Alpine Air Express Posts Its Third Quarter 10QSB for FY 2005

September 26 2005 - 5:05PM

Business Wire

-Alpine Aviation Inc., a subsidiary of Alpine Air Express Inc.

(OTCBB: ALPE), and the third largest, by volume, regional cargo

airline and transportation logistics company in the United States,

with a fleet of 26 airplanes, along with its sister company, Alpine

Air Chile, S.A., for the three months ending July 31, 2005, posted

revenues of $5,369,327. This represents an increase in total

revenue of approximately 8% over revenues of $4,965,758 during the

same period in 2004. During the quarter ended July 31, 2005, the

company had a net loss of $809,480, which includes a one-time

write-down of aircraft and other assets and the forfeiture of

certain deposits. For further information, please see Alpine

Aviation's third quarter 10QSB available at the company's Web site,

www.alpine-air.com/investors.htm/. The company receives the

majority of its revenues from contracts with the U.S. Postal

Service (USPS). For the three months ended July 31, 2005 and 2004,

the revenues from contracts with the USPS represented 100% and 81%

of total revenues, respectively. At July 31, 2005 and Oct. 31,

2004, accounts receivable from the USPS totaled $1,724,114 and

$1,046,321, or 95% and 43%, respectively. The contracts currently

in effect with USPS will expire between August and November 2006

for mainland U.S. operations and as early as Oct. 7, 2005, for

Hawaii for certain routes and the remainder may be under new

contracts for an additional three years. Since April 2004, the

company has operated a new USPS contract to provide delivery of the

mail between the Hawaiian Islands. This obligation placed more

demand on company resources, including the increase in fuel costs,

which has hindered the company's desire to expand its delivery

services for additional routes in the mainland United States. As a

result, on Jan. 31, 2005, the company notified the USPS of its

intention to discontinue or terminate its service to the Hawaiian

Islands under the terms of the current AMOT contract. The contract

obligation to provide service may cease as early as Oct. 7, 2005.

The company believes it has mitigated the recent losses through

management plans, which have included re-bidding the USPS contract

in Hawaii, the recovery of aircraft previously leased which can now

be redeployed to reduce the company's costs of chartering aircraft

to cover delivery routes in the mainland United States, the

reduction of any further significant investment into Alpine Air

Chile, and the company has entered into agreements to postpone the

payments on the related party notes payable and the dividends on

preferred stock. Gene Mallette, CEO of Alpine Air, commented: "We

are excited to finally have the opportunity to return to

profitability this quarter, given the potential of receiving

notification of the Hawaiian contract award from the U.S. Postal

Service." Founded in 1975, Alpine Air, a wholly owned subsidiary of

Alpine Air Express Inc., provides competitively priced scheduled

air cargo flights throughout the western and southwestern United

States. The company has an established client base that includes

various contract operations and the U.S. Postal Service. Alpine Air

provides substantial "on time" performance and reliability,

together with the flexibility to adapt quickly to the growing

frequency and capacity requirements of its clients. This press

release may contain forward-looking statements including the

company's beliefs about its business prospects and future results

of operations. These statements involve risks and uncertainties.

Among the important additional factors that could cause actual

results to differ materially from those forward-looking statements

are risks associated with the overall economic environment,

realization of USPS projected volumes, changes in anticipated

earnings of the company and other factors detailed in the company's

filings with the SEC. In addition, the factors underlying company

forecasts are dynamic and subject to change and therefore those

forecasts speak only as of the date they are given. The company

does not undertake to update them; however, it may choose from time

to time to update them and if it should do so, it will disseminate

the updates to the investing public.

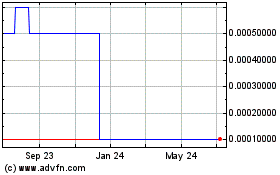

Alpha En (CE) (USOTC:ALPE)

Historical Stock Chart

From Feb 2025 to Mar 2025

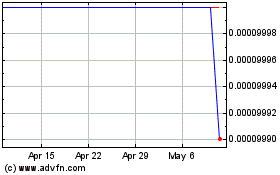

Alpha En (CE) (USOTC:ALPE)

Historical Stock Chart

From Mar 2024 to Mar 2025