By Costas Paris and Benoit Faucon

The Suez Canal remained shut Thursday as Egyptian authorities

worked to clear a ship blocking the critical waterway and shipping

experts warned a resumption of traffic through the channel could

still be days, if not weeks, away.

The canal, which connects markets from Europe to Asia, is a

transit point for oil products refined in Europe and crude oil from

North African and Black Sea ports. Exporters and customers on both

continents were girding for delays.

Singapore's transport minister told port authorities to prepare

for disruptions. "Some draw down on inventories will become

necessary" if the blockage is prolonged, Ong Ye Kung said in a

Facebook post Thursday. Ducati Motor Holding said some customers of

its high-end motorcycles, built at a Bologna, Italy, plant,

probably won't get their bikes on time.

Tugboats and a dredger resumed work early Thursday to dig out

the Ever Given -- a 1,300-foot ship operated by Taiwan-based

Evergreen Group -- partially refloat it and move it out of the way.

As the day progressed, people involved in the operation described

an increasingly tricky engineering and logistics challenge.

The bow of the ship is still wedged deep into one side of the

canal, requiring dredging, these people said. The ship needs to be

lightened by taking off fuel, ballast water and, possibly, a

portion of its container cargo. With no cranes high enough along

the stretch of canal where the ship is marooned, helicopters are

the only option. Officials are hoping a higher-than-normal tide

expected over the weekend could help lift the ship free.

Evergreen has hired Dutch ship-salvage specialist Smit Salvage

to help with the operation. Peter Berdowski, Chief Executive of

Smit parent Royal Boskalis Westminster, told Dutch state television

that the operation "can take days to weeks."

Danish shipping giant A.P. Moller-Maersk A/S told customers late

Thursday that close to 200 ships were caught up in the traffic

snarl in both directions. Nine Maersk container vessels and two

partner vessels have been directly affected.

Suez Canal service provider Leth Agencies said Thursday that 70

northbound ships were stuck, along with 79 southbound ships -- up

from about 100 vessels combined -- late Wednesday. The World

Shipping Council, a shipping trade body, said a maximum 106 ships

can cross the waterway daily, and warned it could take a number of

days to clear the queue of ships once the Ever Given is pushed out

of the way.

Maersk and Germany's Hapag-Lloyd AG are looking into diverting

ships around Africa to avoid gridlock in the waterway. Torm A/S, a

Danish owner of tankers, also said its customers have asked how

much it will cost to divert.

"We are considering all options to deliver cargo for our

customers including air, rail and sending ships around South

Africa, but no decisions have been made" a Maersk spokesman

said

More than a dozen shipping operators polled by The Wall Street

Journal put the value of the cargo stranded at the canal at around

$12 billion.

The Suez Canal Authority has reopened an older part of the

channel to divert some ships, but the passage can only handle

smaller vessels.

"We could be here for days," said Manolis Kritikos, a mechanic

at a Greek-operated tanker, stuck in the waterway. "Nothing is

moving, and the radio talk is that we'll be here until the

weekend."

Shoei Kisen Kaisha Ltd., the owner of the Ever Given, said it

was doing its best to free the ship but "the situation involves

extreme difficulty." Evergreen Group said it was informed by the

owner that the crew, ship and cargo were safe and there was no

marine pollution as a result of the grounding. The operator said it

would continue to coordinate with the owner and the canal authority

to free the vessel and "mitigate the effects of the incident." It

said, though, that responsibility for any expense incurred in the

recovery operation, third-party liability and the cost of repair is

the owner's.

The ship had been sailing to Rotterdam from China, according to

shipping data.

The Suez Canal is a vital trade route for tankers carrying oil

and natural gas, along with container ships moving manufactured

goods such as clothing, electronics and heavy machinery from Asia

to Europe and the other way around. Around 19,000 vessels,

including smaller boats and passenger ships, crossed the Suez in

2020, according to the Suez Canal Authority. Some 39 large cargo

ships transit the Suez Canal daily on average, according to

maritime industry trade group Bimco.

Shipping operators occasionally divert ships from the canal to

the Cape of Good Hope around the southern tip of Africa to avoid

bottlenecks, but sailings can take two weeks longer and cost cargo

owners more in freight costs. Shippers said early Thursday they

were already taking alternative routes to get supplies of oil, gas

and other goods. Shipping costs have risen.

The cost of renting some tankers for voyages from the Middle

East to Asia has jumped 47% over the last three days, as shippers

seek replacements from deliveries that used to transit from Europe

to Suez, said Anoop Singh, Singapore-based head of tanker analysis

at Braemar ACM.

Avoiding the canal by sailing around Africa can add $450,000 in

costs per voyage, Mr. Singh said. As a result, vessels that were

already at the entrance of the canal or nearby have mostly stuck

with their plans so far. Braemar estimates the equivalent of 2

million barrels a day of crude and refined oil products are

currently stuck at the canal -- about 2% of global oil

consumption.

It was sailing northbound as part of a convoy when it got stuck

in the canal at around 7 a.m. local time Tuesday, according to Gulf

Agency Co., a service provider in the canal.

An Evergreen spokesperson said the ship was probably hit by

strong winds causing it "to deviate from the channel and run

aground."

Parts of the 120-mile long Suez Canal are a single lane stretch

waterway measuring just 300-feet wide, which can require ships to

travel through them in one direction at a time. Ships transit in

northbound and southbound convoys. Any ship getting stuck can stop

others from completing the transit.

William Boston contributed to this article.

Write to Costas Paris at costas.paris@wsj.com and Benoit Faucon

at benoit.faucon@wsj.com

(END) Dow Jones Newswires

March 25, 2021 19:39 ET (23:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

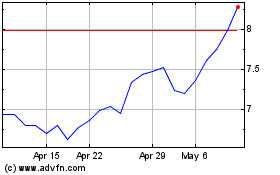

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

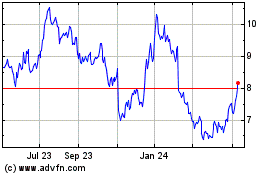

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Nov 2023 to Nov 2024