Amended Annual Report (10-k/a)

June 08 2017 - 4:37PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment

No. 1)

|

☒

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For

the fiscal year ended December 31, 2016

|

☐

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE EXCHANGE ACT

|

For

the transition period from _________ to ________

Commission

File No.: 000-55127

|

Blue

Sphere Corporation

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

Nevada

|

98-0550257

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

|

301

McCullough Drive, 4th Floor,

Charlotte,

North Carolina 28262

|

|

(Address

of principal executive offices) (zip code)

|

|

|

|

704-909-2806

|

|

(Registrant’s

telephone number, including area code)

|

|

|

Securities

registered pursuant to Section 12(b) of the Exchange Act of 1934: None.

Securities

registered pursuant to Section 12(g) of the Exchange Act of 1934: Common Stock, $0.001 per share.

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act of

1934.

Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ☐ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

☐

|

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

|

Smaller

reporting company

|

☒

|

|

Emerging

growth company

|

☒

|

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The

aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $8,670,232,

based on the closing sales price of the registrant’s common stock as of the last business day of its most recently completed

second fiscal quarter. For purposes of calculating the aggregate market value of shares of our common stock held by non-affiliates

as set forth on the cover page of this Annual Report on Form 10-K, we have assumed that all outstanding shares are held by non-affiliates,

except for shares held by each of our executive officers, directors and 10% or greater stockholders. These assumptions should

not be deemed to constitute an admission that all executive officers, directors and 10% or greater stockholders are, in fact,

affiliates of our company, or that there are not other persons who may be deemed to be affiliates of our company. Further information

concerning shareholdings of our officers, directors and principal stockholders is included or incorporated by reference in Part

III, Item 12 of this Annual Report on Form 10-K.

As

of February 14, 2017, there were 279,913,848 shares of the Registrant’s common stock, par value $0.001 per share (“Common

Stock”), issued and outstanding.

EXPLANATORY

NOTE

Blue

Sphere Corporation (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) to

its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission on February

15, 2017 (the “Form 10-K”), to amend Part II, Item 9A, Controls and Procedures. The Company is amending the Form 10-K

due to an inadvertent omission of the subsection “Management’s Report on Evaluation of Internal Controls Over Financial

Reporting” from Part II, Item 9A of the Form 10-K. Accordingly, Part II, Item 9A of the Form 10-K is being amended to substitute

the subsection previously titled “Changes in Internal Controls” with the subsection titled “Management’s

Report on Evaluation of Internal Controls Over Financial Reporting”.

In

connection with the foregoing, and pursuant to the rules of the SEC, we are including with this Form 10-K/A certain new certifications

by our principal executive officer and principal financial officer. Accordingly, Part IV, Item 15 of the Form 10-K is being amended

to reflect the filing of a new Exhibit 31.1 and Exhibit 31.2.

Other than with respect to the foregoing, this Form 10-K/A does not

modify or update in any way the disclosures made in the Form 10-K. This Form 10-K/A speaks as of the original filing date of the

Form 10-K and does not reflect events that may have occurred subsequent to such original filing date.

Item

9A. Controls and Procedures

Evaluation

of Disclosure Controls and Procedures

Our

management is responsible for establishing and maintaining a system of disclosure controls and procedures (as defined in Rule

13a-15(e) under the Exchange Act) that is designed to ensure that information required to be disclosed by the Company in the reports

that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified

in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation,

controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files

or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive

officer or officers and principal financial officer or officers, or persons performing similar functions, as appropriate to allow

timely decisions regarding required disclosure.

Pursuant

to Rule 13a-15(b) under the Exchange Act, the Company carried out an evaluation with the participation of the Company’s

management, including the Company’s Chief Executive Officer (“CEO”) and the Company’s Chief Financial

Officer (“CFO”), of the effectiveness of the Company’s disclosure controls and procedures (as defined under

Rule 13a-15 (e) under the Exchange Act) as of the three months ended December 31, 2016. Based upon that evaluation, the Company’s

CEO and CFO concluded that, as of the end of such period, the Company’s disclosure controls and procedures were not effective

in ensuring that (i) information required to be disclosed by us in the reports that we file or submit under the Exchange Act is

recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) information

required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to

our management, including our principal executive and principal financial officers, or persons performing similar functions, as

appropriate to allow timely decisions regarding required disclosure.

Management

is in the process of determining how best to change our current system and implement a more effective system to ensure that information

required to be disclosed has been recorded, processed, summarized and reported accurately. Our management acknowledges the existence

of this issue, and intends to develop procedures to address it to the extent possible given limitations in financial and human

resources in and to remediate all the material weaknesses by the end of the fiscal quarter ending June 30, 2017.

Management’s

Report on Evaluation of Internal Controls Over Financial Reporting

Our

management is responsible for establishing and maintaining adequate internal controls over financial reporting (as defined in

Rule 13a-15(f) under the Exchange Act). Our system of internal control over financial reporting is a process designed to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements

for external reporting purposes in accordance with GAAP. Because of its inherent limitations, internal control over financial

reporting may not prevent all error or fraud. The design of a control system must reflect the fact that there are resource constraints,

and the benefits of controls must be considered relative to their costs. In addition, an evaluation of effectiveness of controls

is subject to the risk that the controls may become inadequate because of changes in business conditions, or that the degree of

compliance with policies or procedures may decrease over time. Our internal control over financial reporting includes those policies

and procedures that (a) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions

and dispositions of our assets; (b) provide reasonable assurance that transactions are recorded as necessary to permit preparation

of consolidated financial statements in accordance with GAAP, and that our receipts and expenditures are made only in accordance

with authorizations of our management and directors; and (c) provide reasonable assurance regarding prevention or timely detection

of unauthorized use, acquisition, or disposition of our assets that could have a material effect on the consolidated financial

statements.

Pursuant

to Rule 13a-15(c) under the Exchange Act, the Company carried out an evaluation, with the participation of the Company’s

management, including the CEO and CFO, of the effectiveness of our internal controls over financial reporting as of the year ended

December 31, 2016. In making this assessment, we utilized the criteria set forth by the Committee of Sponsoring Organizations

of the Treadway Commission (COSO) in Internal Control — Integrated Framework. Based on that evaluation, the Company’s

CEO and CFO concluded that the Company’s internal controls over financial reporting were not effective as of December 31,

2016. Specifically, during our assessment of the effectiveness of internal controls over financial reporting, management identified

material weaknesses related to the lack of segregation of duties and the need for stronger financial reporting oversight. Due

to our limited resources, we do not have multiple levels of transaction review.

Our

management is in the process of determining how best to change our current system and implement a more effective system of controls

and procedures. During 2016, the Board of Directors created an audit committee comprised of only disinterested directors, and

our management recruited a seasoned Chief Financial Officer and began implementing and evaluating new internal controls over financial

reporting and disclosure controls and procedures. Although management is still evaluating the design of these new controls and

procedures, we believe that our improved processes and procedures will assist in the remediation of our material weaknesses. Once

placed in operation for a sufficient period, we will subject these controls and procedures to appropriate tests in order to determine

whether they are operating effectively. Management, with oversight from the audit committee of the Board of Directors, is committed

to the remediation of known material weaknesses as expeditiously as possible. However, given limitations in financial and human

resources, we may not have the resources to address fully the weaknesses in controls. No assurance can be made that the implementation

of a more effective system of controls and procedures will be completed in a timely manner, or that such controls and procedures

will be adequate once implemented.

This

Annual Report does not include an attestation report of the Company’s registered public accounting firm regarding internal

controls over financial reporting. Management’s report was not subject to attestation by the Company’s registered

public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s

report.

Item

15.

Exhibits and Financial Statement Schedules

|

No.

|

|

Description

|

|

Note(s)

|

|

|

|

|

|

|

|

3.1

|

|

Amended

and Restated Articles of Incorporation, dated November 22, 2013.

|

|

(1)

|

|

|

|

|

|

|

|

3.2

|

|

Amended

and Restated Bylaws, dated June 17, 2015.

|

|

(2)

|

|

|

|

|

|

|

|

4.1

|

|

Form

of Common Stock Certificate.

|

|

(15)

|

|

|

|

|

|

|

|

10.1

|

|

Orbit

Energy Rhode Island LLC Membership Interest Purchase Agreement, dated April 8, 2015.

|

|

(3)

|

|

|

|

|

|

|

|

10.2

|

|

Rhode

Island Energy Partners LLC Development and Indemnification Agreement, dated April 8, 2015.

|

|

(3)

|

|

|

|

|

|

|

|

10.3

|

|

Amended

and Restated Rhode Island Energy Partners LLC Agreement, dated April 8, 2015.

|

|

(3)

|

|

|

|

|

|

|

|

10.4

|

|

Orbit

Energy Charlotte, LLC Letter Agreement dated January 29, 2015.

|

|

(4)

|

|

|

|

|

|

|

|

10.5

|

|

Orbit

Energy Charlotte, LLC Membership Interest Purchase Agreement, dated January 30, 2015.

|

|

(5)

|

|

|

|

|

|

|

|

10.6

|

|

Concord

Energy Partners, LLC Development and Indemnification Agreement, dated January 30, 2015.

|

|

(4)

|

|

|

|

|

|

|

|

10.7

|

|

Amended

and Restated Concord Energy Partners LLC Agreement, dated January 30, 2015.

|

|

(4)

|

|

|

|

|

|

|

|

10.8

|

|

Share

Purchase Agreement by and among Bluesphere Italy S.r.l. and Volteo Energie S.p.A., Agriholding S.r.l. and Overland S.r.l.,

dated May 14, 2015.

|

|

(7)

|

|

|

|

|

|

|

|

10.9

|

|

Amendment

to the Share Purchase Agreement Dated May 14, 2015, by and among Bluesphere Italy S.r.l. and Volteo Energie S.p.A., Agriholding

S.r.l. and Overland S.r.l., dated December 14, 2015.

|

|

(21)

|

|

|

|

|

|

|

|

10.10

|

|

Framework

EBITDA Guarantee Agreement dated July 17, 2015.

|

|

(5)

|

|

|

|

|

|

|

|

10.11

|

|

Long

Term Mezzanine Loan Agreement by and among Blue Sphere Corp., Eastern Sphere Ltd., Bluesphere Italy S.r.l., and Helios Italy

Bio-Gas 1 L.P., dated August 18, 2015.

|

|

(8)

|

|

|

|

|

|

|

|

10.12

|

|

Organic

Waste Delivery Agreement, dated October 13, 2016.

|

|

(20)

|

|

|

|

|

|

|

|

10.13

|

|

Acceptance

Letter of Grant Application from Rijksdienst voor Ondernemend Nederland, dated December 8, 2016.

|

|

(19)

|

|

|

|

|

|

|

|

10.14

|

|

Service

Agreement between Blue Sphere Corporation and Shlomo Palas, dated October 15, 2015.

|

|

(9)

#

|

|

|

|

|

|

|

|

10.15

|

|

Service

Agreement by and among Blue Sphere Corporation, JLS Advanced Investment Holdings Limited, and Roy Amitzur, dated October 15,

2015.

|

|

(9)

#

|

|

|

|

|

|

|

|

10.16

|

|

Advisory

Agreement between Blue Sphere Corporation and Joshua Shoham, dated October 15, 2015.

|

|

(9)

#

|

|

|

|

|

|

|

|

10.17

|

|

Addendum

No. 1 to Service Agreement dated December 29, 2016, between the Company, Mr. Amitzur, JLS Advanced Investment Holdings Limited

and Renewable Energy Management Services.

|

|

(21)

|

|

|

|

|

|

|

|

10.18

|

|

Service

and Consulting Agreement dated May 30, 2013, between the Company and Efim Monsov.

|

|

(21)

|

|

|

|

|

|

|

|

10.19

|

|

Personal

Employment Agreement dated January 1, 2016, between Eastern Sphere and Elad Kerner.

|

|

(21)

|

|

|

|

|

|

|

|

10.20

|

|

Services

Agreement, dated May 1, 2016, between the Company and Ran Daniel.

|

|

(11)

|

|

|

|

|

|

|

|

10.21

|

|

Form

of July Offering Subscription Agreements, entered into December 2, 2015.

|

|

(12)

|

|

|

|

|

|

|

|

10.22

|

|

Form

of February 3, 2016 Warrant.

|

|

(12)

|

|

|

|

|

|

|

|

10.23

|

|

Form

of Securities Subscription Agreement and Warrant from the February 2016 Offering.

|

|

(10)

|

|

|

|

|

|

|

|

10.24

|

|

Form

of Securities Subscription Agreement and Warrant from the June 2016 Offering.

|

|

(13)

|

|

|

|

|

|

|

|

10.25

|

|

Form

of Maxim Warrant.

|

|

(14)

|

|

|

|

|

|

|

|

10.26

|

|

Form

of Securities Purchase Agreement, Promissory Note and Common Stock Purchase Warrant from the October 2016 Financing.

|

|

(16)

|

|

|

|

|

|

|

|

10.27

|

|

2010

Stock Incentive Plan.

|

|

(18)

|

|

|

|

|

|

|

|

10.28

|

|

2014

Stock Incentive Plan.

|

|

(6)

|

|

|

|

|

|

|

|

10.29

|

|

2016

Stock Incentive Plan

|

|

(14)

|

|

|

|

|

|

|

|

10.30

|

|

Amended

and Restated Non-Employee Director Compensation Policy.

|

|

(21)

|

|

|

|

|

|

|

|

10.31

|

|

Promissory

Note issued by the Company to Viskoben Limited, dated February 13, 2017

|

|

(22)

|

|

|

|

|

|

|

|

14.1

|

|

Code

of Ethics and Anti-Harassment Policy of the Company.

|

|

(17)

|

|

|

|

|

|

|

|

21.1

|

|

Subsidiaries

of Registrant.

|

|

(21)

|

|

|

|

|

|

|

|

23.1

|

|

Consent

of Brightman Almagor Zohar & Co.

|

|

**

|

|

|

|

|

|

|

|

31.1

|

|

Rule 13a-14(a) / 15d-14(a) Certification of Chief Executive Officer

|

|

*

|

|

|

|

|

|

|

|

31.2

|

|

Rule 13a-14(a) / 15d-14(a) Certification of Chief Financial Officer

|

|

*

|

|

|

|

|

|

|

|

32.1

|

|

Section

1350 Certification of Chief Executive Officer

|

|

**

|

|

|

|

|

|

|

|

32.2

|

|

Section

1350 Certification of Chief Financial Officer

|

|

**

|

|

|

|

|

|

|

|

99.1

|

|

Charter

of the Audit Committee.

|

|

(20)

|

|

|

|

|

|

|

|

99.2

|

|

Charter

of the Finance Committee.

|

|

(20)

|

|

|

|

|

|

|

|

99.3

|

|

Charter

of the Nominations Committee.

|

|

(20)

|

|

|

|

|

|

|

|

99.4

|

|

Charter

of the Compensation Committee.

|

|

(20)

|

|

|

|

|

|

|

|

101

|

|

The

following materials from Blue Sphere Inc.’s Annual Report on Form 10-K for the year ended December 31, 2016 are formatted

in XBRL (eXtensible Business Reporting Language): (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Operations,

(iii) Consolidated Statement of Stockholders’ Equity/ (Deficit), (iv) Consolidated Statements of Cash Flow, and (iv)

Notes to Consolidated Financial Statements.

|

|

**

|

|

|

|

|

|

|

|

|

|

|

|

#

|

|

Indicates

management contract or compensatory plan or arrangement.

|

|

*

**

|

|

Filed

herewith.

Previously

filed.

|

|

|

|

|

|

(1)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on December 3, 2013.

|

|

(2)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on June 17, 2015.

|

|

(3)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on April 14, 2015.

|

|

(4)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on February 5, 2015.

|

|

(5)

|

|

Incorporated

by reference to our Quarterly Report on Form 10-Q filed with the SEC on August 14, 2015.

|

|

(6)

|

|

Incorporated

by reference to our Quarterly Report on Form 10-Q filed with the SEC on May 15, 2015.

|

|

(7)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on May 18, 2015.

|

|

(8)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on August 24, 2015.

|

|

(9)

|

|

Incorporated

by reference to our Annual Report on Form 10-K filed with the SEC on January 13, 2016.

|

|

(10)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on February 17, 2016.

|

|

(11)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on May 4, 2016.

|

|

(12)

|

|

Incorporated

by reference to our Quarterly Report on Form 10-Q/A filed with the SEC on June 13, 2016.

|

|

(13)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on July 8, 2016.

|

|

(14)

|

|

Incorporated

by reference to our Registration Statement on Form S-1 filed with the SEC on August 15, 2016.

|

|

(15)

|

|

Incorporated

by reference to Amendment No. 1 to our Registration Statement on Form S-1/A filed with the SEC on September 1, 2016.

|

|

(16)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on October 31, 2016.

|

|

(17)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on April 29, 2016.

|

|

(18)

|

|

Incorporated

by reference to our Amendment to Annual Report on Form 10-K filed with the SEC on March 9, 2011.

|

|

(19)

|

|

Incorporated

by reference to our Current Report on Form 8-K filed with the SEC on December 13, 2016.

|

|

(20)

|

|

Incorporated

by reference to our Registration Statement on Form S-1 filed with the SEC on December 15, 2016.

|

|

(21)

|

|

Incorporated

by reference to Amendment No. 1 to our Registration Statement on Form S-1 filed with the SEC on February 2, 2017.

|

|

|

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

June

8, 2017

|

Blue

Sphere Corporation

|

|

|

|

|

|

|

By:

|

/s/

Shlomo Palas

|

|

|

|

Shlomo

Palas

|

|

|

|

President

and Chief Executive Officer

|

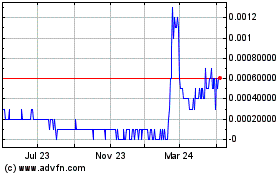

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

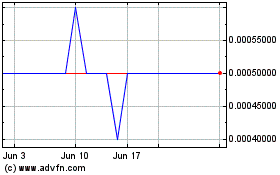

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Nov 2023 to Nov 2024