Current Report Filing (8-k)

June 21 2022 - 9:01AM

Edgar (US Regulatory)

0001695473

false

0001695473

2022-06-19

2022-06-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

June

19, 2022

Date

of Report (Date of earliest event reported)

The

Greater Cannabis Company, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Florida |

|

000-56027 |

|

30-0842570 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

15

Walker Ave, Suite 101

Baltimore, MD 21208

(Address

of Principal Executive Offices)

(443)

738-4051

(Registrant’s

telephone number, including area code)

N/A

(Former

Name or Former Address, if Changed Since Last Report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

|

|

|

As

used in this Current Report on Form 8-K (this “Current Report”), and unless otherwise indicated, the terms “the

Company,” “GCAN,” “we,” “us” and “our” refer to

The Greater Cannabis Company, Inc. and it subsidiaries.

Item

1.01 Entry into a Material Definitive Agreement.

On

June 19, 2022, GCAN and FirstFire Global Opportunities Fund, LLC (“FFG”) agreed to further amend, effective May 27,

2022, that certain Amended Securities Purchase Agreement originally dated March 11, 2021 and amended June 7, 2021 and May 18, 2022 (as

amended, the “SPA”), to provide that the Conversion Price of the Convertible Promissory Note dated June 28, 2021 in

the original principal amount of $272,500 issued pursuant to the SPA, be set at $0.001 with respect to the conversion of up to $100,000

in principal and interest thereunder into shares of the Company’s common stock as provided for therein.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

THE GREATER CANNABIS COMPANY, INC.

a Florida corporation

|

| |

|

|

| Dated:

June 21, 2022 |

By: |

/s/

Aitan Zacharin |

| |

|

Chief

Executive Officer |

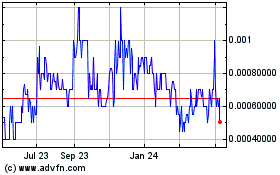

Greater Cannabis (PK) (USOTC:GCAN)

Historical Stock Chart

From Nov 2024 to Dec 2024

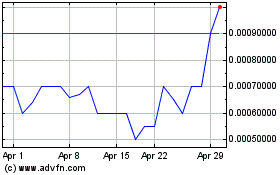

Greater Cannabis (PK) (USOTC:GCAN)

Historical Stock Chart

From Dec 2023 to Dec 2024