UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

ATACAMA RESOURCES INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

46-3105245

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

1317 Edgewater Dr., #2510

Orlando, FL 32804

Telephone: (780) 512-3805

(Address and telephone number of registrant's

principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 per share

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting registrant, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] |

Accelerated filer [ ] |

| Non-accelerated filer [ ] |

Smaller reporting registrant [x] |

| |

Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

TABLE OF CONTENTS

Unless otherwise specified or the context otherwise requires, references in this registration statement to "we", "our" and "us" and the "Company" refer to Atacama Resources International, Inc.

Item 1. Description of Business

Atacama Resources International, Inc. was incorporated in Florida on June 14, 2013 (formerly Arrakis Mining Research, Inc, until 1/9/2015). The registrant has been publicly traded on OTC Pink Markets under the symbol "ACRL" since March 2016. The registrant has an active standing in that state. Atacama Resources International, Inc. focuses on mining claims for properties in Kirkland Lake, Ontario's 'Golden Mile' that show indications of having viable concentrations of gold ore. When looking for gold, concentrations of cobalt and graphite were found as well, and the registrant decided that cobalt and graphite were targets of interest as well.

On June 20, 2018, the registrant received a Determination Letter from the Alberta Securities Commission ("ASC") stating that their staff had determined that the registrant met the requirements to be designated an "OTC reporting Issuer" in Alberta. As part of this designation, the ASC required the registrant to file the two most recent years of outstanding filings beginning with the annual period ended December 31, 2016 must be filed on SEDAR+ in Canada before July 26, 2018 or else a CTO would be placed on the registrant. On July 27, 2018, the registrant was unable to meet these financial disclosure obligations and received a Cease Trade Order from the ASC.

On August 10, 2022, the officers and directors of the registrant resigned. Glenn Grant and Dan Finch became the Chief Executive Officer and the Chief Operating Officer respectively of the registrant at that time. Before the change in management, the registrant had large outstanding payables, a negative balance in its bank accounts, no mining activities, and was not making any efforts to address the Cease Trade Order. At the same time, unpaid salaries were being accrued.

On February 1, 2024, Mr. Finch resigned from his position as the Chief Operating Officer. On April 1, 2024, Greg Praver was appointed as the Chief Operating Officer. On April 16, 2024, Thomas Moynihan and Brian Praver were appointed as the Chief Financial Officer and Vice President of Business Development, respectively.

Following the change in management, the registrant has purchased numerous mining claims that are considered claims of merit, developed a 43-101F1 for one of its properties, and has plans to drill on at least one property as soon as possible. The registrant is currently working to satisfy the requirements of the Alberta Securities Commission for the removal of the Cease Trade Order.

Mining Market

Since the registrant was founded, the EV (Electric Vehicle) market has matured and over the last two years especially, virtually all automobile manufacturers globally have decided that their future is dependent on transitioning from internal combustion engine-powered automobiles to electric automobiles, SUV's, and trucks. This means that the demand for lithium, cobalt, and graphite used to manufacture EV batteries will increase exponentially in the years ahead.

Because of the ever-increasing demand for lithium, especially, new lithium mining sources must be found in the Western Hemisphere to offset current sources of lithium in countries that may exploit their strong position and do not always work in the best interests of the United States. The registrant is committed to becoming a player in lithium exploration activities in Canada and the US.

Atacama Resources International is a United States public company which is current with the OTC Pink Market. As stated earlier the registrant is a mining exploration company with mining claims in the greater Kirkland Lake area in Ontario, Canada. The company is reviewing additional properties in northern Canada as well as properties in the United States.

Due to the enormous growth of the EV market, minerals of interest include gold, graphite, cobalt, lithium, silver, and nickel.

There are several gold properties near the existing Atacama gold property in Kirkland Lake that are under review for the purpose of acquiring additional mining claims. In addition, the company has previously explored cobalt and graphite locations within 30 miles of the existing Atacama gold property. The cobalt and graphite claims are still available, and steps are being taken to acquire the mineral rights to these properties.

The registrant is talking with brokers presenting lithium properties in both Canada and the United States. Decisions will be made this year regarding the acquisition of mining claims relating to lithium. Properties in Nevada look very promising, and a lithium processing plant is being built in Northern Nevada.

The emergence of the EV market has presented a new opportunity for the registrant and the registrant is positioning itself to take advantage of the opportunity.

Growth Strategy for the Company

The registrant is a small cap mining exploration and development company that has the rights to 147 mining claims spread over 4647 acres in Northern Ontario. 80% of the acreage has been acquired in the last year. The registrant plans to add significant graphite acreage in the next six to twelve months. The registrant intends to start developing the Tannahill gold property and the Heighington lithium property during 2023. The Atacama 3 gold, the Cabo cobalt property, and the rare earth properties will be developed in 2024.

Competition

The registrant operates in a competitive industry and competes with other more well-established companies which have greater financial resources than we do. We face strong competition from other mining companies in connection with exploration and the acquisition of properties producing, or capable of producing, base and precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all.

Our prime competitors are mining exploration companies, such as Teck Resources Limited, a Canadian company, and Agnico Eagle Mines Limited, a Canadian company, which both engage in the exploration and production of minerals from properties around the world, including Canada. We also compete with Cabo Drilling Corp., Kirkland Lake Gold Inc., AECON Mining Inc. in Timmins, Victoria Gold Mines East Timmins Ltd., and GOWEST Gold Ltd, Timmins, Ont. These companies all perform mining exploration in Canada.

Employees

As of August 22, 2024, we do not have any full or part time employees. All work is done through independent contractors.

Properties

The registrant has office space at 1317 Edgewater Dr., #2510, Orlando, FL 32804 as their US office for corporate management. It is an office suite that has approximately 500 square feet. The registrant pays a monthly rental expense of $500 for the space.

Item 1A. Risk Factors

Not applicable to a smaller reporting company.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Plan of Operations

The registrant plans to develop all of its properties through geophysical analysis, drilling, collecting core samples, and assaying core samples. The objective is to locate and develop potentially commercially viable amounts of gold, lithium, cobalt and rare earth minerals. The registrant has contracts with geologists, drilling operations, prospectors, assay laboratories, and 43-101 experts.

After the registrant prepares the NI 43-101 technical report for the properties, we will use the results to determine whether it is in the best interests of the registrant to seek a joint venture with a mining production company or to sell the property.

On June 20, 2018, the registrant received a Determination Letter from the ASC stating that their staff had determined that the registrant met the requirements to be designated an "OTC reporting Issuer" in Alberta. As part of this designation, the ASC required the registrant to file the two most recent years of outstanding filings beginning with the annual period ended December 31, 2016 must be filed on SEDAR+ in Canada before July 26, 2018 or else a CTO would be placed on the registrant. On July 27, 2018, the registrant was unable to meet there financial disclosure obligations and received a Cease Trade Order from the ASC. The registrant has raised funds from current investors sufficient to continue operations until the raise has been completed and has spent significant time and funds to satisfy the requirements of the Alberta Securities Commission for the removal of the Cease Trade Order.

Going Concern

As of June 30, 2024, we had $18,678 of cash on hand and an accumulated deficit of $7,217,950. There is substantial doubt as to our ability to continue as a going concern based on the understanding that we do not have adequate working capital to finance our day-to-day operations for at least twelve months. We will require additional funding to meet our obligations as they come due and to fund the development of our existing technologies. We may raise capital through loans from current stockholders, public or private equity or debt offerings, grants, or strategic arrangements with third parties, and we intend to and are in the process of seeking out possible international capital raising opportunities. There can be no assurance that additional capital will be available to us on favorable terms, or at all.

We anticipate that our future liquidity requirements will arise from the need to fund our growth from operations, pay current obligations and future capital expenditures. The primary sources of funding for such requirements are expected to be cash generated from operations and raising additional funds from the private sources and/or debt financing. However, we can provide no assurances that we will be able to generate sufficient cash flow from operations and/or obtain additional financing on terms satisfactory to us, if at all, to remain a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis and ultimately to attain profitability. Our Plan of Operation for the next twelve months is to raise capital to implement our strategy. We do not have the necessary cash and revenue to satisfy our cash requirements for the next twelve months. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then we may not be able to expand our operations.

We believe that the successful completion of this offering will eliminate this doubt and enable us to continue as a going concern; however, if we are unable to raise sufficient capital in this offering, we may need to obtain alternative financing or significantly modify our operational plans in order to continue operations. We currently have no agreements, arrangements, or understandings with any person to obtain additional funds through bank loans, lines of credit or any other sources. If we are not able to obtain the additional financing on a timely basis, we may be required to further scale down or perhaps even cease the operation of our business. The issuance of additional equity securities could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. Our financial statements do not include adjustments that might result from the outcome of this uncertainty.

We are not aware of any trends or known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in material increases or decreases in liquidity.

Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this prospectus. Material changes in our Statement of Operations for the six months ended June 30, 2024 and 2023, and the years ended December 31, 2023 and 2022 are discussed below.

The Six Months Ended June 30, 2024 compared to the Six Months Ended June 30, 2023

For the six months ended June 30, 2024 and 2023, the registrant did not generate any revenues.

Operating Expenses

Total operating expenses for the six months ended June 30, 2024 and 2023 were $732,444 and $499,100, respectively. Total operating expenses consisted of consulting fees of $30,753 and $193,500, respectively; exploration fees of $406,937 and $106,653 respectively; management fees of $134,100 and $96,000, respectively; professional fees of $135,911 and $90,951, respectively and selling, general and administrative expenses of $24,743 and $11,996, respectively.

Consulting fees were the result of stock issued for services rendered. Consulting fees decreased by approximately 84% as the Company reduced the services of outside consultants.

Exploration fees increased by approximately 281% as the Company continued exploration of its mineral leases. The Company focused it efforts of geophysical analysis, mag particle cutting core samples, assaying samples and developing the 43-101 for the Tannahill property

Management fees increased by approximately 40% due to new hiring of critical positions and the management fees incurred in connection with the new management compensation agreements.

Professional fees increased by approximately 49% due to legal and audit expenses relating to removal of the cease trade order and expenses of being a publicly reporting company.

Selling, general and administrative expenses increased by approximately 106% due to increased operations and the normal business expenses incurred.

Other Income and Expenses

Other income (expense) for the six months ended June 30, 2024 and 2023 was $358,424 and $52,344, respectively. The change in other income (expense) can be attributed to the registrant's increase in interest expense and the ratable changes in derivative liabilities along with a gain on settlement of liabilities. Other income (expense) consisted of interest expense of ($12,569) and ($2,732), respectively; gain on settlement of liabilities of $372,222 and $95,884, respectively; amortization of debt discount of $0 and ($29,749), respectively and change in derivatives of ($1,229) and ($11,059), respectively.

Income Loss from Operations

Net loss from operations for the six months ended June 30, 2024 was $(374,020) compared to ($446,756) for the six months ended June 30, 2023. The decrease in net loss can primarily be attributed to the registrant's gain on settlement of liabilities of $372,222 for the six months ended June 30, 2024 as compared to $95,884 for the six months ended June 30, 2023. Net loss decreased by ($72,736) over the comparable periods.

Comprehensive Income (Loss)

For the six months ended June 30, 2024 and 2023, the registrant had a foreign exchange translation gain (loss) of ($9,142) and $2,526 respectively. As a result, the registrant had a comprehensive loss of ($383,162) for the six months ended June 30, 2024 compared to a comprehensive loss of ($444,230) for the six months ended June 30, 2023.

The Year Ended December 31, 2023 compared to the Year Ended December 31, 2022

For the years ended December 31, 2023 and 2022, the registrant did not generate any revenues.

Operating Expenses

Total operating expenses for the years ended December 31, 2023 and 2022 were $597,876 and $535,654, respectively. Total operating expenses consisted of consulting fees of $156,490 and $34,811, respectively; exploration fees of $93,048 and $130,124 respectively; management fees of $197,000 and $323,774, respectively; professional fees of $131,196 and $36,930, respectively and selling, general and administrative expenses of $20,142 and $10,015, respectively.

Consulting fees increased by approximately 349.5%. Consulting fees consisted of stock issued for services paid to our COO, Daniel Finch valued at $146,500 and for stock issued for services rendered by non-related parties valued at $9,990.

Exploration costs decreased by approximately 28.5% as the Company's continues exploration of its mineral leases. For the year ended December 31, 2023, the Company spent a total of $93,048, which includes the $16,815 spent on the 43-101 report for the Tannahill property and the $76,233 used for magnetic particle testing, electronic penetration testing, and trenching that occurred on the Atacama #3 property. Between geophysical analysis, mag particle, cutting core samples, assaying samples, developing the 43-101 for Tannahill, the company is budgeting $527,750 for the next 12 months. For Heighington lithium, the budget is $378,400 and for Atacama 3 Gold, the budget is $473, 250.

Management fees decreased by approximately 39.2%. David Berry, a former Director, and Colin Keith, a former Consultant, accrued management fees during the year ended 2022. Their agreements were terminated in the second quarter of 2022. The new management fees did not commence until August of 2023.

Professional fees increased by approximately 255.3% due to the fees and cost associated with maintaining audited financial statements and current reporting status with the OTC Market and generating IFRS financial statements.

Selling, general and administrative expenses increased by approximately 101% due to increased operations and the normal business expenses incurred.

Other Income and Expenses

Other income (expense) for the years ended December 31, 2023 and 2022 was ($19,981) and $590,077, respectively. The change in other income (expense) can be attributed to the registrant's increase in interest expense and the ratable changes in derivative liabilities along with a gain on settlement of liabilities. Other income (expense) consisted of interest expense of ($13,557) and ($454), respectively; gain on settlement of liabilities of $0 and $594,516, respectively; amortization of debt discount of ($3,639) and ($4,925), respectively and change in derivatives of ($2,767) and $940, respectively.

Income (Loss) from Operations

Net income (loss) from operations for the year ended December 31, 2023 was $(617,857) compared to $54,423 for the year ended December 31, 2022. The decrease in net income can primarily be attributed to the registrant's gain on settlement of liabilities of $594,516 in 2022. There was no similar gain during the year ended December 31, 2023. Net loss increased by ($672,280) over the comparable periods.

Comprehensive Income (Loss)

For the years ended December 31, 2023 and 2022, the registrant had a foreign exchange translation gain (loss) of ($373) and $31,464 respectively. As a result, the registrant had a comprehensive loss of ($618,230) for the year ended December 31, 2023 compared to a comprehensive income of $85,887 for the year ended December 31, 2022.

Liquidity and Capital Resources

The accompanying financial statements have been prepared assuming that the registrant will continue as a going concern which contemplates, among other things, the realization of assets and satisfaction of liabilities in the ordinary course of business.

As of June 30, 2024, the registrant had $18,678 in cash and cash equivalents. The registrant has not generated revenue and has relied primarily upon capital generated from officers and directors of the registrant.

The registrant had a comprehensive loss of $383,162 and $444,230 for the six months ended June 30, 2024 and 2023, respectively. The registrant has accumulated losses totaling $7,217,950 at June 30, 2024. Because of the absence of positive cash flows from operations, the registrant will require additional funding for continuing the development and marketing of products. These factors raise substantial doubt about the registrant's ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The registrant presently able to meet its obligations as they come due through borrowing and the support of the registrant's officers and directors. At June 30, 2024, the registrant had a working capital deficit of $1,434,997. The registrant's working capital deficit is due to the results of operations.

The registrant issued three convertible promissory notes in 2022, eighteen convertible promissory notes in 2023 and two convertible promissory notes as of June 30, 2024. The interest rate of these notes is 8%, and they each had a term of one year. The registrant and certain lenders executed an amendment to each of the notes to restate their respective interest rates as 8% and to extend the maturity date by an additional year. None of the notes issued contain penalty provisions upon default and none of the notes are currently in default.

The registrant sources of financing were provided by the issuance of convertible promissory notes. The table below represent the convertible promissory notes issued as of June 30, 2024:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Eligible |

|

| Note |

|

Note |

|

|

Original |

|

|

Current |

|

|

Accrued |

|

|

|

|

|

Interest |

|

|

Default |

|

|

|

|

|

Shares if |

|

| Holder |

|

Date |

|

|

Princpal |

|

|

Principal Bal |

|

|

Interest |

|

|

Maturity |

|

|

Rate |

|

|

Int. Rate |

|

|

Status 1 |

|

|

Full Conversion |

|

| James White |

|

8/26/2022 |

|

$ |

5,000 |

|

$ |

5,000 |

|

$ |

738.64 |

|

|

8/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

1,109,878 |

|

| Deborah McNamara |

|

8/26/2022 |

|

|

5,000 |

|

|

5,000 |

|

|

738.64 |

|

|

8/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

1,109,878 |

|

| Kevin Bonnebie |

|

10/12/2022 |

|

|

10,000 |

|

|

10,000 |

|

|

1,374.23 |

|

|

10/12/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

2,219,756 |

|

| Paul Bremner |

|

1/24/2023 |

|

|

2,000 |

|

|

2,000 |

|

|

229.26 |

|

|

1/24/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

400,000 |

|

| Donald Flindt |

|

1/26/2023 |

|

|

35,000 |

|

|

35,000 |

|

|

2,807.67 |

|

|

1/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

7,000,000 |

|

| Christina Crowther |

|

1/26/2023 |

|

|

25,000 |

|

|

25,000 |

|

|

2,005.48 |

|

|

1/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

5,000,000 |

|

| Clifford Baschuk |

|

1/27/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

802.18 |

|

|

1/27/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Bill Campbell |

|

1/27/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

1,139.71 |

|

|

1/27/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Garth Eberle |

|

1/28/2023 |

|

|

5,000 |

|

|

5,000 |

|

|

568.78 |

|

|

1/28/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

1,000,000 |

|

| Stephen Campbell |

|

1/30/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

802.18 |

|

|

1/30/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Brandon Campbell |

|

1/30/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

1,133.14 |

|

|

1/31/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Bob Washington |

|

1/30/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

1,133.14 |

|

|

1/31/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Mark Benoit |

|

2/1/2023 |

|

|

5,000 |

|

|

5,000 |

|

|

564.39 |

|

|

2/1/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

1,000,000 |

|

| Clifford Baschuk |

|

2/1/2023 |

|

|

15,000 |

|

|

15,000 |

|

|

1,693.16 |

|

|

2/1/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

3,000,000 |

|

| Harry Leach |

|

4/13/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

973.14 |

|

|

4/13/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Jeb Fiebelkorn |

|

4/26/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

973.14 |

|

|

4/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

2,000,000 |

|

| Graham Gilbert |

|

5/26/2023 |

|

|

5,000 |

|

|

5,000 |

|

|

401.10 |

|

|

5/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

715,000 |

|

| Derek Hokanson |

|

5/26/2023 |

|

|

5,000 |

|

|

5,000 |

|

|

439.46 |

|

|

5/26/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

1,000,000 |

|

| Donald Flindt |

|

5/30/2023 |

|

|

20,000 |

|

|

20,000 |

|

|

1,604.38 |

|

|

5/30/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

3,333,000 |

|

| Kenton Embree |

|

7/6/2023 |

|

|

20,000 |

|

|

20,000 |

|

|

1,578.08 |

|

|

7/6/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Overdue |

|

|

4,000,000 |

|

| Bob Washington |

|

11/15/2023 |

|

|

10,000 |

|

|

10,000 |

|

|

499.72 |

|

|

11/15/2024 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

3,000,000 |

|

| Clifford Baschuk |

|

3/4/2024 |

|

|

10,000 |

|

|

10,000 |

|

|

258.63 |

|

|

3/4/2025 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

3,000,000 |

|

| Leonard Bilodeau |

|

6/16/2024 |

|

|

25,000 |

|

|

25,000 |

|

|

76.71 |

|

|

6/16/2025 |

|

|

8.00% |

|

|

8.00% |

|

|

Current |

|

|

3,787,879 |

|

The promissory notes are convertible into common stock of the registrant at the holder's option following the removal of the Cease Trade Order issued by the Alberta Securities Commission.

* Eligible shares based on the Black Scholes Model calculated at period end of June 30, 2024

Cash Flows

The following table sets forth the primary sources and uses of cash and cash equivalents for the six months ended June 30, 2024 and 2023 as presented below:

ATACAMA RESOURCES INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

|

|

|

|

|

|

| SIX MONTHS ENDED JUNE 30, |

|

2024 |

|

|

2023 |

|

|

Percent

Increase

(Decrease) |

|

| Operating Activities |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(374,020 |

) |

$ |

(446,756 |

) |

|

(16%) |

|

| Change in fair value of derivatives |

|

1,229 |

|

|

11,059 |

|

|

(89%) |

|

| Amortization of debt discount |

|

---- |

|

|

29,749 |

|

|

(100%) |

|

| Gain on settlement of payables |

|

(372,222 |

) |

|

(95,884 |

) |

|

288% |

|

| Stock issued for settlement of liabilities |

|

40,500 |

|

|

---- |

|

|

100% |

|

| Stock issued for mineral rights |

|

---- |

|

|

56,000 |

|

|

(100%) |

|

| Stock issued for services |

|

17,921 |

|

|

234,000 |

|

|

(92%) |

|

| Accrued compensation and accounts payable |

|

456,864 |

|

|

5,079 |

|

|

8,895% |

|

| Net cash from operating activities |

|

(229,728 |

) |

|

(206,753 |

) |

|

11% |

|

| |

|

|

|

|

|

|

|

|

|

| Financing Activities |

|

|

|

|

|

|

|

|

|

| Proceeds from related party |

|

(30,178 |

) |

|

76,371 |

|

|

(140%) |

|

| Proceeds from convertible notes payable |

|

35,000 |

|

|

177,000 |

|

|

(80%) |

|

| Proceeds from the sale of Common Stock |

|

200,232 |

|

|

---- |

|

|

100% |

|

| Net cash provided by financing activities |

|

205,054 |

|

|

253,371 |

|

|

(19%) |

|

| |

|

|

|

|

|

|

|

|

|

| Foreign Currency Translation |

$ |

9,142 |

|

$ |

2,526 |

|

|

262% |

|

| |

|

|

|

|

|

|

|

|

|

| Net Increase (Decrease) in Cash Equivalents |

|

(15,532 |

) |

|

49,144 |

|

|

(132%) |

|

| Cash and Cash Equivalents at beginning of period |

|

34,210 |

|

|

4,259 |

|

|

703% |

|

| Cash and Cash Equivalents at end of period |

$ |

18,678 |

|

$ |

53,403 |

|

|

(65%) |

|

| |

|

|

|

|

|

|

|

|

|

Net cash used in operating activities for the six months ended June 30, 2024 and 2023 were ($229,728) and ($206,753), respectively.

Net cash provided by financing activities for the six months ended June 30, 2024 and 2023 were $205,054 and $253,371, respectively.

We anticipate that our future liquidity requirements will arise from the need to fund our growth from operations, pay current obligations and future capital expenditures. The primary sources of funding for such requirements are expected to be cash generated from operations and raising additional funds from the private sources and/or debt financing. However, we can provide no assurances that we will be able to generate sufficient cash flow from operations and/or obtain additional financing on terms satisfactory to us, if at all, to remain a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis and ultimately to attain profitability. Our Plan of Operation for the next twelve months is to raise capital to implement our strategy. We do not have the necessary cash and revenue to satisfy our cash requirements for the next twelve months. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then we may not be able to expand our operations. If adequate funds are not available, we believe that our officers and directors will contribute funds to pay for some of our expenses. However, we have not made any arrangements or agreements with our officers and directors regarding such advancement of funds. We do not know whether we will issue stock for the loans or whether we will merely prepare and sign promissory notes. If we are forced to seek funds from our officers or directors, we will negotiate the specific terms and conditions of such loan when made, if ever.

We are not aware of any trends or known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in material increases or decreases in liquidity.

Critical Accounting Policies and Estimates

Management's Discussion and Analysis of its Financial Condition and Results of Operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to the reported amounts of revenues and expenses and the valuation of our assets and contingencies. In consultation with the Company's Board of Directors, management has identified in the accompanying financial statements the accounting policies that it believes are key to an understanding of its financial statements. These are important accounting policies that require management's most difficult, subjective judgments. See "Note 3 - Summary of Significant Accounting Policies" in our financial statements for additional information. We believe our estimates and assumptions to be reasonable under the circumstances. However, actual results could differ from those estimates under different assumptions or conditions. Our financial statements are based on the assumption that we will continue as a going concern. If we are unable to continue as a going concern, we would experience additional losses from the write-down of assets.

Off - Balance Sheet Arrangements

We have made no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Contractual Obligations

Tannahill Option Agreement

Atacama entered into an option agreement on January 27, 2023 with CJP Exploration Inc., Edward Shynkorenko, Peter Hermeston, and Margaret W. Sigouin. Pursuant to this option agreement, the company has the sole and exclusive option to acquire up to an undivided 100% interest in and to the mining claims located in Schedule A of the agreement. The option shall be exercisable by the company by making cash payments according to the following schedule. These payments shall be made in Canadian Dollars. The conversion rate as of January 27, 2023 is $1 CAD = $0.7499 USD.

i) $10,000 CAD ($7,499 USD) within 10 days following the effective date of the option agreement;

ii) $10,000 CAD ($7,499 USD) within 10 days of the first anniversary of the effective date of the option agreement;

iii) $10,000 CAD ($7,499 USD) within 10 days of the second anniversary of the effective date of the option agreement;

iv) $30,000 CAD ($22,497 USD) within 10 days of the third anniversary of the effective date of the option agreement; and

v) $40,000 CAD ($29,996 USD) within 10 days of the fourth anniversary of the effective date of the option agreement.

$250,000 CAD ($187,475 USD) in eligible work payments are required over the four-year period.

In addition, there is a 2% royalty on Net Smelter Returns for all minerals within the optioned property. The company will have the right to purchase this royalty for a purchase price of $2,000,000 CAD ($1,499,800 USD).

Heighington Option Agreement

Atacama entered into an option agreement on February 11, 2023 with Fred Kiernicki, which was amended and revised on August 28, 2023. Pursuant to this option agreement, the company has the sole and exclusive option to acquire up to an undivided 100% interest in and to the mining claims located in Schedule A of the agreement. The option shall be exercisable by the company making cash payments and according to the following schedule. These payments shall be made in Canadian Dollars. The conversion rate as of February 10, 2023 is $1 CAD = $0.7470 USD.

i) $10,100 CAD ($7,545 USD) within 10 days following the effective date of the option agreement;

ii) $10,100 CAD ($7,545 USD) within 10 days of the first anniversary of the effective date of the option agreement;

iii) $10,100 CAD ($7,545 USD) within 10 days of the second anniversary of the effective date of the option agreement;

iv) $30,300 CAD ($22,634 USD) within 10 days of the third anniversary of the effective date of the option agreement; and

v) $40,400 CAD ($30,179 USD) within 10 days of the fourth anniversary of the effective date of the option agreement.

$80,000 CAD ($59,760 USD) in eligible work payments are required over the four-year period.

In addition, there is a 2% royalty on Net Smelter Returns for all minerals within the optioned property. The company will have the right to purchase this royalty for a purchase price of $1,000,000 CAD ($747,000 USD) per percent.

Item 3. Description of Property

The following table describes the mining claims on the properties owned by the registrant and the primary minerals found on the properties.

| Asset Name |

Primary

Mineral |

Claims |

Acres |

Options

Payments |

Maintenance

Commitments |

Acquisition

Date |

| Tannahill |

gold |

29 |

640 |

10,000 |

|

1/27/2023 |

| Atacama #3 |

gold |

49 |

1940 |

32,000 |

|

12/15/2022 |

| Heighington Lithium |

lithium |

12 |

500 |

10,000 |

|

2/11/2023 |

| Heighington Lithium |

lithium |

2 |

100 |

Staked |

|

6/15/2023 |

| Heighington Lithium |

lithium |

12 |

500 |

Shares |

|

7/15/2023 |

| Atikokan Lithium |

lithium |

2 |

40 |

1,000 |

|

10/31/2022 |

| Cabo Cobalt |

cobalt |

8 |

237 |

4,500 |

|

8/25/2022 |

| Carbonatite #1 |

niobium |

18 |

370 |

2,500 |

|

9/28/2022 |

| Carbonatite #2 |

niobium |

17 |

370 |

2,500 |

|

9/28/2022 |

| Total |

|

149 |

4697 |

62,500 |

|

|

The Heighington Lithium Property located in the Larder Lake Mining Division in Northeastern Ontario. The property is held by Fred Kiernicki , and there is an option agreement between Kiernicki and Cambrian Mining Corporation/Atacama Resources International Inc. dated 2023/02/11.

The Atakokan Lithium Property consists of 2 claim units situated to the east of Atikokan with a section of the TransCanada Highway cutting across the northwest section of the claim block.

The Carbonatite #1 Property consists of 18 claim units that cover a significant portion of a massive Alkalic Intrusive unit with Carbonatite. This property is situated in the Porcupine Mining Division of Northern Ontario. The Ministry of Northern Development and Mines, Ontario registration information for the transfer is Event ID #1618650, Transaction #98508.

The Carbonatite #2 Property consists of 17 claim units that cover a significant Alkalic Intrusive unit with Carbonatite. This property is situated in the Patricia Mining Division of Northwestern Ontario. The Ministry of Northern Development and Mines, Ontario registration information for the transfer is Event ID #1621194, Transaction #980507.

The Tannahill Gold Property consists of 29 claim units located to the northeast of the Kirkland Lake gold camp. The property is situated in the Larder Lake Mining Division of Northeastern Ontario. The Ministry of Northern Development and Mines, Ontario registration for the transfer is Event ID #1591092, Transaction #96484. An early Exploration Plan/Permit, PR-23-000059 has been requested and approved by the Ministry of Northern Development and Mines to complete ground geophysical surveys and follow up diamond drilling on the property.

The Golden Eagle/Atacama 3 Properties consist of 49 claim units in the middle of the Kirkland Lake Gold camp and lie approximately 3 kilometers to the south of the Macassa Gold Mine in the town of Kirkland Lake, Ontario. In total, there are 2000 acres present on this property. The property is situated in the Larder Lake Mining Division of Northeastern Ontario. The Ministry of Northern Development and Mines, Ontario registration information for the transfer is Event ID #1596520, Transaction #96762.

The Cabo Cobalt Property consists of 8 claim units located in Lorrain Township in the Cobalt Camp.

The following map shows the location of each property held by Atacama/Cambrian Mining in the Province of Ontario.

Item 4. Security Ownership of Certain Beneficial Owners and Management

The table below sets forth the beneficial ownership of our common stock, Series A Preferred Stock, and Series B Preferred Stock, as of August 22, 2024, by:

• All of our current directors and executive officers, individually; and

• All persons who beneficially own more than 5% of our outstanding common stock.

The beneficial ownership of each person was calculated based on 1,142,366,403 shares of our common stock outstanding, 0 shares of our Series A Preferred Stock outstanding, and 580 shares of our Series B Preferred Stock outstanding as of August 22, 2024. The SEC has defined "beneficial ownership" to mean more than ownership in the usual sense. For example, a person has beneficial ownership of a share not only if he owns it in the usual sense, but also if he has the power (solely or shared) to vote, sell or otherwise dispose of the share. Beneficial ownership also includes the number of shares that a person has the right to acquire within 60 days, pursuant to the exercise of options or warrants or the conversion of notes, debentures or other indebtedness, but excludes stock appreciation rights. Two or more persons might count as beneficial owners of the same share. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. Each person named in the table has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. Unless otherwise noted, the address of the following persons listed below is c/o Atacama Resources International, Inc., 1317 Edgewater Dr., #2510, Orlando, FL 32804.

|

Name

|

Amount

|

Class

|

Ownership

Percentage of

Class

Outstanding

|

|

Glenn Grant

CEO/CFO, Director

|

41,889,341(1)

|

Common

|

3.59%

|

|

0

|

Preferred A

|

0.00%

|

|

82(2)

|

Preferred B

|

14.19%

|

|

Gregory Praver

COO, Director

|

5,220,000(6)

|

Common

|

0.45%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

|

Thomas Moynihan

CFO

|

400,000

|

Common

|

0.04%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

|

Brian Praver

VP of Business Development

|

7,986,112

|

Common

|

0.68%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

5.54%

|

|

Don Swartz

Director

|

11,478,527(5)

|

Common

|

0.98%

|

|

0

|

Preferred A

|

0.00%

|

|

32(3)

|

Preferred B

|

5.54%

|

|

John Grant

Director

|

0

|

Common

|

0.00%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

|

William MacRae

Director

|

0

|

Common

|

0.00%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

|

All Officers and Directors as a Group

(7 persons)

|

66,973,980

|

Common

|

5.74%

|

|

0

|

Preferred A

|

0.00%

|

|

114

|

Preferred B

|

19.66%

|

|

Daniel Finch(7)

Former COO, Former Director

|

92,691,705

|

Common

|

7.94%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

|

Ben Burkhardt(8)

Former Director

|

0

|

Common

|

0.00%

|

|

0

|

Preferred A

|

0.00%

|

|

58(4)

|

Preferred B

|

10.19%

|

|

Brian Grant(8)

Former Director

|

1,025,000

|

Common

|

0.09%

|

|

0

|

Preferred A

|

0.00%

|

|

0

|

Preferred B

|

0.00%

|

(1) Includes 12,000,000 common shares owned by Sandra Grant, Mr. Grant's wife.

(2) The 82 Series B Preferred Shares owned by Mr. Grant are convertible into 41,000,000 common shares.

(3) The 32 Series B Preferred Shares owned by Mr. Swartz are convertible into 16,000,000 common shares.

(4) The 58 Series B Preferred Shares owned by Mr. Burkhardt are convertible into 29,000,000 common shares.

(5) This includes 2,033,265 common shares owned by the Donald H. Swartz Trust.

(6) This includes 2,275,000 common shares owned by Gabriella Nutile, Mr. Praver's wife.

(7) Mr. Finch retired from the Company and resigned from all positions on February 1, 2024.

(8) Mr. Burkhardt resigned as a director on April 15, 2024.

(9) Mr. Grant resigned as a director on April 16, 2024.

The following persons listed below have been retained to provide services as director until the qualification and election of his successor. All holders of common stock and Series A preferred stock will have the right to vote for directors.

The board of directors has primary responsibility for adopting and reviewing implementation of the business plan of the registrant, supervising the development business plan, review of the officers' performance of specific business functions. The board is responsible for monitoring management, and from time to time, to revise the strategic and operational plans of the registrant. A director shall be elected by the shareholders to serve until the next annual meeting of shareholders, or until his or her death, or resignation and his or her successor is elected.

Changes in Control

There are no present arrangements or pledges of our securities that may result in a change in control of the registrant.

Item 5. Directors and Executive Officers

The following persons listed below have been retained to provide services as director until the qualification and election of his successor. All holders of common stock and Series A preferred stock will have the right to vote for directors.

The board of directors has primary responsibility for adopting and reviewing implementation of the business plan of the registrant, supervising the development business plan, review of the officers' performance of specific business functions. The board is responsible for monitoring management, and from time to time, to revise the strategic and operational plans of the registrant. A director shall be elected by the shareholders to serve until the next annual meeting of shareholders, or until his or her death, or resignation and his or her successor is elected.

The Executive Officers and Directors are:

| Name |

|

Position |

|

Term(s) of Office |

Glenn Grant

|

|

Chief Executive Officer |

|

June 15, 2013 to September 1, 2019

August 2022 to present |

| |

Director |

|

June 15, 2013 to September 1, 2019

August 2022 to present |

| |

Chief Financial Officer |

|

June 15, 2013 to September 1, 2019

August 2022 to April 2024 |

| Gregory Praver |

|

Chief Operating Officer |

|

April 1, 2024 to present |

| Thomas Moynihan |

|

Chief Financial Officer |

|

April 15, 2024 to present |

| Brian Praver |

|

Vice President of Business Development |

|

April 15, 2024 to present |

Don Swartz

|

|

Director |

|

October 15, 2016 to September 1, 2019

April 2023 to present |

| John Grant |

|

Director |

|

April 2024 to present |

| William MacRae |

|

Director |

|

April 2024 to present |

| Brian Grant |

|

Former Director |

|

January 2023 to April 2024 |

| |

|

Former Chief Operating

Officer |

|

June 1, 2015 to September 1, 2019

August 2022 to February 1, 2024 |

| Daniel Finch |

|

Former Director |

|

June 1, 2015 to September 1, 2019

August 2022 to February 1, 2024 |

| Ben Burkhardt |

|

Former Director |

|

April 2023 to April 2024 |

Resumes

Glenn Grant, age 76, originally became the Chief Executive Officer of Atacama Resources International Inc. in January 2015. Mr. Grant is a resident of Alberta, Canada. On July 27, 2018, the Alberta Securities Commission placed a Cease Trade Order ("CTO") on the Company due to the Company being unable to make the necessary financial filings on SEDAR. The CTO is currently in effect. On September 1, 2019, Mr. Grant resigned from his position with the registrant. On August 10, 2022, David Berry, the last remaining board member from the previous management team, requested that Mr. Grant return to the position with registrant, which Mr. Grant accepted. Mr. Grant works through his 100% owned company, BOWER Solutions, Ltd. Mr. Grant holds a Construction Engineering Degree from the Middleham University which was completed May 25, 1995.

Greg Praver, age 29, has been working for the Company as the director of Investor Relations since December 2023 and was named Chief Operating Officer on April 1, 2024. Mr. Praver is a resident of Stamford, Connecticut. From October 2022 through December 2023, Mr. Praver developed community relationships and created new business as a life insurance field underwriter, agent, and independent broker for Symmetry Financial Group. From January 2022 through October 2022, Mr. Praver managed operations as an account executive of The Plam Beaches. From January 2017 through January 2023, Mr. Praver acted as the CEO/Founder/author for Grasshopper Greg, LLC, a media website focused on travel strategies and travel guides. Mr. Praver received a BA Cum Laude in Communication and Journalism from the University of Tampa honors program in December 2015. Mr. Praver was appointed as a director of the Company pursuant to Article III, Section 4 of the Company's bylaws on April 16, 2024.

Don Swartz, age 91, is the founder and former president of Effectiveness Resource Group, Inc., which was a professional consulting company devoted to helping individuals, groups and organizations increase effectiveness. Mr. Swartz is a resident of Washington State in the United States. Mr. Swartz is a Registered Organization Development Consultant, having met the performance and ethical standards of the Organization Development Institute. During his 42 years of organization development consulting, Mr. Swartz served clients throughout the US, Canada, and southeast Asia in public and private sectors, profit and non-profit. Mr. Swartz has been a director of the Company since April 18, 2023 and was previously a director from October 15, 2016 to September 1, 2019. Mr. Swartz graduated with honors as a mechanical engineer from Lehigh University in 1953.

Thomas Moynihan, age 61, was named Chief Financial Officer of Atacama Resources International Inc. on April 16, 2024. Mr. Moynihan is a resident of Connecticut in the United States. Mr. Moynihan has been a tax accountant located in Stamford, Connecticut since April 2014. Mr. Moynihan received a Masters in Accounting from Pace University in May 1984 and a Masters in Tax from Pace University in June 1989.

Brian Praver, age 62, was named the Vice President of Business Development of Atacama Resources International Inc. on April 16, 2024. Mr. Praver is a resident of Florida in the United States. Mr. Praver has been a recruiter for Anderson Young Association in Woodcliff Lake, New Jersey since August 2015 and was a regional manager at First Citizens Bank in Atlanta, Georgia from June 2011 to July 2015. Mr. Praver received a BA from Queens College in 1984 and an MBA from Adelphi University in 1986.

John Grant, age 71, has been involved in all aspects of the Mining and Exploration industry for 48 years with a primary focus on the geophysical aspect of the industry. Mr. Grant is a resident of Timmons, Ontario. Mr. Grant was a senior field geophysical manager of Geophysical Engineering, now Teck, from 1975 to 1980. Mr. Grant has acted as the exploration Manager and the owner of Exsics Exploration Limited from 1980 through the present, in which he has managed numerous exploration programs for a number of major and junior mining companies through Ontario, Quebec, Newfoundland, Manitoba, British Columbia and Nevada. Mr. Grant graduated from Cambrian College of Applied Arts and Technology in 1975 with a three year honours diploma in Geology Technology. Mr. Grant is a Fellow of the Geological Association of Canada, a member of the Certified Engineering Technologists of Ontario and a member of the PDAC. Mr. Grant was appointed as a director of the Company pursuant to Article III, Section 4 of the Company's bylaws on April 16, 2024.

William MacRae, age 75, has been in the mining industry for more than 43 years. Mr. MacRae is a resident of Timmons, Ontario. Mr. MacRae has worked for Noranda, Newmont, Kinross Gold, Placer Dome, several Junior Exploration companies, the Geological Survery of Canada and the Ontario Geological Survey. Mr. MacRae acted as the VP of Exploration (Ontario) for Matamec Exploration from 2007 to 2008 and has been a director and member of the Audit Committee of RJK Explorations since 2017. Mr. MacRae has been involved primarily in gold exploration from grass roots to bulk sampling of underground mineralization. Mr. MacRae was the Exploration Manager in Timmins for the Canada Nickel Company from 2019 to 2023 and played a role in taking the Crawford Nickel deposit from grass roots exploration to a bankable feasibility over the course of four years. Mr. MacRae held executive positions on volunteer boards, including acting as the president of Porcupine Prospectors and Developers since 1975, the vice president of Ontario Prospectors Association since 1998, the executive director of Timmins Economic Development Corporation from 1991 to 2011, and as a director on the Timmins and District Hospital Foundation Board since 2021. Mr. MacRae has a good working relationship with all levels of government from municipal to federal and a long working history with the Ontario Minister of Mines from 2000 to 2010. Mr. MacRae graduated from Lakehead University with an Honours BSc in 1975 and from McMaster University with a post graduate degree in Geology in 1982. Mr. MacRae was appointed as a director of the Company pursuant to Article III, Section 4 of the Company's bylaws on April 16, 2024.

Brian Grant, age 52, has 30 years of experience in local and international oilfield service companies. Mr. Grant is a resident of Alberta, Canada. Mr. Grant has knowledge and experience in increasing company revenues, both local and international and in streamlining processes and sales and marketing strategies. Mr. Grant is responsible for a multi-million profit and loss center as the Senior Vice President and as a director of Clean Harbor Inc. His responsibilities include maintaining sales, operating and capital budgets and various cost savings initiatives. This involves ensuring compliance of operational units with overall corporate objectives. Mr. Grant was a director of the Company from January 1, 2023 to April 16, 2024. Mr. Grant graduated from Devon High School in Alberta, Canada in 1988.

Daniel Finch, age 80, was named Chief Operating Officer of Atacama Resources International Inc. on June 15, 2015 and elected to the board of directors of the Company by board resolution on July 15, 2015. Mr. Finch is a resident of Alabama in the United States. On July 27, 2018, the Alberta Securities Commission placed a CTO on the Company due to the Company being unable to make the necessary financial filings on SEDAR. The CTO is currently in effect. On September 1, 2019, Mr. Finch resigned from his position with the registrant. On August 10, 2022, David Berry, the last remaining board member from the previous management team, requested that Mr. Finch return to the position with registrant, which Mr. Finch accepted. Mr. Finch works through his 100% owned company, Dannette Technologies. Mr. Finch graduated from the Indiana Institute of Technology with a BS in Physics in June 1963 and an MBA from the Booth School of Business, the University of Chicago in December 1969. Mr. Finch retired from the Company on February 1, 2024 and resigned from all positions.

Ben Burkhardt, age 49, is an entrepreneur and business operator who has established, developed, and sold cannabis businesses for more than twenty years. Mr. Burkhardt is a resident of Texas in the United States. He founded Beyond Broadway LLC in Colorado on October 1, 2009. Mr. Burkhardt was introduced to Atacama Resources International Inc. in 2019. Mr. Burkhardt will assist the registrant with fundraising, grant applications, and applicable investor relations as the registrant prepares to accrue and deploy key resources into exploration of precious metals and rare earth minerals. Mr. Burkhardt was a director of the Company from April 18, 2023 to April 15, 2024. Mr. Burkhardt graduated from the St. Thomas Military Academy in St. Paul, Minnesota and received a Bachelor of Arts degree from St. Norbert College in De Pere, Wisconsin in 1996.

Significant Employees

We have no significant employees who are not executive officers.

Family Relationships

Glenn Grant is the father of Brian Grant.

Brian Praver is the father of Gregory Praver.

There is no relationship between Glenn Grant and John Grant.

Directorships

None

Involvement in Certain Legal Proceedings

During the past ten years, no director, promoter or control person:

• has filed a petition under federal bankruptcy laws or any state insolvency laws, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

• was convicted in a criminal proceeding or named subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

• was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him or her from or otherwise limiting the following activities:

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

Engaging in any type of business practice; or

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

was the subject of any order, judgment or decree, not subsequently reverse, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in the preceding bullet point, or to be associated with persons engaged in any such activity;

was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any Federal or State securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or vacated;

was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

any Federal or State securities or commodities law or regulation; or

any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

any law or regulation prohibiting mail or wire fraud in connection with any business activity; or

was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, or any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Promoters and control person

Not applicable.

Item 6. Executive Compensation

Executive Compensation

The following table sets forth the compensation paid to officers and board of directors since inception. The table sets forth this information for salary, bonus, and certain other compensation to the board of directors and named executive officers since inception and includes all board of directors and officers as of June 30, 2024.

SUMMARY COMPENSATION TABLE

|

Name and

position

|

Year

|

Salary,

consulting

fee, retainer

or

commission

($)

|

Bonus

($)

|

Committee or

meeting fees

($)

|

Value of

perquisites

($)

|

Value of all

other

compensation ($)

|

Total

compensation ($)

|

|

Glenn Grant

CEO

|

2022

|

25,000

|

0

|

0

|

0

|

0

|

25,000

|

|

2023

|

60,000

|

0

|

0

|

0

|

0

|

60,000

|

|

2024

|

45,000

|

0

|

0

|

0

|

0

|

45,000

|

|

Dan Finch

Former COO

|

2022

|

25,000

|

0

|

0

|

0

|

0

|

25,000

|

|

2023

|

65,000

|

0

|

0

|

0

|

0

|

65,000

|

|

2024

|

36,000

|

0

|

0

|

0

|

0

|

36,000

|

|

Greg Praver COO

|

2024

|

26,100

|

0

|

0

|

0

|

0

|

26,100

|

|

Thomas Moynihan, CFO

|

2024

|

9,000

|

0

|

0

|

0

|

0

|

9,000

|

|

Brian Praver, Director

|

2024

|

9,000

|

0

|

0

|

0

|

0

|

9,000

|

|

David Berry

Former board(1)

|

2022

|

0

|

0

|

0

|

0

|

129,387

|

129,387

|

|

Colin Keith

Former CEO (1)

|

2022

|

0

|

0

|

0

|

0

|

129,387

|

129,387

|

1) The amounts paid to Mr. Berry and Mr. Keith were paid in Canadian Dollars. The exchange rate on December 30, 2022 was 1 Canadian Dollar equaled $0.7368 United States Dollars.

Except for such compensation and as indicated above, no cash compensation, deferred compensation, pension benefits or long-term incentive plan awards were issued or granted to our management during the fiscal years indicated above. Further, no member of management has been granted any option or stock appreciation rights except as indicated below; accordingly, no tables relating to such items have been included within this Item.

Item 7. Certain Relationships and Related Transactions, and Director Independence

Transactions with Related Persons

Certain current officers and directors paid expenses on behalf of the Company and are due reimbursement. During the period ended September 30, 2023, the Company issued Demand Notes to Glenn Grant and Daniel Finch for the conversion of outstanding liabilities. As of June 30, 2024 and December 31, 2023, the balance due to notes payable - related parties was $89,805 and $119,983, respectively. The amount attributed to Glenn Grant was $87,945 and $114,124, respectively; and Daniel Finch was $1,860 and $5,860, respectively. As of June 30, 2024 and December 31, 2023, the accrued interest related party was $3,466 and $901, respectively. The amount attributed to Glenn Grant was $3,264 and $827, respectively; and Daniel Finch was $203 and $74, respectively.

Promoters and Certain Control Persons

Except as indicated under the heading "Transactions with Related Persons" above, there have been no transactions since the beginning of our last fiscal year, or any currently proposed transaction in which we were or are to be a participant and the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the last three completed fiscal years.

Director Independence

Our Common Stock is currently quoted on the OTC Pink Markets, which does not impose specific standards relating to director independence or the makeup of committees with independent directors, or provide definitions of independence. In accordance with the rules of the SEC, we determine the independence of our directors by reference to the rules of The Nasdaq Stock Market ("NASDAQ"). Independent directors are directors who do not have a material or pecuniary relationship with the company or related persons, except for sitting fees. In accordance with such rules, the Board has determined that Ben Burkhardt and Don Swartz are independent directors.

Item 8. Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings that may arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may have an adverse effect on our business, financial conditions, or operating results. We are not aware of any legal proceedings or claims that will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

Item 9. Market Price of and Dividends on the Registrant's Common Equity and Related Stockholder Matters.

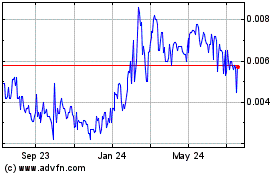

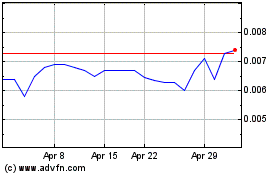

a) Market Information. The Company began trading publicly under the symbol ACRL on March 4, 2016 on the OTC Markets Pink Sheets. The quotations represent inter-dealer prices without retail markup, markdown or commission, and may not necessarily represent actual transactions.

The following table sets forth the high and low sales prices for our common stock, which has been listed on the OTC Markets Pink for all periods presented.

| Quarter Ended |

High |

|

Low |

|

| 9/30/23 |

$ |

.0054 |

|

$ |

.0015 |

|

| 12/31/23 |

$ |

.0050 |

|

$ |

.0015 |

|

| 3/31/24 |

$ |

.0092 |

|

$ |

.0035 |

|

| 6/30/24 |

$ |

.0079 |

|

$ |

.0052 |

|

| Quarter Ended |

High |

|

Low |

|

| 9/30/22 |

$ |

.0100 |

|

$ |

.0037 |

|

| 12/31/22 |

$ |

.0083 |

|

$ |

.0037 |

|

| 3/31/23 |

$ |

.0100 |

|

$ |

.0039 |

|

| 6/30/23 |

$ |

.0085 |

|

$ |

.0037 |

|

b) Holders. As of August 22, 2024, there were 224 shareholders of record of our common stock.

c) Dividends. Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. No dividends on our common stock have ever been paid, and we do not anticipate that dividends will be paid on our common stock in the foreseeable future.

d) Securities authorized for issuance under equity compensation plans. Not applicable

e) Performance graph. Not applicable.

Item 10. Recent Sales of Unregistered Securities.

The Company is authorized to issue 2,900,000,000 common shares with a par value of $0.0001.

During the last three years, we issued the following securities:

Date of

Transaction |

Transaction

type |

Number of

Shares

Issued (or

cancelled) |

Class of

Securities |

Value of

shares issued

($/per share) |

Individual/ Entity Shares were

issued to |

Reason for

share issuance |

| 8/15/22 |

Cancellation |

(92) |

Series B

Preferred |

0.0001 |

Daniel Finch, former COO, Atacama Resources International |

Cancellation |

| 8/15/22 |

New issuance |

46,000,000 |

Common |

0.0001 |

Daniel Finch, former COO, Atacama Resources International |

Conversion Preferred B to Common |

| 8/17/22 |

Cancellation |

(6) |

Series B

Preferred |

0.0001 |

Johnathan Yellin |

Cancellation |

| 8/17/22 |

New issuance |

3,000,000 |

Common |

0.0001 |

Johnathan Yellin |

Conversion Preferred B to Common |

| 8/30/22 |

Cancellation |

(18) |

Series B

Preferred |

0.0001 |

Shaka Holdings Trust, Sandip Patidar, Trustee |

Cancellation |

| 8/30/22 |

New issuance |

9,000,000 |

Common |

0.0001 |

Shaka Holdings Trust, Sandip Patidar, Trustee |

Conversion Preferred B to Common |

| 9/08/22 |

Cancellation |

(8) |

Series B

Preferred |

0.0001 |

Spivak Family Trust, Stephen Spivak, Manager |

Cancellation |

| 9/08/22 |

New issuance |

4,000,000 |

Common |

0.0001 |

Spivak Family Trust, Stephen Spivak, Manager |

Conversion Preferred B to Common |

| 4/01/23 |

New issuance |

9,000,000 |

Common |

0.0045 |

John C Grant |

Settlement of accounts payable |

| 4/01/23 |

New issuance |

27,000,000 |

Common |

0.0045 |

Daniel Finch, former COO, Atacama Resources International |

Services |

| 4/01/23 |

New issuance |

4,000,000 |

Common |

0.0045 |

Daniel Finch, former COO, Atacama Resources International |

Conversion Preferred B to Common |

| 4/01/23 |

Cancellation |

(8) |

Series B

Preferred |

0.0001 |

Daniel Finch, former COO, Atacama Resources International |

Cancellation |

| 4/01/23 |

New issuance |

12,000,000 |

Common |

0.0045 |