ALKM Announces Growing Revenue On Balance Sheet and Operational Improvements

April 05 2022 - 12:19PM

InvestorsHub NewsWire

LAS VEGAS, NV

-- April 5, 2022 -- InvestorsHub NewsWire -- Alkame Holdings, Inc.

(OTC

PINK: ALKM), is pleased to provide a corporate

update.

Valued

shareholders,

As the first

quarter of 2022 has come to an end, we would like to take this

opportunity to provide an update of what has been happening with

our company since our last corporate update for the fourth quarter

2021.

There are

several exciting and positive updates that we are pleased to share

with you.

As we

mentioned in our last corporate update, one of our goals was to

continue to reduce our corporate debt and we continue to do so. We

recently settled a $500,000 + dispute over an equipment transaction

for the West Salem Facility. We replaced that debt with a new third

party $100,000 UCC-1 assumption on the equipment under the terms of

our credit facility note. We also structured a deal to buyout

$280,000 of equipment for the West Salem Facility and have already

paid $100,000 towards that purchase. The remaining balance is to be

paid by end of august 2022. Our corporate debt has been reduced by

over $1,000,000 this past

quarter.

We continue to

work hard to increase our revenues, enabling us an opportunity to

further reduce our debts from cash flow. The heightened demand for

Food & Beverage co-packing and contract manufacturing line time

space currently plays very well for us. With line time scarce in

the industry, we are in a unique situation to be selective in the

inquiries that we continue to receive from small to medium size

companies, to even large major household name brands. This leads us

to another of our corporate goals of increasing our revenues and

cash flow situation to further reduce debt

obligations.

We made major

changes to our operational model this year. We no longer act as the

“bank” for our customers or clients. Previously, we were purchasing

our clients supplies and ingredients which constantly put a strain

on our cash flow. While we will forgo top line revenue, our

commitment to bottom line revenue will increase as we no longer

need to finance the materials and ingredients for our clients. We

still provide our clients with assistance in the sourcing and

procurement with our vendors for the purchasing of these items, we

no longer have to outlay the cash for those

purchases.

At the end of

last year we established a $1,000,000 credit facility which allows

us to improve our manufacturing capabilities and footprint, as well

as finance any operational requirements based on purchase orders.

With that facility we have been able to reduce debt, increase our

footprint, and improve our operations and production

capacity.

On New Year’s

Eve we purchased too long-established Jam and Jelly brands, Maury

Island Farms Jams and Quinn’s Pepper Jellies. We have just recently

begun production and have already been receiving orders and getting

product ready to ship. We are very excited about entering this new

market segment.

We are looking

to increase our production space at the West Salem facility to

expand out hot pack capabilities to compliment both our Bell Food

& Beverage Plant as well as accommodate the influx of business

we are currently getting for hot packed products. After a lot of

hard work and investment, this facility started production in

December of 2021, and we look to have hot pack capabilities in that

facility by the end of 2022.

We have many

more good things in the works to announce shortly, including but

not limited to production and development deals with several new

clients. Stay tuned.

About Alkame Holdings,

Inc.

Alkame

Holdings, Inc. is a publicly traded health and wellness technology

holding company, with a focus on patentable, innovative, and

eco-friendly consumer products. The Company's wholly owned

subsidiaries manufacture products with enhanced water utilizing a

proprietary technology to create products with several unique

properties. The organization is diligently building a strong

foundation through the launch and acquisition of appropriate

business assets, and by pursuing multiple applications by placement

into several emerging business sectors, such as consumer bottled

water and RTD products, household pet products, horticulture and

agriculture applications, hand sanitizers, and many other various

water-based treatment solutions to both new and existing business

platforms.

For more information, visit www.alkameholdingsinc.com.

Alkame

Holdings, Inc. Investor Relations

Website: www.alkameholdingsinc.com

Email: info@alkameholdingsinc.com

Disclaimer/Safe Harbor: This news release contains

forward-looking statements within the meaning of the Securities

Litigation Reform Act. The statements reflect the Company's current

views with respect to future events that involve risks and

uncertainties. Among others, these risks include the expectation

that Alkame will achieve significant sales, the failure to meet

schedule or performance requirements of the Company's contracts,

the Company's liquidity position, the Company's ability to obtain

new contracts, the emergence of competitors with greater financial

resources and the impact of competitive pricing. In the light of

these uncertainties, the forward-looking events referred to in this

release might not occur. These statements have not been evaluated

by the Food and Drug Administration. These products are not

intended to diagnose, treat, cure, or prevent any

disease.

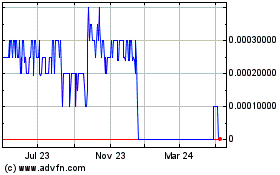

Alkame (CE) (USOTC:ALKM)

Historical Stock Chart

From Nov 2024 to Dec 2024

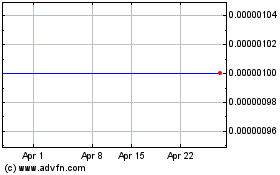

Alkame (CE) (USOTC:ALKM)

Historical Stock Chart

From Dec 2023 to Dec 2024