Baron Capital Has Been Upgraded to OTCPINK

August 05 2014 - 8:11AM

Access Wire

FT. LAUDERDALE, Fla. / ACCESSWIRE / August 05, 2014 / Baron

Capital Enterprises, Inc. (OTCPK: BCAP) is pleased to announce the

"Caveat Emptor" status has been removed from the Company and it has

been upgraded to OTCPINK Current status.

Baron through its filings has brought is shareholders current up

through June 30, 2014 and would like to take this time to layout

the Company's objectives for the last 6 months of 2014.

Baron should have several hundred thousand dollars in its

coffers to grow the business during the last 6 months of 2014

generated from the equity it currently holds and is entitled to

receive.

The Company will allocate the use of those funds as follows:

1. To pay down debt and strengthen Baron's balance sheet.

2. To retain the new auditor and complete an audit for 2012

through June of 2014.

3. To audit the 2 shell companies Baron owns and to file a Form

10 for each.

4. To move transfer agents.

5. To create a new website.

6. To establish a corporate headquarters.

7. To pay for legal services for various matters which should

yield beneficial outcomes for the Company.

8. Put the proper D&O insurance in place to attract new

Officers and Directors.

9. Generate new business.

Baron should close 2014 on deals for its two shells with the

goal of having one if not both of them trading before the year is

out. Baron will use the money generated to fund operations

for next year with a goal to complete 4 new deals prior to the end

of 2015 and 6 deals for 2016.

As the Company collects it's fees on the new deals moving

forward Baron should have more working capital and therefore the

Company can work on bigger and better deals.

The Company has removed the Special Provision within the Bylaws

of the Corporation as voted and agreed to by a majority of the

shareholders in 2012. Baron has not issued a single share of

Common or Preferred since January of 2012 and currently has no

plans or need to increase either the Authorized or the Outstanding

share count.

Once the new Board is created a plan will be presented to

eliminate the Preferred without converting any of the Preferred

stock, but will entail the Company buying some of the Preferred and

buying back half of the current float over a period of time.

Baron will continue to use newswire services, but will also

begin taking advantage of social media outlets and its own website

to disseminate news on the Company.

The foregoing press announcement contains forward-looking

statements that can be identified by such terminology such as

"believes," "expects," "potential," "plans," "suggests," "may,"

"should," "could," "intends," or similar expressions. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results

to be materially different from any future results, performance or

achievements expressed or implied by such statements. In

particular, management's expectations could be affected by among

other things, uncertainties relating to our success in completing

acquisitions, financing our operations, entering into strategic

partnerships, engaging management and other matters disclosed by us

in our public filings from time to time. Forward-looking statements

speak only as to the date they are made. The Company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the

forward-looking statements are made.

Contact:

Matt Dwyer

matt@bcapent.com

954-623-3209

SOURCE: Baron Capital Enterprises, Inc

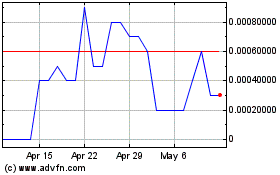

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

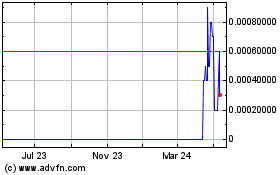

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Nov 2023 to Nov 2024