Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium

Ionic” or the “Company”) is pleased to announce the results of a

Feasibility Study (“FS” or “Study”) for its 100%-owned Bandeira

Lithium Project (“Bandeira” or the “Project”) located in Minas

Gerais, Brazil. The Bandeira claims span 157 hectares, which

represents only about 1% of Lithium Ionic’s extensive

14,182-hectare land package in Brazil’s 'Lithium Valley', a region

of global significance for hard-rock lithium production.

Highlights of the Feasibility Study for

the Bandeira Project:

- Mine Life &

Production: 14-year underground mining operation producing

an average of 178,000t of high-quality spodumene concentrate

grading 5.5% Li2O (“SC5.5”).

- Strong Project

Economics: After-tax net present value (“NPV8%”) of US$1.3

billion and after-tax internal rate of return (“IRR”) of 40% at

average SC5.5 price of $2,277/t.

- Industry-leading Operating

Costs: All-in LOM OPEX of $444/t of SC5.5

- Low Capital

Intensity: Total capital expenditure (“CAPEX”) of US$266

million (including a 15% contingency) with after-tax payback of 3.4

years. LOM sustaining costs of US$ 81 million.

- Minimal Land-use

Footprint: The development plan contemplates an

underground mining operation with a simple processing circuit to

optimize recoveries while minimizing the impact on the environment

and local communities.

- Responsible Tailings

Management: For safety and environmental reasons, the mine

will utilize dry stacking waste disposal, which among other

benefits will reduce water usage and facilitating site

rehabilitation.

- Local Social & Economic

Contributions: Total estimated taxes payable of $915

million, a peak local workforce of ~870 direct employees, and an

estimated $677 million procuring goods and services within Brazil

over the life of mine.

- Construction Permits on

Track for mid-2024: The LAC license application submitted

in November is currently under review by the state agency. Approval

is expected in early Q3 2024.

Blake Hylands, P.Geo., Chief Executive Officer

of Lithium Ionic, commented, “This study marks an important

developmental milestone, confirming the strong results from our PEA

in late 2023 and solidifying our path to becoming a near-term

lithium producer. Furthermore, it outlines the significant positive

impacts Bandeira will have through employment, tax contributions,

and local procurement. While we are very pleased with the results

of the study, the Company intends to move project engineering

forward to the basic engineering phase where a value-add process

will take place to further optimize and streamline capital and

operating costs. Several opportunities identified in the

feasibility stage will be subjected to trade-off studies, prior to

entering the detailed engineering phase to ensure the project value

and operational efficiencies are maximized. We look forward to

continuing to rapidly advance Bandeira towards production,

recognizing that this will deliver the most value to our

shareholder, however we are very excited by the growth

opportunities and development potential at our other regional

properties which could present significant future scale

opportunities for the Company.”

Bandeira Definitive Feasibility Study

Results

The Feasibility Study for the Bandeira Project,

completed by Atkins Réalis (formerly SNC Lavalin), is the

culmination of over 12 months of comprehensive work involving the

expertise of all engineering disciplines as well as market

studies. This includes detailed planning for the mine, process

design, plant layout, infrastructure, and product logistics. The

study supports a robust project with strong economic viability,

featuring a minimal footprint underground mine, an efficient

and straightforward processing circuit, and a safe, sustainable dry

stack tailings facility. The FS builds on and confirms the strong

results from the Preliminary Economic Assessment (“PEA”) completed

in October 2023.

Table 1. Bandeira FS – Summary of Key

Results and Assumptions

|

Project Economics |

|

Post - Tax NPV8 |

$1.31 B |

|

Post - Tax IRR |

40% |

|

Pre - Tax NPV8 |

$1.57 B |

|

Pre - Tax IRR |

44% |

|

Annual Revenue – LOM Average |

$417 M |

|

Average Annual After-Tax Free Cash Flow(after repayment of initial

capital, years 4-14) |

$286 M |

|

Payback |

41 months |

|

Production Profile |

|

Total Project Life (LOM) |

14 years |

|

Total LOM production (ore mined) |

17.2 Mt |

|

Total SC5.5 production (LOM) |

2,493 kt(338.3 kt LCE) |

|

Nominal Plant Capacity |

1.30 Mtpa |

|

Average plant throughput |

1.23 Mtpa |

|

Run-of-Mine grade, Li2O (mine diluted) |

1.16% |

|

Average Annual Production of Spodumene Concentrate @ 5.5% Li2O |

178 ktpa(24.2 ktpa LCE) |

|

Metallurgical Recovery (SC5.5% Li2O) |

68.9% |

|

CAPEX & OPEX |

|

Initial Capital Costs |

$266M |

|

Sustaining CAPEX |

$81M |

|

Operating costs (FOB / t SC5.5) |

$444/t |

|

Economic Assumptions & Parameters |

|

Spodumene Concentrate Price (5.5% Li2O; LOM Avg) |

$2,277/t |

|

Exchange rate (USD:BRL) |

$1.00: $5.07 |

|

Discount Rate |

8% |

|

|

|

Project Location and Infrastructure

The Bandeira property covers 157 hectares,

representing only approximately 1% of the Company’s large

14,182-hectare land package in the northern region of Minas Gerais

State, Brazil, within the renowned "Lithium Valley" (see Figure 1).

This area is recognized for its significant concentration of

lithium-bearing pegmatites, making it one of the most promising

lithium-producing regions globally. The Project benefits from

excellent local infrastructure, which is critical for the efficient

development and operation of the future mining activities.

The Bandeira site is well-connected via major

highways, facilitating the transport of materials and personnel.

The project site is approximately 570 kilometers from the port of

Ilhéus in Bahia, which serves as a key logistical point for

exporting lithium concentrate to international markets, including

Shanghai, China. The proximity to Araçuaí provides access to

essential services and amenities, enhancing operational

efficiency.

A key infrastructure component for the Bandeira

Project was secured in October 2023 through an agreement with Cemig

Distribuição S.A. (“Cemig”). This agreement facilitates the

construction and electrification of essential power infrastructure,

including three kilometers of new transmission lines and a new

substation adjacent to the future Bandeira mine and will ensure

that the Project will be powered by low-cost, renewable

hydroelectric power, aligning with the Company’s commitment to

operating sustainably.

Figure 1. Bandeira Project Location

View Figure 1

here:https://www.globenewswire.com/NewsRoom/AttachmentNg/292fd9e3-464e-4594-9846-0b8d3bc160f1

Mining Operations

The Bandeira project is designed to incorporate

dual underground mining operations, ensuring efficient extraction

of its deposits. The primary orebodies, representing approximately

83% of the total deposit, will be mined using a bottom-up sublevel

stoping method (Bandeira Sublevel Mine, or “BSL Mine”).

Concurrently, the secondary southeast orebody, which comprises

approximately 0.98 million tonnes, will be mined using the

room-and-pillar technique (Bandeira Room and Pillar Mine, or“BRP

Mine”). Figures 2 and 3 present the annual mine production plan and

the annual plant feed along with the Li2O grade, highlighting the

project's robust production capabilities.

Figure 2. ROM to Plant Feed and Li2O grade,

%

View Figure 2

here:https://www.globenewswire.com/NewsRoom/AttachmentNg/c62c719b-e95c-43cb-a87a-d81498287171

Figure 3. Annual Production of Spodumene

Concentrate grading 5.5% Li2O

View Figure 3

here:https://www.globenewswire.com/NewsRoom/AttachmentNg/6e174968-c2e0-43ba-8bc2-0bebba4af38b

Mineral Processing

The mineral processing flowsheet for the

Bandeira project is designed to maximize lithium recovery and

quality. It features a two-stage crushing circuit, which includes a

Jaw crusher and a Gyratory Cone crusher, followed by dry screening

classification. The coarse and mid fractions undergo ore sorting

and Dense Media Separation (DMS) to produce a final SC5.5 Li2O

concentrate. See Figure 4 for a visual representation of the

process flowsheet.

The underground mine is expected to produce ore

with an average Li2O grade of 1.16% over the Life of Mine (LOM),

considering a mined dilution rate of 17.0%. The ore sorting process

will enhance the ore quality by removing undesirable dilution

materials, mainly schist, and non-lithium-bearing minerals such as

feldspar and muscovite. This process improves the lithium oxide

grade to approximately 1.50%, providing a higher-quality feed for

the DMS while rejecting barren uneconomical waste. Based on Heavy

Liquid Separation (HLS) bench scale test work completed by the

Company, ore sorting and DMS pilot plant operations, the overall

Li2O recovery is projected to reach 68.9%.

This efficient mineral processing approach

ensures that we can maximize lithium recovery while maintaining the

highest product quality. A higher quality chemical grade spodumene

results in lower conversion costs therefore could potentially be

sold at premium prices.

Figure 4: Bandeira process flow diagram

View Figure 4

here:https://www.globenewswire.com/NewsRoom/AttachmentNg/599b88e7-4263-4690-bb7f-b549c16fe9c9

Capital Costs

Initial capital costs for the Bandeira Project are estimated at

$266 million, which includes a 15% contingency of $33.7 million.

The sustaining capital over the 14-year mine life is projected at

$81.4 million. A breakdown of the capital costs is presented in

Table 2.

Table 2. Project Capital Costs (CAPEX)

Breakdown

|

Initial CAPEX |

$266.1M |

|

Mine |

$50.5M |

|

Plant |

$102.7M |

|

Engineering Service |

$26.6M |

|

General Infrastructure & Others |

$41.9M |

|

Pre-operation |

$10.8M |

|

Contingency (15%) |

$33.7M |

|

LOM Sustaining CAPEX |

$81.4M |

|

SUDENE Federal Tax Incentive (%, reduction in Corporate Income

Tax) |

75% |

| |

|

*Discrepancies in the totals are due to rounding effects.

Operating Costs

The operating costs of the Bandeira Project are

estimated to be US$64.30 per tonne of ore processed. Total

operating costs are estimated at US$444 per tonne of 5.5% Li2O

spodumene concentrate produced, placing it in the first quartile of

the global lithium industry. A breakdown of the operating costs is

presented in Table 3.

Table 3. Project Operating Costs (OPEX)

|

Operating costs (per tonne of ore processed) |

$64.3/t |

|

Mining |

$36.7/t |

|

Processing |

$24.6/t |

|

SG&A |

$3.0/t |

|

Operating costs (per tonne of 5.5% Li2O spodumene

concentrate produced) |

$444/t |

|

Mining |

$253/t |

|

Processing + Tailings handling |

$170/t |

|

SG&A |

$21/t |

|

Transportation costs to customer destination (Project Mine Site to

Shanghai Port, China) |

$112.50/t |

| |

|

*Discrepancies in the totals are due to rounding effects.

Project Economics and Sensitivities

The after-tax NPV8 for the Bandeira Project is

$1.3 billion and IRR is 40%, assuming a 5.5% spodumene concentrate

(“SC5.5”) price of $2,277/t. At an elevated price of $3,416/t, the

NPV increases to $2.4 billion with an IRR of 62%, underscoring the

project’s strong potential to benefit from rising lithium prices

(see sensitivity analysis in Table 4).

Sensitivity analyses completed as part of the FS

demonstrate that the Project's value is strongly influenced by the

selling price of spodumene concentrate. As demonstrated in Figure

5, while capital (CAPEX) and operational (OPEX) costs impact the

Net Present Value (NPV), their effects are relatively minor

compared to concentrate price fluctuations. Given the expected

increase in lithium demand, Bandeira is well-positioned to

capitalize on favourable market conditions and benefit from rising

spodumene prices.

Figure 5: Sensitivity Analysis for Spodumene

5.5% Li2O price, CAPEX and OPEX estimation

View Figure 5

here:https://www.globenewswire.com/NewsRoom/AttachmentNg/50bdb0c1-09eb-47b8-b540-684fbe5dba21

Table 4. After-Tax NPV and IRR Sensitivity to Spodumene

Price

|

|

Low Case |

Base Case |

High Case |

|

LOM Avg Spodumene Price (SC5.5) |

$1,822/t |

$2,277/t |

$3,416/t |

|

NPV |

$864 M |

$1.31B |

$2.41B |

|

IRR |

32.5% |

40.3% |

62.2% |

|

Payback |

4.3 years |

3.4 years |

2.2 years |

| |

|

|

|

Lithium Market Outlook & Spodumene Concentrate Price

Forecast

A long-term spodumene concentrate price of

US$2,277/tonne (5.5% Li2O grade) was used in the Feasibility Study.

This long-term price forecast was obtained by Fastmarkets, one of

the leading providers of global commodity pricing and market

intelligence, in a report issued in April 2024.

The conservative spodumene concentrate selling

price forecasts in the early years of the Bandeira mine life of

$1,000-$1,600/t for the years 2026 to 2028 resulted in an increased

payback period of the project compared to the PEA results from

October 2023 (41 months compared to 14 months). Fastmarkets

forecasts a higher long-term price based on strong demand and

supply fundamentals, which is expected to benefit the Project's

overall economics in the future.

Lithium has emerged as a critical component in

the global energy transition, with an annual consumption growth

rate exceeding 25% over the past four years. Despite the supply of

lithium compounds surpassing demand in 2023, the demand remains

robust due to the increasing market penetration of electric

vehicles (EVs). According to industry expert reports from

Fastmarkets, Benchmark Mineral Intelligence and the International

Energy Agency (IEA), this trend is expected to continue as EV

adoption accelerates globally.

Bandeira Mineral Resource Estimate

On April 12, 2024, the Company reported an

updated NI 43-101 mineral resource estimate (“MRE”) for Bandeira of

23.68 million tonnes (“Mt”) grading 1.34% Li2O (783kt lithium

carbonate equivalent, “LCE”) in the Measured and Indicated

(“M&I”) category, with an additional 18.25Mt grading 1.37% Li2O

(617kt LCE) in the Inferred category. This estimate was based on

233 drill holes, or 50,760 metres, drilled between April 2022 and

March 2024.

The Bandeira FS proven and probable reserves,

however, utilizes an NI 43-101 mineral resource estimate with an

earlier data cut-off of November 13, 2023, which includes 186 drill

holes (41,831 metres). This study mine plan is therefore based on a

smaller estimate of 20.95Mt grading 1.35% Li2O (697kt LCE) M&I,

in addition to 16.91Mt grading 1.40% Li2O (584kt LCE) Inferred (see

Table 5).

The inclusion of the larger April 2024 MRE, as

well as the additional drilling completed after the March 2024 data

cut-off represents important future upside to the Project. The mine

plan will be updated to incorporate the expanded mineral resource

estimate in the next phase of project development.

The MRE was completed by independent Brazilian

consultancy, GE21 Consultoria Mineral Ltda ("GE21").

Table 5: Bandeira Mineral Resource

Estimate (base case cut-off grade of 0.5 %

Li2O)

|

Category |

Resource (Mt) |

Grade (% Li2O) |

Contained LCE (kt) |

|

Measured |

3.42 |

1.39 |

117.61 |

|

Indicated |

17.52 |

1.34 |

578.92 |

|

Measured + Indicated |

20.95 |

1.35 |

696.52 |

|

Inferred |

16.91 |

1.40 |

583.53 |

| |

|

|

|

Notes related to the Mineral Resource Estimate:

- The spodumene pegmatite domains

were modelled using composites with Li2O grades greater than

0.3%.

- The mineral resource estimates were

prepared by the CIM Standards and the CIM Guidelines, using

geostatistical and classical methods, plus economic and mining

parameters appropriate to the deposit.

- Mineral Resources are not ore

reserves or demonstrably economically recoverable.

- Grades reported using dry

density.

- The effective date of the MRE is

November 13, 2023.

- Geologist Carlos José Evangelista

da Silva (MAIG #7868) is the QP responsible for the Mineral

Resources.

- The MRE numbers provided have been

rounded to estimate relative precision. Values cannot be added due

to rounding.

- The MRE is delimited by MGLIT

Bandeira Target Claims (ANM).

- The MRE was estimated using

ordinary kriging in 12m x 12m x 4m blocks.

- The MRE report table was produced

using Leapfrog Geo software.

- The reported MRE only contains

fresh rock domains.

- The MRE was restricted by RPE3 with

grade shell using 0.5% Li2O cut-off.

- To convert percentage lithium (Li)

to percentage lithium oxide (Li2O), multiply by 2.153; to convert

Li to lithium carbonate (Li2CO3), multiply by 5.323. To convert a

percentage of lithium oxide (Li2O) to lithium carbonate (Li2CO3),

multiply by 2.472.

Project Advancement & Optimization

Opportunities

Lithium Ionic is committed to progressing the

Bandeira Project towards production, aiming to become a leading

lithium producer in Brazil’s Lithium Valley. This goal is supported

by the following ongoing activities:

Permitting Process and Government Engagement:

The Company continues to advance the permitting process and

actively engage with governmental agencies. The next major

permitting milestone, the approval of the Licença Ambiental

Concomitante (LAC), is expected by early Q3 2024.

Next Phase of Engineering: The Bandeira Project

will proceed to the next phase of engineering, focusing on

implementing the optimization opportunities identified during the

feasibility stage. This phase will include an expanded mineral

deposit, which among other positive impacts could potentially

extend the mine life. Significant opportunities have also been

identified to streamline capital and operating costs, enhancing

overall efficiency and optimization of the Project.

Feasibility Study Contributors and

Methodology

Lithium Ionic engaged AtkinsRéalis (formerly SNC

Lavalin) to coordinate the Feasibility Study, which covers

engineering, process design, mine layout, risk assessment, and

logistics for transporting the concentrate from Araçuaí, Minas

Gerais, to the port of Ilhéus, Bahia, and then to Shanghai, China.

The certification of mineral resources was conducted by GE21, with

geologist Carlos José Evangelista Silva serving as the qualified

professional for the estimation.

Underground mine studies were led by mining

engineer Rubens Mendonça from Planminas, who signed off as the

qualified professional for this discipline. The mineral processing

studies were consolidated and defined by Tony Lipiec, Process

Engineer and Vice President Global, Minerals & Metals

Processing at AtkinsRéalis. Environmental studies were reviewed by

Branca Horta from GE21, who signed off as the qualified

professional for this area. The economic and financial model was

validated by L&M Advisory, with João Augusto Hilario de Souza

as the qualified professional.

The Feasibility Study considers Mineral

Resources categorized as Measured and Indicated, converting 71%

into Mineral Reserves. Mineral processing methodologies were

developed based on extensive test work, including ore sorting and

dense media separation using core drill samples in bench scale (HLS

– Heavy Liquid Separation), ore sorting and DMS pilot plant tests

at Steinert and SGS Geosol, respectively. Cost estimates for mine

and plant equipment were based on vendor quotations, while power

and FeSi prices were obtained through commercial consultations with

Centrais Elétricas de Minas Gerais (CEMIG) and Washington Mills in

the USA. The owners' team costs were projected for 21 employees

during the engineering and construction phases.

This comprehensive and collaborative approach

ensures that the Feasibility Study encompasses all critical

aspects, providing a robust foundation for the successful

development and operation of the Project.

Report Filing

The complete NI 43-101 technical report

associated with the FS will be available on SEDAR+ at

www.sedarplus.ca under the Company’s issuer profile, as well as the

Company’s website at www.lithiumionic.com within 45 calendar

days.

Qualified Persons

The FS is prepared by independent

representatives of AtkinsRéalis, GE21, Planminas and L&M each

of whom are Qualified Person as defined by NI 43-101 Standards of

Disclosure for Mineral Projects. Each of the QPs are independent of

Lithium Ionic and have reviewed and confirmed that this news

release fairly and accurately reflects, in the form and context in

which it appears, the information contained in the respective

sections of the Bandeira FS for which they are responsible. The

affiliation and areas of responsibility for each QP involved in

preparing the Bandeira FS are provided below.

Mineral Resource Estimate: Carlos José

Evangelista, Geologist from GE21

Underground mine studies: Engineer, Rubens

Mendonça from Planminas

The mineral processing studies were consolidated

and defined by Tony Lipiec, Process Engineer and Vice President

Global, Minerals & Metals Processing at AtkinsRéalis

Environmental studies: Branca Horta from

GE21

Tailings Disposal systems: Porfírio Cabaleiro

from GE21

The economic and financial model was certified

and validated by João Augusto Hilario de Souza from L&M

Advisory, as the qualified professional.

On behalf of the Board of Directors of

Lithium Ionic Corp.

Blake HylandsChief Executive Officer,

Director

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company

exploring and developing its lithium properties in Brazil. Its

Itinga and Salinas group of properties cover 14,182 hectares in the

northeastern part of Minas Gerais state, a mining-friendly

jurisdiction that is quickly emerging as a world-class hard-rock

lithium district. Its Feasibility-stage Bandeira Project is

situated in the same region as CBL’s Cachoeira lithium mine, which

has produced lithium for +30 years, as well as Sigma Lithium

Corp.’s Grota do Cirilo project, which hosts the largest hard-rock

lithium deposit in the Americas.

Investor and Media

Inquiries:

+1 647.316.2500info@lithiumionic.com

Cautionary Note Regarding Forward-Looking

Statements

This press release contains statements that

constitute “forward-statements.” Such forward looking statements

involve known and unknown risks, uncertainties and other factors

that may cause the Company’s actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Although the Company

believes, in light of the experience of its officers and directors,

current conditions and expected future developments and other

factors that have been considered appropriate that the expectations

reflected in this forward-looking information are reasonable, undue

reliance should not be placed on them because the Company can give

no assurance that they will prove to be correct. When used in this

press release, the words “estimate”, “project”, “belief”,

“anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or

“should” and the negative of these words or such variations thereon

or comparable terminology are intended to identify forward-looking

statements and information. The forward-looking statements and

information in this press release include information relating to

the prospectivity of the Project, the economic viability of the

Project, future spodumene prices, the Company’s ability to obtain

financing, the Company’s ability to develop the Project, the

Company’s ability to obtain the requisite permits and approvals to

develop the Project, the Company’s exploration program and other

mining projects and prospects thereof, and the Company’s future

plans. Such statements and information reflect the current view of

the Company. Risks and uncertainties that may cause actual results

to differ materially from those contemplated in those

forward-looking statements and information. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results,

performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. The forward-looking information contained in this news

release represents the expectations of the Company as of the date

of this news release and, accordingly, is subject to change after

such date. Readers should not place undue importance on

forward-looking information and should not rely upon this

information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management’s beliefs, estimates or opinions, or other factors,

should change.

Information and links in this press release

relating to other mineral resource companies are from their sources

believed to be reliable, but that have not been independently

verified by the Company.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

press release.

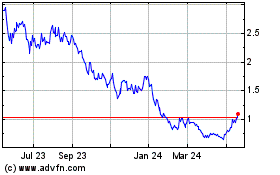

Lithium Ionic (TSXV:LTH)

Historical Stock Chart

From Nov 2024 to Dec 2024

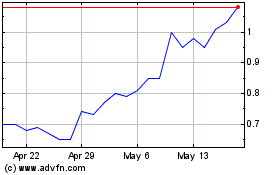

Lithium Ionic (TSXV:LTH)

Historical Stock Chart

From Dec 2023 to Dec 2024