Astur Gold and Gold-Ore Resources Announce $150 Million Merger Creating a European Leader in Gold Production, Development and...

December 16 2011 - 4:18PM

Marketwired Canada

Astur Gold Corp. (TSX VENTURE:AST)(FRANKFURT:CDC) ("Astur Gold") and Gold-Ore

Resources Ltd. (TSX:GOZ) ("Gold-Ore") are pleased to announce the joint

execution of a binding letter agreement to complete a business combination (the

"Transaction"), whereby Gold-Ore would acquire all of the issued shares of Astur

Gold by way of a plan of arrangement. The combined company, to be called "Astur

Gold Corp.", will be a well-funded, growth-oriented gold producer with a

portfolio of production and near-term production assets in Sweden and Spain. The

two companies have agreed to combine whereby each Astur Gold shareholder will

receive 2.35 common shares of Gold-Ore for each common share of Astur Gold, and

the combined company will affect a 3 for 1 roll back of its issued and

outstanding shares. The boards of directors of Astur Gold and Gold-Ore have

unanimously approved the terms of the Transaction, and strongly recommend that

shareholders vote in favour of the proposed Transaction.

Transaction Rationale:

-- A combination of strong cash flow and one of the largest undeveloped

gold projects in Western Europe, creating a new high growth European-

focused gold producer.

-- Combined reserves and Measured and Indicated resources of approximately

2.6 million ounces of gold and combined Inferred resources of

approximately 1 million ounces of gold (Note: NI 43-101 compliant

Resources and Reserves shown at end of news release).

-- Combined $22 million of cash, un-hedged production, and fully-funded to

take Salave through bankable feasibility and into development.

-- Combined management team of complementary financial and technical

experience with a proven track record of success of building and

operating gold mines and creating strong shareholder returns.

-- An attractive European growth platform with mining and development

expertise, and a view towards additional accretive merger and

acquisition activity in Europe.

-- Doubling of market capitalization to enhance capital markets exposure

and trading liquidity.

Glen Dickson, Chairman and CEO of Gold-Ore, stated: "The merger with Astur Gold

provides the Gold-Ore shareholders the opportunity to participate in the near

term development of Western Europe's most promising gold deposit. The Astur Gold

shareholders will benefit from Gold-Ore's cash and cash-flow to fund the Salave

deposit through feasibility and into initial development with no further

dilution. We are certain that shareholders of both companies will truly benefit

from the merger."

Cary Pinkowski, CEO and Director of Astur Gold, stated: "The combination of

Astur Gold and Gold-Ore is truly a complementary transaction bringing together a

strong platform of technical, operational and financial management. Our new

company will have a first mover advantage on consolidating the European gold

space and presents a strong growth profile focused on enhancing shareholder

value with the singular objective of becoming a major European gold producer."

Transaction Details

The proposed business combination between Astur Gold and Gold-Ore is expected to

be completed by way of a court-approved plan of arrangement whereby Gold-Ore

would acquire all of the issued shares of Astur Gold (the "Arrangement"). The

Transaction will be subject to certain standard conditions including: the

approval of holders of not less than 66 2/3% of the total votes cast by holders

of Astur Gold common shares; the approval of holders of not less than 50% plus

one vote of the total votes cast by holders of Gold-Ore common shares; execution

of definitive agreement; the approval of the Toronto Stock Exchange and TSX

Venture Exchange; and other customary closing conditions.

Gold-Ore currently has 85,402,309 shares outstanding and will issue 81,088,369

new shares for all outstanding shares of Astur Gold. A concurrent 3 for 1 roll

back of the new combined company will result in 55,496,893 shares outstanding.

Following the Transaction, Gold-Ore has agreed to change its name to "Astur Gold

Corp." and maintain Toronto Stock Exchange listing. Gold-Ore shareholders will

own 51.3% of the new company.

Full details of the Transaction will be included in the Gold-Ore management

information circular and the Astur Gold proxy statement, both of which are

expected to be mailed to their respective shareholders as soon as practical.

Under the terms of the Transaction, shareholders of Astur Gold will receive 2.35

common shares of Gold-Ore (the "Exchange Ratio") for each share of Astur Gold

held. All of Astur Gold's unexercised options will be exchanged for Gold-Ore

options with the number and exercise prices of such options to be adjusted based

on the Exchange Ratio.

The business combination includes a commitment by each of Astur Gold and

Gold-Ore to not solicit alternative transactions to the Transaction. Each

company has agreed to pay a break fee to the other party of $2.5 million upon

the occurrence of certain events.

Management Team and Board of Directors

The board and management structure of the combined company will draw on the

expertise of both companies. Glen Dickson, Robert Wasylyshyn, David Mullen and

Ron Ewing from the Board of Gold-Ore will become Directors of the new company.

Cary Pinkowski, Josh Crumb, and Sean Roosen will be the Astur Gold nominees to

the new Board of Directors. Glen Dickson will become non-executive Chairman of

the Board. Cary Pinkowski will assume the role of CEO, Robert Wasylyshyn will

assume the title of President, and Michael Kerfoot will become CFO. Emilio

Hormaeche will become President of Operations in Spain. Mike Surratt will become

the Chief Technical Advisor to the Board of the new company.

Advisors and Counsel

Astur Gold's legal counsel is Anfield Sujir Kennedy & Durno LLP. Haywood

Securities Inc. provided an independent opinion to the special committee of

Astur Gold's board of directors that, as of the date thereof and subject to the

assumptions, limitations and qualifications set out therein, the exchange ratio

is fair, from a financial point of view, to the shareholders of Astur Gold.

Gold-Ore's legal counsel is McLeod & Company LLP. Fraser Mackenzie Limited

provided an independent opinion to Gold-Ore's board of directors that, as of the

date thereof and subject to the assumptions, limitations and qualifications set

out therein, the exchange ratio is fair, from a financial point of view, to the

shareholders of Gold-Ore.

Conference Call

A joint conference call will be held by both companies on Monday, December 19,

2011 at 11:00 AM EST (8:00 AM PST). Below are the conference access code and

phone numbers:

Participant Access code: 3448726

Toll-free: 1-877-385-4099 (Canada & USA)

Vancouver direct: +1-604-899-2339

Toronto direct: +1-416-883-0133

Resources & Reserves

Gold-Ore: Bjorkdal Reserves & Resources

----------------------------------------------------------------------------

Category Tonnes (000's) Grade (g/t Au) Gold (oz)

----------------------------------------------------------------------------

Reserves

----------------------------------------------------------------------------

P&P (O/P) 3,568 1.13 129,945

----------------------------------------------------------------------------

P&P (U/G) 457 2.46 36,128

----------------------------------------------------------------------------

Total Reserves(i) 4,025 1.28 166,073

----------------------------------------------------------------------------

Resources

----------------------------------------------------------------------------

M&I (O/P) 10,281 1.19 393,400

----------------------------------------------------------------------------

M&I (U/G) 6,191 2.65 527,500

----------------------------------------------------------------------------

Total M&I 16,472 1.74 920,900

----------------------------------------------------------------------------

Inferred (O/P) 10,435 1.07 359,000

----------------------------------------------------------------------------

Inferred (U/G) 2,736 2.91 256,000

----------------------------------------------------------------------------

Total Inferred 13,171 1.45 615,000

----------------------------------------------------------------------------

(i) Does not account for 2011 Production

- Reserves from "Technical Report on Bjorkdal Gold Mine, Sweden" by Wardell

Armstrong International, March 26, 2010

- Resources from "Bjorkdal Resource Estimate" by Wardell Armstrong

International, January 21, 2011

- Mineral resources listed at cut-off grade of 0.3 g/t Au for open pit and 1

g/t Au for underground

- Mineral reserves listed at cut-off grade of 0.45 g/t Au for open pit and

1/1.3 g/t Au for underground

- Mineral resources that are not mineral reserves do not have demonstrated

economic viability

Astur Gold: Salave Resources

----------------------------------------------------------------------------

Category Tonnes (000's) Grade (g/t) Gold (Oz)

----------------------------------------------------------------------------

Measured 2,155 3.88 268,000

----------------------------------------------------------------------------

Indicated 15,790 2.79 1,415,000

----------------------------------------------------------------------------

M&I 17,945 2.92 1,683,000

----------------------------------------------------------------------------

Inferred 2,600 1.94 160,000

----------------------------------------------------------------------------

Inferred (UG) 1,170 4.7 178,000

----------------------------------------------------------------------------

Total Inferred 3,770 2.8 338,000

----------------------------------------------------------------------------

Source: "Technical Report on Salave Gold Deposit, Spain" by Scott Wilson

RPA, February 25, 2010

- Mineral resources listed at cut-off grade of 0.7 g/t Au for open pit and

2.5 g/t Au for underground

- Mineral resources that are not mineral reserves do not have demonstrated

economic viability

Robert Wasylyshyn, P. Geo., President and COO of Gold-Ore, is the qualified

person for Bjorkdal as defined in NI 43-101 and has reviewed the contents of

this news release.

Brian McEwen, P. Geo., consultant to Astur Gold, is the qualified person for

Salave as defined in NI 43-101 and has reviewed the contents of this news

release.

ABOUT GOLD-ORE

Gold-Ore Resources is a gold producing company focused in the low political risk

jurisdiction of Sweden. The Company's primary asset is the Bjorkdal Gold Mine,

which has produced 1,050,000 ounces in the last 24 years. Drilling is expanding

the resources indicating a long mine life at current gold prices. The Company

has a strong balance sheet, generates significant cash flow from gold sales, and

remains un-hedged.

ABOUT ASTUR GOLD

Astur Gold is developing its 100% owned Salave Gold Project in Asturias,

northern Spain comprising 3198 hectares. Salave is one of the largest

undeveloped gold deposits in Western Europe. The Company submitted an

application for an underground mine permit to the government of Asturias in

September 2011. Astur Gold is currently conducting geotechnical drilling for

underground mine planning and an Environmental Impact Study. The Company is

building a partnership with the people of Asturias to generate significant

economic benefit for the region and bring Salave into production as soon as

possible.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. This document contains certain forward looking statements

which involve known and unknown risks, delays and uncertainties not under the

Company's control which may cause actual results, performance or achievements of

the Company to be materially different from the results, performance or

expectation implied by these forward looking statements.

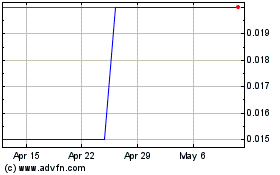

Astron Connect (TSXV:AST)

Historical Stock Chart

From Jun 2024 to Jul 2024

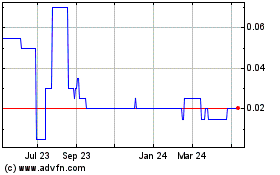

Astron Connect (TSXV:AST)

Historical Stock Chart

From Jul 2023 to Jul 2024