Northern Graphite Improves Yield of Large Flake Graphite

August 15 2017 - 8:50AM

Northern Graphite Corporation (TSXV:NGC) (OTCQX:NGPHF) (“Northern”

or the “Company”) is pleased to announce the results of additional

metallurgical test work carried out on ore from the Bissett Creek

deposit by BGRIMM, a Chinese state owned metallurgical research and

development company. BGRIMM confirmed the high recoveries and

high purities used in the Feasibility Study (“FS”) and successfully

increased the percentage of high value, +50 mesh XL flake in the

final concentrate from 48 to 61 per cent.

Gregory Bowes, CEO commented that: “We believe

Bissett Creek has the best flake size distribution of any graphite

project which will result in concentrate prices that are more than

60 per cent higher than for the “average” project, and we will not

have the fines problem that characterizes almost every graphite

deposit.” He added that “XL flake markets are growing rapidly

while Chinese production of XL flake is declining which creates an

excellent opportunity for the Bissett Creek Project.”

| Estimated Revenue per tonne of Concentrate

(US$) |

|

|

|

Flake Size Distribution |

|

Flake Size |

Current Price1 |

Northern2 |

Average Project1 |

|

+32 mesh XXL |

$2,200 |

30% |

- |

|

+50 mesh XL |

$1,600 |

43% |

20% |

|

+80 mesh Large |

$1,000 |

20% |

25% |

|

+100 mesh Medium |

$900 |

7% |

10% |

|

+150 mesh Small |

$800 |

0% |

20% |

|

-150 mesh fines3 |

$500 |

0% |

25% |

|

|

|

100% |

100% |

| |

|

|

| Estimated revenue/tonne of

concentrate (US$) |

$1,600 |

$950 |

| |

| 1 Company estimates from market sources and

public information. |

| 2 Graphite concentrates are priced and sold as

80% meeting the size requirement. Smaller sizes can beblended

in to make up the balance as long as the required purity level is

maintained. |

| 3 Limited marketability. |

China produces 70 to 80 per cent of the world’s

graphite and has substantial expertise in graphite mining and

processing. BGRIMM was engaged to complete a full suite of

metallurgical testing to confirm the assumptions and estimates used

in the FS and to determine if they could be improved and costs

reduced. Testing included chemical analysis, X-ray diffraction,

thin section analysis, process mineralogy, progressive grinding

tests, reagent regime tests for rougher flotation, flotation times,

first and second stage regrinding tests for cleaner flotation,

open-circuit tests, locked-cycle testing and recycled water tests.

BGRIMM achieved a purity level over 95 per cent and a carbon

recovery over 96 per cent in locked cycle tests which are

consistent with the FS. Most importantly, the concentrate was 25

per cent +32 mesh XXL flake and 36 per cent +50 mesh XL flake for a

combined total of 61 per cent (compared to 48 per cent in the

FS). An additional 17 per cent was +80 mesh large flake and

only 14 per cent was less than 100 mesh, small flake.

Work carried out by BGRIMM and the Company’s

Brazilian metallurgical consultant have also identified a number of

opportunities to potentially reduce capital and operating

costs. These modifications are currently being evaluated at

SGS Lakefield.

About BGRIMM BGRIMM is a

premier Chinese institute in the field of mining and metallurgical

technology and operates directly under the Chinese Government

(SASAC). It has over 4,000 employees, is headquartered in

Beijing and has operations in a number of provinces including

Hebei, Jiangsu, Liaoning and Hunan as well as Santiago,

Chile. BGRIMM has been conducting research on graphite since

the 1970s and its services include mining, mineral processing

(process development, flotation and reagent optimization and

equipment design), and purification and downstream

processing. It has completed a number of key national

projects in recent years.

About Northern Graphite

Northern Graphite is a Canadian company that has a 100% interest in

the Bissett Creek graphite deposit located in southern Canada and

relatively close to all required infrastructure. Bissett

Creek is an advanced stage project that has a full Feasibility

Study and its major environmental permit. Subject to the

completion of operational and species at risk permitting, which are

well advanced, Northern could commence construction in early 2018

subject to obtaining the required financing. Northern

believes that Bissett Creek has the best flake size distribution,

highest margin and lowest marketing risk of any new graphite

project, and has the added advantages of a low capital cost and

realistic production target relative to the size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified

Person as defined under NI 43-101, has reviewed and is responsible

for the technical information in this news release.

This press release contains forward-looking

statements, which can be identified by the use of statements that

include words such as "could", "potential", "believe", "expect",

"anticipate", "intend", "plan", "likely", "will" or other similar

words or phrases. These statements are only current predictions and

are subject to known and unknown risks, uncertainties and other

factors that may cause our or our industry's actual results, levels

of activity, performance or achievements to be materially different

from those anticipated by the forward-looking statements. The

Companies do not intend, and do not assume any obligation, to

update forward-looking statements, whether as a result of new

information, future events or otherwise, unless otherwise required

by applicable securities laws. Readers should not place undue

reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact: Gregory Bowes (613) 241-9959

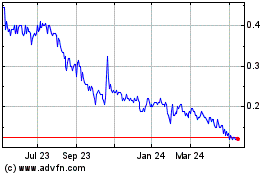

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Dec 2024 to Jan 2025

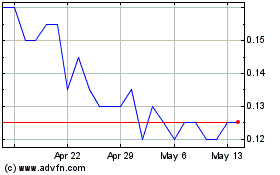

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Jan 2024 to Jan 2025