Fission Uranium Corp. Announces Closing of Offering

April 01 2014 - 11:59AM

Marketwired

Fission Uranium Corp. Announces Closing of Offering

KELOWNA, BRITISH COLUMBIA--(Marketwired - Apr 1, 2014) - Fission

Uranium Corp. (TSX-VENTURE:FCU)(OTCQX:FCUUF)(FRANKFURT:2FU)

("Fission" or the "Company") is pleased to announce that it has

completed its previously announced private placement of 15,625,000

special warrants (the "Special Warrants"), at a price of $1.60 per

Special Warrant, for gross proceeds of $25,000,000 (the

"Offering"). The Offering was conducted on a bought deal basis by a

syndicate of underwriters led by Dundee Securities Ltd. and

including Cantor Fitzgerald Canada Corporation, Macquarie Capital

Markets Canada Ltd., Raymond James Ltd., BMO Nesbitt Burns Inc., TD

Securities Inc., Clarus Securities Inc. and Cormark Securities Inc.

(collectively, the "Underwriters"). On March 27, 2014, the

Underwriters exercised their over-allotment option (the "Option")

in full to purchase an additional 2,343,750 Special Warrants at a

price of $1.60 per Special Warrant, which increased the gross

proceeds of the Offering to $28,750,000.

Each Special Warrant is exercisable by the holders thereof into

one common share (a "Common Share") in the capital of the Company

at any time after April 1, 2014 (the "Closing Date") for no

additional consideration and all unexercised Special Warrants will

be deemed to be exercised at 4:00 pm (Toronto time) on the earlier

of: a) the date that is four months and one day following the

Closing Date, and b) the first business day after a receipt is

issued for a final prospectus (the "Final Prospectus") qualifying

the Common Shares to be issued upon the exercise or deemed exercise

of the Special Warrants by the securities regulatory authorities in

the Canadian provinces where the Special Warrants were sold.

The Company shall use its reasonable best efforts to obtain such

receipt for the Final Prospectus within 30 calendar days following

the Closing Date.

In connection with the Offering, the Underwriters received a

cash commission equal to 5.0% of the gross proceeds raised under

the Offering (inclusive of the Option) and 898,438 non-transferable

broker warrants. Each broker warrant is exercisable for one Common

Share of the Company until April 1, 2016 at a price of $1.60 per

broker warrant.

All securities issued are subject to a statutory hold period

expiring on the earlier of: (a) the date that is four months and

one day following the Closing Date, and (b) the first business day

after a receipt is issued for a Final Prospectus by the securities

regulatory authorities.

The net proceeds of the Offering will be used for exploration

and development and for working capital and general corporate

purposes.

About Fission Uranium Corp.

Fission Uranium Corp. is a Canadian based resource company

specializing in the strategic exploration and development of the

Patterson Lake South uranium property and is headquartered in

Kelowna, British Columbia. Common Shares are listed on the TSX

Venture Exchange under the symbol "FCU" and trade on the OTCQX

marketplace in the U.S. under the symbol "FCUUF".

ON BEHALF OF THE BOARD

Dev Randhawa, Chairman & CEO

Cautionary Statement: Certain information contained in this

press release constitutes "forward-looking information", within the

meaning of Canadian legislation. Generally, these forward-looking

statements can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur", "be achieved" or "has the potential to".

Forward looking statements contained in this press release include

statements regarding the Offering, the Special Warrants and the

Final Prospectus, which involve known and unknown risks and

uncertainties and which may not prove to be accurate. Actual

results and outcomes may differ materially from what is expressed

or forecasted in these forward-looking statements. Such statements

are qualified in their entirety by the inherent risks and

uncertainties surrounding future expectations. Among those factors

which could cause actual results to differ materially are the

following: market conditions and other risk factors listed from

time to time in our reports filed with Canadian securities

regulators on SEDAR at www.sedar.com. The forward-looking

statements included in this press release are made as of the date

of this press release and the Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities

legislation.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Fission Uranium Corp.Rich MatthewsInvestor RelationsTF:

877-868-8140rich@fissionuranium.comwww.fissionuranium.com

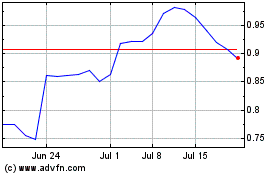

Fission Uranium (QX) (USOTC:FCUUF)

Historical Stock Chart

From Jan 2025 to Feb 2025

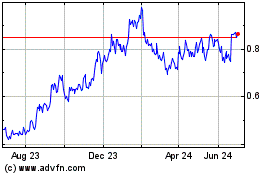

Fission Uranium (QX) (USOTC:FCUUF)

Historical Stock Chart

From Feb 2024 to Feb 2025