Advantex Marketing International Inc. ("Advantex" or the "Company") (CNSX:ADX),

a leading specialist in merchant funding and loyalty marketing programs, today

announced its results for the fiscal fourth quarter and year ended June 30,

2011. All references to quarters or years are for the fiscal periods and all

currency amounts are in Canadian dollars unless otherwise noted.

Year ended June 30, 2011 (Fiscal 2011) Overview

"We had many successes in securing opportunities that will allow the Company to

expand its business profitably. A multi-year renewal of our agreement with the

Canadian Imperial Bank of Commerce ("CIBC"), an arrangement that accounts for

about 90% of the Company's gross profit; the launch of the Company's programs

into a new business segment per agreement with Aeroplan Canada Inc.

("Aeroplan"); and extension of its agreement with Accord Financial Inc.

("Accord") that gives access to a $8.5 million line of credit which the Company

can access to increase merchant participation in its Advance Purchase Marketing

("APM") program are key highlights during this fiscal year. Additionally, the

Company re-financed its debentures providing financial stability, and increased

the average number of merchants participating in its program to 823 during

current Fiscal 2011 from 627 during previous Fiscal 2010," said Kelly Ambrose,

Advantex President and Chief Executive Officer.

"While the operational launch of the Aeroplan sponsored program was a success in

terms of merchant recruitment and consumer usage, the financial outcome was

below expectations because of higher than planned reward cost due to

dramatically higher consumer uptake of the loyalty reward program. Accordingly,

in conjunction with Aeroplan, we lowered reward cost per transaction. However,

by the time the reward issue was rectified in March 2011, and the Company

re-started the sales process, about four months of selling time was lost. Sales

staff was ramped up, to take advantage of the Aeroplan and other opportunities,

during the third quarter of Fiscal 2011, and the results for Fiscal 2011 reflect

the cost, while its benefits in terms of increased merchant participation and

higher revenues are expected to be enjoyed in the next fiscal year. The net

outcome of high reward costs, lost selling time, and increased selling costs was

a net loss despite a 13% increase in revenues. Our goal was to build on the net

profit of $34,000 of Fiscal 2010 and from this perspective Fiscal 2011, despite

a 13% increase in revenues, was a disappointment," said Mr. Ambrose.

Financial Highlights

----------------------------------------------------------------------------

3 months 3 months 12 months 12 months

ended June ended June ended June ended June

30, 2011 30, 2010 30, 2011 30, 2010

----------------------------------------------------------------------------

Revenues $ 3,667,000 $ 3,195,000 $13,523,000 $11,961,000

----------------------------------------------------------------------------

Gross Profit $ 2,249,000 $ 2,210,000 $ 9,060,000 $ 8,315,000

----------------------------------------------------------------------------

Gross Margin 61.3% 69.2% 67.0% 69.5%

----------------------------------------------------------------------------

Contribution from

Operations (EBITDA(i)) $ 401,000 $ 629,000 $ 2,170,000 $ 2,337,000

----------------------------------------------------------------------------

Amortization $ 89,000 $ 137,000 $ 439,000 $ 459,000

----------------------------------------------------------------------------

Stated Interest $ 431,000 $ 353,000 $ 1,593,000 $ 1,289,000

----------------------------------------------------------------------------

Non-cash Interest $ 134,000 $ 171,000 $ 612,000 $ 670,000

----------------------------------------------------------------------------

Profit / (Loss)

Discontinued operations $ - $ 45,000 $ (18,000) $ 114,000

----------------------------------------------------------------------------

Net Profit/(Loss) $ (252,000) $ 13,000 $ (492,000) $ 34,000

----------------------------------------------------------------------------

Some numbers in the above presentation may not add due to rounding.

(i) EBITDA is a non-GAAP financial measure which does not have any

standardized meaning prescribed by the issuer's GAAP and is therefore

unlikely to be comparable to similar measures presented by other issuers.

For the Company, the most directly comparable measure to EBITDA is Profit

before Amortization and Interest.

The Company's revenues increased 13.1% in Fiscal 2011, a reflection of increased

merchant participation in the programs. The Company's premier product, APM,

generated revenues of $8.7 million in Fiscal 2011 compared with $7.4 million

during Fiscal 2010, representing 64.6% and 61.5% of the Company's revenues for

Fiscal 2011 and Fiscal 2010 respectively.

Gross Margins at 67.0% for Fiscal 2011 declined when compared with 69.5% for

Fiscal 2010, due to increases in direct costs which in turn reflect higher cost

of rewards associated with the participating merchants in men's and ladies

fashion, footwear and accessories business segment.

SG&A in Fiscal 2011 at $6.9 million is 51.0% of revenues compared with $6.0

million, 50%, in Fiscal 2010, reflecting partially the increased sales staff to

capitalize on the revenue expansion opportunities. The increase in SG&A is also

partially consequent to staff salaries being restored in latter half of Fiscal

2010 to March, 2008 levels.

Stated interest cost (cash interest paid or payable) for Fiscal 2011 was $1.6

million compared with 1.3 million for Fiscal 2010. The higher dollar cost

reflects both an increase in the utilization of the line of credit facility

(loan payable) which the Company utilized to expand its APM program business,

and increase in the interest rate on this facility effective March, 2010. The

percent of cash interest to revenues in Fiscal 2011 is 11.8% compared with 10.8%

in Fiscal 2010.

The Company closed down its online shopping mall business during the third

quarter ended March 31, 2011 and it is now a discontinued operation. Respecting

discontinued operation, Fiscal 2011 was a loss of $18,000 compared with a profit

of $114,000 in Fiscal 2010.

The Company is reporting a Net Loss for Fiscal 2011 of $492,000 vs. a Net Profit

for Fiscal 2010 of $34,000, an adverse decline of $526,000.

Prospects for Fiscal 2012

With multi-year affinity and financial partner arrangement now locked in,

operational issues such as those connected to the Aeroplan program resolved, and

potentially a large untapped merchant market for its programs, the Company

believes it has a solid platform to grow its merchant base and ensure a

sustainable high growth in its future revenues and profitability.

The ramp up in sales staff is beginning to yield results in Fiscal 2012, and the

Company is confident of its ability to increase the number of merchants

participating in its programs. The progress since June, 2011 has been

encouraging. The Company's merchant base has grown from 923 at the end of June,

2011 to 1,034 by end of September, 2011. That being said, the uncertain economic

outlook continues to be a worry; softness in the consumer spending given the

recent pressures on household incomes is expected to impact their discretionary

spending, and therefore put merchant margins under pressure which in turn

impacts Advantex though slow-down in new sales, retention and lower fees as

merchants attempt to cut costs.

About Advantex Marketing International Inc.

Advantex is a specialist in the marketing services industry, managing

white-labeled rewards accelerator programs for major affinity groups through

which their members earn bonus frequent flyer miles and/or other rewards on

purchases at participating merchants. Under the umbrella of each program,

Advantex provides merchants with marketing, customer incentives, and

additionally pre -purchase of merchants' future sales through its Advance

Purchase Marketing (APM) model. Advantex partners include more than 1,000

merchants; CIBC; and Aeroplan. Advantex is traded on the Canadian National Stock

Exchange under the symbol "ADX". For additional information on Advantex, please

visit www.advantex.com.

Forward-Looking Information

This Press Release contains certain "forward-looking information". All

information, other than information comprised of historical fact, that addresses

activities, events or developments that the Company believes, expects or

anticipates will or may occur in the future constitutes forward-looking

information. Forward-looking information is typically identified by words such

as: anticipate, believe, expect, goal, intend, plan, will, may, should, could

and other similar expressions. Such forward-looking information relates to,

without limitation, information regarding: the Company's belief that its success

in securing opportunities to date will allow it to expand its business

profitably; the Company's belief that the operational launch of the Aeroplan

sponsored program was a success in terms of merchant recruitment and consumer

usage; the Company's expectation that the benefits of ramp up in sales staff

during Fiscal 2011 will be increased merchant participation and higher revenues

in next fiscal year; the Company's belief that operational issues are resolved;

the Company's belief that there is a large untapped merchant market for its

programs; the Company's belief that it has a solid platform to grow its merchant

base and ensure sustainable high growth in its future revenues and

profitability; the Company's belief in its ability to increase the number of

merchants participating in its programs; the Company's belief that the uncertain

economic outlook may adversely impact its business; and other information

regarding financial and business prospects and financial outlook is

forward-looking information.

Forward-looking information reflects the current expectations or beliefs of the

Company based on information currently available to the Company. With respect to

the forward-looking information contained in this Press Release, the Company has

made assumptions regarding, among other things, the size of the market for the

Company's programs; its ability to increase merchant participation in its

programs; its ability to access future financing; continued affinity partner

participation with the Company; continued support from its providers of Loan

payable and holders of Debentures payable; current and future economic and

market conditions and the impact of same on the Company's business; ongoing and

future revenue sources; future business levels; interest and currency rates; the

appropriateness of the Company's tax filing position; ongoing consumer interest

in accumulating frequent flyer miles; and the Company's ability to manage risks

connected to collection of transaction credits.

Forward-looking information is subject to a number of risks, uncertainties and

assumptions that may cause the actual results of the Company to differ

materially from those discussed in the forward-looking information, and even if

such actual results are realized or substantially realized, there can be no

assurance that they will have the expected consequences to, or effects on the

Company. Factors that could cause actual results or events to differ materially

from current expectations include, among other things, changes in general

economic and market conditions; changes to regulations affecting the Company's

activities; level of merchant participation in the Company's programs;

uncertainties relating to the availability and costs of financing needed in the

future; termination of the CIBC agreement; termination of the Aeroplan

agreement; currency risks; the financial impact from failure to meet its

obligations noted under Contractual Obligations section of the Management

Discussion and Analysis ("MD&A") for the fiscal year ended June 30, 2011; the

inability of the Company to collect under its APM program; the Company's

financial status, and other factors, including without limitation, those listed

under "General Risks and Uncertainties" and "Economic Dependence" in MD&A for

the fiscal year ended June 30, 2011.

All forward-looking information speaks only as of the date on which it is made

and, except as may be required by applicable securities laws, the Company

disclaims any intent or obligation to update any forward-looking information,

whether as a result of new information, future events or results or otherwise.

Although the Company believes that the assumptions inherent in the

forward-looking information are reasonable, forward-looking information is not a

guarantee of future performance and accordingly undue reliance should not be put

on such information due to the inherent uncertainty therein.

ADVANTEX MARKETING INTERNATIONAL INC.

CONSOLIDATED BALANCE SHEETS

AS AT JUNE 30, 2011 AND 2010

NOTE June 30, 2011 June 30, 2010

-------------- --------------

ASSETS

Current:

Cash and cash equivalents $ 5,000 $ 505,941

Accounts receivable 842,249 379,366

Assets of discontinued operations 17 - 321,561

Transaction credits 1(e) 12,408,060 9,538,364

Aeronotes 4 66,451 381,309

Prepaid expenses and sundry assets 248,541 249,510

-------------- --------------

13,570,301 11,376,051

-------------- --------------

Long-term:

Other asset 5 100,000 -

Property, plant and equipment 6 761,177 807,315

-------------- --------------

861,177 807,315

-------------- --------------

TOTAL ASSETS $ 14,431,478 $ 12,183,366

-------------- --------------

-------------- --------------

LIABILITIES

Current:

Bank Indebtedness $ 83,262 $ -

Loan payable 7 4,917,446 3,030,549

Accounts payable and accrued

liabilities 3,319,363 2,617,970

Liabilities of discontinued

operations 17 432,440 475,682

14% Non-convertible debentures

payable 3/8 - 2,620,705

Convertible debentures payable 3/9 - 5,217,578

-------------- --------------

8,752,511 13,962,484

-------------- --------------

Long-term:

14% Non-convertible debentures

payable 3/8 1,747,497 -

12% Non-convertible debentures

payable 3/9 5,300,492 -

--------------

7,047,989 -

--------------

15,800,500 13,962,484

-------------- --------------

SHAREHOLDERS' DEFICIENCY

Capital Stock 10

Class A preference shares 3,815 3,815

Common shares 24,106,281 24,106,281

-------------- --------------

24,110,096 24,110,096

Contributed surplus 726,795 645,879

Equity portion of debentures 9 2,114,341 2,114,341

Warrants 8/9 1,196,013 374,554

Deficit (29,516,267) (29,023,988)

-------------- --------------

(1,369,022) (1,779,118)

-------------- --------------

TOTAL LIABILITIES AND SHAREHOLDERS'

DEFICIENCY $ 14,431,478 $ 12,183,366

-------------- --------------

-------------- --------------

Commitments and contingencies (note 14)

Approved by the Board:

(Signed): "William Polley" (Signed): "Kelly E. Ambrose"

Director: Director:

-------------------------- ----------------------------

William Polley Kelly E. Ambrose

ADVANTEX MARKETING INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF PROFIT/(LOSS) AND COMPREHENSIVE PROFIT/(LOSS)

YEARS ENDED JUNE 30, 2011 AND 2010

NOTE 2011 2010

------------- -------------

REVENUE $ 13,522,952 $ 11,961,059

Direct expenses 4,462,678 3,646,323

------------- -------------

GROSS PROFIT 9,060,274 8,314,736

------------- -------------

OPERATING EXPENSES

Selling and marketing 2,906,372 2,574,062

General and administrative 3,902,798 3,335,522

Stock-based compensation 80,916 67,789

------------- -------------

6,890,086 5,977,373

CONTRIBUTION FROM OPERATIONS 2,170,188 2,337,363

AND PROFIT BEFORE AMORTIZATION AND INTEREST

FROM CONTINUING OPERATIONS

Amortization of property, plant and

equipment 439,469 458,522

Interest expense

Stated interest expense - loan

payable, debentures, and other 7/8/9 1,592,580 1,288,894

Non-cash interest expense on loan

payable, and debentures

7/8/9 612,023 669,546

------------- -------------

2,204,603 1,958,440

(LOSS) AND COMPREHENSIVE (LOSS)

- CONTINUING OPERATIONS $ (473,884) $ (79,599)

PROFIT/(LOSS) FROM DISCONTINUED

OPERATIONS 18 (18,395) 113,626

NET PROFIT/(LOSS) AND COMPEHENSIVE

PROFIT/(LOSS)

FOR THE YEAR $ (492,279) $ 34,027

BASIC AND DILUTED EARNINGS PER SHARE 12 $ 0.00 $ 0.00

------------- -------------

------------- -------------

ADVANTEX MARKETING INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF DEFICIT

YEARS ENDED JUNE 30, 2011 AND 2010

2011 2010

----------------- -----------------

BALANCE AT THE START OF THE YEAR $ (29,023,988) $ (29,058,015)

Net profit/(loss) for the year (492,279) 34,027

----------------- -----------------

BALANCE AT THE END OF THE YEAR $ (29,516,267) $ (29,023,988)

----------------- -----------------

----------------- -----------------

ADVANTEX MARKETING INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED JUNE 30, 2011 and 2010

NOTE 2011 2010

------------ ------------

OPERATING ACTIVITIES

(Loss) for the year - from continuing

operations $ (473,884) $ (79,599)

Items not affecting cash

Amortization of property, plant and

equipment 439,469 458,522

Accretion charge on debentures 8/9 475,958 483,354

Amortization of deferred financing

charges 7/8/9 136,065 186,192

Stock-based compensation 80,916 67,789

------------ ------------

658,524 1,116,258

Changes in non-cash working capital items

Accounts receivable (462,883) (295,300)

Transaction credits (2,869,696) (1,387,179)

Aeronotes 314,858 (381,309)

Prepaid expenses and sundry assets 969 (26,444)

Accounts payable and accrued liabilities 701,393 (271,190)

------------ ------------

(2,315,359) (2,361,422)

Cash provided by/(utilized in) operating

activities (1,656,835) (1,245,164)

FINANCING ACTIVITIES

Proceeds from draw of credit facility 1,854,728 1,985,229

Payments for maturity/retirement of

debentures 8/9 (8,665,000) -

Proceeds from renewal of debentures 8/9 8,272,000 -

Debenture renewal costs 8/9 (155,689) -

------------

1,306,039 1,985,229

INVESTING ACTIVITIES

Purchase of property, plant and equipment (393,331) (613,198)

Investment in other asset (100,000) -

------------ ------------

(493,331) (613,198)

MOVEMENT IN CASH AND CASH EQUIVALENTS

DURING THE YEAR - FROM CONTINUING (844,127) 126,867

OPERATIONS

FROM DISCONTINUED

OPERATIONS 17 259,924 34,894

Cash and cash equivalents, including bank

indebtedness -beginning of year 505,941 344,180

------------ ------------

CASH AND CASH EQUIVALENTS, including Bank

Indebtedness-end of year $ (78,262) $ 505,941

------------ ------------

------------ ------------

ADDITIONAL INFORMATION

Interest paid $ 1,541,817 $ 1,288,894

Cash and Cash Equivalents, including Bank

Indebtedness

Cash $ - $ 500,941

Term deposits $ 5,000 $ 5,000

Bank indebtedness $ (83,262) $ -

------------ ------------

Total $ (78,262) $ 505,941

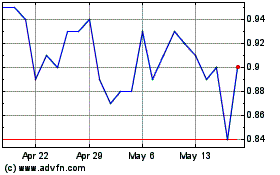

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024