false

0001389518

0001389518

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November 9, 2023

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada |

|

333-140645 |

|

99-0364697 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

|

3651

Lindell Road, D517

Las

Vegas, Nevada |

|

89103 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (702) 479-3016

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A

|

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

November 9, 2023, Clubhouse Media Group, Inc. (the “Company”) issued a press release announcing that the Company has filed

it Form 10-Q Quarterly report for the quarter ending September 30, 2023, on November 9, 2023 (“10-Q”).

The press release also announced a financial

summary from the 10-Q, comparing key financial results from the third quarter of 2023 to key financial results from the second

quarter of 2023, including: total net revenue increased 48% to $1,162,631, compared to $786,489; operating

expenses decreased 24% to $535,860 compared to $707,529; net loss decreased 40% to $215,065, compared

to $359,766; total liabilities decreased 16% to $9,255,638, compared to $11,005,895; and operating income of $88,819 compared to operating

loss of $405,819.

The

information included in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

November 9, 2023 |

CLUBHOUSE

MEDIA GROUP, INC. |

| |

|

|

| |

By: |

/s/

Amir Ben-Yohanan |

| |

|

Amir

Ben-Yohanan |

| |

|

Chief

Executive Officer |

Exhibit 99.1

Clubhouse

Media Group, Inc. Announces Third Quarter 2023 Financials, Reporting Growth Over Second Quarter

LOS

ANGELES, November 9th, 2023 /PRNewswire/ — Clubhouse Media Group, Inc. (OTCMKTS: CMGR) (“Clubhouse Media”),

a social media firm and digital agency, today announced financial results for the third quarter of 2023.

Third

Quarter 2023 Financial Summary Compared to Second Quarter 2023

| ● | Total

net revenue increased 48% to $1,162,631, compared to $786,489 |

| ● | Operating

expenses decreased 24% to $535,860, compared to $707,529 |

| ● | Net

loss decreased 40% to $215,065, compared to $359,766 |

| ● | Operating

income of $88,819, compared to operating loss of $405,819 |

| ● | Total

Liabilities decreased 16% to $9,255,638, compared to $11,005,895 |

Management

Commentary

“We

are pleased with the overall results this quarter”, said Amir Ben-Yohanan, CEO of CMGR. “Our revenue has significantly increased

and we managed to decrease the total debt from last quarter. We’re excited about the growth potential for both our digital agency

and our creator monetization platform.”

“I

think this was a successful quarter” added Scott Hoey, Chief Financial Officer of CMGR. “We managed to increase our revenue

and decrease our expenses once again. We are working hard to continue this trajectory throughout Q4.”

Visit

us at www.clubhousemediagroup.com

About

Clubhouse Media Group, Inc.

CMGR

offers management, production, and deal-making services to its handpicked influencers, a management division for individual influencer

clients, and an investment arm for joint ventures and acquisitions for companies in the social media influencer space.

Follow

CMGR on Twitter: https://twitter.com/ClubhouseCMGR

FORWARD-LOOKING

STATEMENTS: This release contains “forward-looking statements”. Forward-looking statements also may be included in other

publicly available documents issued by CMGR and in oral statements made by our officers and representatives from time to time. These

forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial

performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as “anticipate,”

“intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “would,”

“could,” “will” and other words of similar meaning in connection with a discussion of future operating or financial

performance.

Examples

of forward-looking statements include, among others, statements relating to future sales, earnings, cash flows, results of operations,

uses of cash and other measures of financial performance.

Because

forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause CMGR’s

actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks,

uncertainties and other factors include, among others such as, but not limited to economic conditions, changes in the laws or regulations,

demand for CMGR’s products and services, the effects of competition and other factors that could cause actual results to differ

materially from those projected or represented in the forward-looking statements. Any forward-looking information provided in this release

should be considered with these factors in mind. We caution investors not to rely unduly on any forward-looking statements and urge you

to carefully consider the risks described in our filings with the Securities and Exchange Commission from time to time, including our

most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K, which are available

on the Securities and Exchange Commission’s website at sec.gov. We assume no obligation to update any forward-looking statements

contained in this press release.

Contact:

Clubhouse

Media Group, Inc.

media@clubhousemediagroup.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

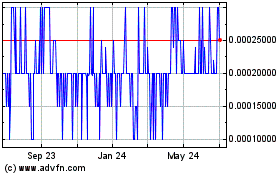

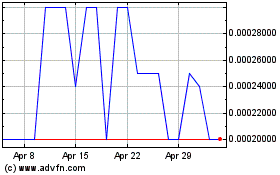

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Dec 2023 to Dec 2024