Adventus Mining Corporation

(“

Adventus”) (TSXV: ADZN) (OTCQX: ADVZF) and

Luminex Resources Corp.

(“

Luminex”) (TSXV: LR) (OTCQX: LUMIF) are pleased

to announce that they have entered into an arrangement agreement

(the “

Arrangement Agreement”), pursuant to which

Adventus will acquire all of the issued and outstanding common

shares of Luminex (the “

Luminex Shares”), in

exchange for common shares of Adventus (the “

Adventus

Shares”), by way of a plan of arrangement (the

“

Transaction”, with the resulting entity referred

to as the “

Resulting Issuer”). The Transaction

will create a combined company that intends to lead the advancement

of the El Domo-Curipamba copper-gold project (the “

El Domo

Project”) towards production and consolidates a large and

prospective gold-copper development and exploration portfolio in

Ecuador totalling over 135,000 hectares which includes the

preliminary economic assessment (“

PEA”) stage

Condor gold project (the “

Condor Project”).

Further details of the Transaction are outlined below.

Transaction Highlights

-

Exceptional Shareholder Base & Renewed Support

– Brings together the support of members of Mr. Ross Beaty’s Lumina

Group, local Ecuadorian investors and strategic and equity

investors that include Altius Minerals Corporation

(“Altius”) and Wheaton Precious Metals Corp.

(“Wheaton”). A concurrent financing for

approximately US$17.1 million, with participation by Mr. Ross Beaty

and Wheaton is expected to be completed as part of the Transaction

(described below).

-

Well-Capitalized Copper-Gold Company – Transaction

establishes a well-capitalized copper-gold company focused on the

advancement of the El Domo Project and consolidation of one of the

largest exploration portfolios in Ecuador for future growth

potential. The El Domo Project, with a completed feasibility study

centred on a shallow and high-grade copper-gold dominant deposit1 ,

is supported by an investment contract with the Government of

Ecuador and is on track for a construction decision in the first

half of 2024.

- Large

Pipeline Gold Project – 98.7% ownership of the gold-copper

Condor Project, adjacent to Lundin Gold’s Fruta del Norte project

and Tongling / China Rail’s Mirador project. A PEA was completed in

2021 highlighting a 12-year operation producing 187k ounces of gold

per year and a US$562 million after-tax NPV5% and a 20.3% after-tax

IRR at US$1,760/oz gold2.

- Industry

Leading Exploration Portfolio – Combined exploration

portfolio totalling over 135,000 hectares across 13 projects will

be one of the largest land packages in Ecuador with approximately

US$50 million in joint venture partner spending to date, and which

continues to see funding interest from third parties.

- Synergy

& Cost Savings – Post Transaction, the Resulting

Issuer will be led by a strengthened board, and a management team

with a proven history and in-country track record of discovery,

exploration success, mine building, operations, community

engagement and monetization. The Resulting Issuer is expected to

save approximately US$2 million per annum through synergies.

- Value

Creation & Potential for Shareholders – Expected to

directly add liquidity and a greater following, while establishing

a path to production at the El Domo Project: one of the highest

grade and lowest capital intensity copper-gold projects

globally.

___________________________________________

1 The El Domo Project feasibility study is a NI

43-101 Technical Report entitled: “NI 43-101 Technical Report -

Feasibility Study - Curipamba El Domo Project - Central Ecuador”,

filed on SEDAR+ on December 10, 2021.

2 The PEA is preliminary in nature and includes

inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral resources, and

there is no certainty the PEA will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The Condor Project PEA was based on the July 28, 2021

mineral resource estimate and base case economics were calculated

using a gold price of $1,600 per ounce and a silver price of $21.00

per ounce, details of which, together with a summary of capital and

operating expenditure estimates, assumptions and qualifications

used by the qualified persons in preparing the PEA and the

underlying mineral resource estimate, are disclosed in the

report.

Christian Kargl-Simard, President and

CEO of Adventus, commented: “This Transaction is an

exciting opportunity to unite complementary assets, teams, and

investors to create value for all Adventus and Luminex

shareholders. Adventus is pleased to welcome Mr. Ross Beaty,

members of the Lumina Group, and new investors as we continue the

advancement of the El Domo Project towards future cash flowing

operations. For Adventus shareholders, the new capital and

acquisition of Luminex’s Condor Project and other properties allows

the creation of a stronger and more diversified company with one of

the largest copper-gold exploration portfolios in Ecuador.”

Marshall Koval, CEO of Luminex,

commented: “We are very pleased to be entering into this

combination with Adventus. The Adventus team has done a tremendous

job advancing the El Domo Project from an exploration and PEA stage

project to the expected start of construction in the first half of

2024. This combination gives Luminex shareholders a more immediate

re-rating and return potential from the advancement of the El Domo

Project, while reinforcing the growth and new discovery potential

of the combined exploration portfolio.”

Concurrent with the Transaction, Adventus and

Luminex plan to raise approximately US$17.1 million in equity, as a

combination of US$13.5 million in a fully committed non-brokered

private placement (the “Non-Brokered Private

Placement”) of subscription receipts of Adventus (the

“Subscription Receipts”), and approximately C$5

million (approximately US$3.64 million based on the US$/C$ exchange

rate on November 21, 2023) in a brokered “bought deal” private

placement (the “Bought Deal Private Placement”,

and together with the Non-Brokered Private Placement, the

“Concurrent Financing”) of units (the

“Units”) of Adventus, co-led by Raymond James Ltd.

and National Bank Financial Inc., on their own behalf and on

behalf of a syndicate of investment dealers (collectively, the

“Underwriters”). In respect of the Non-Brokered

Private Placement, Adventus and Luminex have received firm

commitments for US$13.5 million in total, comprised of lead orders

from Mr. Ross Beaty, Wheaton, and certain of Luminex’s existing

Ecuadorian investors. Further details of the Concurrent Financing

are outlined below.

Altius, Adventus’ largest shareholder, has

agreed to extend its outstanding US$4 million unsecured convertible

debenture until December 31, 2024, subject to completion of the

Non-Brokered Private Placement (the “Loan

Amendment”). As Altius is an insider of Adventus, the Loan

Amendment constitutes a “related party transaction” within the

meaning of Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). The Loan Amendment is exempt from the formal

valuation and minority approval requirements of MI 61-101 as, at

the time it was agreed to, neither the fair market value thereof,

nor the fair market value of the consideration therefor, exceeds

25% of Adventus’ market capitalization.

Transaction Terms

Pursuant to the terms and conditions of the

Arrangement Agreement, the holders of the issued and outstanding

Luminex Shares will receive 0.67 Adventus Shares for each one (1)

Luminex Share held (the “Exchange Ratio”). Luminex

options that are outstanding at the time of completion of the

Transaction shall be exchanged in accordance with the Exchange

Ratio for similar securities to purchase Adventus Shares on

substantially the same terms and conditions, and outstanding

warrants of Luminex will become exercisable, based on the Exchange

Ratio, to purchase Adventus Shares on substantially the same terms

and conditions. The Transaction will be carried out by way of a

court-approved plan of arrangement under the Business Corporations

Act (British Columbia).

Upon completion of the Transaction, the

Resulting Issuer will continue to be listed as a Tier 1 mining

issuer on the TSX Venture Exchange (“TSXV”) under

the same Adventus name and ticker symbol, as well as on the OTCQX.

Prior to completion of the Concurrent Financing, existing

shareholders of Adventus will own approximately 61% of the

Resulting Issuer and existing shareholders of Luminex will own

approximately 39% of the Resulting Issuer on an undiluted basis.

Mr. Ross Beaty is expected to be the only shareholder post

completion of the Transaction and the Concurrent Financing to own

greater than 10% of the issued and outstanding shares of the

Resulting Issuer, owning approximately 13% on an undiluted

basis.

The Arrangement Agreement contains customary

reciprocal deal-protection provisions including non-solicitation

covenants and a right to match any superior proposal as defined in

the Arrangement Agreement. Under certain circumstances, Adventus or

Luminex would be entitled to a termination fee of US$1,200,000. In

connection with the Transaction, certain officers of Luminex shall

agree to receive part of any change of control amounts owed in the

form of Luminex Shares, which shall have a deemed value per Luminex

Share equal to C$0.194 per share (the “Change of Control

Share Settlement”). Any Change of Control Share Settlement

is subject to the approval of the TSXV.

Complete details of the Transaction will be

included in a management information circular to be delivered to

Luminex securityholders in the coming weeks.

Conditions to CompletionThe completion of the

Transaction is subject to a number of terms and conditions,

including without limitation the following: (a) approval of the

Luminex securityholders, as described below; (b) approval of the

TSXV; (c) approval of the British Columbia Supreme Court; (d) there

being no material adverse changes in respect of either Adventus or

Luminex; (e) a minimum of US$13.5 million in gross proceeds from

the Concurrent Financing (which is fully committed, see Concurrent

Financing below), and other standard conditions of closing for a

transaction of this nature. There can be no assurance that all of

the necessary approvals will be obtained or that all conditions of

closing will be satisfied.

The Transaction is subject to the approval at a

special meeting of Luminex securityholders by (i) 662/3% of the

votes cast by Luminex shareholders, (ii) 662/3 % of the votes

cast by Luminex shareholders and optionholders, voting together as

a single class, and (iii) if required, a simple majority of the

votes cast by the Luminex shareholders, excluding the votes cast by

certain persons as required by MI 61-101. Adventus and Luminex are

arm’s length parties and, accordingly, the Transaction is not a

related party transaction.

Board of Directors and

Management

Upon closing of the Transaction, the board of

directors of the Resulting Issuer (the “Resulting Issuer

Board”) will be comprised of eight (8) members, including

three (3) nominees from Luminex. Mr. Christian Kargl-Simard will

remain serving as President, CEO and Director of the Resulting

Issuer and lead the combined management and project team. The head

office will continue to be in Toronto, Canada.

The Resulting Issuer Board is expected to be led

by Mr. Mark Wellings and is anticipated to include Ms. Karina

Rogers, Mr. Leif Nilsson, Mr. David Darquea Schettini, Mr. David

Farrell and Mr. Ron Halas as independent directors, and Mr.

Christian Kargl-Simard and Mr. Marshall Koval as non-independent

directors. Advisors to the Resulting Issuer Board will continue to

be Mr. Christian Aramayo and Mr. Gerardo Fernandez; Adventus also

anticipates the addition of Mr. Leo Hathaway in an advisory

role.

Concurrent Financing

The Concurrent Financing will consist of two

tranches, for total gross proceeds of approximately US$17.1

million, of which US$13.5 million is fully committed and the

balance of approximately C$5M (approximately US$3.64 million) has

agreed to be purchased on a “bought deal” private placement

basis.

The first tranche is the Non-Brokered Private

Placement, a US$13.5 million fully committed offering of

Subscription Receipts of Adventus at a price of C$0.29 per

Subscription Receipt.

Each Subscription Receipt shall entitle the

holder thereof to receive, without payment of any additional

consideration or further action on the part of the holder, one

Common Share in the capital of Adventus upon the satisfaction or

waiver of all conditions to the completion of the Transaction in

accordance with the terms of the Arrangement Agreement

(collectively, the “Escrow Release Conditions”).

Mr. Ross Beaty, Wheaton and certain of Luminex’s existing

Ecuadorian shareholders have committed to participating in this

tranche. No commission is being paid on the Non-Brokered Private

Placement.

In connection with the second tranche, the

Bought Deal Private Placement, Adventus and Luminex have entered

into an engagement letter with Raymond James Ltd. and National Bank

Financial Inc., on their own behalf and on behalf of the

Underwriters, pursuant to which the Underwriters have agreed to

purchase, on a “bought deal” private placement basis 1,725,000

Units of Adventus at a price of C$2.90 per Unit (the “Unit

Offering Price”) for gross proceeds of approximately C$5

million, which the parties may agree to increase in the context of

the market by an amount of up to an additional C$5 million. Each

Unit shall consist of four (4) Adventus Shares and six (6)

Subscription Receipts, with 40% of the price per Unit allocated to

the Adventus Shares underlying each Unit and 60% of the price per

Unit allocated to the Subscription Receipts underlying each Unit.

Adventus has granted the Underwriters an over-allotment option to

purchase at the Unit Offering Price up to such number of an

additional Units as is equal to 15% of the number of Units sold

pursuant to the Bought Deal Private Placement (the

“Over-Allotment Option”). The Over-Allotment

Option is exercisable by the Underwriters in whole or in part at

any time until 48 hours prior to the closing date of the Bought

Deal Private Placement. Adventus shall pay to the Underwriters a

commission equal to 6.0% of the gross proceeds from the Bought Deal

Private Placement, 50% of which will be paid to the Underwriters at

closing of the Bought Deal Private Placement and 50% of which will

be placed in escrow (the “Escrowed Commission”) as

described below.

The gross proceeds of the Non-Brokered Private

Placement, the gross proceeds from the sale of the Subscription

Receipts underlying the Bought Deal Private Placement and the

Escrowed Commission (collectively, the “Escrowed

Proceeds”), will be placed into escrow. Provided that the

Escrow Release Conditions are satisfied or waived (where permitted)

prior to 5:00 p.m. (Toronto time) on March 31, 2024 (the

“Escrow Release Deadline”), the Escrowed

Commission will be released to the Underwriters from the Escrowed

Proceeds, and the balance of the Escrowed Proceeds (less certain

expenses of an escrow agent to be appointed) will be released to or

as directed by Adventus and the Subscription Receipts shall be

automatically converted into Adventus Shares, without payment of

any additional consideration or further action on the part of the

subscribers. In the event that the Escrow Release Conditions are

not satisfied by the Escrow Release Deadline, the Escrowed

Proceeds, together with interest earned thereon, will be returned

to the holders of Subscription Receipts and such Subscription

Receipts will be cancelled.

The net proceeds of the Concurrent Financing

will be used to advance the El Domo Project, select exploration

programs across the combined exploration portfolio of Adventus and

Luminex, costs related to the proposed Transaction and for working

capital and general corporate purposes.

The Concurrent Financing is being conducted in

all of the provinces and territories of Canada pursuant to private

placement exemptions, in the United States pursuant to available

exemptions from the registration requirements of the U.S.

Securities Act of 1933, as amended (the “U.S. Securities

Act”), and applicable state securities laws, and in such

other jurisdictions outside of Canada and the United States, in

each case, in accordance with all applicable laws, provided that

no prospectus, registration statement or similar document is

required to be filed in such foreign jurisdiction. Completion of

the Concurrent Financing is subject to obtaining the required TSXV

approvals and satisfaction of customary closing conditions. The

Subscription Receipts and the Adventus Shares to be issued in

connection with the Concurrent Financing, and the Adventus Shares

underlying the Subscription Receipts, will be subject to a

statutory four-month and one day hold period from the closing date.

The closing date of both the Non-Brokered Private Placement and the

Bought Deal Private Placement is expected to be on or around

December 8, 2023.

Luminex and Adventus intend to rely on the “part

and parcel exception” under the policies of the TSXV with respect

to the Concurrent Financing and the Change of Control Share

Settlement, as each is integral to the Transaction by ensuring the

Resulting Issuer is sufficiently capitalized to complete mine

construction at the El Domo Project.

The securities to be offered in the Concurrent

Financing and the Change of Control Share Settlement have not been,

and will not be, registered under the U.S. Securities Act or any

U.S. state securities laws, and may not be offered or sold in the

United States or to, or for the account or benefit of, United

States persons absent registration or any applicable exemption from

the registration requirements of the U.S. Securities Act and

applicable U.S. state securities laws. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

securities in the United States, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Transaction Timeline

Pursuant to the Arrangement Agreement and

subject to satisfying all necessary conditions and receipt of all

required approvals, the parties anticipate completion of the

Transaction in January 2024. Following completion of the

Transaction, Luminex Shares will be de-listed from the TSXV and

Luminex will cease to be a reporting issuer under Canadian

securities laws.

Recommendations by the Boards of

Directors and Fairness Opinion

After consultation with its financial and legal

advisors, the board of directors of Adventus unanimously approved

the entering into of the Arrangement Agreement. Raymond James Ltd.

provided a fairness opinion to the board of directors of Adventus,

stating that, as of the date of such opinion and based upon and

subject to the assumptions, limitations and qualifications stated

in such opinion, the consideration to be paid by Adventus is fair,

from a financial point of view, to Adventus.

After consultation with its financial and legal

advisors, the board of directors of Luminex (the “Luminex

Board”) unanimously approved the entering into of the

Arrangement Agreement, following the unanimous recommendation of a

special committee of the Luminex Board (the “Luminex

Special Committee”). The Luminex Board recommends that

Luminex securityholders vote in favour of the Transaction. Haywood

Securities Inc. provided a fairness opinion to the Luminex Special

Committee, stating that, as of the date of such opinion and based

upon and subject to the assumptions, limitations and qualifications

stated in such opinion, the consideration to be received by Luminex

shareholders under the Transaction is fair, from a financial point

of view, to such Luminex shareholders.

Advisors and Counsel

Bacchus Capital Advisors is acting as financial

advisor to Adventus. DLA Piper (Canada) LLP, DLA Piper LLP (US) and

AVL Abogados are acting as legal counsel to Adventus in Canada, the

U.S. and Ecuador, respectively.

Haywood Securities Inc. is acting as financial

advisor to Luminex. Borden Ladner Gervais LLP, Troutman Pepper

Hamilton Sanders LLP, and Tobar ZVS are acting as legal counsel to

Luminex in Canada, the U.S. and Ecuador, respectively.

Analyst and Investor Webcast and Conference

Call

Adventus and Luminex will host a joint

conference call on Tuesday, November 22, 2023, at 12:00 pm (noon)

ET to discuss the Transaction. Conference call and webcast

details:

| Date: |

Wednesday,

November 22, 2023 |

| Time: |

12:00 pm noon ET |

| Webcast link: |

https://events.6ix.com/preview/adventus-mining-corporation |

| |

|

Qualified Person and Technical

ReportsThe technical information of this news release has

been reviewed and approved by Mr. Dustin Small, P.Eng., Vice

President Projects of Adventus, a non-Independent Qualified Person,

as defined by National Instrument 43-101 (“NI

43-101”). Technical information for the El Domo Project is

derived from the Technical Report for the El Domo Project titled:

“NI 43-101 Technical Report - Feasibility Study - Curipamba El Domo

Project - Central Ecuador”, filed on SEDAR+ on December 10, 2021.

Technical information for the Condor Project is derived from the

Technical Report for the Condor Project titled: “Condor Project NI

43-101 Technical Report on Preliminary Economic Assessment”, filed

on SEDAR+ on September 13, 2021.

About AdventusAdventus Mining

Corporation is an Ecuador-focused copper-gold exploration and

development company. Adventus is majority owner of the 215 sq. km

Curipamba copper-gold project, which has a completed feasibility

study on the shallow and high-grade El Domo deposit. In addition,

Adventus is engaged in a country-wide exploration alliance in

Ecuador, which has incorporated the Pijili and Santiago copper-gold

porphyry projects to date. Outside of Ecuador, Adventus owns an

exploration project portfolio in Ireland with South32 Limited as

the funding participant. Its strategic shareholders include Altius

Minerals Corporation, Greenstone Resources LP, Wheaton Precious

Metals Corp., and significant Ecuadorian shareholders. Adventus is

based in Toronto, Canada, and is listed on the TSXV under the

symbol ADZN and trades on the OTCQX under the symbol ADVZF.

About LuminexLuminex Resources

Corp. is a Vancouver, Canada based precious and base metals

exploration and development company focused on gold and copper

projects in Ecuador. Luminex’s inferred and indicated mineral

resources are located at the Condor Gold-Copper project in

Zamora-Chinchipe Province, southeast Ecuador. Luminex also holds a

large and highly prospective land package in Ecuador.

For further information from Adventus, please contact

Christian Kargl-Simard, President and Chief Executive Officer, at

+1-416-230-3440 or christian@adventusmining.com. Please also visit

the Adventus website at www.adventusmining.com

For further information from Luminex, please contact

Scott Hicks, VP Corporate Development and Communications, at

+1-604-646-1890 or info@luminexresources.com. Please also visit the

Luminex website at https://luminexresources.com

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws and “forward-looking statements” within the meaning of the

United States Private Securities Litigation Reform Act of 1995,

respectively (collectively referred to herein as “forward-looking

information”). Forward-looking information may be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects”, “is expected”, “scheduled”, “estimates”, “outlook”,

“forecasts”, “projection”, “prospects”, “strategy”, “intends”,

“anticipates”, “believes”, or variations of such words and phrases

or terminology which states that certain actions, events or results

“may”, “could”, “would”, “might”, “will”, “will be taken”, “occur”

or “be achieved”. Forward-looking information in this news release

includes: expected timing and completion of the Transaction; the

strengths, characteristics and expected benefits and synergies of

the Transaction; receipt of court approval; approval of the

Transaction by Luminex shareholders and optionholders at the

special meeting of Luminex securityholders; obtaining TSXV

acceptance to complete the Transaction; certain officers of Luminex

agreeing to receive the Change of Control Share Settlement, and

obtaining TSXV acceptance to complete the Change of Control Share

Settlement; the completion of the Concurrent Financing; the

participation of the identified persons in the Concurrent

Financing; the expected use of proceeds from the Concurrent

Financing; the satisfaction of the Escrow Release Conditions; the

conversion of the Subscription Receipts into shares of the

Resulting Issuer; the exercise of the Over-Allotment Option;

obtaining TSXV acceptance to complete the Concurrent Financing; the

payment of commissions by Adventus with respect to the Concurrent

Financing; the anticipated holdings of Ross Beaty and Altius after

the completion of the Transaction; the completion of the Loan

Amendment; obtaining TSXV acceptance to complete the Loan

Amendment; the anticipated timing of the special meeting of Luminex

securityholders to vote on the Transaction and the related

management information circular; the expected delisting of the

Luminex Shares from the TSXV; the composition of the Resulting

Issuer board and management team; and the companies’ assessments

of, and expectations for, future periods. In addition, any

statements that refer to expectations, intentions, projections or

other characterizations of future events or circumstances,

including information in this news release regarding the

Transaction and the Concurrent Financing, contain forward-looking

information. Statements containing forward-looking information are

not historical facts but instead represent the companies’

expectations, estimates and projections regarding possible future

events or circumstances. The forward-looking information included

in this news release is based on the companies’ opinions, estimates

and assumptions in light of their experience and perception of

historical trends, current conditions and expected future

developments, their assumptions regarding the Transaction and the

Concurrent Financing (including, but not limited to, their ability

to close the Transaction and the Concurrent Financing on the terms

contemplated, and to derive the anticipated benefits therefrom), as

well as other factors that they currently believe are appropriate

and reasonable in the circumstances. The forward-looking

information contained in this news release is also based upon a

number of assumptions, including the companies’ ability to obtain

the required securityholder, court and regulatory approvals in a

timely matter, if at all; their ability to satisfy the terms and

conditions precedent of the Arrangement Agreement in order to

consummate the Transaction; their ability to satisfy the Escrow

Release Conditions; assumptions in respect of current and future

market conditions and the execution of the companies’ business

strategies, that operations in Adventus’ and Luminex’s properties

will continue without interruption, and the absence of any other

factors that could cause actions, events or results to differ from

those anticipated, estimated, intended or implied. Despite a

careful process to prepare and review the forward-looking

information, there can be no assurance that the underlying

opinions, estimates and assumptions will prove to be correct.

Forward-looking information is also subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements to be

materially different from those expressed or implied by such

forward-looking information. Such risks, uncertainties and other

factors include, but are not limited to, failure to receive the

required shareholder, court, regulatory and other approvals

necessary to effect the Transaction; the potential for a third

party to make a superior proposal to the Transaction; that the

Resulting Issuer and its shareholders will not realize the

anticipated benefits following the completion of the Transaction;

that all tranches of the Concurrent Financing will not be

completed; that the proceeds of the Concurrent Financing will not

be used as announced; that the Loan Amendment will not be

completed; that the special meeting of Luminex securityholders to

vote on the Transaction will not occur at the anticipated

timeframe; and those set forth under the caption “Risk Factors” in

Adventus’ annual information form, the companies’ most recent

respective management’s discussion and analysis, and other

documents filed with or submitted to the Canadian securities

regulatory authorities on the SEDAR+ website at

www.sedarplus.ca.

Although the companies have attempted to

identify important risk factors that could cause actual results or

future events to differ materially from those contained in

forward-looking information, there may be other risk factors not

presently known to them or that they presently believe are not

material that could also cause actual results or future events to

differ materially from those expressed in such forward-looking

information. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information, which speaks only as of the date made.

The forward-looking information contained in this news release

represents the companies’ expectations as of the date of this news

release and is subject to change after such date. Adventus and

Luminex each disclaim any intention or obligation or undertaking to

update or revise any forward-looking information whether as a

result of new information, future events or otherwise, except as

required by applicable securities laws. All of the forward-looking

information contained in this news release is expressly qualified

by the foregoing cautionary statements.

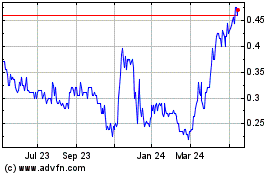

Adventus Mining (TSXV:ADZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

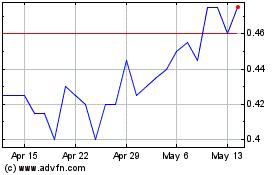

Adventus Mining (TSXV:ADZN)

Historical Stock Chart

From Jan 2024 to Jan 2025