UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 28, 2017 (December 22, 2017)

Blue

Sphere Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer Identification

No.)

|

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

|

|

(Address of principal

executive offices) (Zip Code)

|

|

704-909-2806

|

|

(Registrant’s

telephone number, including area code)

|

|

|

|

(Former

Name or Former Address, if Changed since Last Report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☒ Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report, all

references to the terms “we”, “us”, “our”, “Blue Sphere” or the “Company”

refer to Blue Sphere Corporation and its wholly-owned subsidiaries, unless the context clearly requires otherwise.

Explanatory Note

This Current Report on Form 8-K/A is being

filed to amend the Current Report on Form 8-K filed by the Company on December 28, 2015 and the Current Report on Form

8-K filed by the Company on March 24, 2017.

Unless otherwise indicated in this Current

Report, all the Company’s common stock, par value $0.001 per share (“Common Stock”), share and per share information,

including price per share information, in this Current Report gives effect to the reverse split of our Common Stock at a ratio

of 130-to-1 effectuated on March 24, 2017 (the “Reverse Stock Split”).

Item 1.01

Entry Into a Material Definitive Agreement

As previously reported, on December 23,

2015, the Company completed an offering with six investors (the “Holders”), thereby issuing USD $3,000,000 of our two-year

11% Senior Debentures (the “Debentures”) and warrants to purchase up to 61,544 shares of Common Stock, with 50% of

such shares exercisable at a price per share of $6.50 ($0.05 on a pre-Reverse Stock Split basis) and the other 50% of such shares

exercisable at price per share of $9.75 ($0.075 on a pre-Reverse Stock Split basis) (all such warrants, the “Warrants”).

On March 24, 2017, the Company and five of the six Holders of the Debentures, representing an aggregate principal balance of USD

$2,000,000, amended the Debentures to provide that some or all of the principal balance, and accrued but unpaid interest thereon,

is convertible into shares of Common Stock at the Holders’ election (such amended Debentures, the “Convertible Debentures”).

The Debentures matured on December 22, 2017 (the “Original Maturity Date”).

Between December 22, 2017 and

December 28, 2017, the Company and the Holders entered into a letter agreement dated December 21, 2017 (the “Letter

Agreement”), pursuant to which the Holders agreed to extend the Original Maturity Date to April 3, 2018 (the

“Extended Maturity Date”), and the Company agreed to (a) pay to the Holders an additional five percent (5%)

interest payment on the principal balance of their Debentures totaling, in the aggregate, USD $150,000, of which USD $30,000

was paid and the remaining $120,000 will be paid on the Extended Maturity Date; (b) amend the Warrants

to so that the exercise price of each is equal to the December 21, 2017 closing price of the Common Stock on the OTCQB

Venture Marketplace (the “New Exercise Price”); and (c) issue to the Holders,

pro rata

based on their

respective investments in the Debentures, five-year warrants to purchase, in the aggregate, up to 224,550 shares of Common

Stock at the New Exercise Price (the “New Warrants”). The Convertible Debentures will continue to be convertible

in accordance with the terms thereof.

As of December 22, 2017, Five of

the six Holders and the Company entered into a Second Amendment to Senior Debenture and the remaining Holder and the

Company entered into a First Amendment to Senior Debenture, all such amendments being on substantially the same terms,

pursuant to which the Original Maturity Date was modified to the Extended Maturity Date (collectively, the

“Debenture Amendments”). As of the same date, all Holders and the Company entered into a First Amendment to $0.05

Warrant and First Amendment to $0.075 Warrant, all such amendments being on substantially the same terms, pursuant to which

the exercise price of the Warrants was modified to be equal to the New Exercise Price (collectively, the “Warrant

Amendments”). Lastly, on the same date, the Company issued the New Warrants to the Holders.

The foregoing descriptions of the Letter

Agreement, form of Debenture Amendments, form of Warrant Amendments and form of New Warrants do not purport to be complete and

are qualified in their entirety by reference to the full text of the Letter Agreement, form of Debenture Amendments, form of Warrant

Amendments and form of New Warrants filed as Exhibits 10.1, 10.2, 10.3 and 10.4 hereto, respectively, and are incorporated herein

by reference.

The Company is providing this report in

accordance with Rule 135c under the Securities Act of 1933, as amended (the “Securities Act”), and the notice contained

herein does not constitute an offer to sell the Company’s securities, and is not a solicitation for an offer to purchase

the Company’s securities. The securities offered have not been registered under the Securities Act, as amended, and may not

be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

Item

3.02

Unregistered

Sales of Equity Securities

Reference is made to the disclosure set

forth under Item 1.01 above, which disclosure is incorporated herein by reference.

The Company has sold the Securities in

a private transaction in reliance on the exemption from registration afforded by Section 4(a)(2) of the Securities Act and Regulation

D promulgated thereunder since, among other things, the above transaction did not involve a public offering. Additionally, the

Company relied on similar exemptions under applicable state laws. The Holders had access to information about the Company and their

investments, took the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer

of the securities. Upon issuance, the resale of the securities will not be registered under the Securities Act and may not be offered

or sold in the United States absent registration or an applicable exemption from registration requirements.

Item 9.01

Financial Statements and Exhibits.

The following exhibits are furnished as

part of this Current Report on Form 8-K/A:

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Blue Sphere Corporation

|

|

|

|

|

|

Dated: December 28, 2017

|

By:

|

/s/ Shlomi Palas

|

|

|

Name:

|

Shlomi Palas

|

|

|

Title:

|

President and Chief Executive Officer

|

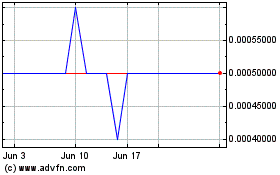

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

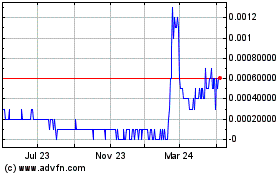

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Nov 2023 to Nov 2024