Covalon Technologies Ltd. (the "Company" or "Covalon") (TSXV:

COV; OTCQX: CVALF), an advanced medical technologies company, today

announced its fiscal 2024 first quarter results for the period

ended December 31, 2023.

Brent Ashton, Covalon’s newly appointed Chief Executive Officer

stated, “Covalon’s strong focus on our product business in the

United States delivered a remarkable 36% growth in Q1. These

advances were offset by revenue challenges primarily due to a

decrease in our coatings business with a large customer and the

timing of shipments for some international customers. Our team

excelled in delivering strong gross margins despite the absence of

the high-margin coating revenue we recognized in prior years.

I am extremely proud of the progress that the Covalon team has

made in the past few months with a solid focus on strengthening

foundational elements for our business and setting the stage for

substantial revenue growth in fiscal 2024. In parallel with our

intense focus on growth, we are also highly focused on streamlining

our operating expenses relative to revenue, with the goal of

achieving EBITDA profitability within fiscal 2024.

The entire Covalon team is very energized to drive Covalon into

its forthcoming growth phase. Covalon’s strengths in our products,

intellectual property, dedicated team, and excellent industry

partnerships gives us high confidence in our ability to generate

significant value for our customers, team members, and

shareholders."

Q1 Financial Overview

US product revenue for the quarter increased 36%, offset by

International product revenue declining by 77%, largely due to the

timing of shipments for a large International tender. Revenue for

the three months ended December 31, 2023 therefore decreased 25% to

$4.7M compared to $6.2M for the same period of the prior year.

Development and consulting services revenue for the three-month

period ended December 31, 2023 decreased to $0.06M, compared to

$0.8M for the same period of the prior year. This decrease is a

result of a customer’s decision to not proceed with a medical

coatings project, and a strategic decision by Covalon to increase

the focus and priority of our US product segment.

Licensing and royalty fees for the three months ended December

31, 2023 were $0.03M, compared to $0.1M for the three months ended

December 31, 2022. The timing of this revenue will vary depending

on length and timing of projects and discussions with

customers.

Gross margin for the three-month period ended December 31, 2023

increased to 61% compared to 60% in the same period for the prior

year. During the three months ended December 31, 2023, the Company

released inventory provisions of $0.2M as a result of changes in

obsolescence estimates, as compared to $nil inventory provisions

being recorded during the three months ended December 31, 2022. The

gross margin is significantly influenced by source of revenue and

by the relative mix of products sold in any given financial

period.

Operating expenses for the three months ended December 31, 2023

increased $0.3M to $4.3M, compared to $4.1M for the prior year’s

comparative period. Approximately $0.4M relates to increased

operations activities primarily due to an increase in staffing

levels and product development expenses, this is offset with

approximately $0.6M decrease related to the finance lease

receivable for the sublease of a portion of our Seattle

location.

Net loss for the three months ended December 31, 2023 was $0.9M

or $0.03 per share, compared to a net loss of $0.4M or $0.02 per

share for the three months ended December 31, 2022.

Adjusted Gross Margin(1) for the three-month period ended

December 31, 2023 was 58% compared to 61% for the same period of

the prior year. Gross margin is highly influenced by the mix of

collagen-based dressings, silicone-based dressings, medical coating

services, passive dressings, and related service revenues generated

in the periods. Gross margin fluctuates as a result of the mix of

products sold in any given quarter, or year, by product type and

geography. For further information about Adjusted Gross Margin, see

“Definitions and Reconciliations of Non-GAAP Financial Measures”

below.

Adjusted EBITDA(1) loss for the three months ended December 31,

2023 was $1.3M, compared to an Adjusted EBITDA income of $0.05M for

the three months ended December 31, 2022. For further information

about Adjusted EBITDA, see “Definitions and Reconciliations of

Non-GAAP Financial Measures” below.

Statement of Operations

The following audited table presents Covalon’s consolidated

statements of operations for the three-month periods ended December

31, 2023 and 2022.

(unaudited)

Three months ended

December 31,

2023

2022

Revenue

Product

$

4,575,767

$

5,245,264

Development and consulting services

56,640

818,346

Licensing and royalty fees

30,650

121,795

Total revenue

4,663,057

6,185,405

Cost of sales

1,814,520

2,490,573

Gross profit before operating

expenses

2,848,537

3,694,832

Operating expenses

Operations

630,713

207,879

Research and development activities

311,411

285,975

Sales, marketing, and agency fees

1,646,303

2,029,936

General and administrative

1,731,625

1,526,895

4,320,052

4,050,685

Gain of finance lease receivable

610,088

-

Finance (income) expenses

(9,964

)

24,968

Net loss

$

(851,543

)

$

(380,821

)

Other comprehensive income

(loss)

Amount that may be reclassified to

profit or loss

Foreign currency translation

adjustment

(387,273

)

(16,785

)

Total comprehensive loss

$

(1,238,816

)

(397,606

)

Loss per common share

Basic loss per share (Note 17)

$

(0.03

)

$

(0.02

)

Diluted loss per share (Note 17)

$

(0.03

)

$

(0.02

)

Non-GAAP Financial Measures

This press release makes reference to certain non-GAAP measures.

These measures are not recognized or defined measures under IFRS

Accounting Standards, do not have standardized meaning prescribed

by IFRS Accounting Standards and are therefore unlikely to be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional financial

information to complement those IFRS Accounting Standards measures

by providing further understanding of our results of operations

from management’s perspective. Accordingly, these measures should

not be considered in isolation or as a substitute for analysis of

our financial information reported under IFRS Accounting Standards.

The non-GAAP financial measures, adjustments, and reasons for

adjustments should be carefully evaluated as these measures have

limitations as analytical tools and should not be used in

substitution for an analysis of the Company’s results under IFRS

Accounting Standards. We use non-GAAP measures including “Adjusted

Gross Margin” and “Adjusted EBITDA” to provide investors with

supplemental measures of our operating performance and thus

highlight trends in our core business that may not otherwise be

apparent when relying solely on IFRS Accounting Standards measures.

We believe that securities analysts, investors and other interested

parties frequently use non-GAAP measures in the evaluation of

issuers. Our management also uses non-GAAP measures in order to

facilitate operating performance comparisons from period to period,

to prepare annual operating budgets and forecasts and to determine

components of management compensation. The following non-GAAP

financial measures are presented in this news release, and a

description of the calculation for each measure is included

below:

- Adjusted Gross Margin is defined as gross profit before

operating expenses, plus depreciation and amortization included in

cost of sales, plus inventory provision amounts.

- Adjusted EBITDA is defined as net loss, plus interest expense,

plus depreciation and amortization, plus stock-based compensation,

less government subsidies, plus inventory provisions, plus accounts

receivable write-off expenses.

You should also be aware that the Company may recognize income

or incur expenses in the future that are the same as, or similar to

some of the adjustments in these non-GAAP financial measures.

Because these non-GAAP financial measures may be defined

differently by other companies in our industry, our definitions of

these non-GAAP financial measures may not be comparable to

similarly titled measures of other companies, thereby diminishing

their utility.

The table below provides a reconciliation of gross profit before

operating expenses under IFRS Accounting Standards in the

consolidated financial statements to Adjusted Gross Margin for the

three months, and year ended December 31, 2023 and 2022. Management

believes that Adjusted Gross Margin is useful in assessing the

performance of the Company’s ongoing operations and its ability to

generate cash flows from period to period. The adjusting items

below are considered to be outside of the Company’s core operating

results, and these items can distort the trends associated with the

Company’s ongoing performance, even though some of those expenses

may recur.

(unaudited)

Three months ended December

31,

2023

2022

Gross profit before operating expenses

2,848,537

3,694,832

Add: Depreciation and amortization

52,548

56,033

Add: Inventory provisions

(192,771)

-

Adjusted Gross Margin

2,708,314

3,750,865

Adjusted Gross Margin (%)

58%

61%

The table below provides a reconciliation of net loss under IFRS

Accounting Standards in the consolidated financial statements to

Adjusted EBITDA for the three months, and year ended December 31,

2023 and 2022. Management believes that these non-GAAP measures are

useful in assessing the performance of the Company’s ongoing

operations and its ability to generate cash flows to fund its cash

requirements from period to period. The adjusting items below are

considered to be outside of the Company’s core operating results,

and these items can distort the trends associated with the

Company’s ongoing performance, even though some of those expenses

may recur.

Three months ended December

31,

2023

2022

Net loss

(851,543)

(380,821)

Add: Net finance (income) expenses

(9,964)

24,968

Add: Depreciation and amortization

240,194

250,085

Add: Share based compensation

115,929

156,307

Add: Inventory provisions

(192,771)

-

Add: Gain on finance lease receivable

(582,140)

-

Adjusted EBITDA

(1,280,295)

50,539

About Covalon

Covalon Technologies Ltd. is a patient-driven medical device

company, built on the relentless pursuit to help the most

vulnerable patients have a better chance at healing. Through a

strong portfolio of patented technologies and solutions for

advanced wound care, infection prevention, and medical device

coatings, we offer innovative, gentler, and more compassionate

options for patients to heal with less infections, less pain, and

better outcomes. Our solutions are designed for patients and made

for care providers. Covalon leverages its patented medical

technology platforms and expertise in two ways: (i) by developing

products that are sold under Covalon’s name; and (ii) by developing

and commercializing medical products for other medical companies

under development and license contracts. The Company is listed on

the TSX Venture Exchange, having the symbol COV and trades on the

OTCQX Market under the symbol CVALF. To learn more about Covalon,

visit our website at www.covalon.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release may contain forward-looking statements which

reflect the Company's current expectations regarding future events.

The forward-looking statements are often, but not always,

identified by the use of words such as "seek", "anticipate", "plan,

"estimate", "expect", "intend", or variations of such words and

phrases or state that certain actions, events, or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur”, or

“be achieved”. In addition, any statements that refer to

expectations, projections or other characterizations of future

events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts, but instead represent management’s expectations,

estimates, and projections regarding future events. Forward-looking

statements involve risks and uncertainties, including, but not

limited to, the factors described in greater detail in the “Risks

and Uncertainties” section of our management’s discussion and

analysis of financial condition and results of operations for the

year ended September 30, 2023, which is available on the Company’s

profile at www.sedarplus.ca, any of which could cause results,

performance, or achievements to differ materially from the results

discussed or implied in the forward-looking statements. Investors

should not place undue reliance on any forward-looking statements.

The forward-looking statements contained in this news release are

made as of the date of this news release, and the Company assumes

no obligation to update or alter any forward-looking statements,

whether as a result of new information, further events, or

otherwise, except as required by law.

(1) See “Non-GAAP Measures” below, including for a

reconciliation of the non-GAAP measures used in this release to the

most comparable IFRS Accounting Standards measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228780937/en/

To learn more about Covalon:

Investor Relations, Covalon Technologies Ltd. Email:

investors@covalon.com Website: https://covalon.com/ Twitter:

@covalon

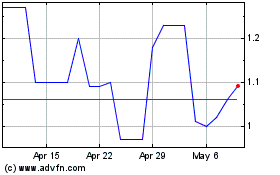

Covalon Technologies (TSXV:COV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Covalon Technologies (TSXV:COV)

Historical Stock Chart

From Nov 2023 to Nov 2024