Report of Foreign Issuer (6-k)

April 03 2018 - 8:27AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities

Exchange

Act of 1934

Date of Report: April 3, 2018

Commission

File Number:

001-36891

|

Cellectis S.A.

|

|

(Exact Name of registrant as specified in its charter)

|

|

|

|

8, rue de la Croix Jarry

|

|

75013 Paris, France

|

|

+33 1 81 69 16 00

|

|

(Address of principal executive office)

|

Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form

20-F

☑

Form 40-F

⃞

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1):

⃞

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

⃞

Cellectis S.A. (the “Company”) issued a press release today reporting

the announcement on April 3, 2018, that Pfizer Inc. (“Pfizer”) and

Allogene Therapeutics, Inc. (“Allogene”) have entered into an agreement

(the “Asset Purchase Transaction”), pursuant to which Allogene will

purchase Pfizer’s portfolio of assets related to allogeneic CAR T-cell

therapy, which Pfizer licensed from the Company in 2014. Pursuant to the

Asset Purchase Transaction, Allogene will take over exclusive global

rights to develop and commercialize previously defined allogeneic CAR-T

programs directed at select targets. Allogene also agreed to assume

Pfizer’s obligations. Cellectis remains eligible to receive clinical

and commercial milestone payments (up to $2.8 billion, or $185 million

per target, for 15 targets) and tiered royalties ranging in the high

single digit percentages applied on annual net sales of commercialized

products. Pfizer and Allogene also announced that Allogene will receive

Pfizer’s rights to UCART19 licensed from Les Laboratoires Servier S.A.S.

(“Servier”) and will have exclusive rights to develop and commercialize

UCART19 in the United States, while Servier retains exclusive rights for

all other countries. Subject to the satisfaction of certain closing

conditions, Pfizer and Allogene expect the Asset Purchase Transaction to

close in the second quarter of 2018. Following the Asset Purchase

Transaction, Pfizer will hold a 25% ownership stake in Allogene. As of

the date of this report, Pfizer holds an approximately 8% ownership

stake in Cellectis, which was acquired pursuant to an equity agreement

entered in 2014.

Allogene is a newly-formed biotechnology company focused on the

development of allogeneic CAR T-cell therapies for blood cancer and

solid tumors. Allogene was co-founded by former Kite Pharma, Inc.

executives Arie Belldegrun, M.D., FACS, who will serve as Allogene’s

Executive Chairman, and David Chang, M.D., Ph.D., who will serve as

Allogene’s President and Chief Executive Officer.

Cellectis notes the following risk factor relating to the Asset Purchase

Transaction, which supplements the risk factors reported in the

Company’s Annual Report on Form 20-F for the year ended December 31,

2017:

A strategic alliance with an early stage biotechnology company,

such as Allogene, poses additional risks for the development and

commercialization of product candidates pursuant to that strategic

alliance.

We rely in part on strategic alliances for the development and

commercialization of certain biopharmaceutical products. If any

collaborator fails to conduct the collaborative activities successfully

and in a timely manner, the pre-clinical or clinical development or

commercialization of the affected target candidates or research programs

would be delayed or could be terminated. Moreover, because our success

depends, in part, on our ability to collect milestone and royalty

payments from our collaborators, a failure of our collaborators to

aggressively or effectively pursue product candidates for which we are

entitled to such payments would prevent us from realizing these

significant revenue streams. Any of the foregoing failures could have an

adverse effect on our business and future prospects.

As an early stage biotechnology company, Allogene is subject to

significant risks that could impede its ability to aggressively and

effectively pursue the development and commercialization of the CAR

T-cell portfolio that it will license from us. The process of

developing and commercializing gene-edited therapeutic products is

complex and expensive, and Allogene will have limited experience in

developing and commercializing such product candidates. This may result

in delays, heightened regulatory challenges and significantly increased

costs and expenses. In addressing such risks, Allogene will have

substantially more limited resources than a large multinational

pharmaceutical company, such as Pfizer. In addition, as an early stage

biotechnology company, we do not expect that Allogene will generate

substantial, if any, revenue for the foreseeable future. As a result,

there can be no assurance that Allogene will have sufficient financial

resources to make milestone and royalty payments that may be come due to

us from time to time pursuant to our strategic collaboration. As a

result, our future revenue and financial condition could be adversely

affected.

This report on Form 6-K (excluding Exhibit 99.1) shall be deemed to be

incorporated by reference in the Company’s registration statements on

Form F-3 (333-217086), Form S-8 (333-204205), Form S-8 (333-214884) and

Form S-8 (333-222482), in each case to the extent not superseded by

documents or reports subsequently filed.

EXHIBIT INDEX

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

CELLECTIS S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

April 3, 2018

|

By:

|

/s/ André Choulika

|

|

|

|

André Choulika

|

|

|

|

Chief Executive Officer

|

4

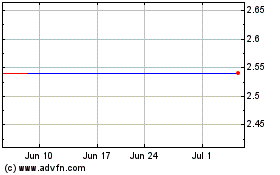

Cellectis (PK) (USOTC:CMVLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

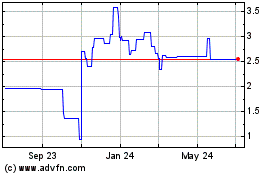

Cellectis (PK) (USOTC:CMVLF)

Historical Stock Chart

From Jul 2023 to Jul 2024