Rubicon Organics Inc. (TSXV: ROMJ) (OTCQX: ROMJF) (“Rubicon

Organics” or the “Company”), a licensed producer focused on

cultivating and selling organic certified and premium cannabis,

today reported its financial results for the three and six months

ended June 30, 2024 (“Q2 2024”). All amounts are expressed in

Canadian dollars.

"Rubicon Organics’ house of premium brands

remains the #1 premium licensed producer in Canada. I expect this

leadership position to grow with our entry into the vape sector

where two strains were launched in Q2 2024. I’m proud to report

that we have already seen our national distribution hit over 40% of

stores in the first two months of sales to July. I expect this

growth momentum to continue as we expect to have five vape strains

in market by year-end,” said Margaret Brodie, CEO.

Janis Risbin commented, "I am pleased to

announce a record quarter with net revenue reaching $12.1 million,

leading to a profit from operations and an adjusted EBITDA of $0.9

million. Additionally, we have generated $1.1 million in operating

cash flow and $0.7 million in free cash flow, all while investing

in our one-time ERP project, maintaining a strong balance sheet and

advancing through the late stages of our debt financing

negotiations that I expect to be completed at similar terms to our

existing debenture. We acknowledge the shift in consumer preference

toward larger format purchases, which yield lower gross profit per

unit. However, we are proactively working to re-engage consumers

with our more profitable product offerings."

Q2 2024 and Subsequent

Highlights:For the three and six months ended June 30,

2024

- Net revenue of $12.1 million (7% increase from Q2 2023)

and $21 million (5% increase from Q2 2023) for the three and six

months ended June 30, 2024.

- Gross profit before fair value adjustments of $3.7 million

(21% decrease from Q2 2023) and $5.8 million (23% decrease from Q2

2023) for the three and six months ended June 30, 2024.

- Adjusted EBITDA10 gain of $0.9 million and $0.4 million

compared to $1.8 million and $1.9 million in Q2 2023, for the three

and six months ended June 30, 2024.

- Cash provided by operating activities of $1.1 million for

the three months ended June 30, 2024.

- Free cash flow of $0.7 million for the three months ended

June 30, 2024.

- Number one premium licenced producer across all

categories11 with 6.5% market share, up from 4.95%12

- 2.0%13 national market share of flower and pre-rolls for

the three and six months ended June 30, 2024.

- 5.7%14 and 6.1%15 national market share of premium flower

and pre-rolls for the three and six months ended June 30,

2024.

- WildflowerTM is the number one topical brand in Canada with

market share of 28%16 for the six months ended June 30, 2024.

- 29.9%17 and 26.8%18 national market share of premium

edibles for the three and six months ended June 30, 2024.

- Launch of full spectrum extract vapes in Alberta, BC, and

Ontario initially with cultivars Blue Dream and Comatose followed

by GLTO #41.

2024 Results of Operations:

| |

Three months ended |

Six months ended |

|

|

June 30,2024$ |

June 30,2023$ |

June 30,2024$ |

June 30,2023$ |

|

Net revenue |

12,105,697 |

11,281,793 |

|

20,996,114 |

20,081,733 |

|

| Production costs |

2,931,952 |

2,592,334 |

|

5,624,644 |

5,270,938 |

|

| Inventory expensed to cost of

sales |

5,209,148 |

3,916,114 |

|

8,946,482 |

6,851,008 |

|

|

Inventory written off or provided for |

312,964 |

173,179 |

|

579,003 |

330,603 |

|

|

Gross profit before fair value adjustments |

3,651,633 |

4,600,166 |

|

5,845,985 |

7,629,184 |

|

| Fair value adjustments to

cannabis plants, inventory sold, and other charges |

398,790 |

(606,406 |

) |

563,042 |

(466,943 |

) |

|

Gross profit |

4,050,423 |

3,993,760 |

|

6,409,027 |

7,162,241 |

|

|

|

|

|

|

|

|

|

|

As At: |

June 30,2024

$ |

December 31,2023$ |

|

Cash and cash equivalents |

9,501,994 |

9,784,190 |

| Working

capital † |

9,795,925 |

10,132,089 |

† Working capital as at June 30, 2024 includes $10.8 million

current portion of loans and borrowings. The Company is currently

in discussions with the debenture holder and other lenders to

extend the term of the existing agreement or to enter into a new

loan agreement in the second half of 2024.

2024 Outlook

Brand and Product

Development

Our strategy is founded on a strong premium

house of brands, highly regarded by both budtenders and consumers

alike. Guided by consumer research, we continually innovate our

products to anticipate market trends. Our commitment to quality and

excellence is evident throughout all areas of our business, seeking

to deliver products and services that consistently meet the highest

quality standards.

Launch into Vape Category

Rubicon launched into the vape category with our

1964 Supply CoTM brand. The introduction of vapes strategically

aligns with our market expansion strategy and offers substantial

growth prospects. The vape market has demonstrated robust growth

over recent years and trends in Canada and the US demonstrate

indicating the vape category's increasing prominence, rivaling or

surpassing traditional flower products.

Using our Delta grown genetics and supplementing

with biomass of the same genetics grown at partners, we launched

Comatose and Blue Dream Full Spectrum Extract (“FSE”) resin vapes

in Ontario, BC, and Alberta in May 2024. Following strong demand,

we launched a new cultivar, GLTO #41, in late July 2024.

In line with our approach to the live rosin

edibles we launched under the brand in 2023, we are focused on

delivering products that maintain a competitive edge through

superior quality, right price to value ratio leveraging our

established and reputable brands. We are confident that by

capitalizing on this opportunity, over time we can achieve

comparable financial success with our vape offerings as we have

with our flower business.

WildflowerTM’s Leadership

in Cannabis Wellness

WildflowerTM's prominence in the cannabis

wellness sector is characterized by its notable dominance in

topical products and the Company has recently expanded the brand to

other categories, including edibles, oils, and capsules designed to

address specific wellness needs such as sleep, pain relief, and

anxiety reduction. While we expect more competition to enter the

topical and wellness category, we are expanding the brand into

other categories and anticipate steady growth and momentum behind

the daily wellness consumer.

Launch of New Genetics

Rubicon plans to continue to launch new and

novel genetics into its Simply BareTM Organic and 1964 Supply CoTM

to continue leadership in the premium cannabis market. Launches in

2024 include BC Organic Zookies, BC Organic Power Mintz, and BC

Organic Fruit Loopz under the Simply Bare TM Organic brand, and

Blue Dream under the 1964 Supply CoTM brand.

Growth from Solid Business

Fundamentals

Consistent quality and systematic delivery to

our customers, including the provincial distributors and retailers,

and consumers to meet their needs is imperative to be successful in

the Canadian cannabis industry. In 2024 we are investing in an

Enterprise Resource Planning (“ERP”) system which is necessary for

our business to deliver more growth in future and allow less

reliance on key people within our internal systems. Anticipated

project costs for 2024 are estimated to reach $1 million, with $0.5

million incurred in the first six months of 2024. While a resource

intensive process, this ERP implementation readies our business for

growth in future.

Financial

We believe that our commitment to cannabis

quality, strategic brand positioning, diverse product portfolio,

and committed team will position us as one of the premier cannabis

companies in Canada. We anticipate year over year growth in net

revenue, supported by modest increases in our cost base, excluding

the impact of the ERP implementation occurring across 2024, thereby

enhancing our operating leverage. While we expect growth in 2024,

we also anticipate that much of the growth will come from our

branded products that are produced using external capacity and

thereby deliver lower gross margin than our current mix.

Furthermore, we anticipate continued fierce competition in the

distressed Canadian cannabis industry, leading to the maintenance

or growth of value and standard pricing levels, rather than premium

price tiers. Notwithstanding these pressures, we expect to deliver

continued operating positive cash flow in the year ahead and plan

to refinance our debt to a longer-term mortgage facility in the

second half of 2024.

Conference Call

The Company will be hosting a conference call to

discuss Q2 2024 results on Thursday, August 15, 2024. Conference

call details are as follows:

|

Time: |

7:00 AM PT / 10:00 AM ET |

|

Conference ID: |

28425 |

|

Local dial-in: |

+1 (289) 514 5100 |

|

Toll Free N. America: |

+1 (800) 717 1738 |

|

Webcast: |

https://onlinexperiences.com/Launch/QReg/ShowUUID=998CDFC5-521F-481F-A060-E0B295AB46B5 |

ABOUT RUBICON ORGANICS INC.

Rubicon Organics Inc. is the global brand leader

in premium organic cannabis products. The Company is vertically

integrated through its wholly owned subsidiary Rubicon Holdings

Corp, a licensed producer. Rubicon Organics is focused on achieving

industry leading profitability through its premium cannabis flower,

product innovation and brand portfolio management, including three

flagship brands: its super-premium brand Simply Bare™ Organic, its

premium brand 1964 Supply Co™, and its cannabis wellness brand

Wildflower™ in addition to the Company’s mainstream brand Homestead

Cannabis Supply™.

The Company ensures the quality of its supply

chain by cultivating, processing, branding and selling organic

certified, sustainably produced, super-premium cannabis products

from its state-of-the-art glass roofed facility located in Delta,

BC, Canada.

CONTACT INFORMATION

Margaret BrodieCEOPhone: +1 (437) 929-1964Email:

ir@rubiconorganics.com

The TSX Venture Exchange or its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

does not accept responsibility for the adequacy or accuracy of this

press release.

Non-GAAP Financial Measures

This press release contains certain financial

performance measures that are not recognized or defined under IFRS

(“Non-GAAP Measures”) including, but not limited to, “Adjusted

EBITDA”. As a result, this data may not be comparable to data

presented by other companies.

The Company believes that these Non-GAAP

Measures are useful indicators of operating performance and are

specifically used by management to assess the financial and

operational performance of the Company as well as its liquidity.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS. For more information, please refer to the “Selected Financial

Information” section in the MD&A for the year ended December

31, 2023, which is available on SEDAR+ at www.sedarplus.ca.

Adjusted EBITDA

Below is the Company’s quantitative

reconciliation of Adjusted EBITDA calculated as earnings (losses)

from operations before interest, tax, depreciation and

amortization, share-based compensation expense, and fair value

changes. The following table presents the Company’s reconciliation

of Adjusted EBITDA to the most comparable IFRS financial measure

for the three and six months ended June 30, 2024.

| |

Three months ended |

Six months ended |

| |

June 30,2024 |

June 30,2023 |

June 30,2024 |

June 30,2023 |

|

|

$ |

$ |

$ |

$ |

|

Profit / (Loss) from operations |

118,567 |

|

(160,396 |

) |

(1,619,919 |

) |

(464,893 |

) |

| |

|

|

|

|

| IFRS fair value accounting

related to cannabis plants and inventory |

(398,790 |

) |

606,406 |

|

(563,042 |

) |

466,943 |

|

| |

(280,223 |

) |

446,010 |

|

(2,182,961 |

) |

2,050 |

|

| |

|

|

|

|

| Depreciation and

amortization |

831,949 |

|

775,227 |

|

1,608,629 |

|

1,520,010 |

|

| Share-based compensation

expense |

307,434 |

|

546,684 |

|

1,010,280 |

|

414,526 |

|

|

Adjusted EBITDA |

859,160 |

|

1,767,921 |

|

435,948 |

|

1,936,586 |

|

‡ Included in Adjusted EBITDA in the six months ended June 30,

2024 is $0.5 million of one-time costs incurred for the ERP

implementation project.

Free Cash Flow

Free cash flow is a non-GAAP measure used by management that is

not defined by IFRS and may not be comparable to similar measures

presented by other companies. Management believes that free cash

flow presents meaningful information regarding the amount of cash

flow required to maintain and organically expand our business, and

that the free cash flow measure provides meaningful information

regarding our liquidity requirements.

Free cash flow is calculated as net cash provided by (used in)

operating activities, less purchases of and deposits on property,

plant and equipment.

| |

Three months ended |

Six months ended |

| |

June 30,2024 |

June 30,2023 |

June 30,2024 |

June 30,2023 |

|

|

$ |

$ |

$ |

$ |

|

Cash from operating activities |

1,050,411 |

|

2,371,322 |

|

191,253 |

|

2,563,846 |

|

| |

|

|

|

|

| Purchases of and deposits on

property, plant and equipment |

(313,668 |

) |

(652,733 |

) |

(697,672 |

) |

(1,139,065 |

) |

| Free Cash

Flow |

736,743 |

|

1,718,589 |

|

(506,419 |

) |

1,424,781 |

|

| |

|

|

|

|

|

|

|

|

Cautionary Statement Regarding Forward Looking

Information

This press release contains forward-looking

information within the meaning of applicable securities laws. All

statements that are not historical facts, including without

limitation, statements regarding future estimates, plans, programs,

forecasts, projections, objectives, assumptions, expectations or

beliefs of future performance, statements regarding Rubicon

Organics' goal of achieving industry leading profitability are

"forward-looking statements". Forward-looking information can be

identified by the use of words such as “will” or variations of such

word or statements that certain actions, events or results "will"

be taken, occur or be achieved.

Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results, events or developments to be materially different

from any future results, events or developments expressed or

implied by such forward looking statements. The forward-looking

information in this press release is based upon certain assumptions

that management considers reasonable in the circumstances,

including the impact on revenue of new products and brands entering

the market, and the timing of achieve Adjusted EBITDA1

profitability and cashflow positive. Risks and uncertainties

associated with the forward looking information in this press

release include, among others, dependence on obtaining and

maintaining regulatory approvals, including acquiring and renewing

federal, provincial, local or other licenses and any inability to

obtain all necessary governmental approvals licenses and permits

for construction at its facilities in a timely manner; regulatory

or political change such as changes in applicable laws and

regulations, including bureaucratic delays or inefficiencies or any

other reasons; any other factors or developments which may hinder

market growth; Rubicon Organics' limited operating history and lack

of historical profits; reliance on management; and the effect of

capital market conditions and other factors on capital

availability; competition, including from more established or

better financed competitors; and the need to secure and maintain

corporate alliances and partnerships, including with customers and

suppliers; and those factors identified under the heading "Risk

Factors" in Rubicon Organic’s annual information form dated March

27, 2024 filed with Canadian provincial securities regulatory

authorities.

These factors should be considered carefully,

and readers are cautioned not to place undue reliance on such

forward-looking statements. Although Rubicon Organics has attempted

to identify important risk factors that could cause actual actions,

events or results to differ materially from those described in

forward-looking statements, there may be other risk factors that

cause actions, events or results to differ from those anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in forward-looking statements. Rubicon Organics assumes

no obligation to update any forward-looking statement, even if new

information becomes available as a result of future events, new

information or for any other reason except as required by law.

We have made numerous assumptions about the

forward-looking statements and information contained herein,

including among other things, assumptions about: optimizing yield,

achieving revenue growth, increasing gross profit, operating

cashflow and Adjusted EBITDA1 profitability. Even though the

management of Rubicon Organics believes that the assumptions made,

and the expectations represented by such statements or information

are reasonable, there can be no assurance that the forward-looking

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in

forward-looking statements. Investors are cautioned against undue

reliance on forward-looking statements or information.

Forward-looking statements and information are designed to help

readers understand management's current views of our near and

longer term prospects and may not be appropriate for other

purposes. Rubicon Organics assumes no obligation to update any

forward-looking statement, even if new information becomes

available as a result of future events, changes in assumptions, new

information or for any other reason except as required by

law.____________________________

1 Adjusted EBITDA is a non-GAAP measure that is

calculated as earnings (losses) from operations before interest,

tax, depreciation and amortization, share-based compensation

expense, and fair value changes. Included in Adjusted EBITDA in the

six months ended June 30, 2024 is $0.5 million of one-time costs

incurred for the ERP implementation project. See Non-GAAP Financial

Measures for details on the Adjusted EBITDA calculation. 2 Free

Cash Flow is a non-GAAP measure that is calculated as net cash

provided by (used in) operating activities, less purchases of and

deposits on property, plant and equipment. See Selected Financial

Information for details on the Free Cash Flow calculation.3 Hifyre

data for premium products covering flower, pre-rolled products,

concentrates, edibles, topicals, and vapes for the three and six

months ended June 30, 20244 Hifyre data for flower & pre-rolled

products covering three and six months ended June 30, 20245 Hifyre

data for premium flower & pre-rolled products covering three

months ended June 30, 20246 Hifyre data for premium flower &

pre-rolled products covering six months ended June 30, 20247 Hifyre

data for topical products covering six months ended June 30, 20248

Hifyre data for premium edible products covering three months ended

June 30, 20249 Hifyre data for premium edible products covering six

months ended June 30, 202410 Adjusted EBITDA is a non-GAAP measure

that is calculated as earnings (losses) from operations before

interest, tax, depreciation and amortization, share-based

compensation expense, and fair value changes. Included in Adjusted

EBITDA in the six months ended June 30, 2024 is $0.5 million of

one-time costs incurred for the ERP implementation project. See

Non-GAAP Financial Measures for details on the Adjusted EBITDA

calculation.11 Hifyre data for premium products covering flower,

pre-rolled products, concentrates, edibles, topicals, and vapes for

the six months ended June 30, 202412 Hifyre data for premium

products covering flower, pre-rolled products, concentrates,

edibles, topicals, and vapes for the six months ended June 30,

202313 Hifyre data for flower & pre-rolled products covering

three and six months ended June 30, 202414 Hifyre data for premium

flower & pre-rolled products covering three months ended June

30, 202415 Hifyre data for premium flower & pre-rolled products

covering six months ended June 30, 202416 Hifyre data for topical

products covering six months ended June 30, 202417 Hifyre data for

premium edible products covering three months ended June 30, 202418

Hifyre data for premium edible products covering six months ended

June 30, 2024

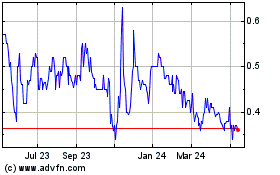

Rubicon Organics (TSXV:ROMJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

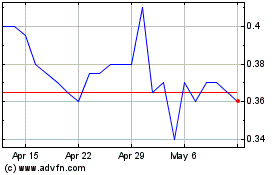

Rubicon Organics (TSXV:ROMJ)

Historical Stock Chart

From Jan 2024 to Jan 2025