September 14, 2021 - Bedford, NS - InvestorsHub NewsWire -

(TSXV:SSE) - Silver Spruce Resources, Inc. ("Silver Spruce" or the

"Company") is pleased to announce that it has signed a Definitive

Agreement with two parties (the "Vendors") to acquire 100% of three

early-stage gold exploration properties, Mystery, Till and Marilyn,

(the "Property" or the "Properties") located near Grand Falls,

Newfoundland, Canada, 20-25 kilometres west of New Found Gold

Corp.'s Queensway project and 15-35 kilometres south of Sokoman

Minerals Corp.'s Moosehead gold project.

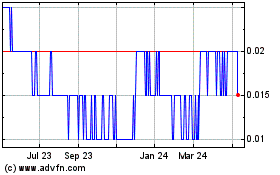

Figure 1. Location Map of Mystery, Till and Marilyn Gold

Properties in the Exploits Subzone Gold Belt (Image adapted from

exploits.gold).

"We expedited our initial site visit on the Properties during

the week of August 23rd and given the positive initial report on

the mineral and rock textures potentially related to shallow

epithermal and/or orogenic vein-style mineralization, we are

pleased to move forward with this Definitive Agreement with the

Vendors," said Greg Davison, Silver Spruce VP Exploration and

Director. "We believe that this is a timely opportunity to acquire

these Properties given their strategic location in a very active

exploration camp, displaying prospective geology with only limited

exploration and no history of drilling, and proximal to regional

and secondary structural features defined by the geophysical and

geological coverage. We have started building out the project

ArcGIS database and investigating the most up-to-date and

appropriate geochemical and geophysical techniques to conduct a

Fall 2021 Phase 1 exploration program."

The Properties are well situated in exploration logistics,

located close to each other and <10-25 kilometres southeast and

south by road from Grand Falls, Newfoundland. The Properties are

located <50 kilometres from the Gander International Airport and

are easily accessible from major paved roads and local logging and

bush roads and trails largely by vehicles and more remote areas by

ATV.

The 8,750-hectare project is located within the Exploits

Subzone, an extensive area of mineral exploration activity and

discoveries over the past two years (Figure 1). The region is

structurally complex and located, in large part, between two major

crustal lineaments, the Grub Line and Valentine Lake Faults.

Numerous major to lesser sub-parallel features merge and bifurcate

along strike and are transected by NW and EW-trending faults. These

deep-seated structures, which juxtapose geological terranes over

hundreds of kilometres, are key to the location and formation of

orogenic gold deposits containing several million ounces of gold as

reported by a number of junior companies in the district. Though

younger, the lineaments are very similar to those of the Abitibi

Gold Belt in Ontario and Quebec in scale, splaying surface

expression and wide distribution of mineral endowment, though in an

earlier stage of overall exploration and development.

"We look forward to working in Newfoundland which offers a

favorable regulatory environment, supportive communities,

outstanding provincial geological survey, near year-round operating

conditions, excellent property access and of principal importance,

significant potential for new deposits as indicated by the number

and quality of recent successful exploration projects," said Greg

Davison, Silver Spruce VP Exploration and Director. "The Company's

decision to add multiple properties to our portfolio in

high-quality jurisdictions will give shareholders more

opportunities for notable discoveries."

Due Diligence

Silver Spruce contracted a Newfoundland-based professional

geologist to visit the properties with one of the Vendors. They

travelled to the Mystery and Marilyn properties, shown in Figures 2

and 3 respectively, examined the geology, verified sample locations

for the historical assays and collected new rock samples, thirteen

of which were submitted to ALS Global for analysis, and took

photographs of pertinent topography, geomorphology, geological

exposures, access and types of vegetation. The four claims on the

Till property were not evaluated during the site visit. Additional

rock samples and splits of assay samples were shipped by courier to

the Company's QP for forthcoming examination by optical microscopy.

The results of the due diligence rock geochemistry for thirteen

samples are expected from ALS Global in due course.

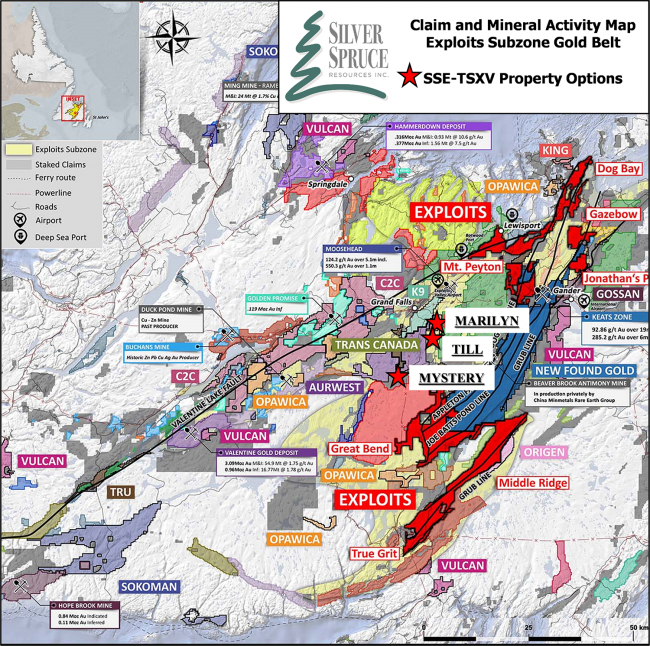

Figure 2. Mystery claims transected by the Great Rattling

Brook. Due diligence sampling sites indicated.

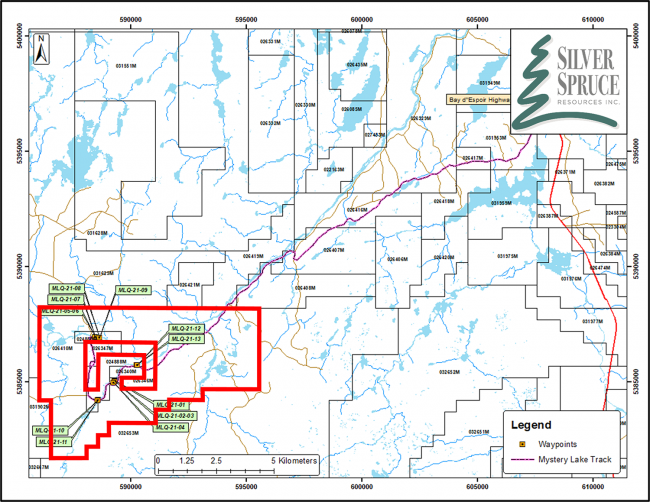

Figure 3. Marilyn claims, southeast of Grand Falls, transected

by the Bay d'Espoir Highway. Due diligence sampling sites

indicated.

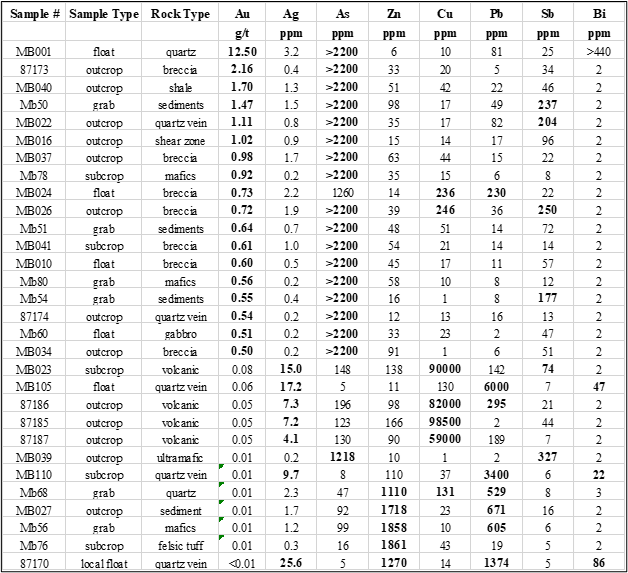

A selection of historical assays reported for precious and base

metals and pathfinder elements from 123 samples collected from

Mystery and Marilyn are shown in Table 1. Eighteen samples reported

Au >0.5 g/t (max. 12.5 g/t Au). Cu values were reported up to to

9.85% with minor Ag, Pb and Zn. Arsenic was highly anomalous with

values for 36 samples over the 2200 ppm upper limit for Inductively

Coupled Plasma (ICP-OES) analysis, strongly associated with

elevated Au values and displayed generally as minor to abundant

arsenopyrite (see Figure 4).

Table 1. Select analyses from historical exploration on the

Mystery and Marilyn properties - n=123 The samples represent those

with Au, Ag and base metal (Cu, Pb, Zn) values in the 90th

percentiles for each element from a total of 123 samples

analysed.

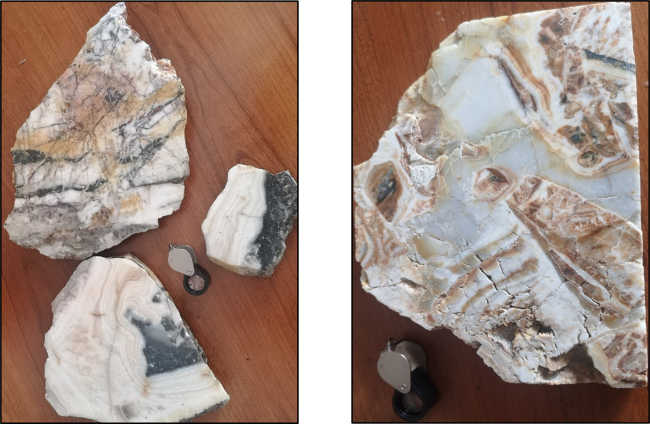

Multiple surface occurrences are reported of agate chalcedony to

colloform and crystalline silica veining and multi-phase breccias

(see Figures 4 and 5), carbonate replacement by quartz, and

open-space filling quartz and calcite, all textures indicative of

the upper zones of epithermal systems and epizonal to mesozonal

structural conduits in orogenic systems, and are accompanied by Au

and arsenopyrite, stibnite, chalcopyrite, bornite and Cu carbonate

mineralization in several host lithologies including quartz, black

shale and other sediments, ultramafics and gabbro.

Figure 4. Left - Epithermal silica veining outcropping along

Great Rattling Brook. Right - Quartz float with arsenopyrite,

sample grade reported as 12.5 g/t Au, 3.2 g/t Ag with anomalous As

and Bi.

Figure 5. Polished samples showing epithermal chalcedonic

silica veining with complex depositional and compositional banding,

open space filling and multi-stage brecciation from Mystery

property.

Terms of Agreement

Silver Spruce had a 30-day window after signing the LOI (see

Press Release August 16th, 2021) to carry out its due diligence and

prepare a Definitive Agreement ("DA") for the Property

acquisition.

The principal terms to purchase 100% interest in the Properties

include cash payments and Silver Spruce common shares, with

CAD$40,000 in cash and 1,000,000 shares on signing, and escalating

payments of CAD$575,000 and 9,000,000 shares spread over five years

on the anniversary date of TSX Venture Exchange approval. The

minimum work expenditures over the life of the agreement total

CAD$1,500,000. All financial terms are in Canadian dollars.

A finder's fee is payable on the acquisition pursuant to the

guidelines of the TSX Venture Exchange.

Upon TSX acceptance for the DA, Silver Spruce will earn a 100%

interest in the Property by paying the following cash payments to

the Vendors or their nominee(s):

- $40,000 collectively upon receipt by the Purchaser of the

Conditional Acceptance of the Exchange of this Agreement;

- $50,000 collectively upon the first anniversary of the date of

the Final Exchange Bulletin;

- $75,000 collectively upon the second anniversary of the date of

the Final Exchange Bulletin;

- $100,000 collectively upon the third anniversary of the date of

the Final Exchange Bulletin;

- $150,000 collectively upon the fourth anniversary of the date

of the Final Exchange Bulletin;

- $200,000 collectively upon the fifth anniversary of the date of

the Final Exchange Bulletin; and

issuing to the Vendors or their nominee(s) from treasury the

following Shares:

- 1,000,000 common shares collectively upon receipt by the

Purchaser of the Conditional Acceptance of the Exchange of this

Agreement;

- 1,000,000 common shares collectively upon the first anniversary

of the date of the Final Exchange Bulletin;

- 1,250,000 common shares collectively upon the second

anniversary of the date of the Final Exchange Bulletin;

- 1,500,000 common shares collectively upon the third anniversary

of the date of the Final Exchange Bulletin;

- 2,000,000 common shares collectively upon the fourth

anniversary of the date of the Final Exchange Bulletin;

- 3,250,000 common shares collectively upon the fifth anniversary

of the date of the Final Exchange Bulletin; and

incurring a minimum of $1,500,000 in Expenditures on the

Property as follows:

- $150,000 in property expenditures by the first anniversary of

the date of the Final Exchange Bulletin; and

- $200,000 in additional property expenditures by the second

anniversary of the date of the Final Exchange Bulletin; and

- $250,000 in additional property expenditures by the third

anniversary of the date of the Final Exchange Bulletin; and

- $300,000 in additional property expenditures by the fourth

anniversary of the date of the Final Exchange Bulletin; and

- $600,000 in additional property expenditures by the fifth

anniversary of the date of the Final Exchange Bulletin.

Upon completion of the above terms in to earn a 100% interest in

the Property, and the Title Transfer, the Vendors will reserve,

retain and hold a 2% net smelter return royalty as described in the

Royalty Agreement (the "Royalty").

An advance payment against the Royalty payable by the Purchaser

to the Vendors in the amount of $15,000 will be made on an annual

basis starting on the 6th anniversary of the date of the Final

Exchange Bulletin.

The Company shall be entitled, at any time in its sole

discretion, upon written notice to the Vendors, to buy back 1% of

the Royalty for $2,000,000, and shall have the right to buy back

the remaining 1% of the Royalty from the Vendors at any time at a

prevailing market price.

Geochemical Analysis, Quality Assurance and Quality Control

Rock samples were collected, packaged and delivered by the

Company's contract professional geologist to a courier service for

shipment to the ALS sample preparation facility in North Vancouver,

British Columbia, Canada. ALS Global is a facility certified as ISO

9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards

Council of Canada.

Pulps (50gram split) were submitted for Au analysis by Fire

Assay with Atomic Absorption finish (Au-AA24) and Four Acid

Digestion with Inductively Coupled Plasma Atomic Emission

Spectrometry (ICP-AES) multi-element analyses (ME-ICP61m).

Given the small size of the sample suite, no additional in-house

quality control samples (blanks, standards, duplicates, preparation

duplicates) were inserted into the sample set. ALS Global conducts

its own internal QA/QC program of blanks, standards and duplicates,

and the results are provided with the Company sample certificates.

The results of the ALS control samples will be reviewed by the

Company's QP and evaluated for acceptable tolerances. All sample

and pulp rejects will be stored at ALS Global pending full review

of the analytical data, and future selection of pulps for

independent third-party check analyses, as requisite.

All of the metal values disclosed herein for the Mystery and

Marilyn properties by past operators, including the Vendors, and by

Silver Spruce are reported from grab samples which may not be

representative of the metal grades, or the metal grade

distribution, and those from previous exploration efforts must be

considered as historical in nature. The Company has reviewed the

historical certificates, where available, and conducted data

verification sampling on the known areas of mineralization with a

view to to confirm the presence and tenor of metal values. The

verification sample results are pending from ALS.

The Company believes that the analytical protocols and data will

withstand scrutiny for inclusion. Sample grades reported by element

in the technical documentation and analytical certificates range

from detection limit (based on the specific instrumentation and by

element) to anomalous values which represent and include select

samples and are reported as 'up to' the maximum values and/or

ranges presented. Average values may be reported for select suites

of samples in which the sample frequency is indicated and which

only represent metal grades from those samples.

Qualified Person

Greg Davison, PGeo, Silver Spruce VP Exploration and Director,

is the Company's internal Qualified Person for the Mystery, Marilyn

and Till Projects and is responsible for approval of the technical

content of this press release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects

("N.I. 43-101"), under TSX guidelines.

About Silver Spruce Resources Inc.

Silver Spruce Resources Inc. is a Canadian junior exploration

company which has signed Definitive Agreements to acquire 100% of

the Melchett Lake Zn-Au-Ag project in northern Ontario, and with

Colibri Resource Corp. in Sonora, Mexico, to acquire 50% interest

in Yaque Minerales S.A de C.V. holding the El Mezquite Au project,

a drill-ready precious metal project, and up to 50% interest in

each of Colibri's early stage Jackie Au and Diamante Au-Ag

projects, with the three properties located from 5 kilometres to 15

kilometres northwest from Minera Alamos' Nicho deposit,

respectively. The Company also is acquiring 100% interest in the

drill-ready and fully permitted Pino de Plata Ag project, located

15 kilometres west of Coeur Mining's Palmarejo Mine, in western

Chihuahua, Mexico. Silver Spruce has signed a Definitive Agreement

to acquire 100% interest in three exploration properties in the

Exploits Subzone Gold Belt, located 15-40 kilometres from recent

discoveries by Sokoman Minerals Corp. and New Found Gold Corp.,

central Newfoundland. Silver Spruce Resources Inc. continues to

investigate opportunities that Management has identified or that

have been presented to the Company for consideration.

Contact:

Silver Spruce Resources Inc.

Greg Davison, PGeo, Vice-President Exploration and Director

(250) 521-0444

gdavison@silverspruceresources.com

Michael Kinley, CEO and Director

(902) 826-1579

mkinley@silverspruceresources.com

info@silverspruceresources.com

www.silverspruceresources.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Notice Regarding Forward-Looking

Statements

This news release contains "forward-looking

statements," Statements in this press release which are not purely

historical are forward-looking statements and include any

statements regarding beliefs, plans, expectations or intentions

regarding the future, including but not limited to, statements

regarding the private placement.

Actual results could differ from those projected in

any forward-looking statements due to numerous factors. Such

factors include, among others, the inherent uncertainties

associated with mineral exploration and difficulties associated

with obtaining financing on acceptable terms. We are not in control

of metals prices and these could vary to make development

uneconomic. These forward-looking statements are made as of the

date of this news release, and we assume no obligation to update

the forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements. Although we believe that the beliefs, plans,

expectations and intentions contained in this press release are

reasonable, there can be no assurance that such beliefs, plans,

expectations or intentions will prove to be

accurate.

Silver Spruce Resources (TSXV:SSE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Silver Spruce Resources (TSXV:SSE)

Historical Stock Chart

From Feb 2024 to Feb 2025