false

0001566243

0001566243

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): February 28, 2024

ARAX

HOLDINGS CORP.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

333-185928 |

|

99-0376721 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(IRS employer

identification no.) |

820 E Park Ave,

Bld. D200

Tallahassee, Florida |

|

32301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: 850 254

1161

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| None |

|

|

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| | ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| | ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure

Arax

Holdings Corp. (“Registrant”) issued a press release today, a copy of which is attached to this current report as

Exhibit 99.1

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

Arax Holdings Corp. |

| |

|

|

| Dated: February 28, 2024 |

By: |

/s/ Christopher D. Strachan |

| |

|

Christopher D. Strachan |

| |

|

Chief Financial Officer |

Exhibit

99.1

The

Forefront of Financial Ingenuity in Democratized Life Settlement Contract EcoSystem

ARAX and LCC Deploy Core Blockchain and Its Ecosystem

in a Fully Transparent DeFi Solution with a Real-Time Tokenized Life Settlement Bond Value Investment Index in a jointly owned

Solutions Provider, VERAT LLC

Summary

This

article takes a deep dive into the innovative Core Blockchain ecosystem, encompassing CorePass, Ping Exchange, Core Tokenization

and Smart Contract Platform, the Core Digital Asset Management Platform, and Core Regtech Solutions in a fully transparent DeFi

and Fractional Life Settlement Bond Platform deployed in a unique real-time valuation system developed by Longevity Capital Company

(LCC).

In

the article, we review how these platforms are redefining the financial industry through decentralization and integration of advanced

tech solutions with specific reference to programmable money, referred to as purpose-bounded money (PBM), and within a sphere

of programmable regulatory compliance. The article highlights multiple unique, first-of-their-kind solutions that the VERAT partnership

will generate as a result of the collaboration between the Real-Time Life Settlement Valuations Platform of LCC and ARAX Holdings

Corp’s (ARAX) Core Blockchain EcoSystem, focusing on the synergy between decentralized finance (DeFi), tokenization, digital

identity verification linked to verifiable digital attributes, and regulatory compliance.

The

goal of the VERAT partnership is to offer complete legal infrastructure solutions for banks, InsureTech companies, investment

fund managers, and people looking for small investment opportunities in an open-ended life settlement bond industry that is transparent

and accountable. The article delves into the potential and challenges of adopting VERAT technologies, presenting multiple solutions

in trade finance underwriting, DeFi-based stable token offerings, and open-ended life settlement bonds manifesting in a transparent

and quantifiable predictive investment platform.

Concluding

with key insights, the article lays out the roadmap for a second version of the VERAT Platform for future explorations in the

constantly evolving realm of the tokenized financial landscape, creating a platform for institutions to cherry-pick settlement

contracts that fit their investment portfolio and ultimately facilitate the integration of Life Settlement Bonds into financial

instruments that offer streamlined interactions within a new financial ecosystem that embraces emerging technologies and adapts

them into new paradigms of innovative and trustworthy structured investment opportunities.

Keywords:

Life Settlement Bonds, Life Settlement Contracts, Core Blockchain, CorePass Digital Identity, Core Digital Attributes Platform,

Blockchain-based Accounting Information System (AIS), Business Intelligence (BI), Smart Contracts, Decentralized Finance

(DeFi), Trade Finance Underwriting, Tokenization of Real-World Assets, Purpose Bounded Money (PBM)

Introduction

A

Paradigm Shift in Transparent Investment and Finance

ARAX's

Core Blockchain ecosystem and LCC's Real-Time Life Settlement Valuation Platform are transforming the current financial paradigm.

ARAX and LCC are teaming up to launch an innovative, first-of-its-kind life settlement fintech ecosystem called VERAT LCC. This

groundbreaking partnership introduces the two companies' network of integrated platforms, including LCC Algorithmic Real-Time

Portfolio Valuation, Core Blockchain Smart Contract and Tokenization Platform, CorePass, Ping Exchange, Core Digital Asset Management,

Digital Attribute Platforms, and Core Regtech. Together, they are revolutionizing the landscape of compliant financial ecosystems

and infrastructure solutions in the digital age.

Real-World

Implementation of the VERAT Ecosystem

| ● | Core

Blockchain: Trustworthy Real-Time Data Analytics |

The

Core Blockchain consists of cryptographically linked data blocks within ARAX's Core Blockchain EcoSystem. The ecosystem grants

users access to the complete transaction history via a decentralized ledger, which allows the possibility of building solutions

like transparent and accountable real-time data analytical platforms that provide trustworthy predictive analytical solutions,

a perfect match for Fintech and investment management infrastructure solutions. The architecture employs various peer-to-peer

(P2P) nodes for cryptographic transaction validation, eliminating the need for a central authority. The Core Blockchain technology,

rooted in a peer-to-peer network, operates independently of centralized control. Transactions are recorded using a cryptographic

hash value as a trust mechanism. Each transaction is logged in a block with its hash value and the preceding block's hash value.

Advanced ED448 encryption safeguards the decentralized Core Blockchain system, enhancing security through a sophisticated "proof

of distributed efficiency network," an improved evolution of the conventional Bitcoin "proof of work" technology.

| ● | Core

Blockchain Enterprise Distributed Ledger Technology (DLT): |

Core's

blockchain-based Accounting Information System (AIS) and Business Intelligence (BI), developed on the Totams platform, is a first-of-its-kind

feature due to its ability to organize information and big data in a decentralized, distributed, and shared chain of blocks. This

information and data can be sorted into hashed events and fingerprinted data blocks that merge off-chain cloud platforms into

a blockchain network, creating a dynamic balance of on-chain and off-chain database management platforms. Managed by multiple

users, these platforms operate within Core Blockchain's Peer-to-Peer (P2P) network, referred to as Core's blockchain-based Accounting

Information System (AIS). AIS is developed on the Totams platform and is a first-of-its-kind feature due to its ability

to organize information and big data in a decentralized, distributed, and shared chain of blocks. This information and data can

be sorted into hashed events and fingerprinted data blocks that merge off-chain cloud platforms into a blockchain network, creating

a dynamic balance of on-chain and off-chain database management platforms. Managed by multiple users, these platforms operate

within Core Blockchain's Peer-to-Peer (P2P) network, referred to as Core Enterprise Distributed Ledger Technology (DLT).

Within

the Core Blockchain Enterprise DLT Network, transactions are entered and securely stored in a distributed ledger. This transparent

system is accessible to all relevant parties, including regulators, auditors, and users, each possessing an identical copy of

the ledger for maximum transparency and accuracy.

CorePass:

Digital Identity Evolved

CorePass

transforms identity authentication by merging verifiable digital attributes with blockchain-based digital identities by harnessing

Core Blockchain's distinctive security capabilities. This simplifies KYC and AML compliance while facilitating smooth financial

transactions for digital asset management and settlement.

| ● | Core

Tokenization and Smart Contracts: Asset Management |

Leveraging

Core Blockchain's robust YLEM platform for smart contracts, the Core Blockchain CBC20 standards, Tokenization, and Smart Contract

Platform offer a secure foundation for the fractionalization of real-world assets such as bonds and financial instruments like

Life Settlement Bond investments and a PBM platform for settling reverse auction offerings of life insurance policies. It will

enhance liquidity for individual life insurance policy sellers, democratize access to investment opportunities, and revolutionize

asset management through DeFi initiatives.

| ● | Core

Purpose Bound Money Platform (CT-PBM): Perfect Solutions for Bond Originators, Fund Administrators,

and Managers |

Broadening

the potential of offering an advanced and revolutionary investment management infrastructure, VERAT will deploy the Core Blockchain

Ecosystem's Business Intelligence toolset (CT-EBI) to provide its clients, such as Bond Administrators, not only with asset verification

and real-time investment instrument valuations but, at the same time, service asset management platforms the Core's CT-EBI toolset

platform for VERAT clients interested in a blockchain-based digital attribute management platform connected to the CorePass to

modernize, streamline and simplify the traditional siloed design of the financial industry infrastructure with a shared digital

asset management and settlement platform connecting common information and pushing boundaries within innovative regulatory compliant

financial investment opportunities primarily driven by two elements:

| o | Smart

Contracts

Self-executing

autonomous programs built on the consensus of the network participants and users VERAT

serves in its Life Settlement Management platform. The Core Smart Contract Platform offers

comprehensive compliance with self-executable instances across the digital fund management

value chain. This includes automated securities transfer and settlement in addition to

decentralized compliance. Adhering to the CBC20 Token Standards ensures the secure tokenization

of real-world financial assets. |

| o | CBC20

Tokens

The CBC20 Token

Standards introduce the standard functionality and features of WrappedToken, EquivalentToken,

CheckableToken, and BountiableToken contracts, culminating in a dynamic and multifaceted

token standard. CoreToken consolidates various functionalities into one comprehensive

contract, serving as a versatile solution for projects. It provides advanced token attributes,

such as value stability, improved transactional capabilities, and incentive mechanisms,

catering to diverse project requirements. |

Furthermore,

the CBC20 Token Standard bolsters security by facilitating offline transactions and mitigating cyber threats. Its incentivization

structure rewards users for blockchain activities, and its upgradable nature affords future adaptability for cloud platform integration

off-chain, ensuring compatibility of any technological advancements in future software developments.

| o | CBC20

Tokens Key Attributes |

| ■ | Facilitate

the wrapping and unwrapping of another CBC20 token, which could, e.g., represent fingerprinted

data bundles for off-chain cloud platform integration. |

| ■ | Incorporate

real-time external price feeds to uphold value equivalence, apt for data analytics platforms

and algorithmic investment portfolio predictions. |

| ■ | Enable

the issuance and cash-out for controlled token allowances and settlements. |

| ■ | Implement

a system to assign and execute token bounties for broker rewards and external fee structures. |

| ● | Ping

Exchange: Trading Efficiency at its Peak |

| ● | Designed

to cater to novice and seasoned traders' needs, Ping Exchange exemplifies Core Blockchain's

power to create versatile platforms for exchanging tokenized real-world assets securely

and efficiently. |

VERAT

Life Settlement Management Platform

VERAT's

Life Settlement Management Platform allows clients and institutional users to create tokenized fractional life settlement investment

instruments. These tokenized assets are distributed among investors via private placements, auctions, or public offerings, depending

on the jurisdiction of the proposed bond custody and its regulatory compliance. Following this distribution, these tokens are

listed on the Ping Exchange, facilitating secondary market trading and ensuring liquidity for token holders.

Converting

open-ended life settlement investment funds into fractioned parts, referred to as tokens, transforms traditionally hard-to-move

assets into easily transferable units. This fosters a more streamlined and efficient marketplace.

The

VERAT platform, with specific reference to its embedded tokenization system, is set to not only revolutionize liquidity transformation

in the life settlement bond industry but also to allow more inclusivity for smaller and even individual investors. Enabling fractional

ownership in traditionally large life settlement bond structures can unlock asset value. Previously, these structures were exclusive

to large financial institutions and investors. On the other hand, VERAT expands the investor base and specifically includes smaller

investors by reducing the capital investment requirements.

| ● | Real-Time

Valued Financial Instruments: Transparent Real-Time Data Analytics |

VERAT's

digital Life Settlement platforms will be developed using the Core Blockchain Ecosystem and the CorePass Digital Identity platform.

It will present users with a streamlined dashboard designed for various functions. These include those wishing to tender their

life insurance policies, financial institutions and individuals seeking to acquire policies and construct a compliant structured

life settlement bond, and those interested in participating in or establishing an underwritten DAO-based DeFi project. These instruments

will be converted into tokenizable, regulation-compliant asset-backed securities on the VERAT Platform. This allows owners to

list the compliant tokens on Ping Exchange's secondary trading market.

| ● | Key

Takeaways of the VERAT Life Settlement Platform |

| o | Digital

treasury teams and fund managers in charge of financial institutions' investment portfolios

can use VERAT's streamlined dashboard solution directly. It will provide on-demand portfolio

valuations and algorithmic predictive performance analytics for cash and investment workflows. |

| o | The

VERAT dashboard will equip portfolio owners and stakeholders with fully integrated modules.

These modules will facilitate real-time financial and liquidity position monitoring and

streamline investment and accounting workflows. |

| o | In

the second version of the VERAT platform, VERAT token holders, portfolio managers, and

fund managers could attain real-time straight-through processing using the extensive

API and Oracle library of the Core Digital Asset Management Platform (CT-DAMP). As part

of this, tokenized automated deal tickets will be generated using XCB as underwriting.

This will ensure the creation of a series of transactions for operations using the Core

DAO's Liquidity Staking and Treasury Modules to be deployed later in 2024 on the Ping

Exchange's Settlement platform. |

| o | Enhanced

competitiveness: By harnessing the power of real-time analytics, businesses can swiftly

identify trends and benchmarks, securing a distinct edge over competitors who rely solely

on historical data. Giving them instant access to performance reports about partners

and competitors improves their strategic thinking and makes them even more competitive.

This is especially true for fund managers who will improve bond performance by replacing

bad policies on the reverse auction platform with better ones using the VERAT Platform's

real-time valuation algorithm and the comparative module that will be released in Version

2. |

| o | Accurate

insights: Real-time analytics prioritize immediate analysis, ensuring focused outcomes

and preventing time wasted on irrelevant data collection. |

| o | Cost-effectiveness:

Despite the upfront investment, the ultimate advantages of real-time technologies make

them a financially savvy choice in the long run. These technologies also ward off delays

in resource allocation and information congestion, further enhancing their value. |

| o | Swift

outcomes: Instant data classification enables efficient queries and rapid data processing,

facilitating quicker trend predictions and decision-making. |

| ● | Blockchain

and Asset Management on the VERAT Life Settlement Platform |

Leaders

in the investment management industry have responsibilities beyond troubleshooting daily issues. They need to take proactive measures

to secure the future of their firms in a highly competitive environment, implementing innovative and optimized investment solutions

for their financial resources.

The

VERAT Life Settlement Platform offers a unique blockchain-based asset management solution that empowers investment managers to

have greater control over their clients' portfolios and deliver better returns. At the same time, these investment funds, using

the VERAT Platform, have access to cherry-picking opportunities in bond and investment origination, a platform that utilizes blockchain

technology's secure and immutable nature to streamline data management, improve transparency, and reduce operational costs.

By

leveraging VERAT's life settlement tokenization process, investment managers can provide their clients with direct access to various

alternative assets, such as life settlement policies and fractionated live settlement bonds. These assets offer attractive returns

with low volatility compared to traditional financial instruments, making them a valuable addition to any investment portfolio

as these asset classes are, in general, not linked to market forces.

Moreover,

the VERAT Life Settlement Platform automates many manual processes to manage these alternative assets, reducing human error and

increasing efficiency. This not only saves time but also reduces risk.

By

significantly improving asset management value chains and opening the door to previously unheard-of levels of resource optimization,

VERAT technology, which will be built on the Core EcoSystem, is poised to transform the life settlement sector. Consider the following:

Verified VERAT platform users with a CorePass digital identity tied to their financial and transaction history can authorize creating

a new account 24/7. A smart contract is triggered by this action, which searches records and then approves account opening.

Upon

eligibility assessment, the account opening documents are securely displayed to the customer on their VERAT Dashboard or directly

on their smartphone. All details and records in the form of digital attributes, such as the time and date stamp, location, and

e-signature, are securely hashed in the Core Blockchain. The app efficiently oversees the financing of the new account through

an automated DAO payment or securities transfer system.

At

the same time, blockchain and smart contracts revolutionize private equity fund administration by managing capital resources on

the CT-DAMP and Core RegTech Platform. This programmable and automated DAO process minimizes risk, requiring human intervention

only when necessary.

Clarifying

Complex Innovations

We

aim to demystify the intricacies of Core Blockchain's products and LCC's real-time Life Settlement Bond and Insurance Policy Acquisition

Process, punctuating the discussion with a reader-friendly narrative to shed light on the real-world implications of these groundbreaking

platforms to build.

Core

Blockchain: Decentralization at the Heart

Taking

cues from prominent studies within the sector, we explore the transformative impact of decentralized solutions offered by Core

Blockchain and its EcoSystem. Emphasizing its role in asset tokenization and settlement of DeFi transactions, the review dissects

the nuances that render Core Blockchain and the Core EcoSystem essential players in today's FinTech platforms.

Innovative

Attributes of Core Blockchain

| ● | Decentralized

Core Blockchain and; |

| ● | Core

EcoSystem deployed on Digital Identity and Digital Attribute Verification |

| ● | Core

Dao Platform, XCB and CTN Liquidity Staking Pools, and XCB Treasury Wallets |

| ● | Core

Real-World Tokenized Asset-Backed Assets |

| ● | Purpose-Bound

Money in Smart Contracts |

| ● | Core

Wrapped Token and CBC20 Standards |

| ● | Core

Digital Asset Management Platform (CT-DAMP) |

| ● | Ping

Exchange Digital Asset Settlement Platform |

CorePass:

Streamlining Digital Integrity

CorePass

ushers in a pioneering method for managing digital identities through blockchain technology, facilitating regulatory compliance

and fostering a user-centric environment for digital interactions connecting digital attributes deployed in the Core Digital Asset

Management Platform (CT-DAMP) and the Ping Exchange Digital Asset Settlement Platform.

Asset

Tokenization: Democratizing the Wealth Market in the Life Settlement Industry

We

sift through the dynamics of tokenizing assets and the consequential benefits, ranging from enhanced liquidity to fractional ownership.

The use of Core Blockchain’s smart contracts in encapsulating the DNA of real-world assets is particularly emphasized, illustrating

the platform's excellence in engineering DeFi solutions and DAO solution architectures and implementing Life Settlement Platforms

like that of VERAT.

In

recent years, the financial landscape has witnessed a significant transformation with the emergence of blockchain technology and

the concept of asset tokenization. This innovative approach is reshaping traditional investment strategies, making them more accessible

and inclusive for a broader range of individuals. According to a report by the Boston Consulting Group (BCG), tokenized alternative

assets are poised to democratize investing and become a staggering $16 trillion business by 2030.

An

Insight into the USA Life Settlement Market

According

to recent data, the U.S. life settlement market continues to demonstrate robust growth and resilience, even in the face of economic

adversity. Research conducted

by Conning displays a promising future for life settlements.

This upward trajectory is fueled by factors such as the increasing consumer demand for alternative income sources and investor

interest in diverse assets. Economic circumstances, such as rising interest rates, also play a positive role, enhancing the crediting

rates for universal life policies. Such a conducive environment is projected to stimulate consistent growth in the annual face

value of newly settled policies, as well as the overall gross market from 2023 to 2032.

Montage

Financial Group offers valuable insights into the evolving market dynamics and trends of life settlements. According to a 2020

report by The Deal, approximately $4.6 billion was disbursed to 3,241 policyholders, marking an increase from $4.4 billion and

2,878 policyholders in 2019. This demonstrates notable growth potential. The average policy value in life settlements is about

$1.2 million, and the typical life settlement payout is nearly four times the cash surrender value of the life insurance policy.

This reveals an increasing perception of life settlements as a feasible and profitable option for policyholders.

On

average, sellers received $255,000 per settlement, far greater than the cash surrender offerings from insurance companies. Noteworthy

is that policies worth an approximate face value of $640 billion were lapsed or surrendered, suggesting that many policyholders

could have benefited significantly from life settlements.

The

aging of the Baby Boomer generation, which increases the pool of potential life settlement candidates, is driving the soaring

interest in life settlements. Additionally, increased awareness and educational initiatives will likely support the life settlement

market's growth. The range of available options for a growing number of seniors. In the United States, life settlements are a

practical financial solution for the elderly. They offer a secure, regulated avenue to access funds for retirement needs via trustworthy

brokers.

Asset

tokenization is revolutionizing the wealth market by transforming physical or digital assets into blockchain-based tokens, representing

ownership shares that can be traded on blockchain platforms. This leverages blockchain's transparency, security, and efficiency,

enabling new ways of asset ownership and trading.

VERAT

Life Settlement Platform

Key

Aspects of Life Settlement Asset-Backed Tokenization

| ● | Diverse

Applications: Applies to various assets, like: |

| o | The

acquisition of individual life insurance policies. |

| o | Fractionation

of Life Settlement Bonds |

| o | Asset-Backed

Stable Tokens |

| ● | Fractional

Ownership: It enables tokenizing fractions of high-value bonded assets, making investments

accessible with smaller capital. This approach democratizes high-value investments in

above-average return open-ended bonds with low correlation to market factors. |

| ● | Liquidity

and Accessibility: These tokens are highly liquid and tradeable 24/7 on digital exchanges,

breaking down geographical barriers and allowing global participation. |

| ● | Transparency

and Security: Blockchain ensures tamper-proof, transparent ownership records, reducing

fraud risk and increasing trust. |

| ● | Reduced

intermediaries: It cuts out intermediaries, lowers fees and barriers, and channels more

capital directly into the asset. |

| ● | Global

Diversification: Tokenization facilitates global portfolio diversification without currency

conversion and international regulation complexities. |

Key

Growth Drivers

| ● | Institutional

Adoption: Banks, asset management firms, and pension funds are increasingly exploring

tokenized assets, including insurance companies buying back their own life policies. |

| ● | Regulatory

Clarity: Evolving favorable legal frameworks are boosting investor confidence. |

| ● | Technological

Advancements: Continuous improvements in blockchain scalability, security, and efficiency. |

| ● | Retail

Investor Participation: The market is expanding with more retail investors engaging in

tokenized assets. |

| ● | Global

Market Integration: Cross-border investment opportunities foster market growth, specifically

with the regulated asset-backed MICA regulation in Europe. |

Implications

for Wealth Democratization in the Life Settlement Industry

| ● | Inclusive

Investment Opportunities: Tokenization enables investment in previously inaccessible

assets for individuals with limited resources. |

| ● | Wealth

Redistribution: It can potentially redistribute wealth more equitably by allowing people

from diverse socio-economic backgrounds to engage in wealth creation. |

| ● | Financial

Education: Growing involvement in tokenized assets necessitates enhanced financial literacy

about blockchain and smart contracts. |

| ● | Risk

Mitigation: Tokenization platforms often include risk management tools like smart contracts

that include decentralized regulation solutions offered in platforms like the Core RegTech

Platform. |

| ● | Economic

Growth: Potential to stimulate economic growth by attracting capital across industries. |

Real-Time

Valuation of LCC

| ● | The

method employed by LCC, which integrates models, statistical analysis, and cutting-edge

data systems, ensures unparalleled efficiency and precision. LCC also forms strategic

partnerships across various ventures, capitalizing on its proprietary intellectual property

to generate significant value. |

| ● | At

the core of LCC's operations is an integrated system designed to streamline the identification,

segmentation, acquisition, and ongoing evaluation of the real-time value of Tier 3 assets.

These assets, which are institutional-level financial instruments often presenting valuation

challenges, are recorded at acquisition cost under generally accepted accounting principles

until sold. Although this system encompasses a wide array of assets, LCC mainly concentrates

on a specialized market segment known as senior life securities, essentially life insurance

policies for seniors. |

| ● | LCC

has devised an elaborate modelling and management framework to manage these assets effectively,

complete with a perpetual valuation engine that employs advanced mathematics and statistical

analysis. "Bayesian Inference," a pivotal theorem for artificial intelligence

platforms, is central to this framework. This system has undergone extensive scrutiny

from independent parties, such as accounting firms, regulatory bodies, and credit rating

institutions, earning a BBB+ mid-level investment grade rating. The system's valuation

methodology has also gained audit-level endorsement for its dependability and precision. |

| ● | Independent,

comprehensive analysis suggests that LCC's system can aggregate and manage an extensive

portfolio of financial assets in a way expected to yield significant returns over 10

to 15 years. While definitive outcomes will become more apparent after at least two years

of real-time valuation, the consensus among analysts is that the value of the asset pools

is highly unlikely to decrease. This confidence in the system's performance has secured

a commendable BBB+ investment grade rating. |

Conclusion

ARAX

and LCC have jointly established VERAT, a corporate venture with equal ownership. This new entity aims to develop a range of products

leveraging the combined intellectual property of both companies. The focus is on capitalizing on highly valuable intellectual

assets by creating a blockchain-enabled, fully transparent, real-time investment platform. This innovative tool is designed for

investors and fund managers, facilitating the identification, segmentation, acquisition, and ongoing valuation of Tier 3 assets.

Through

the lens of Core Blockchain and ARAX’s suite of platforms, this piece highlights the burgeoning significance of decentralized,

tokenized solutions in the financial sector's life settlement industry. As the industry continues to gravitate towards these pioneering

methods, the promise of an efficient, inclusive, and secure financial environment emerges more brightly. By solidifying our knowledge

of the life settlement industry's foundational elements, we can harness DeFi's potential to unlock novel financial opportunities

and shape the future. Through the implementation of the Core EcoSystem and CorePass and their strong ties to digital attributes,

we can leverage blockchain technology's power via DeFi. This creates decentralized applications (DApps), empowering individuals

to engage in diverse financial activities such as lending, borrowing, and trading while harnessing the potential of stable tokens

for use in PBM and DAO networks.

Unlike

traditional finance, DeFi operates on a permissionless and transparent network, ensuring equal access and fostering financial

inclusion.

Harnessing

the potential of the life settlement bond asset class in DeFi solutions can pave the way for unprecedented financial opportunities,

sculpting the future of resource optimization of a somewhat unknown asset class.

The

potential within DeFi is limitless. To harness this potential, staying informed and adaptable is crucial. We thus invite DeFi

enthusiasts, scholars, and academics to join the ARAX and LCC teams at the Blockchain Hub on a journey towards wealth creation,

ultimately leading to financial freedom.

The

path ahead may pose challenges, but the rewards are unparalleled. Embrace this decentralized revolution and lay the foundation

for a prosperous future.

For

media inquiries, please contact:

Email Address: press@arax.cc

Safe Harbor Statement Under the Private Securities

Litigation Reform Act of 1995

Certain statements contained in this report may be construed

as "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 (the “Act”).

All statements that are not historical facts are “forward-looking statements.” The words "estimate," "project,"

"intends," "expects," "anticipates," "believes" and similar expressions are intended to

identify forward-looking statements. Such forward-looking statements are made based on management's beliefs, as well as assumptions

made by, and information currently available to, management pursuant to the "safe harbor" provisions of the Act. These

statements are subject to certain risks and uncertainties that may cause actual results to differ materially from those projected

on the basis of these statements. Investors should consider this cautionary statement and furthermore, no assurance can be made

that the transaction described in this Report will be consummated. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date made. The Company also undertakes no obligation to disclose any revision

to these forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated

events.

Investor@arax.cc

Arax Holdings Corp

+1 850-254-1161

email us here

Visit us on social media:

Twitter

LinkedIn

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

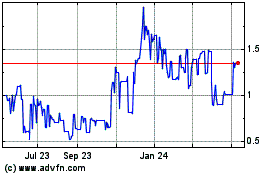

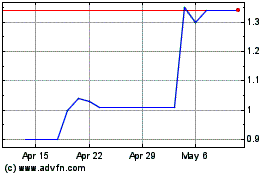

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Nov 2023 to Nov 2024