UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| |

|

|

|

☒

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the year ended March 31, 2015.

| |

|

|

|

☐

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 333-173680

GLORYWIN ENTERTAINMENT GROUP INC.

(Exact name of Registrant as specified in its charter)

| |

|

|

|

Nevada

|

|

27-3369810

|

|

(State or other jurisdiction ofincorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

Room 8, 20/F, AIA Tower, Nos

Avenida Commercial de Macau 251A-301

Macau

(Address of principal executive offices)

+853 8294-2333

(Registrant's telephone number, including area code)

Indicate by check whether the Registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer," "non-accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

| |

|

|

|

Large Accelerated Filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated Filer ☐

|

|

Smaller reporting company ☒

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of September 30, 2014, the aggregate market value of voting stock held by non-affiliates of the registrant, based on the closing sales price of Common Stock on September 30, 2014, was approximately $63,415,460.2

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 20,800,338 shares of common stock par value $0.001 as of June 24, 2015.

Table of Contents

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

6 |

|

|

|

|

7 |

|

|

|

|

9 |

|

|

|

|

9 |

|

|

|

|

10 |

|

|

|

|

10 |

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

15 |

|

|

|

|

15 |

|

|

|

|

16 |

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Forward Looking Statements

This annual report contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report. Except as required by applicable law, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our audited financial statements are expressed in US dollars and are prepared in accordance with generally accepted accounting principles in the United States of America. They reflect all adjustments (all of which are normal and recurring in nature) that, in the opinion of management, are necessary for fair presentation of our interim financial information.

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this annual report.

As used in this annual report, the terms "we", "us" and "our" mean Glorywin Entertainment Group Inc., unless otherwise indicate

OVERVIEW AND OUTLOOK

The Company was formed in the state of Nevada on August 26, 2010 under the name "Zippy Bags, Inc." to provide retail sales of snowboard carrying bags to the general public.

After the takeover by new management on June 17, 2014, the Company, through its 100% indirectly owned subsidiary, Wonderful Gate Strategy Company Limited, became principally engaged in the service of introducing sub-junkets and information technology infrastructure to land-based casinos. For sub-junkets introduction service and IT infrastructure introduction service performed, we charge 0.2% and 0.05%, respectively, of total bets played by players introduced by sub-junkets from the three casinos located in Cambodia.

On October 30, 2014, the Company filed a certificate of amendment (the "Amendment") to its Certificate of Incorporation with the Secretary of State of the State of Nevada in order to change its name to "Glorywin Entertainment Group, Inc." in order to better reflect the direction and business of the Company. The Company has adopted a fiscal year end of March 31.

We have established a website (www.glorywinentertainment.com) which set forth general information for the Company.

Based on our current operating plan, we expect that we will be able to generate revenue that is sufficient to cover our expenses for the next twelve months. Our ability to maintain sufficient liquidity is dependent on our ability to raise additional capital.

Recent Developments

The Company is in the process of developing mobile applications to provide gaming to customers where such activity is legal. The software is provided by a third party vendor who is providing the on-line casino platform in selected markets. Development of the mobile application of gaming requires the Company to customize the appearance and branding of the third party software, and establish merchant services to accept payments and facilitate distribution of winnings.

Player acquisition is a key factor for organic growth in the online gaming industry. Players are primarily acquired from affiliates for a fixed fee or percentage of earnings based on negotiated predetermined criteria. Affliates are websites or individuals that attract players through various means such as player news/interest websites, email campaigns or other relationships. The key is that payment to affiliates takes place only when negotiated criteria are met. The criteria may be player minimum deposit, level of play, or revenue earned. The critical element is that unlike most marketing campaigns, the revenues returned by marketing are generally predictable.

The key elements of player retention are the creation of exciting opportunities to maintain player interest and increase play frequency. Similar to land-based casino's compensation programs, the tools used for this purpose include prizes, "free money," opportunities to play against famous (or infamous) players, and tournament qualifications.

On January 19, 2015, the Company entered into a conditional agreement with the Company's major shareholder, Taipan Pearl Sdn Bhd to acquire 100% interest in GWIN Company Limited ("GWIN"), operating Chetaeu De Bavet Club Co ("Chetaeu") a land based casino in Kingdom of Cambodia. Under the terms of the conditional purchase agreement, the Company is entitle to 100% interest of the company. In consideration for the purchase, GWIN made a Refundable Deposit of USD2,000,000 ("Deposit") and will take full operation of the land-based casino for a total of 12 months. Upon the operations achieving at least positive revenue within that 12 months period, the transaction is considered completed with Deposit being the Consideration Purchase Price.

On February 18, 2015, the Company entered into a binding sub agreement worth $2 million with GWIN. Pursuant to the binding sub agreement, the Company would finance the construction amount and Banker's Capital for operations of GWIN. GWIN has extensive experience in promoting gaming business in Asia, as well as implementing fraud and Risk Control, payment processing and compliance with particular respect to gaming. It is envisaged that the parties will work together in a joint venture to raise capital and contribute expertise with the intention of generating revenues, profits and returning value to shareholders.

The Company is currently finalizing due diligence on this transaction and incorporated as part of the due diligence will be an assurance that GWIN does not facilitate gaming in any illegal jurisdictions and are fully compliant with all laws pertaining to their current operation.

Support and Services

Online support is provided to the Company and sub-junkets by Casino's contracted independent IT company in Vietnam. The IT Company functions also as an independent third party, to confirm on month end sales and commission for each individual party.

Competition

The market for the Company's businesses has relatively low competition in the region of Southeast Asia, being in contract with licensed and regulated land-based casinos. Internationally, primary competition would be expected from offshore gaming companies. With few exceptions, significant listed game companies (many of which are listed on the stock exchanges) operate using their own software. We believe that we retain the ability to utilize the most profitable platform available and are not restricted to a single platform.

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding any statement in this Form 10-K or elsewhere. The following information should be read in conjunction with Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes in Part II, Item 8, "Financial Statements and Supplementary Data" of this Form 10-K.

The business, financial condition and operating results of the Company can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below. Any one or more of such factors could directly or indirectly cause the Company's actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, could materially and adversely affect the Company's business, financial condition, results of operations and stock price.

Because of the following factors, as well as other factors affecting the Company's financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Legality of Gambling Globally and Regionally

Regulations relating to online gaming vary significantly in different jurisdictions. Although the Company can set pre-emptive measures, it is still currently unable to ensure that sub-junkets only receive deposits from gamers in jurisdictions in which we are legally entitled to provide services.

Money Laundering

The Company's online platform provides a borderless access to people from across the globe. Although the Company tightly scrutinizes to prevent illegal gambling, it is uninvitable that money laundering may exist among sub-junkets without our knowledge. The Company is not in a position to predetermine the source of funds from gamers.

Item 1B. Unresolved Staff Comments

None.

We lease approximately 100 square feet at Room 8, 20/F, AIA Tower, Nos 251A-301, Avenida Commercial de Macau, Macau for a monthly rent of MOP 10,000. Our current lease expires on October, 2015. We believe that this office is suitable for our current operations and we do not anticipate requiring any additional property in the foreseeable future.

We also leased a staff quarters in ZhuHai, China for RMB 6,000 monthly rent. This quarters is relatively cheaper than hotel stays or house renting in Macau.

Item 3. Legal Proceedings

We are not aware of any legal proceedings to which we are a party or of which our property is the subject. None of our directors, officers, affiliates, any owner of record or beneficially of more than 5% of our voting securities, or any associate of any such director, officer, affiliate or security holder are (i) a party adverse to us in any legal proceedings, or (ii) have a material interest adverse to us in any legal proceedings. We are not aware of any other legal proceedings that have been threatened against us.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

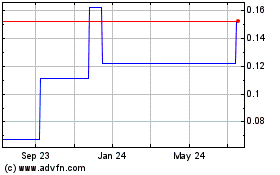

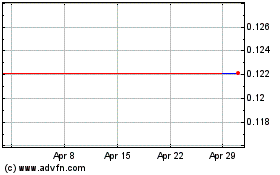

Our common stock is quoted under the symbol "GWIN" on the OTCQB operated by the Financial Industry Regulatory Authority, Inc. ("FINRA"). Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following table sets for the high and low bid quotations for our common stock as reported on the OTCBB/OTCQB for the periods indicated, as applicable.

|

Quarter Ended

|

|

High

|

|

|

Low

|

|

|

June 30, 2014

|

|

|

0.86

|

|

|

|

0.56

|

|

|

September 30, 2014

|

|

|

5.80

|

|

|

|

0.56

|

|

|

December 31, 2014

|

|

|

2.95

|

|

|

|

1.25

|

|

|

March 31, 2015

|

|

|

2.25

|

|

|

|

1.25

|

|

|

Quarter Ended

|

|

High

|

|

|

Low

|

|

|

June 30, 2013

|

|

|

14.50

|

|

|

|

4.20

|

|

|

September 30, 2013

|

|

|

6.00

|

|

|

|

2.50

|

|

|

December 31, 2013

|

|

|

3.80

|

|

|

|

0.51

|

|

|

March 31, 2014

|

|

|

1.73

|

|

|

|

0.86

|

|

Holders of Common Stock

As of June 24, 2015, there were approximately 65 shareholders of 20,800,338 shares of our common stock.

Dividends

We have never paid dividends on our Common Stock. We intend to follow a policy of retaining earnings, if any, to finance the growth of the business and does not anticipate paying any cash dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

As of March 31, 2015, we did not have any equity compensation plans.

Recent Sales of Unregistered Securities

None.

Item 6. Selected Financial Data

Not applicable for a smaller reporting company

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our financial statements, including the notes thereto, appearing elsewhere in this annual report. The discussions of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future.

Results of Operations for the Year Ended March 31, 2015 and 2014

Sales

Revenue of $3,853,913 and $nil was recognized for the year ended March 31, 2015 and 2014, respectively. Revenues for the year ended March 31, 2015 were comprised of introduction fee of junkets and technical support to three casinos.

General and administrative expenses

General and administrative expenses were $2,012,146 for the year ended March 31, 2015 compared to $8,232 for the year ended March 31, 2014, an increase of $2,003,914. The majority of the increase was due to shares issued for services valued at fair market value in addition to salaries and rental expenses.

Net Profit / Loss

Net income for the year ended March 31, 2015 was $1,322,132. For the year ended March 31, 2014, the Company recorded a net loss of $59,311.

Professional fees

Professional fees were $175,633 for the year ended March 31, 2015 compared to $17,354 for the year ended March 31, 2014, an increase of $158,279 which resulted from the costs of being a public company.

Interest Expense

Interest expense for the year ended March 31, 2015 is $0 compared to $33,725 for the year ended March 31, 2014, a decrease of $33,725.

LIQUIDITY AND CAPITAL RESOURCES

We believe that our existing sources of liquidity will be sufficient to fund our operations, anticipated capital expenditures, working capital and other financing requirements for at least the next twelve months.

The following table summarizes total assets, accumulated deficit, stockholder's equity and working capital at March 31, 2015 and March 31, 2014.

|

|

|

March 31, 2015

|

|

|

March 31, 2014

|

|

|

Total Assets

|

|

$

|

496,372

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated (Deficit)

|

|

$

|

1,199,852

|

|

|

$

|

(118,524

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Deficit

|

|

$

|

(269,741

|

)

|

|

$

|

(16,869

|

) |

|

|

|

|

|

|

|

|

|

|

|

Net Working Capital

|

|

$

|

(269,741

|

)

|

|

$

|

(16.869

|

) |

Net cash provided by operating activities total $2,873,564 for the year ended March 31, 2015.

Satisfaction of Our Cash Obligations for the Next Twelve Months

Our plan for satisfying our cash requirements for the next twelve months is through generating revenue from junket operations and technical service fees.

Inflation

The rate of inflation has had little impact on the Company's results of operations and is not expected to have a significant impact on the continuing operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

We have identified the policies outlined below as critical to our business operations and an understanding of our results of operations. The list is not intended to be a comprehensive list of all of our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management's judgment in their application. The impact and any associated risks related to these policies on our business operations is discussed throughout management's Discussion and Analysis or Plan of Operation where such policies affect our reported and expected financial results. Note that our preparation of the financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of our financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

Revenue Recognition

Revenues from service contracts are recognized as services are performed if collectability is reasonably assured.

The Company engaged in provision of junket services to bring VIP customers to the online operations of 3 land-based casinos in Cambodia. The Company also provides technical support services to these 3 casinos regarding their online casino platforms. In summary, the Company is charging the 3 casinos 0.2% commission regarding our junket services based on the amount of total bets played by the gamers introduced by the Company. In addition, the Company is charging the 3 casinos 0.05% technical support fees regarding our maintenance service to the online gaming platform of the 3 casinos.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are presented net of an allowance for doubtful accounts. Management of the Company makes judgments as to its ability to collect outstanding receivables and provides allowances for the portion of receivables when collection becomes doubtful. Provisions are made based upon a specific review of all significant outstanding invoices. For those invoices not specifically reviewed, provisions are provided at different rates, based upon the age of the receivables. In determining these percentages, management analyzes its historical collection experience and current economic trends. If the historical data the Company uses to calculate the allowance for doubtful accounts does not reflect the future ability to collect outstanding receivables, additional provisions for doubtful accounts may be needed and the future results of operations could be materially affected.

Stock-Based Compensation

The Company accounts for stock based compensation issued to employees in accordance with ASC 718 "Stock Compensation". ASC 718 requires companies to recognize an expense in the statement of income at the grant date of stock options and other equity based compensation issued to employees. The Company accounts for non-employee share-based awards in accordance with ASC 505-50 "Equity-based payments to nonemployees".

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. A valuation allowance is provided for significant deferred tax assets when it is more likely than not, that such asset will not be recovered through future operations. Current income taxes are provided for in accordance with the laws and regulations applicable to the Company as enacted by the relevant tax authorities.

Recently Issued Accounting Pronouncements

In April 2014, the FASB issued ASU 2014-08, "Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity". The amendments in the ASU change the criteria for reporting discontinued operations while enhancing disclosures in this area. It also addresses sources of confusion and inconsistent application related to financial reporting of discontinued operations guidance in U.S. GAAP. Under the new guidance, only disposals representing a strategic shift in operations should be presented as discontinued operations. In addition, the new guidance requires expanded disclosures about discontinued operations that will provide financial statement users with more information about the assets, liabilities, income, and expenses of discontinued operations. The amendments in the ASU are effective in the first quarter of 2015 for public organizations with calendar year ends. Early adoption is permitted. The Company does not expect the adoption to have a significant impact on its consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, "Revenue from contracts with Customers (Topic 606)". This ASU affects any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of non-financial assets. This ASU will supersede the revenue recognition requirements in Topic 605, Revenue Recognition, and most industry-specific guidance. The ASU also supersedes some cost guidance included in Subtopic 605-35, Revenue Recognition-Construction-Type and Production-Type Contracts. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchanged for those goods or services. The standard is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. The Company is currently in the process of evaluating the impact of the adoption on its consolidated financial statements.

In June 2014, the FASB issued ASU 2014-10, "Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements". The amendments in this Update remove all incremental financial reporting requirements from U.S. GAAP for development stage entities, thereby improving financial reporting by eliminating the cost and complexity associated with providing that information. The Company has elected to early adopt this ASU by removing the inception to date information and all references to development stage.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Not required.

Item 8. Financial Statements and Supplementary Data

Our financial statements are contained in pages F-1 through F-17, which appear at the end of this report.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

The Company's CEO and CFO are responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control system was designed to provide reasonable assurance to the company's management and board of directors regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

In making its assessment of internal control over financial reporting management used the criteria issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework. Because of the material weakness described in the following paragraphs, management believes that, as of March 31, 2015, the Company's internal control over financial reporting was not effective based on those criteria.

Management's evaluation was retrospective and conducted as of March 31, 2015, the last day of the fiscal year covered by this Form 10-K. Based upon management's evaluation, we have concluded that our internal controls over financial reporting were not effective as of March 31, 2015 because we have not completed the remediation (discussed elsewhere in this document) for the fiscal year ended March 31, 2015 due to the following material weaknesses:

Company-level controls. We did not maintain effective company-level controls as defined in the Internal Control—Integrated Framework published by COSO. These deficiencies related to each of the five components of internal control as defined by COSO (control environment, risk assessment, control activities, information and communication, and monitoring). These deficiencies resulted in more than a remote likelihood that a material misstatement of our annual or interim financial statements would not be prevented or detected. Specifically,

|

|

·

|

Our control environment did not sufficiently promote effective internal control over financial reporting throughout our organizational structure, and this material weakness was a contributing factor to the other material weaknesses described in this Item 9A;

|

|

|

·

|

Our board of directors had not established adequate financial reporting monitoring activities to mitigate the risk of management override, specifically:

|

|

|

–

|

no formally documented financial analysis was presented to our board of directors, specifically fluctuation, variance, trend analysis or business performance reviews;

|

|

|

–

|

an effective whistleblower program had not been established;

|

|

|

–

|

there was insufficient oversight of external audit specifically related to fees, scope of activities, executive sessions, and monitoring of results;

|

|

|

–

|

there was insufficient oversight of accounting principle implementation;

|

|

|

–

|

there was insufficient review of related party transactions; and

|

|

|

–

|

there was insufficient review of recording of stock transactions.

|

|

|

·

|

We did not maintained sufficient competent evidence to support the effective operation of our internal controls over financial reporting, specifically related to our board of directors' oversight of quarterly and annual SEC filings; and management's review of SEC filings, journal entries, account analyses and reconciliations, and critical spreadsheet controls;

|

|

|

·

|

We had inadequate risk assessment controls, including inadequate mechanisms for anticipating and identifying financial reporting risks; and for reacting to changes in the operating environment that could have a material effect on financial reporting;

|

|

|

·

|

There was inadequate communication from management to employees regarding the general importance of controls and employees duties and control responsibilities;

|

|

|

·

|

We had inadequate monitoring controls, including inadequate staffing and procedures to ensure periodic evaluations of internal controls, to ensure that appropriate personnel regularly obtain evidence that controls were functioning effectively and that identified control deficiencies were remediated in a timely manner;

|

|

|

·

|

We had an inadequate number of trained finance and accounting personnel with appropriate expertise in U.S. generally accepted accounting principles. Accordingly, in certain circumstances, an effective secondary review of technical accounting matters was not performed;

|

|

|

·

|

We had inadequate controls over our management information systems related to program changes, segregation of duties, and access controls;

|

|

|

·

|

We had inadequate access and change controls over end-user computing spreadsheets. Specifically, our controls over the completeness, accuracy, validity and restricted access and review of certain spreadsheets used in the period-end financial statement preparation and reporting process were not designed appropriately or did not operate as designed; and

|

|

|

·

|

We were unable to assess the effectiveness of our internal control over financial reporting in a timely matter.

|

Financial statement preparation and review procedures. We had inadequate policies, procedures and personnel to ensure that accurate, reliable interim and annual consolidated financial statements were prepared and reviewed on a timely basis. Specifically, we had insufficient: a) levels of supporting documentation; b) review and supervision within the accounting and finance departments; c) preparation and review of footnote disclosures accompanying our financial statements; and d) technical accounting resources. These deficiencies resulted in errors in the financial statements and more than a remote likelihood that a material misstatement of our annual or interim financial statements would not be prevented or detected.

Inadequate reviews of account reconciliations, analyses and journal entries. We had inadequate review procedures over account reconciliations, account and transaction analyses, and journal entries. Specifically, deficiencies were noted in the following areas: a) management review of supporting documentation, calculations and assumptions used to prepare the financial statements, including spreadsheets and account analyses; and b) management review of journal entries recorded during the financial statement preparation process. These deficiencies resulted in a more than a remote likelihood that a material misstatement of our annual or interim financial statements would not be prevented or detected.

Inadequate controls over purchases and disbursements. We had inadequate controls over the segregation of duties and authorization of purchases, and the disbursement of funds. These weaknesses increase the likelihood that misappropriation of assets and/or unauthorized purchases and disbursements could occur and not be detected in a timely manner. These deficiencies resulted in errors in the financial statements and in more than a remote likelihood that a material misstatement of our annual or interim financial statements would not be prevented or detected. Specifically,

|

|

·

|

We had inadequate procedures and controls to ensure proper segregation of duties within our purchasing and disbursements processes and accounting systems;

|

|

|

·

|

We had inadequate procedures and controls to ensure proper authorization of purchase orders; and

|

|

|

·

|

We had inadequate approvals for payment of invoices and wire transfers.

|

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management's report in this annual report.

As of March 31, 2015, we had not completed the remediation of any of these material weaknesses.

Attached as exhibits to this report are certifications of our CEO and CFO, which are required in accordance with Rule 13a-14 of Securities Exchange Act of 1934, as amended. The discussion above in this Item 9A includes information concerning the controls and controls evaluation referred to in the certifications and those certifications should be read in conjunction with this Item 9A for a more complete understanding of the topics presented.

We are committed to improving our internal control processes and will continue to diligently review our internal control over financial reporting and our disclosure controls and procedures. The failure to implement adequate controls may result in deficient and inaccurate reports under the Exchange Act.

Item 9B. Other Information

None.

Item 10. Directors, Executive Officers and Corporate Governance

|

Name

|

Age

|

Position

|

|

Wen Wei Wu

|

48

|

Non-Executive Chairman

|

|

Eng Wah Kung

|

50

|

Chief Executive Officer and Director

|

|

Carmen Lum

|

26

|

Chief Financial Officer and Director

|

|

Zhen Long Ho

|

37

|

Chief Operating Officer and Director

|

|

Boon Siong Lee

|

33

|

Director

|

Mr. Wen Wei WU, aged 48, is the non-executive Chairman of the Company. He is a citizen of Macau, China. Mr. Wu is a merchant. From 1984 to 1989, he worked in Longhua Food Factory Co., Ltd. and Mali Plastics Co., Ltd. of Jinjiang City, Fujian Province, China respectively. In 1993, he went to Yiwu City of Zhejiang Province, China to engage in commerce and trade and successively established Yiwu Xiaomuma Ornament Trading Company, Yiwu Weilainina Ornament Co., Ltd., Guangzhou Tiffany Ornament Co., Ltd., etc. During his engaging in the trade business, he studied law in the School of Politics of National University of Defense Technology of PLA and obtained a bachelor's degree. He also participated in many public bodies. In 2005, he established Jinhua Quanzhou Chamber of Commerce and held the post of president of the chamber. Later, he took the posts of permanent honorary chairman of Hong Kong Guying Village Natives Association, Hong Kong Yangxi Social Club, Hong Kong Wu's Clan Association and Hong Kong Overseas Chinese General Chamber of Commerce.

Mr. Eng Wah KUNG, aged 50, is the CEO and executive director of the Company. He holds a First Class Diploma in Hotel Management with Les Roches, Switzerland. He was the General Manager with Hic Inn, Cambodia prior to joining the Company. Mr. Kung has been a general manager for several Southeast Asian hotel operations companies since year 2003, including Nha trang Lodge, Vietnam and NCL Cambodia Pte Ltd. He has over 33 years in the senior general management position in the Meetings/Incentives/Convention/Exhibition industry. He is responsible for over-seeing the future MICE operations of the Company using his extensive skills, knowledge and experience. In fact, Mr. Kung has established good working relationships with the central governments and local authorities of Cambodia, Vietnam and Malaysia.

Miss Carmen LUM, aged 27, is the CFO and executive director of the Company. She is a Practicing Certified Financial Planner with the qualification obtained from the Financial Planning Association of Malaysia. Miss Lum also holds a Bachelor's Degree (Hons) in Financial Economics from the University Tunku Abdul Rahman, Malaysia. Prior to joining the Company, she had been a personal banker with United Overseas Bank, Kuala Lumpur office and a business development manager with the Kuala Lumpur office of Allianz Insurance, a German listed company. Miss Lum has over 6 years' experience of private banking, financial modeling, forecast, assets management and investment advisory services. She is also the Vice President of Step Well Equity Inc. a Nevada company which is principally engaged in provision of corporate finance advisory services to various listed and unlisted companies in Hong Kong, China and Malaysia.

Mr. Zhen Long HO, aged 37, is the Chief Operating Officer and executive director of the Company. He holds a Diploma of Computer Science/ Information Technology from the Institute Technologi Pertama, Malaysia. Prior to joining the company, he is a programmer with Onyx Enterprise Sdn Bhd Malaysia from July 97 till May 2004. From June 2004 till August 2011, he was a software development manager with Profdoc Sdn Bhd Malaysia. From September 2011 onwards, he has been acting as the Chief Technology Officer of Neklstech Sdn Bhd, an Information Technology company providing software and healthcare consultancy. Mr. Ho has over 16 years in the IT industry.

Mr. Boon Siong LEE, aged 33, is an Executive director of the Company. He holds a Bachelor's Degree in Computer Science / Informative Technology from Campbell University. Prior to joining the Company, he was a System Engineer and System Architect with Game Flier (M) Sdn Bhd Malaysia and F-Secure Corporation Sdn Bhd. Mr. Lee has over 11 years of experience in the IT industry.

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Family Relationships

There are no family relationships among our directors, executive officers or persons nominated or chosen by us to become directors or executive officers except that Alexander Kunz is the son of Daniel Kunz.

Legal Proceedings

None of our directors, executive officers, promoters or control persons has been involved in any of the following events during the past 10 years:

|

|

●

|

any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

|

|

|

|

|

●

|

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

|

|

|

|

●

|

being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

|

|

|

|

|

|

|

●

|

being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated any federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated;

|

|

|

|

|

|

|

●

|

any judicial or administrative proceedings resulting from involvement in mail or wire fraud or fraud in connection with any business activity;

|

|

|

|

|

|

|

●

|

and judicial or administrative proceedings based on violations of federal or state securities, commodities, banking or insurance laws and regulations, or any settlement to such actions; or

|

|

|

|

|

|

|

●

|

any disciplinary sanctions or orders imposed by a stock, commodities or derivatives exchange or other self-regulatory organization.

|

Section 16(a) Beneficial Ownership Compliance Reporting

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of our common stock to file reports regarding ownership of, and transactions in, our securities with the SEC and to provide us with copies of those filings. Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons, we believe that during fiscal year ended March 31, 2015 our directors, executive officers and 10% stockholders complied with all applicable filing requirements except that each of Eng Wah Kung and Taipan Pearl Sdn Bhd was late in filing a Form 4 for acquisition of shares of the Company's common stock.

Code of Ethics

We have not yet adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We expect to adopt a code as we develop our business.

Audit Committee

We do not have an audit committee. Our entire Board of Directors carries out the functions of the audit committee.

Our Board has determined that we do not have an audit committee financial expert on our Board carrying out the duties of the audit committee. The Board has determined that the cost of hiring a financial expert to act as a director and to be a member of the audit committee or otherwise perform audit committee functions outweighs the benefits of having an audit committee financial expert on the Board.

Nomination Procedures for Directors

We do not have a nominating committee. Our Board of Directors selects individuals to stand for election as members of the Board, and does not have a policy with regards to the consideration of any director candidates recommended by our security holders. Our Board has determined that it is in the best position to evaluate our company's requirements as well as the qualifications of each candidate when it considers a nominee for a position on our Board. If security holders wish to recommend candidates directly to our Board, they may do so by communicating directly with our President at the address specified on the cover of this annual report. There has not been any change to the procedures that our shareholder may recommend nominees to our Board of Directors.

Item 11. Executive Compensation

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during the years ended March 31, 2015 and 2014 awarded to, earned by or paid to our executive officers. The value attributable to any Option Awards and Stock Awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. As described further in Note 6 – Stockholders' Equity - Common Stock Options to our consolidated year-end financial statements, the assumptions made in the valuation of these option awards and stock awards is set forth.

|

Name and Principal Position

|

|

Year

|

|

Salary

|

|

Bonus Awards

|

|

Stock Awards

|

|

Option Awards

|

|

Non-Equity Plan Compensation

|

|

|

All Other Compensation

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

|

($)

|

|

($)

|

|

|

Wen Wei Wu

|

|

2015

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

-

|

|

-

|

|

|

Chairman

|

2014

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Eng Wah Kung

|

|

2015

|

|

27,000

|

|

-

|

|

-

|

|

-

|

|

225,000

|

|

|

-

|

|

252,000

|

|

|

CEO and Director

|

2014

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Carmen Lum

|

|

2015

|

|

27,000

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

-

|

|

27,000

|

|

|

CFO and Director

|

2014

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Zhen Long Ho

|

|

2015

|

|

36,000

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

-

|

|

36,000

|

|

|

COO and Director

|

2014

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Boon Siong Lee

|

|

2015

|

|

40,500

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

-

|

|

40,500

|

|

|

Director

|

2014

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

Janet Somsen (1)

|

|

2015

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

-

|

|

-

|

|

|

Former CEO and CFO

|

2014

|

266

|

-

|

-

|

-

|

-

|

-

|

266

|

|

|

(1) |

Janet Somsen resigned from all positions with the Company in June, 2014. |

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We currently do not have a compensation committee of the Board of Directors or a committee performing similar functions. It is the view of the Board that it is appropriate for us not to have such a committee because of our size and because the Board as a whole participates in the consideration of executive compensation. None of our executive officers served as a director or member of the compensation committee of any entity that has one or more executive officers serving on our Board.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of June 24, 2015 by (i) each person who is known by us to beneficially own more than 5% of the Company's Common Stock; (ii) each of the Company's officers and directors; and (iii) all of the Company's officers and directors as a group.

Beneficial ownership has been determined in accordance with the rules and regulations of the Securities and Exchange Commission (the "Commission") and includes voting or investment power with respect to the shares. Unless otherwise indicated, the persons named in the table below have sole voting and investment power with respect to the number of shares indicated as beneficially owned by them. Capital stock beneficially owned and percentage ownership is based on 20,800,338 shares of Common Stock outstanding on June 24_, 2015 and assuming the exercise of any options or warrants or conversion of any convertible securities held by such person, which are presently exercisable or will become exercisable within 60 days of June 24, 2015.

|

Name of Beneficial Owner (1)

|

|

Common Stock Beneficially Owned

|

|

|

|

|

|

Percentage of Common Stock (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taipan Pearl Sdn Bhd (3)

|

|

|

11,648,235

|

(3 |

) |

|

|

|

|

|

56.00

|

%

|

|

Wen Wei Wu (Chairman)

|

|

|

2,912,059

|

|

|

|

|

|

|

|

14.00

|

%

|

|

Boon Siong Lee (Director)

|

|

|

400,000

|

|

|

|

|

|

|

|

1.92

|

%

|

|

Eng Wah Kung (CEO and Director)

|

|

|

100.000

|

|

|

|

|

|

|

|

0.48

|

%

|

|

Carmen Lum (CFO and Director)

|

|

|

0

|

|

|

|

|

|

|

|

-

|

|

|

Zhen Lung Ho (COO and Director)

|

|

|

200,000

|

|

|

|

|

|

|

|

0.96

|

%

|

* Less than 1%

|

(1)

|

Except as otherwise indicated, the corresponding address of each beneficial owner is Glorywin Entertainment Group Inc., Room 8, 20/F, AIA Tower, No's 251A-301 Avenida Commercial De Macau, Macau.

|

|

(2)

|

Applicable percentage ownership is based on 20,800,338 shares of common stock outstanding as of March 31, 2015.

|

|

(3)

|

Sing Hong Ting is the beneficial owner of the shares owned by Taipan Pearl Sdn Bhd.

|

Change of Control

As of the date of this report, we had no pension plans or compensatory plans or other arrangements that provide compensation in the event of a termination of employment or a change in our control.

Item 13. Certain Relationships and Related Transactions, and Director Independence

The Company's officers, directors and related parties, from time to time, provided advances to the Company for working capital purpose. These advances are short-term in nature, unsecured and payable on demand. The due to related parties amount on March 31, 2015 and 2014 was as follows:

|

Name of related parties

|

Relationship with the Company

|

|

Interests of borrowing

|

|

|

March 31, 2015

|

|

|

March 31, 2014

|

|

|

Wenwei Wu

|

Shareholder of 14% of the Company's interest

|

|

|

0

|

%

|

|

$

|

347,177

|

|

|

$

|

-

|

|

|

BK Consulting

|

former majority shareholder

|

|

|

8

|

%

|

|

|

-

|

|

|

|

3,500

|

|

|

Total

|

|

|

|

|

|

|

$

|

347,177

|

|

|

$

|

3,500

|

|

On June 17, 2014, Janet Somsen, the Glorywin's original owner, sold 4,365,000 shares to Taipan Pearl Sdn Bhd and Wenwei Wu. As part of the security purchase agreement, all the debts of the Glorywin as of the transaction date would be repaid by Ms. Somsen. On the same day, Glorywin issued 10,195,294 restricted shares to Wenwei Wu, Taipan Pearl Sdn Bhd, Boom Siong Lee and Zhen Long Ho for their interest in the 1,000 shares of Top Point. Simultaneously, Glorywin paid MOP60,000 (approximately $7,692) to acquire Wonderful Gate from Carmen Lum, who was later appointed as Chief Financial Officer of the Company. See Note 1 – NATURE OF BUSINESS for details.

On November 18, 2014, the Company issued 600,000 restricted shares of common stock to Taipan Pearl Sdn Bhd and 100,000 restricted shares of common stock to Eng Wah Kung, the Company's Chief Executive Officer, as consideration for their services provided. The total fair value of the common stock was $1,400,000 based on the closing price of the Company's common stock on the date of grant.

On October 22, 2014, the Company orally entered into a conditional sale agreement ("Conditional Sale Agreement"), which was later put into a written form on January 19, 2015, with Taipan Pearl Sdn Bhd, shareholder of 56% of the Company's interest. Pursuant to the Conditional Sale Agreement, the Company shall pay a total price of $2,000,000 to acquire Gwin Company Limited ("Target Company", or "Gwin"), which is solely owned by Mr Sing Hong Ting, the 100% beneficial owner of Taipan Pearl Sdn Bhd. The sale would be completed under conditions that the Target Company becomes profitable within 12 months from the date of the Conditional Sale Agreement and that the Target Company maintains all necessary licenses to be operational. If the two conditions are not satisfied, the amount paid will be fully refunded. On February 18, 2015, the Company signed a supplementary agreement to the Conditional Sale Agreement ("Supplementary Agreement") with Taipan Pearl Sdn Bhd, pursuant to which, another $2,000,000 would be paid by the Company for acquisition of the Target Company. The incremental $2,000,000 would be used in renovating and operating of the Target Company. As of March 31, 2015, the Company paid a total of $3,180,425 and additional 463,286 as of the filing date. Since both the Conditional Sale Agreement and Supplementary Agreement are signed between entities under common control, the transaction was recorded as a distribution to shareholder with the payment is reflected as a reduction of shareholders' equity (additional paid-in capital).

Related Person Transaction Policy

Our Board of Directors is responsible to approve all related party transactions. We have not adopted written policies and procedures specifically for related person transactions.

Director Independence

The OTCQB on which our common stock is quoted does not have any director independence requirements. We currently use NASDAQ's general definition for determining director independence, which states that "independent director" means a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship, that, in the opinion of the company's board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of the director. Glorywin Entertainment Group Inc. meet this definition of independence.

Item 14. Principal Accountant Fees and Services

Audit and Non-Audit Fees

The following table sets forth the fees for professional audit services and the fees billed for other services rendered by our auditors, M&K CPAS, PLLC and Malone Bailey, LLP, in connection with the audit of our financial statements for the years ended March 31, 2015 and 2014, and any other fees billed for services rendered by our auditors during these periods.

|

|

|

Year Ended

March 31, 2015($)

|

|

|

Year Ended

March 31, 2014($)

|

|

|

Audit fees

|

|

|

60,000

|

|

|

|

7,250

|

|

|

Audit-related fees

|

|

|

|

|

|

|

|

|

|

Tax fees

|

|

|

|

|

|

|

|

|

|

All other fees

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

60,000

|

|

|

|

7,250

|

|

Since our inception, our Board of Directors, performing the duties of the audit committee, has reviewed all audit and non-audit related fees at least annually. The Board, acting as the audit committee, pre-approved all audit related services for the year ended March 31, 2015.

Item 15. Exhibits, Financial Statement Schedules

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Articles of Incorporation (1)

|

|

3.2

|

|

Bylaws (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

| |

(1)

|

Incorporated herein by reference to exhibits to our registration statement on Form S-1 filed with the SEC on April 22, 2011.

|

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: July 14, 2015

|

GLORYWIN ENTERTAINMENT GROUP INC.

|

|

|

|

|

|

|

By:

|

/s/Eng Wah Kung

|

|

|

|

Eng Wah Kung

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

By:

|

/s/ Carmen Lum

|

|

|

|

Carmen Lum

|

|

|

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

|

Signature

|

|

Capacity

|

|

Date

|

|

|

|

|

|

|

|

/s/ Wen Wei Wu

|

|

Chairman

|

|

July 14, 2015

|

|

Wen Wei Wu

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Eng Wah Kung

|

|

Chief Executive Officer and Director

|

|

July 14, 2015

|

|

Eng Wah Kung

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Carmen Lum

|

|

Chief Financial Officer and Director

|

|

July 14, 2015

|

|

Carmen Lum

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Zhen Long Ho

|

|

Chief Operating Officer and Director

|

|

July 14, 2015

|

|

Zhen Long Ho

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Boon Siong Lee

|

|

Director

|

|

July 14, 2015

|

|

Boon Siong Lee

|

|

|

|

|

GLORYWIN ENTERTAINMENT GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE FISCAL YEARS ENDED MARCH 31, 2015 AND 2014

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

F - 2

|

|

Consolidated Financial Statements:

|

|

|

|

F - 4

|

|

|

F - 5

|

|

|

F - 6

|

|

|

F - 7

|

|

|

F - 8

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Glorywin Entertainment Group, Inc. and Subsidiaries,

We have audited the accompanying consolidated balance sheet of Glorywin Entertainment Group, Inc. and its subsidiaries (collectively, the "Company") as of March 31, 2015, and the related consolidated statements of operations and comprehensive income (loss), changes in stockholders' equity, and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of March 31, 2015, and the results of their operations and their cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

July 15, 2015

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Zippy Bags, Inc.

(A Development Stage Company)

We have audited the accompanying balance sheets of Zippy Bags, Inc. (A Development Stage Company) as of March 31, 2014 and 2013, and the related statements of operations, changes in stockholders' equity (deficit) and cash flows for the years then ended, and the period from inception on August 26, 2010 through March 31, 2014. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company was not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Zippy Bags, Inc. (A Development Stage Company) as of March 31, 2014 and 2013, and the results of its operations and cash flows for the periods described above in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has an accumulated deficit of $118,524 which raises substantial doubt about its ability to continue as a going concern. Management's plans concerning these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ M&K CPAS, PLLC

www.mkacpas.com

Houston, Texas

June 4, 2014

GLORYWIN ENTERTAINMENT GROUP, INC. AND SUBSIDIARIES

(FORMERLY ZIPPY BAGS, INC.)

CONSOLIDATED BALANCE SHEETS

As of March 31, 2015 and 2014

|

|

|

As of March 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

ASSETS

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

28,873

|

|

|

$

|

-

|

|

|

Accounts receivable

|

|

|

463,205

|

|

|

|

-

|

|

|

Other current assets

|

|

|

4,294

|

|

|

|

-

|

|

|

Total current assets

|

|

|

496,372

|

|

|

|

-

|

|

|

Total assets

|

|

$

|

496,372

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

-

|

|

|

$

|

1,650

|

|

|

Accrued liabilities and other payables

|

|

|

74,965

|

|

|

|

-

|

|

|

Taxes payable

|

|

|

343,971

|

|

|

|

11,719

|

|

|

Other payables – related parties

|

|

|

347,177

|

|

|

|

-

|

|

|

Convertible notes payable, related party, net

|

|

|

-

|

|

|

|

3,500

|

|

|

Total current liabilities

|

|

|

766,113

|

|

|

|

16,869

|

|

|

Total liabilities

|

|

|

766,113

|

|

|

|

16,869

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity (deficit)

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 490,000,000 shares authorized, 20,800,338 shares and 9,805,044 shares issued and outstanding as of March 31, 2015 and 2014, respectively

|

|

|

20,800

|

|

|

|

9,805

|

|

|

Additional paid-in capital

|

|

|

(1,490,393

|

)

|

|

|

91,850

|

|

|

Accumulated other comprehensive loss

|

|

|

(3,756

|

)

|

|

|

-

|

|

|

Retained earnings (deficit)

|

|

|

1,203,608

|

|

|

|

(118,524

|

)

|

|

Total shareholders' deficit

|

|

|

(269,741

|

)

|

|

|

(16,869

|

)

|

|

Total liabilities and shareholders' deficit

|

|

$

|

496,372

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of the consolidated financial statements.

GLORYWIN ENTERTAINMENT GROUP, INC. AND SUBSIDIARIES

(FORMERLY ZIPPY BAGS, INC.)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

For the Fiscal Years Ended March 31, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended March 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

Revenues

|

|

$

|

3,853,913

|

|

|

$

|

-

|

|

|

Gross profit

|

|

|

3,853,913

|

|

|

|

-

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

2,012,146

|

|

|

|

8,232

|

|

|

Professional fees

|

|

|

175,633

|

|

|

|

17,354

|

|

|

Total operating expenses

|

|

|

2,187,779

|

|

|

|

25,586

|

|

|

Income (loss) from operations:

|

|

|

1,666,134

|

|

|

|

(25,586

|

)

|

|

Other expenses:

|

|

|

|

|

|

|

|

|

|

Interest expenses

|

|

|

-

|

|

|

|

(33,725

|

)

|

|

Total other expenses

|

|

|

-

|

|

|

|

(33,725

|

)

|

|

Income (loss) before provision for income taxes

|

|

|

1,666,134

|

|

|

|

(59,311

|

)

|

|

Provision for income taxes

|

|

|

(344,002

|

)

|

|

|

-

|

|

|

Net income (loss)

|

|

$

|

1,322,132

|

|

|

$

|

(59,311

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

1,322,132

|

|

|

$

|

(59,311

|

)

|

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

(3,756

|

)

|

|

|

-

|

|

|

Total comprehensive income (loss)

|

|

$

|

1,318,376

|

|

|

$

|

(59,311

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.07

|

|

|

$

|

(0.11

|

)

|

|

Diluted

|

|

$

|

0.07

|

|

|

$

|

(0.11

|

)

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

18,049,602

|

|

|

|

536,457

|

|

|

Diluted

|

|

|

18,049,602

|

|

|

|

536,457

|

|

The accompanying notes are an integral part of the consolidated financial statements.

GlORYWIN ENTERTAINMENT GROUP, INC. AND SUBSIDIARIES

(FORMERLY ZIPPY BAGS, INC.)

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (DEFICIT)

For the Years Ended March 31, 2015 and 2014

|

|

|