Guardian Exploration Closes Asset Sale and Enters Into Farmin Agreement

November 30 2012 - 9:25AM

Marketwired Canada

Closing of Asset Sale

On November 21, 2012, Guardian Exploration Inc. ("Guardian" or "the Company")

(TSX VENTURE:GX) closed its previously announced asset sale to Deckland Inc.

("Deckland") a private company controlled by the CEO of Guardian, Graydon Kowal.

Approximately half of the $2,240,646 sale amount had previously been received by

Guardian by way of debts payable to Guardian Helicopters (a private company

controlled by Mr. Kowal), and through loans from Deckland and Guardian

Helicopters to the Company to fund its existing operations. The sale was

approved by a majority of the disinterested shareholders at Guardian's AGM on

August 2, 2012. More information with respect to the sale can be found in the

Company's September 14, 2012 press release and its Management Information

Circular dated July 4, 2012.

Farmin On Drilling Horizontal Well

On November 23, 2012, Guardian entered into a farm-in agreement with Deckland.

Under the terms of the agreement Guardian will pay 100% of the drilling,

equipping, and completion costs to earn a 50% working interest in the well that

will be operated by Deckland. The agreement is pending TSX Venture Exchange

approval. The well will target oil in the Pekisko formation in the Jenner area

of Alberta and is expected to be completed in the first two weeks of December

2012. Drilling costs of the well are currently estimated at $900,000. Funds from

the closing of the Jenner asset sale will be the source of the required funds.

The farm-in agreement will allow Guardian to fulfill its $825,000 flow-through

spending obligation that arose from its June 2011 flow-through share issuance

and that has a deadline of December 31, 2012.

The well has a planned Total Measured Depth of 2,300m and is being drilled into

a pool of oil that is delineated with an abandoned vertical well that was

drilled in 1987 and proprietary 3D seismic data that Deckland owns. Deckland, as

well as several other operators, have successfully drilled oil wells in this

area using horizontal drilling technology that was not available when these

pools were initially discovered in the 1980's and 1990's. If the drilled well

has negligible amounts of natural gas and does not require the construction of a

pipeline, oil production can likely commence as early as January 1, 2013. This

well will qualify for Alberta's Horizontal Oil New Well Royalty Rate of 5% for

the first of either 50,000 barrels or 18 months, whichever comes first.

Management and the Board of Directors believe this to be an opportunity for

Guardian to participate in the drilling of a well that could provide production

for a relatively low risk and cost compared to other current plays in Western

Canada, coupled with the ability to fulfill its flow through expenditure

obligations.

Montana Update

K2 America Corp ("K2") is still waiting for the drilling permit to be issued

from the Bureau of Land Management in relation to K2's commitment well to the

Blackfeet Tribe. The permit is expected to be completed sometime in Q1 of 2013

and the Company has six months from the issue date to drill its commitment well

which is planned as vertical into the Cutbank formation.

K2 has dropped an appeal to the State of Montana Department of Natural Resources

related to the expiry of State mineral leases totaling 6,000 acres. The leases

were acquired in the first quarter of 2011 for $554,392 to potentially explore

for the Alberta Bakken formation that was being drilled in North West Montana at

the time, which leases were subsequently allowed to expire. To the Company's

knowledge there have yet to be any publicly announced economic wells drilled

into the Alberta Bakken in Montana.

On July 31, 2012 a farm-in agreement expired that Guardian's wholly owned

subsidiary, K2 America Corp, was a party of. The agreement contained a failure

payment clause of $1MM if K2 did not fulfill all of its obligations as outlined

in the agreement. The Farmor has acknowledged that the agreement has been

terminated but has never demanded payment of the aforementioned payment. The

full amount of the $1MM penalty has been booked as a liability in the third

quarter 2012 financial statements. Management is confident that the Farmor will

release the Company from this liability in the coming months.

Guardian is a Calgary-based corporation engaged in the acquisition, exploration

and development of resource properties. Common shares of the company trade on

the TSX Venture Exchange under the trading symbol "GX".

Investors are cautioned that this news release contains forward looking

information. Such information is subject to known and unknown risks,

uncertainties and other factors that could influence actual results or events

and cause actual results or events to differ materially from those stated,

anticipated or implied in the forward-looking information. Readers are cautioned

not to place undue reliance on forward-looking information, as no assurances can

be given as to future results, levels of activity or achievements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Guardian Exploration Inc.

Graydon Kowal

President and CEO

(403) 269-5870

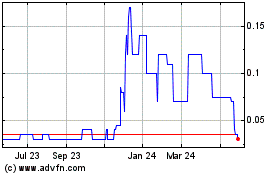

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Dec 2024 to Jan 2025

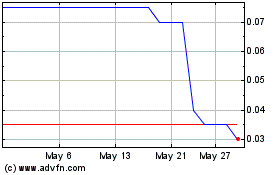

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jan 2024 to Jan 2025