Increasing Lithium-Ion Battery Demand Manganese Industry Expert Report

March 08 2022 - 4:44PM

Increasing Lithium-Ion Battery Demand: Manganese Industry

Expert Martin Kepman, CEO of Manganese X Energy

Weighs In on Ford Projects $45 Billion Profit from New EV Transit

Service.

Tesla is no longer the only player in the electric vehicle

sector, with most big-name automobile manufacturers across the

world producing electric and hybrid models to keep up with market

demand.

Ford Motor Company has recently announced its first electric

delivery van, which is set to roll out this month. The medium-duty

business van is designed for and marketed towards commercial

applications. In addition to selling the vehicles themselves, Ford

will be launching software and services — collectively named Ford

Pro Intelligence — to help companies manage their delivery fleets.

These services are set to include charging depots (to help

customers minimize energy consumption while maximizing vehicle run

time), cloud-based routing (to increase efficiency and decrease

drive time), over-the-air updates for new features, and tailored

alerts for maintenance and repairs.

In total, Ford projects a profit of at least $45 billion from

their electric transit vehicle program.

The company will be producing and selling 150,000 electric vans

(dubbed the “E-Transit”) each year as of 2023. (Fewer vehicles will

be manufactured this year.) The E-transit will be available in

three lengths and three roof heights, as well as cutaway versions

(which have a cab but no body).

Overall, the demand for medium-duty transit vehicles in the

United States is approximately 330,000 vehicles per year. Ford’s

gasoline-powered Transit vans already account for almost half of

this market. Though the point-of-sale price for the E-Transit is

around $10F,000 more than the gasoline-powered

Transit, businesses should be able to quickly make this direct cost

back through energy and efficiency savings.

Three of the thirteen gigafactories set to open in the U.S. in

the next five years will belong to Ford. These gigafactories will

focus on battery production for electric vehicles. Most of Ford’s

existing electric vehicles use lithium-ion batteries, which are the

most sustainable, energy efficient batteries that modern technology

currently has to offer.

Lithium-ion batteries are a staple of everyday life, powering

everything from electric vehicles to electric toothbrushes and

smartphones and laptops. As the demand for lithium-ion batteries

rises even further due to new products and programs in the electric

vehicle sector, so does the demand for one of the key components of

these batteries: manganese.

Manganese is an essential component of the lithium-ion battery,

but it is also used in the other most common type of battery

produced globally, the nickel-manganese-cobalt (NMC) battery.

“There are plans to re-engineer the chemistry of the current NMC

battery by eliminating cobalt and increasing the proportion of

manganese in future lithium-ion nickel manganese EV batteries. Some

of the reasons that make manganese potentially the mineral of the

decade is it doesn’t have the ethical sourcing issues of mining

cobalt in the Congo, where the majority of cobalt is produced.

Economically, cobalt is 10-47 times more expensive than manganese

to acquire, based on the commodity markets of fluctuating prices.

Safety, manganese is renowned for its stability in nature and has

the characteristics of increasing energy density, which ultimately

increases capacity and improves driving range. Also, manganese

decreases the combustibility of EV batteries, which is problematic

with cobalt infused lithium-ion batteries. Our strategically

located manganese property in Canada will provide EV battery

manufacturers access to a domestic supply with less reliance on

China imports, “ Martin Kepman CEO of Manganese X Energy Corp.

Locating and mining manganese deposits will be an important goal

for the electric vehicle industry. Manganese can be found in rich

deposits in North America, such as in the Battery Hill manganese

site in Woodstock, New Brunswick, Canada.

About Manganese X Energy

Manganese X Energy Corp. (TSXV: MN) (FSE: 9SC2) (OTC:QB:MNXXF)

(FRANKFURT:

9SC2) with its head office in Montreal QC, owns 100% of the

Battery Hill property project (1,228 hectares) located in New

Brunswick Canada. Battery Hill is strategically situated 12

kilometers from the US (Maine) border, near existing

infrastructures (power, railways, and roads). It encompasses all or

part of five manganese-iron zones, including Iron Ore Hill, Moody

Hill, Sharpe Farm, Maple Hill and Wakefield. According to Brian

Way’s (2012) master’s thesis on the Woodstock manganese

occurrences, that includes Battery Hill, the area “hosts a series

of banded iron formations that collectively constitute one of the

largest manganese resources in North America, approximately

194,000,000 tons.

Media contact:

Rene Perras Digital PR Consultant

for Manganese X Energy Corp

514-816-4446

When sharing on social media please help us by using these

hashtags:

#ManganeseXEnergyisElectricGold

#ManganeseXMinerforElectricGold

#ManganeseisElectricGold #ManganeseXisElectricGold

New Brunswick, Canada

https://www.manganesexenergycorp.com

###

Cautionary Note Regarding Forward-Looking Statements: Neither

TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release. This news release contains “forward-looking information”

which may include statements with respect to the future exploration

performance of Manganese X Energy Corp (the “Company”). This

forward-looking information involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance, or achievements of the Company to be materially

different from any future results, performance or achievements of

the Company, expressed or implied by such forward-looking

statements. These risks, as well as others, are disclosed within

the Company’s filing on SEDAR, which investors are encouraged to

review prior to any transaction involving the securities of the

Company. Forward-looking information contained herein is provided

as of the date of this publication and the Company disclaims any

obligation, other than as required by law, to update any

forward-looking information for any reason. There can be no

assurance that forward-looking information will prove to be

accurate, and the reader is cautioned not to place undue reliance

on such forward-looking information. We seek safe harbor.

- Increasing Lithium-Ion Battery Demand Manganese Industry

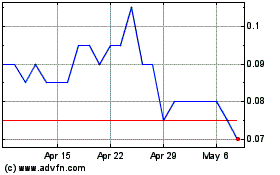

Manganese X Energy (TSXV:MN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Manganese X Energy (TSXV:MN)

Historical Stock Chart

From Feb 2024 to Feb 2025