Hemostemix Inc. (“Hemostemix” or the “Company”) (TSXV: HEM; OTC:

HMTXF) provides the following update:

On February 21, 2020, the Court Queen’s Bench of

Alberta (the “Court”), after having heard the

concerns raised by the Company with respect to an application by

J.M. Wood Investments Ltd (“Wood”) for the

issuance of an order appointing a receiver, ordered that: (i) the

application of Wood be further adjourned to February 27,

2020; (ii) the Company provide Grant Thornton Limited, as court

appointed agent, a copy of Thomas Smeenk’s affidavit and unredacted

copies of the exhibits (subscription agreements) no later than 4:00

p.m. EST on February 21, 2020 (which the Company complied with);

(iii) provide additional rights to Grant Thornton Limited to

prepare a report for the Court by February 27, 2020 to set out the

viability and veracity of closing of the proposed financings of the

Company by March 2, 2020; and (iv) comment on the ability and

viability of the Company to repay Wood in full.

Further to its news release issued in February

10, 2020, the Company wishes to clarify that on February 3, 2020,

the Company was served with a claim filed by Aspire in the Circuit

Court of the 9th Judicial Circuit in and for Orange County,

Florida. On February 13, 2020, Aspire issued a press release that

it filed an amended motion for a speedy hearing in relation to the

previously announced legal proceeding initiated against the

Company. Management of the Company believes that both actions are

attempts by Wood to prevent the Company from closing its financing

announced on January 2, 2020 and to force the Company into

receivership. On February 20, 2020 Thomas Smeenk, President and CEO

of the Company, filed an affidavit through the Company’s attorney,

Allen Dyer Doppelt + Gilchrist, P.A. in Florida, that the dispute

should be governed by the Laws of the Province of Alberta and

attorn to the venue and jurisdiction of Alberta courts.

PRIVATE PLACEMENT UPDATE

The Company expects to close its financing, as

previously announced on January 2, 2020, consisting of up to 300

million units at one cent per unit for gross proceeds of up to

$3-million on or about February 27, 2020, subject to receiving TSX

Venture Exchange approval, which is expected shortly. Each

unit will comprise of one common share of the Company and one share

purchase warrant. Each warrant will entitle the holder to acquire

one additional common share in the capital of the Company at a

price of five cents per warrant, for a period of one year from the

date the units are issued. The proceeds of the private placement

will be used to repay all indebtedness owning to Wood. Please refer

to the January 2, 2020 news release for additional terms and

conditions of the private placement.

The private placement of convertible debentures

announced on February 19, 2020 has been withdrawn.

LITIGATION UPDATE

Management of the Company believe that Jed Wood

and J.M. Wood Investments Ltd. are using the application for the

appointment of a receiver to obtain a collateral advantage in

litigation and using the proceedings to prevent the Company from

closing the private placement, which is a necessary prerequisite to

repaying the outstanding debt.

The Company provides the following chronological

update and recap of the events leading up to the application to the

Court of Queen’s Bench of Alberta by J.M. Wood Investments Ltd. for

an order appointing a receiver and the action filed against the

Company by Aspire Health Science, LLC in Orange County,

Florida.

On May 3, 2019, the Company issued a news

release announcing a $1,000,000 secured convertible debenture

financing (“Convertible Debenture”). On May

16, 2019, the Company announced the first closing for proceeds of

$525,000, including $500,000 from J.M. Wood Investments Ltd.

(“Wood”) and secured by a general security

agreement over all assets of the Company, including intellectual

property rights over the Company’s stem cell technology. The

repayment of principal and interest was due December 31, 2019. The

funds were used for general working capital purposes and to fund

ongoing clinical trial costs.

In a news release dated August 1, 2019, the

Company announced it had secured a demand loan from Wood for up to

$2,000,000 and secured by a general security agreement over all

assets of the Company, including intellectual property rights over

the Company’s stem cell technology (the “Demand

Loan”). After September 30, 2019, Wood could provide the

Company with at least 60 days’ written notice requiring repayment

of the outstanding principal amount of the Demand Loan plus any

accrued and unpaid interest.

The Company used those funds to continue the

phase 2 clinical trial and for general working capital, however the

Company was not successful in raising additional financing or

investment to complete the ACP-01 clinic trial and finance

operations. Therefore, the Company continued to search for

strategic alternatives for financing, licensing or partnering to

complete the current phase 2 clinical trial for CLI. In connection

with this strategy, the Company entered into discussions with its

manufacturing and licensing partner, Aspire Health Science, LLC.

(“Aspire”).

With no other alternative funding available to

continue the clinical trial, the Company entered into an Amended

License Agreement dated September 30, 2019 with Aspire. The

Amended License Agreement amended the original License Agreement

between the Company and Aspire dated February 15, 2018 and

included, among other amendments, the payment of USD$1,000,000 to

the Company within 30 business days from execution of the Amended

License Agreement.

On October 1, 2019, Wood sent the Company a

demand notice for the repayment of all outstanding indebtedness.

The demand letter included certain forbearance provisions delaying

repayment by up to 120 days, which the Company complied with.

On November 19, 2019, the Company announced that

Kyle Makofka resigned as Chief Executive Officer of the Company.

Mr. Makofka is currently the President and CEO of Aspire.

Following the reconstitution of the Company’s

Board of Directors and management team in December of 2019, the

Company provided written notice to Aspire that the Amended License

Agreement was rescinded as a result of Aspire’s failure to pay the

Company USD $1,000,000 as required under the Amended License

Agreement.

On January 2, 2020, the Company announced a

non-brokered private placement financing of up to $3,000,000 to

repay all indebtedness to Wood.

On January 9, 2020, Wood sent the Company a

Notice of Default and Demand for the immediate repayment of

$500,000 Convertible Debenture and $1,172,175.33 Demand Loan plus

12% interest. The Company disputes the effective dates and

principal amounts owing of the Notice of Default and Demand.

The Company believes the total principal amount owing to Wood

is $1,956,180.50 plus interest.

On January 24, 2020, Wood made an application to

the Court of Queen’s Bench of Alberta (the

“Court”) for the issuance of an order appointing a

receiver. The Company responded with a 347 page affidavit

including appendices, sworn on January 30, 2020 by David Wood, the

Chairman of the Company. On January 31, 2020, the Court

granted a consent order to: (i) adjourn the receivership

application to February 20, 2020; (ii) appoint Grant Thornton as

inspector; and (iii) the costs of the application of January 31,

2020 would only be payable by the Company if the receivership

application proceeds on February 20th.

On February 3, 2020, the Company was served with

a claim filed by Aspire in the Circuit Court of the 9th Judicial

Circuit in and for Orange County, Florida regarding the dispute

settlement mechanism under the Amended License Agreement. On

February 13, 2020, Aspire issued a press release that it filed an

amended motion for a speedy hearing in relation to the previously

announced legal proceeding initiated against the Company.

Management of the Company believes this is merely another attempt

to prevent the Company from closing its financing and forcing the

Company into receivership. On February 20, 2020 Thomas Smeenk, on

behalf of the Company, filed an affidavit through the Company’s

attorney, Allen Dyer Doppelt + Gilchrist, P.A. in Florida.

On February 21, 2020, the Court, after having

heard the concerns raised by the Company, ordered that: (i) the

application of Wood be further adjourned to February 27, 2020; (ii)

the Company to provide Grant Thornton Limited, as court appointed

agent, a copy of Thomas Smeenk’s affidavit and unredacted copies of

the exhibits (subscription agreements) no later than 4:00 p.m. EST

on February 21, 2020; (iii) provide additional rights to Grant

Thornton Limited to prepare a report for the Court by February 27,

2020 to set out the viability and veracity of closing of the

proposed private placement by March 2, 2020; and (iv) comment on

the ability and viability of the Company to repay Wood in full.

APPOINTMENT TO SCIENTIFIC ADVISORY

BOARD

The Company is pleased to announce the

appointment of Dr. Pierre Leimgruber, MD, FACC to its Scientific

Advisory Board, as a specialist in the prevention and treatment of

cardiovascular disease (CVD). Dr. Leimgruber is board-certified in

internal medicine, cardiovascular diseases, and interventional

cardiology and he has worked for 32 years as an interventional

cardiologist, affiliated with four leading Spokane hospitals. Dr.

Leimgruber also serves as Clinical Associate Professor of Medicine

at the University of Washington School of Medicine in

Seattle. Dr. Leimgruber received his medical degree from

University of Zurich Medical School and trained with Andreas

Gruentzig, MD, the inventor of balloon angioplasty, at Emory

University Hospital in Atlanta. Dr. Leimgruber is the author of 26

peer-reviewed research studies published in leading medical

journals.

“After performing thousands of angioplasties and

stent placements in patients with severe coronary, carotid artery

but also patients with PAD and severe/critical limb ischemia , I am

excited to be working with the scientific advisory board, to advise

Hemostemix’ officers and directors from a science-based,

cardiology-practice-based, clinical trial and business

development-based perspectives,” said Dr. Leimgruber. “ACP-01’s

clinical trial data and open label study data in both critical limb

ischemia and heart disease is world class to-date,” he said. “Its

medical applications – CLI & PAD, Angina, Ischemic &

Dilated Cardiomyopathy - are unmet needs at a global scale,”

continued Dr. Leimgruber. “Management, I know, now understands what

it is going to take to build a profitable autologous stem cell

therapy company,” said Dr. Leimgruber.

“I have known Dr. Leimgruber since 2008, when he

was graciously introduced to me by my good friend Roger, patient

number 35, and I am delighted to recruit him to the scientific

advisory board” said Thomas Smeenk, President. His open

communication style and multifaceted-experience-based counsel is

going to be a great addition to our SAB and our team” Smeenk

said.

ABOUT HEMOSTEMIX

Hemostemix is a publicly traded autologous stem

cell therapy company, founded in 2003. A winner of the World

Economic Forum Technology Pioneer Award, the Company developed and

is commercializing its lead product ACP-01 for the treatment of

CLI, PAD, Angina, Ischemic Cardiomyopathy, Dilated Cardiomyopathy

and other conditions of ischemia. ACP-01 has been used to treat

over 300 patients, and it is the subject of a randomized,

placebo-controlled, double blind trial of its safety and efficacy

in patients with advanced critical limb ischemia who have exhausted

all other options to save their limb from amputation.

On October 21, 2019, the Company announced the

results from its Phase II CLI trial abstract presentation entitled

“Autologous Stem Cell Treatment for CLI Patients with No

Revascularization Options: An Update of the Hemostemix ACP-01 Trial

With 4.5 Year Followup” which noted healing of ulcers and

resolution of ischemic rest pain occurred in 83% of patients, with

outcomes maintained for up to 4.5 years.

The Company owns 91 patents across five patent

families titled: Regulating Stem Cells, In Vitro Techniques for use

with Stem Cells, Production from Blood of Cells of Neural Lineage,

and Automated Cell Therapy. For more information,

please visit

www.hemostemix.com.

Contact: Thomas Smeenk, President, CEO &

FounderSuite 1150, 707 – 7th Avenue S.W., Calgary, Alberta T2P 3H6,

905-580-4170

Neither the TSX Venture Exchange nor its

Regulation Service Provider (as that term is defined under the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Statements

This release may contain forward-looking

statements. Forward-looking statements are statements that are not

historical facts and are generally, but not always, identified by

the words “expects,” “plans,” “anticipates,” “believes,” “intends,”

“estimates,” “projects,” “potential,” and similar expressions, or

that events or conditions “will,” “would,” “may,” “could,” or

“should” occur. Although Hemostemix believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results may differ materially from

those in forward-looking statements. Forward-looking statements are

based on the beliefs, estimates, and opinions of Hemostemix

management on the date such statements were made. By their nature

forward-looking statements are subject to known and unknown risks,

uncertainties, and other factors which may cause actual results,

events or developments to be materially different from any future

results, events or developments expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to, the Company’s ability to fund operations and access the

capital required to continue operations, the Company’s stage of

development, the ability to complete its current CLI clinical

trial, complete a futility analysis and the results of such, future

clinical trials and results, long-term capital requirements and

future developments in the Company’s markets and the markets in

which it expects to compete, risks associated with its strategic

alliances and the impact of entering new markets on the Company’s

operations. Each factor should be considered carefully and readers

are cautioned not to place undue reliance on such forward-looking

statements. Hemostemix expressly disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events, or

otherwise. Additional information identifying risks and

uncertainties are contained in the Company’s filing with the

Canadian securities regulators, which filings are available at

www.sedar.com.

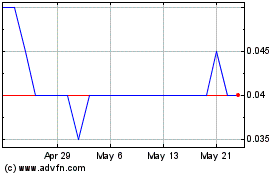

Hemostemix (TSXV:HEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hemostemix (TSXV:HEM)

Historical Stock Chart

From Jan 2024 to Jan 2025