UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 000-55607

First Mining

Gold Corp.

(Translation of registrant's name into English)

Suite 2070, 1188 West Georgia Street, Vancouver, B.C., V6E

4A2

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

First Mining Gold Corp. |

| |

|

(Registrant) |

| |

|

|

| |

|

|

| Date: June 18, 2024 |

|

/s/ Lisa Peterson |

| |

|

Lisa Peterson |

| |

|

Chief Financial Officer and Corporate Secretary |

| |

|

|

Exhibit 99.1

First Mining Identifies Multiple

High-Grade Gold Zones in Duparquet Exploration Drilling

- Drill hole DUP24-024 returns

multiple gold zones including 10.67 g/t Au over 5.3 m, 6.63 g/t Au over 9.0 m, 3.04 g/t Au over 33.5 m, and

5.97 g/t Au over 33.0 m

- Gold zones hosted in newly

identified mafic volcanic units not previously modelled at Duparquet

- Demonstrates significant exploration

growth potential at one of the largest gold deposits in the Abitibi Greenstone Belt

VANCOUVER, BC, June 18, 2024 /CNW/ - First

Mining Gold Corp. ("First Mining" or the "Company") (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG) is pleased

to announce new drilling results from the 2024 Phase 2B winter diamond drilling program at its Duparquet Gold Project ("Duparquet

Project" or the "Project") located in Quebec, Canada. This latest drilling targeted additional exploration

trends of the North Zone, assessing the potential for higher-grade areas with extensional continuity. Drill hole DUP24-024 returned multiple

intervals of significant higher-grade mineralization over considerable widths that are hosted proximal to and within a newly identified

mafic volcanic unit, including 10.67 g/t Au over 5.3 m, 6.63 g/t Au over 9 m, 3.04 g/t Au over 33.5 m, and 5.97 g/t Au over 33 m (including

9.63 g/t Au over 4.2 m and 14.43 g/t Au over 6 m). First Mining continues to explore mineralization trends of the Duparquet Project

for extensions and new discovery zones through its ongoing Phase 3 drill program which aims to continue drill testing at the North Zone,

Buzz Zone, Valentre Target and additional regional opportunities.

"The higher-grade zones at these exceptional

widths at Duparquet clearly demonstrate the ongoing resource growth potential in what is already one of the largest established resources

in the Abitibi Greenstone Belt," stated Dan Wilton, CEO of First Mining. "What I am most excited about is the fact that this

new host unit where identified has never been a focus of exploration at Duparquet, demonstrating the value of our exploration team's systematic,

data-driven approach to discovery which challenges the exploration biases of past operators. With our recent flow-through financing

completed, First Mining is well funded to continue delivering exceptional results at Duparquet."

The Phase 2B winter program concluded in April 2024

and comprised a seven-hole, 2,856 m drill program. The objective of this drilling phase within the overall program was to target further

exploration and resource growth opportunities, with a focus on grade optimization and depth extension targets. Highlights from the first

drill holes completed in Phase 2B included drill hole DUP24-018 which returned 3.11 g/t Au over 13.16 m, and hole DUP24-019 which returned

3.07 g/t Au over 10.32 m at the North Zone (See news release from May 21, 2024), validating the geoscience approach and supporting further

testing of the extensional opportunities of the North Zone.

Three more holes were drilled within the Phase 2B

winter program and these were strategic in targeting the North Zones' higher-grade trends along strike and down-plunge. These latest drill

results have further validated the upside potential for the Project within the North Zone, where multiple intersections of significant

gold mineralization were encountered which are consistent with higher-grade trends (Table 1).

Table 1: Selected Significant Drill Intercepts,

2024 Phase 2B Drill Program (Final Holes)

| Hole ID |

|

From (m) |

To (m) |

Length (m) |

Grade (Au g/t) |

Target |

| DUP24-022 |

|

598.45 |

605.58 |

7.13 |

2.47 |

North Zone |

| DUP24-023 |

|

131.0 |

149.45 |

18.45 |

2.38 |

| DUP24-023 |

inc. |

135.1 |

139.2 |

4.1 |

5.58 |

| DUP24-023 |

|

170.82 |

173.6 |

2.78 |

4.43 |

| DUP24-023 |

inc. |

171.6 |

172.3 |

0.7 |

9.80 |

| DUP24-024 |

|

9.0 |

12.0 |

3.0 |

2.15 |

| DUP24-024 |

inc. |

10.0 |

11.0 |

1.0 |

4.25 |

| DUP24-024 |

|

40.4 |

52.55 |

12.15 |

0.95 |

| DUP24-024 |

|

106.2 |

113.23 |

7.03 |

1.61 |

| DUP24-024 |

|

362 |

365.25 |

3.25 |

2.11 |

| DUP24-024 |

inc. |

364.5 |

365.25 |

0.75 |

6.05 |

| DUP24-024 |

|

448.4 |

453.7 |

5.3 |

10.67 |

| DUP24-024 |

|

464.0 |

470.0 |

6.0 |

1.05 |

| DUP24-024 |

|

476.0 |

485.0 |

9.0 |

6.63 |

| DUP24-024 |

|

488.5 |

522.0 |

33.5 |

3.04 |

| DUP24-024 |

inc. |

503.0 |

507.0 |

4.0 |

4.42 |

| DUP24-024 |

and inc. |

518.0 |

522.0 |

4.0 |

14.78 |

| DUP24-024 |

|

534.0 |

567.0 |

33.0 |

5.97 |

| DUP24-024 |

inc. |

534.7 |

538.9 |

4.2 |

9.63 |

| DUP24-024 |

and inc. |

547.0 |

553.0 |

6.0 |

14.43 |

| DUP24-024 |

|

600.0 |

601.0 |

1.0 |

4.72 |

*Reported

intervals are drilled core lengths (true widths are estimated at 15-45% of the core length

interval, assay values are uncut)

|

A plan map of the final Phase 2B winter exploration

holes at the North Zone target is presented in Figure 1, and corresponding assay highlights presented in Table 1, with full assay results

listed in Table 2 and drill hole locations in Table 3.

Figure 1: Plan view of select drill holes from the

Phase 2B program within the North Zone (CNW Group/First Mining Gold Corp.)

Additional Details on North Zone Drilling

The North Zone drilling strategy is focused on targeting

strike extension opportunities, as well as drill testing multiple deeper, higher-grade trends that support down-plunge extension of the

mineralization. The North Zone mineralization is traditionally modelled largely within porphyritic syenite units with strong sericite

and silica alteration, with higher grades being returned in zones with increased alteration, 2-5% sulphides, quartz carbonate veining,

and brecciation associated with sheared contacts. The increased alteration and veining are spatially coincident with project modelling

associated with D2 high strain zones that are interpreted splay shear zones from the Destor-Porcupine Fault Zone.

First Mining's exploration targeting and vectoring

has been focused on higher-grade trends believed to be within zones that are associated with a change in specific lithology. Consequently,

there has been an increased focus in building up the target resolution through 3D modelling of the contact zones between the syenite-hosted

gold mineralization and mafic volcanic stratigraphy, as these are more favourable, proximal settings for higher-grade mineralization owing

to their geochemical and rheological attributes.

Since the Company started drilling at the Project

in 2023 it has had success in targeting these contact zones and this has become one of the more favourable targeting strategies for higher-grade

trends outside of the traditional Beattie syenite. A key factor contributing to these successes is the integration of multiple sources

of geoscience data into the 3D modelling and target definition process, including geochemistry, geophysics, oriented core and magnetic

susceptibility data.

Three additional drillholes were completed for a total

of 1,527.4 m, all targeting the modelled sheared contact of the syenite and the mafic volcanics at the northern contact zone of the main

resource ("North Zone Target").

Drill hole DUP24-022 (Figure 2) was drilled as a step-out

hole along strike of the main mineralized shear zone at Duparquet, within an area identified with significant extensional resource

growth potential. Historical drilling within the area largely occurred above the plunge of the main mineralization system, so this

new hole targeted an extensional opportunity within the target area. Hole DUP24-022, as an initial hole successfully returned a significant

assay intercept that correlated with the interpreted extension of the targeted main mineralized shear zone, with 2.47 g/t Au over

7.13 m from 598.45 m to 605.58 m. Mineralization within this interval is hosted within a strongly sheared and silica-altered basalt, with

quartz carbonate veining representing up to 10% of the core and up to 10% disseminated pyrite mineralization locally. The mafic volcanic

unit intercepted in DUP24-022 will be further refined in the upcoming geological model updates. As a successful step-out along strike

within this initial vectoring hole, First Mining realizes an important opportunity for additional step-outs that could have a significant

potential for resource growth. A series of drill holes are currently in the planning stage to further test the open mineralization

along strike and down-plunge during the Phase 3 program.

Figure 2: North Zone Target - DUP24-022 is a step-out

hole towards the east of the previously announced DUP24-018 and DUP24-019. Significant intercepts are highlighted downhole, with higher-grade

zones identified along the contact of the syenite and the sheared basalt unit. The mafic unit intercepted in DUP24-022 will be refined

in the upcoming geological model updates. This cross section is looking west (CNW Group/First Mining Gold Corp.)

Drill hole DUP23-023 (Figure 3) was drilled as a down-plunge,

extensional follow-up opportunity to the significant intervals returned from DUP24-019 (3.07g/t Au over 10.32 m from 87.94 m to 98.26

m, including 9.19 g/t Au over 0.85 m from 87.94 m to 98.26 m, and 3.19 g/t Au over 4.53 m from 102.30 to 106.83 m, as reported on May

21, 2024). These holes targeted higher-grade zones along the main mineralized shear zone at the northern contact of the syenite body,

with DUP24-023 further validating the continuation of the higher-grade mineralization at depth. Highlights from the main mineralized shear

zone in DUP24-023 include 2.38 g/t Au over 18.45 m (including 5.58 g/t Au over 4.1 m) from 131 m to 149.45 m, and 4.43 g/t Au over 2.78

m from 170.82 m to 173.6 m. These significant intercepts are hosted within a zone of strongly foliated basalt and syenite that is associated

with strong silica and sericite alteration, quartz carbonate veining including up to 10% in localized areas, and up to 10% disseminated

pyrite. First Mining is pleased with the successful down-plunge validation of the higher-grade zones as it continues to support follow-up

programs targeting the depth extension of these zones.

Figure 3: North Zone Target cross section of drill

hole DUP24-023, highlighting the extension of the higher-grade zone below the previously announced DUP24-019 (CNW Group/First Mining Gold

Corp.)

An important highlight of the Phase 2B winter program

was drill hole DUP23-024 (Figure 5), which was targeting multiple zones and included stepping out to the east of DUP24-018 and drill testing

the extension of an interpreted shear-hosted zone within the syenite, as well as testing the continuity of the shear and higher-

grade mineralization zone at the contact zones of the syenite and mafic volcanic units.

Drill hole DUP24-024 returned multiple intercepts

of significant gold values, with the highlights from the main mineralized shear zone being 10.67 g/t Au over 5.3 m from 448.4 m to 453.7

m, hosted within a 5.3 m wide brecciated quartz-carbonate vein with up to 5% pyrite mineralization that is emplaced along a syenite-basalt

contact (Figure 5). A second zone of significant mineralization was intercepted within a strongly sheared and brecciated rhyolite unit

with up to 3% disseminated pyrite, which returned 6.63 g/t Au over 9.0 m from 476.0 m to 485.0 m. A third zone, and the second syenite-basalt

contact unit within this hole, was intercepted which returned 3.04 g/t Au over 33.5 m from 488.5 m to 522.0 m (including 4.42 g/t Au over

4.0 m and 14.78 g/t Au over 4.0 m), and for this zone strongly brecciated, silica-altered syenite and basalt units with up to 10% localized

area of quartz veining and up to 15% disseminated pyrite mineralization were intercepted (Figure 5). The fourth significant interval in

this hole was hosted within a localized sheared and brecciated silica-altered basalt unit, with up to 10% quartz vein flooding and

up to 3% disseminated pyrite mineralization, and this zone returned 5.97 g/t Au over 33.0 m from 534.0 m to 567.0 m (including 9.63 g/t

Au over 4.2 m, and 14.43 g/t Au over 6.0 m). A favourable setting is recognized with the newly identified mineralized basalt units

at this locality (Figure 6), and further refinement of the geological model, followed up by extensional drill testing will be a priority

in the upcoming Phase 3 program.

Figure 4: North Zone Target – Drill hole DUP24-024

highlighting multiple significant intercepts downhole, with higher-grade zones identified along the contact of the syenite and the basalt

units intercepted. The mafic unit intercepted in DUP24-024 will be refined in the upcoming geological model updates. This cross section

is looking west. (CNW Group/First Mining Gold Corp.)

Figure 5 (A) Close-up photo of pyrite mineralization

in the mafic volcanics and higher-grade mineralization from drill hole DUP24-024 at 518.5 m which was targeting the North Zone. (B) Close-

up photo of mineralized quartz carbonate veining from drill hole DUP24-024 at 449 m which was targeting the North Zone and has higher

grade mineralisation associated with it. (CNW Group/First Mining Gold Corp.)

Figure 6: Section through DUP24-022 and DUP24-024

highlighting the downhole lithologies and significant intercepts. Upcoming geological model updates will focus on increasing the resolution

of the mafic volcanic units in the North Zone target area. (CNW Group/First Mining Gold Corp.)

The North Zone target has returned significant upside

and value to the Duparquet Project and is a priority area for exploration optimization and potential extension of the current open pit

and underground resource. The recent drill results continue to support the area as a highly prospective target zone for the Project, with

potential to unlock meaningful upside along strike and at depth (Figure 7).

Figure 7: Representative long section through the

North Zone, highlighting the multiple significant intercepts returned in the Phase 2B program as well as the upcoming drill hole targets

aimed at unlocking exploration opportunities (CNW Group/First Mining Gold Corp.)

"Our geoscience teams have created exceptional

momentum and continue to deliver strong results with additional drilling", stated James Maxwell, Vice President of Exploration and

Project Operations. "Recognition of a new higher-grade host lithology within the latest result setting greatly advances our ability

to target this higher-grade trend and supports an opportunity for further characterization and discovery."

Duparquet 2024 Exploration Programs

Exploration activities will be advancing at the Duparquet

project through 2024 with continued focus on drilling, regional field work programs that commenced early this spring, and integrating

the data from recently acquired airborne geophysical magnetic and LiDAR surveys. A property-wide expanded 3D geological and target model

is also in development and the ongoing integration and leveraging of layered datasets supports the targeting based on an integrated geoscience

exploration strategy.

Table 2: Final Phase 2B Winter Program Drill Results

| Hole ID |

|

From (m) |

To (m) |

Length (m) |

Grade (Au g/t) |

| DUP24-022 |

|

598.45 |

605.58 |

7.13 |

2.47 |

| DUP24-022 |

|

637.00 |

638.00 |

1.00 |

0.42 |

| DUP24-023 |

|

16.00 |

18.00 |

2.00 |

0.58 |

| DUP24-023 |

|

35.52 |

36.45 |

0.93 |

0.62 |

| DUP24-023 |

|

48.83 |

49.60 |

0.77 |

1.54 |

| DUP24-023 |

|

80.00 |

81.00 |

1.00 |

0.44 |

| DUP24-023 |

|

87.33 |

87.88 |

0.55 |

0.99 |

| DUP24-023 |

|

96.00 |

97.00 |

1.00 |

0.42 |

| DUP24-023 |

|

101.41 |

105.00 |

3.59 |

0.68 |

| DUP24-023 |

|

131.00 |

149.45 |

18.45 |

2.38 |

| DUP24-023 |

incl. |

135.10 |

139.20 |

4.10 |

5.58 |

| DUP24-023 |

|

170.82 |

173.60 |

2.78 |

4.43 |

| DUP24-023 |

incl. |

171.60 |

172.30 |

0.70 |

9.80 |

| DUP24-024 |

|

9.00 |

12.00 |

3.00 |

2.15 |

| DUP24-024 |

incl. |

10.00 |

11.00 |

1.00 |

4.25 |

| DUP24-024 |

|

15.00 |

15.97 |

0.97 |

0.44 |

| DUP24-024 |

|

19.00 |

20.00 |

1.00 |

0.42 |

| DUP24-024 |

|

40.40 |

52.55 |

12.15 |

0.95 |

| DUP24-024 |

|

73.00 |

74.00 |

1.00 |

0.76 |

| DUP24-024 |

|

106.20 |

113.23 |

7.03 |

1.61 |

| DUP24-024 |

|

122.21 |

123.29 |

1.08 |

1.07 |

| DUP24-024 |

|

126.83 |

127.65 |

0.82 |

0.99 |

| DUP24-024 |

|

136.13 |

137.00 |

0.87 |

1.84 |

| DUP24-024 |

|

161.65 |

163.48 |

1.83 |

1.03 |

| DUP24-024 |

|

171.00 |

173.00 |

2.00 |

0.88 |

| DUP24-024 |

|

182.00 |

183.00 |

1.00 |

0.49 |

| DUP24-024 |

|

191.09 |

192.04 |

0.95 |

0.43 |

| DUP24-024 |

|

196.00 |

197.00 |

1.00 |

0.71 |

| DUP24-024 |

|

210.20 |

210.90 |

0.70 |

0.51 |

| DUP24-024 |

|

230.00 |

231.00 |

1.00 |

0.66 |

| DUP24-024 |

|

245.00 |

246.00 |

1.00 |

0.65 |

| DUP24-024 |

|

266.70 |

267.45 |

0.75 |

1.08 |

| DUP24-024 |

|

346.00 |

348.00 |

2.00 |

0.47 |

| DUP24-024 |

|

351.00 |

356.00 |

5.00 |

0.92 |

| DUP24-024 |

|

362.00 |

365.25 |

3.25 |

2.11 |

| DUP24-024 |

incl. |

364.50 |

365.25 |

0.75 |

6.05 |

| DUP24-024 |

|

431.10 |

431.60 |

0.50 |

0.48 |

| DUP24-024 |

|

437.00 |

437.50 |

0.50 |

0.47 |

| DUP24-024 |

|

438.80 |

440.50 |

1.70 |

0.68 |

| DUP24-024 |

|

448.40 |

453.70 |

5.30 |

10.67 |

| DUP24-024 |

|

455.00 |

455.60 |

0.60 |

0.67 |

| DUP24-024 |

|

458.00 |

460.00 |

2.00 |

1.30 |

| DUP24-024 |

|

464.00 |

470.00 |

6.00 |

1.05 |

| DUP24-024 |

|

476.00 |

485.00 |

9.00 |

6.63 |

| DUP24-024 |

|

488.50 |

522.00 |

33.50 |

3.04 |

| DUP24-024 |

incl. |

503.00 |

507.00 |

4.00 |

4.42 |

| DUP24-024 |

and incl. |

518.00 |

522.00 |

4.00 |

14.78 |

| DUP24-024 |

|

527.00 |

528.00 |

1.00 |

4.04 |

| DUP24-024 |

|

534.00 |

567.00 |

33.00 |

5.97 |

| DUP24-024 |

incl |

534.70 |

538.90 |

4.20 |

9.63 |

| DUP24-024 |

and incl. |

547.00 |

553.00 |

6.00 |

14.43 |

| DUP24-024 |

|

570.00 |

570.50 |

0.50 |

0.48 |

| DUP24-024 |

|

582.70 |

584.20 |

1.50 |

1.34 |

| DUP24-024 |

|

587.20 |

590.00 |

2.80 |

0.42 |

| DUP24-024 |

|

600.00 |

601.00 |

1.00 |

4.72 |

| DUP24-024 |

|

604.00 |

604.70 |

0.70 |

1.63 |

| *Reported intervals are drilled core lengths (true widths are estimated at 15-45% of the core length interval; assay values are uncut) |

Table 3: Final Phase 2B Winter Drill Hole Locations,

Duparquet Gold Project

| Hole ID |

Azimuth (°) |

Dip (°) |

Length (m) |

Easting |

Northing |

| DUP24-022 |

160 |

-65 |

642.0 |

632280 |

5374770 |

| DUP24-023 |

15 |

-60 |

264.0 |

631538 |

5374500 |

| DUP24-024 |

358 |

-66 |

621.3 |

632071 |

5374355 |

| Note: Collar coordinates in UTM NAD 83 z17 |

About the Duparquet Gold Project

The Duparquet Project is geologically situated in

the southern part of the Abitibi Greenstone Belt and is geographically located approximately 50 km north of the city of Rouyn-Noranda.

The Project benefits from easy access and proximity to an existing workforce and infrastructure, including road, rail and hydroelectric

grid power. The Duparquet Project currently hosts an NI 43-101 compliant gold resource of 3.44 million ounces in the Measured & Indicated

category grading 1.55 g/t Au, and an additional 2.64 million ounces in the Inferred category, grading 1.62 g/t Au. First Mining completed

a Preliminary Economic Assessment1 ("PEA") on the Project in 2023 (see news release dated September 7, 2023 and October

23, 2023).

The Duparquet Project totals approximately 5,800 hectares

focused along an area of 19 km of strike length along the prolific Destor-Porcupine Fault Zone, along with numerous mineralized splays

and influential secondary lineaments. The Duparquet Project includes the past-producing Beattie, Donchester and Duquesne mines as well

as the Central Duparquet, Dumico and Pitt Gold deposits.

| 1 Further

details on the Duparquet PEA can be found in the technical report entitled "NI 43-101 Technical Report: Preliminary Economic

Assessment, Duparquet Gold Project, Quebec, Canada" dated October 20, 2023, which was prepared for First Mining by G Mining

Services Inc. in accordance with NI 43-101 and is available under First Mining's SEDAR profile at www.sedarplus.ca |

Analytical Laboratory and QA/QC Procedures

All sampling completed by First Mining within its

exploration programs is subject to a Company standard of internal quality control and quality assurance (QA/QC) programs which include

the insertion of certified reference materials, blank materials and a level of duplicate analysis. Core samples from the 2023 drilling

program at Duparquet were sent to AGAT Laboratories, with sample preparation in Val d'Or and analysis in Thunder Bay, where they were

processed for gold analysis by 50 gram fire assay with an atomic absorption finish. Samples from selected holes were sent to AGAT Laboratories

in Calgary, Alberta, for multi-element analysis (including silver) by inductively coupled plasma (ICP) method with a four acid digest.

AGAT Laboratories systems conform to requirements of ISO/IEC Standard 17025 guidelines and meets assay requirements outlined for NI 43-101.

Qualified Person

Louis Martin, P.Geo., Senior Geologic Consultant of

First Mining, is a "Qualified Person" for the purposes of NI 43-101 Standards of Disclosure for Mineral Projects, and

has reviewed and approved the scientific and technical disclosure contained in this news release.

About First Mining Gold Corp.

First Mining is a gold developer advancing two of

the largest gold projects in Canada, the Springpole Gold Project in northwestern Ontario, where we have commenced a Feasibility Study

and permitting activities are on-going with a draft Environmental Impact Statement ("EIS") for the project published in June

2022, and the Duparquet Project in Quebec, a PEA-stage development project located on the Destor-Porcupine Fault Zone in the prolific

Abitibi region. First Mining also owns the Cameron Gold Project in Ontario and a portfolio of gold project interests including the Pickle

Crow Gold Project (being advanced in partnership with Firefly Metals Ltd.) and the Hope Brook Gold Project (being advanced in partnership

with Big Ridge Gold Corp.).

First Mining was established in 2015 by Mr. Keith

Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking

information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning

of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of

1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not

always, identified by words such as "expects", "anticipates", "believes", "plans", "projects",

"intends", "estimates", "envisages", "potential", "possible", "strategy",

"goals", "opportunities", "objectives", or variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or

the negative of any of these terms and similar expressions.

Forward-looking statements in this news release

relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events.

All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made

by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual

results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs,

opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered

reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties

and contingencies. Such factors include, without limitation the Company's business, operations and financial condition potentially being

materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19, and by reactions by government

and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics or other

health crises, such as COVID-19, that may result in a slowdown or temporary suspension of operations at some or all of the Company's mineral

properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities;

fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation,

taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration,

development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and

flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims

by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the

Company's Annual Information Form for the year ended December 31, 2023 filed with the Canadian securities regulatory authorities under

the Company's SEDAR profile at www.sedar.com, and in the Company's Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of

factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect

to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First

Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the

Company or on our behalf, except as required by law.

Cautionary Note to United States Investors

The Company is a "foreign private issuer"

as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended, and is eligible to rely upon the Canada-U.S.

Multi-Jurisdictional Disclosure System, and is therefore permitted to prepare the technical information contained herein in accordance

with the requirements of the securities laws in effect in Canada, which differ from the requirements of the securities laws currently

in effect in the United States. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information

made public by companies that report in accordance with U.S. standards.

Technical disclosure contained in this news release

has not been prepared in accordance with the requirements of United States securities laws and uses terms that comply with reporting standards

in Canada with certain estimates prepared in accordance with NI 43-101.

NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning

the issuer's material mineral projects.

View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-identifies-multiple-high-grade-gold-zones-in-duparquet-exploration-drilling-302175043.html

SOURCE First Mining Gold Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/June2024/18/c6505.html

%CIK: 0001641229

For further information: For further information, please contact:

Toll Free: 1 844 306 8827 | Email: info@firstmininggold.com; Paul Morris | Director, Investor Relations | Email: paul@firstmininggold.com

CO: First Mining Gold Corp.

CNW 07:00e 18-JUN-24

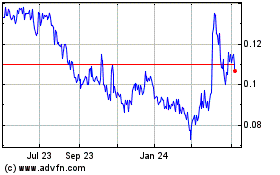

First Mining Gold (QX) (USOTC:FFMGF)

Historical Stock Chart

From Nov 2024 to Dec 2024

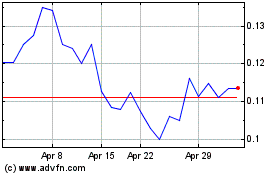

First Mining Gold (QX) (USOTC:FFMGF)

Historical Stock Chart

From Dec 2023 to Dec 2024