LithiumBank Resources

Corp. (

TSX-V: LBNK)

(the “

Company” or “

LithiumBank”)

is pleased to announce it has increased its previously announced

(see news release dated October 10th, 2023) non-brokered private

placement (the “

Offering”) of up to 2,000,000

units (“

Units”) at a price of $1.00 per Unit to up

to 3,000,000 Units, for aggregate gross proceeds of $3,000,000.

The net proceeds of the Offering will expand the

company’s treasury to more than $9M that it will use to expedite

further advancement of its portfolio of district scale direct brine

lithium assets in Western Canada. LithiumBank intends to complete

drilling and sampling to upgrade resources, as well as to conduct

pilot plant testing to determine key performance indicators at its

Boardwalk and Park Place Projects. Directors, officers, and

consultants of the company are expected to purchase in excess of

$1.2M of the Units subscribed for in the Offering.

The securities offered pursuant to the Offering

will be subject to a statutory hold period of four months and a day

from the date of issuance. The Offering is subject to certain

conditions including, but not limited to, receipt of all necessary

approvals including the approval of the TSXV.

Each Unit will consist of one common share in

the capital of the Company (a "Common Share") and

one-half of one Common Share purchase warrant (each whole warrant,

a “Warrant”). Each Warrant will entitle the holder

thereof to purchase one Common Share at a price of $1.50 per Common

Share for a period of 24 months from the date of issuance, subject

to the policies of the TSX Venture Exchange

(“TSXV”).

The Company expects to pay the following

finders’ fees to certain eligible finders in connection with the

Offering: (i) a cash commission of 6.0% of the gross proceeds

raised under the Offering from investors introduced to the Company

by the applicable finder; and (ii) such number of non-transferable

common share purchase warrants of the Company equal to 6.0% of the

Units sold under the Offering from investors introduced to the

Company by the applicable finder.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons (as defined in the U.S. Securities Act)

unless registered under the U.S. Securities Act and applicable

state securities laws or an exemption from such registration is

available.

The Units issued under the Offering will be

issued to insiders of the Company and such participation is

considered to be a "related party transaction" as defined under

Multilateral Instrument 61-101 ("MI 61-101”). The

Company will rely on the exemptions from the valuation and minority

shareholder approval requirements of MI 61-101 contained in

sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of such

insider participation.

Neither TSX Venture Exchange nor its Regulation Services

Provider accepts responsibility for the adequacy or accuracy of

this release.

About LithiumBank Resources

Corp.

LithiumBank Resources Corp. (TSX-V: LBNK)

(OTCQX: LBNKF), is a publicly traded North American lithium company

that is focused on developing its two flagship projects, Boardwalk

and Park Place, in Western Canada. The Company holds 2,480,196

acres of brown-field lithium brine permits, across 3 districts in

Alberta and Saskatchewan. In May 2023, LithiumBank completed

an initial robust preliminary economic assessment of its Boardwalk

project that targets a 31,350 TPA operation with a pre-tax USD

$2.7B NPV and a 21.6% IRR with the potential for a number of

near-term enhancements. The Company will continue to advance its

assets through detailed geological modelling, advanced engineering,

and pilot plant testing with its direct lithium extraction

technology exclusively licensed in Alberta and Saskatchewan for the

purposes of primary lithium production.

For more information see the Company’s Boardwalk

Lithium Brine Project Preliminary Economic Assessment Technical

Report entitled “Preliminary Economic Assessment (PEA) for

LithiumBank Resources Boardwalk Lithium-Brine Project in West-

Central Alberta, Canada” effectively dated June 16, 2023 filed

on SEDAR+ (www.sedarplus.ca) on June 23, 2023 and on the

Company’s website (www.lithiumbank.ca).

A PEA is preliminary in nature as it includes a

portion of inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the preliminary economic

assessment will be realized.

The PEA Technical Report was prepared by the

following Qualified Persons; Roy Eccles, P. Geol. of APEX

Geoscience Ltd., Kim Mohler, P. Eng., of GLJ Ltd., Gordon

MacMillan, P. Geol. of Fluid Domains, Jim Touw, P. Geol. of HCL

Ltd., Frederick Scott, P. Eng., of Scott Energy, Egon Linton, P.

Eng., of Hatch Ltd., Evan Jones, P. Eng., of Hatch Ltd., Stefan

Hlouschko, P. Eng., of Hatch Ltd.

The scientific and technical disclosure in this

news release has been reviewed and approved by Mr. Kevin Piepgrass

(Chief Operations Officer, LithiumBank Resources Corp.), who is a

Member of the Association of Professional Engineers and

Geoscientists of Alberta (APEGA) and the Association of

Professional Engineers and Geoscientists of the Province of British

Columbia (APEGBC) and is a Qualified Person (QP) for the purposes

of National Instrument 43-101. Mr. Piepgrass consents to the

inclusion of the data in the form and context in which it

appears.

Mineral resources are not mineral reserves and

do not have demonstrated economic viability. There is no guarantee

that all or any part of the mineral resource will be converted into

a mineral reserve. The estimate of mineral resources may be

materially affected by geology, environment, permitting, legal,

title, taxation, socio-political, marketing, or other relevant

issues. A preliminary economic assessment is preliminary in nature

as it includes a portion of inferred mineral resources that are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

preliminary economic assessment will be realized.

Contact: Rob ShewchukCo-Founder, CEO &

Directorrob@lithiumbank.ca(778) 987-9767

Cautionary Statement Regarding Forward Looking

Statements

This press release includes certain statements

and information that may constitute forward-looking information

within the meaning of applicable Canadian securities laws. All

statements in this news release, other than statements of

historical facts, including statements regarding future estimates,

plans, objectives, timing, assumptions or expectations of future

performance, including without limitation, statements regarding the

completion of the Offering and the timing thereof, and the

anticipated use of proceeds of the Offering are forward-looking

statements and contain forward-looking information. Generally,

forward-looking statements and information can be identified by the

use of forward-looking terminology such as “intends” or

“anticipates,” or variations of such words and phrases or

statements that certain actions, events or results “may,” “could,”

“should” or “would” or occur. Forward-looking statements are based

on certain material assumptions and analyses made by the Company

and the opinions and estimates of management as of the date of this

press release, including, but not limited to, that the Company will

complete the Offering on the terms disclosed, that the Company will

receive all necessary regulatory approvals for the Offering, that

the Company will use the proceeds of the Offering as currently

anticipated, including to expedite the further advancement of its

portfolio of district scale direct brine lithium assets in Western

Canada, that the Company will complete drilling and sampling to

upgrade its resources, that the Company will conduct pilot plant

testing to determine key performance indicators at its Boardwalk

and Park Place Projects; and assumptions relating to the state of

the financial markets for the Company’s securities. These

forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking statements or forward-looking information.

Important factors that may cause actual results to vary, include,

without limitation, that the Company may not be able to raise funds

under the Offering, as currently anticipated, that the Company may

fail to receive any required regulatory approvals for the Offering,

that the Company will not use the proceeds of the Offering as

anticipated, market volatility, unanticipated costs, changes in

applicable regulations, and changes in the Company’s business

plans. Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and

forward-looking information. Readers are cautioned that reliance on

such information may not be appropriate for other purposes. The

Company does not undertake to update any forward-looking statement,

forward-looking information or financial out-look that are

incorporated by reference herein, except in accordance with

applicable securities laws.

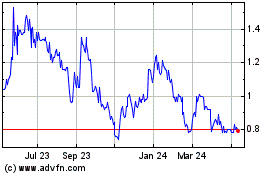

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

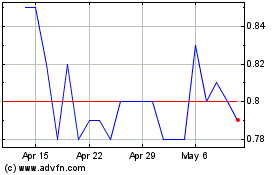

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Dec 2023 to Dec 2024