all platform. That could be a valuable advantage to

Data433.

The company is also on the acquisition hunt. Most recently,

Data433 acquired all rights to the data archiving platform,

ArcMail, a pioneer and leader in the enterprise information and

email archiving market. ArcMail is expected to immediately impact

its revenues-generating operations by capitalizing on ArcMail's

expertise to offer customers an extensive choice of cost-effective,

easy-to-use archiving solutions. The ArcMail acquisition adds to an

impressive product portfolio.

Other products include ARALOC™, its market-leading, secure,

cloud-based platform for managing, protecting, and

distributing digital content to desktop and mobile devices. And

like its other products and services, it has a global addressable

market well into the hundreds of millions. Another product,

DATAEXPRESS®, is a leading data transport, transformation, and

delivery product trusted by financial organizations worldwide. Its

ClassiDocs® is an award-winning data classification and governance

technology, which supports CCPA, LGPD, and GDPR compliance. And its

ClassiDocs™ for Blockchain provides an active implementation for

the Ripple XRP token that protects transactions from inadvertent

disclosure and data leaks.

The great news is that each product and service can generate

massive value over the long term, especially with security thrust

back into the spotlight after the MS Exchange attack. Moreover, the

digital revolution, for all intents and purposes, is still in its

infancy. Thus, as technology quickens, so will Data433's ability to

leverage its multiple shots on goal that targets numerous business

sectors.

Video Link: https://www.youtube.com/embed/MGus0jcli9s

Sector Specific Products And Services

Beyond the products above, Data433 is marketing Data443™ Global

Privacy Manager™, a privacy compliance and consumer loss mitigation

platform. Also, they are selling Resilient Access™, a product that

enables fine-grained access controls across numerous platforms.

This specialized product is designed for internal client systems

and public cloud platforms like Salesforce, Google G Suite, and

Microsoft OneDrive. And while those markets deliver potentially

lucrative opportunities, ATDS's focus on the massive

Software-as-a-Service (SaaS) market can be an enormous value driver

going forward.

There, ATDS is targeting the booming SaaS market with

FileFacets. That platform performs sophisticated data discovery and

content search within corporate networks, servers, content

management systems, email, desktops, and laptops. Demand for

user-based products, like FileFacets®, is on the rise, and Data433

is working to capitalize on that need. The fruits of its efforts

are already starting to show.

Its Q3 revenues were the best in its history.

Record Performance And Balance Sheet Improvements

From an investor's perspective, products are great, but record

revenues are better. With that in mind, ATDS is coming off of a

record-setting Q3 with momentum going into Q4. Those results (Q4),

which are expected in the next week, could help share prices surge,

especially if they meet the expectation of another record-setting

quarter.

Moreover, beyond posting record-setting revenues in its third

quarter, Data433 also eliminated $10 million in derivative

liabilities and reduced expenses by 35% in that same period. Those

accomplishments change the company's capital position dramatically,

and from an accounting perspective, it could help accelerate

positive EBITDA or even bottom-line EPS. That result may come

sooner than many think. Here's why:

Also, in Q3, the company reported an increase in shareholders'

equity of $12.5 million, paid down roughly $500,000 in acquisition

debt, and recorded its highest quarterly bookings ever. Thus, by

any metric, Data433 is growing its company. Moreover, with the

company's prowess to make deals immediately accretive to cash flow,

consecutive record-setting quarters may be in the

forecast.

Notably, Data433 growth is happening during one of the most

unprecedented and challenging periods of commerce in the past fifty

years. The expected near-term return to more normal market

conditions could help to accelerate growth at Data433. After all,

data security will never go out of style.

Better still, its recent business performance suggests that the

best is yet to come. And by capitalizing on opportunities in a data

security market whose growth will likely accelerate along with

technology advancements, Data433 may be in its best position ever

to capitalize on near and long-term business

opportunities.

Thus, the 24% rise in share prices last week may the start of a

much-deserved rally.

Disclaimers: Hawk Point Media is responsible for the

production and distribution of this content. Hawk Point Media is

not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary

compensation. Hawk Point Media was not compensated to

research, prepare, or syndicate this content. Hawk Point Media has

no working relationship with the company

featured. Never invest in any stock featured on our

site or emails unless you can afford to lose your entire

investment. The information made available by Hawk

Point Media is not intended to be, nor does it constitute,

investment advice or recommendations. The contributors may buy and

sell securities before and after any particular article, report and

publication. In no event shall Hawk Point Media be liable to any

member, guest or third party for any damages of any kind arising

out of the use of any content or other material published or made

available by Hawk Point Media, including, without limitation, any

investment losses, lost profits, lost opportunity, special,

incidental, indirect, consequential or punitive damages. Past

performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Mediastrongly urges you

conduct a complete and independent investigation of the respective

companies and consideration of all pertinent risks. Readers are

advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K,

insider reports, Forms 3, 4, 5 Schedule 13D.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in

micro-cap and growth securities is highly speculative and carries

an extremely high degree of risk. It is possible that an investors

investment may be lost or impaired due to the speculative nature of

the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: KL Feigeles

Email: Send

Email

City: Miami Beach

State: Florida

Country: United States

Website: https://www.greenlightstocks.com

Source - https://www.marketwatch.com/press-release/data433-risk-mitigations-inc-shares-jumps-23-company-offers-hack-free-email-resiliency-services-in-response-to-ransomware-attack-of-microsoft-exchange-2021-03-16

Other stocks on the move - ICBU,

MVES and

AABB

SOURCE: MarketWatch

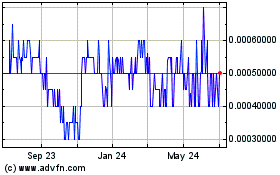

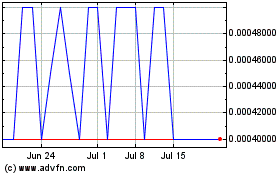

IMD Companies (PK) (USOTC:ICBU)

Historical Stock Chart

From Dec 2024 to Jan 2025

IMD Companies (PK) (USOTC:ICBU)

Historical Stock Chart

From Jan 2024 to Jan 2025