American Bus. Bank Announces Its Results for the First Quarter Ended March 31st 2012, Including 13% Deposit Growth & 9% Earni...

April 16 2012 - 2:58PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $2,404,000 for the first quarter of 2012, a 9% increase

over the $2,213,000 earned in the first quarter of 2011. Earnings

per share (EPS) in the first quarter of 2012 increased to $0.54

versus $0.50 in the first quarter of 2011. Shares outstanding as of

March 31, 2012 totaled 4,427,862.

“Our staff and Officers continue to perform at a superior level,

providing customers with the service and attention to detail that

they expect from an outstanding bank, and for this management is

thankful,” said Leon Blankstein, President.

“Southern California is one of the largest and most resilient

business economies in the country. Our continued earnings growth

reflects our ongoing success in banking some of the best companies

in our area,” said Bob Schack, Chairman of the Bank.

"Our clients and their related loans have demonstrated their

strength and resiliency through a very difficult and protracted

cycle," added Robin Paterson, Chief Credit Officer.

Assets and Liabilities

Total assets increased 13% or $140 million to $1.200 billion at

March 31, 2012 as compared to $1.060 billion at March 31, 2011.

Loans increased 1% or $3 million to $406 million at March 31, 2012

as compared to $403 million at March 31, 2011 while investments and

federal funds sold increased $136 million. Funding the asset growth

was a 13% or $120 million increase in deposits.

Interest Income

During the first quarter of 2012, Net Interest Income rose by

$102,000 or 1% over the same period in 2011.

Non-Interest Income

Non-Interest Income for the first quarter in 2012 rose 4% to

$721,000 from $693,000 during the first quarter of 2011.

Credit Quality

Asset quality at quarter-end remains excellent, with nominal

past dues and no OREO loans. At the end of March of 2012, the

allowance for loan losses stood at $9,234,000 or 2.22% of

loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK BALANCE SHEET

(Unaudited - 000's omitted)

March 2012 2011

Assets Investment Securities $ 724,351 $ 588,939

Federal Funds Sold 1,000 - Loans and Leases (net) 405,836 403,169

Cash, Checks in process of collection, Due From Banks 32,205 33,210

Premises, Equipment and Other Assets 36,824 34,365

Total

Assets $ 1,200,216 $ 1,059,683

Liabilities and Shareholders' Equity Demand Deposits

472,975 382,787 Money Market and NOW Deposits 462,837 433,772

Savings and Time Deposits 88,370 87,283 Total Deposits 1,024,182

903,842 FHLB Advances/ Borrowings 71,000 79,700 Other

Liabilities 15,565 7,326 Shareholders' Equity 89,469 68,815

Total Liabilities and Shareholders' Equity $

1,200,216 $ 1,059,683 AMERICAN BUSINESS

BANK INCOME STATEMENT

(Unaudited - 000's omitted)

Three months ended March

2012 2011 Interest

Income Loans and Leases $ 5,450 $ 5,566 Investment Securities

4,017 3,931 Total Interest Income 9,467 9,497

Interest Expense Money Market and NOW Accounts 553 624

Savings and Time Deposits 151 178 Repurchase Agreements/ Other

Borrowings 65 99 Total Interest Expense 769

901 Net Interest Income 8,698 8,596 Provision

for Loan Losses (300 ) (475 ) Net Interest Income After

Provision for Loan Losses 8,398 8,121

Other Income

721 693

Operating Expenses 5,707 5,786

Operating Income 3,412 3,028

Income

Taxes (1,008 ) (815 )

Net Earnings $ 2,404

$ 2,213 Selected Ratios: Earnings per Share

$0.54 $0.50 Tier 1 Capital Ratio 6.99 % 6.85 % Net Interest Margin

(Prior to tax effects) 3.12 % 3.51 % Return on Beginning Equity

11.12 % 13.13 % Return on Average Assets 0.82 % 0.86 % Efficiency

Ratio 58.0 % 59.7 %

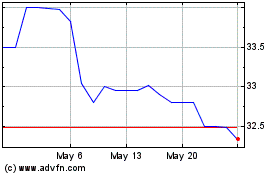

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025