Athabasca Minerals 2018 Year End Financial Results

April 09 2019 - 7:13PM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) announces its financial results for the fourth quarter and

year ended December 31, 2018. The Corporation’s audited financial

statements and management’s discussion and analysis (“MD&A”)

for the year ended December 31, 2018 are available on SEDAR at

www.sedar.com and on the Athabasca Minerals Inc. website at

www.athabascaminerals.com.

Robert Beekhuizen, Chief Executive Officer,

states, “2018 and 2019 are strategically important as AMI

restructures the Corporation’s business model and expands its

operating lines with the advent of AMI Silica Inc and Aggregates

Marketing Inc as wholly-owned subsidiaries. Our base aggregates

business remains fundamentally important and AMI continues to

strengthen its cash position in 2018 and 2019 to support upcoming

projects as well as M&A (merger & acquisition)

opportunities that involve selective roll-up of private companies

offering excellent synergies.”

2018 Year-End Summary:

- Revenue and gross profits for the

year ended December 31, 2018 were $5.1 million and $1.5 million

respectively (versus $7.5 million and $1.6 million for 2017);

- The Corporation’s cash position

improved to $5.1 million (versus $2.6 million for 2017);

- Overall net cash generated in 2018

was +$2.449 million (versus -$1.366 million net cash used in

2017);

- The Corporation closed on a Private

Placement of $1.15 million consisting of 5,750,000 units with each

unit consists of one common share and one-half common share

purchase warrant;

- The Corporation purchased 49.2%

ownership of “Privco” (a private Alberta corporation) that owns the

Montney In-Basin Frac Sand Project (“MIB Project”) located in the

vicinity of Dawson Creek and Fort St John;

- The Corporation had an independent

third-party (Evans & Evans) reappraise its Firebag Frac Sand

Mine (“Firebag Assets”) which were assessed at $30.4 million (fair

market value), and transferred these Firebag Assets at book value

($1.141 million) to its wholly-owned subsidiary AMI Silica Inc

effective October 1, 2018 with no gain on transfer;

- Appointment of Mr. Mark Smith,

P.Eng, MBA to the position of Chief Financial Officer effective

November 30, 2018.

Financial Highlights

|

($ thousands of CDN, except per share amounts and tonnes sold) |

Three Months Q4 2018 |

Three Months Q4 2017 |

Twelve Months Dec 31, 2018 |

Twelve Months Dec 31, 2017 |

|

Aggregate management fees - net |

$575 |

|

$1,267 |

|

$2,993 |

|

$3,769 |

|

|

Aggregate sales revenue |

$115 |

|

$977 |

|

$2,138 |

|

$3,707 |

|

|

Total revenue |

$690 |

|

$2,243 |

|

$5,131 |

|

$7,476 |

|

|

Gross profit |

$144 |

|

$1,077 |

|

$1,466 |

|

$1,643 |

|

|

Total loss and comprehensive loss |

$(933) |

|

$(729) |

|

$(2,510) |

|

$(2,687) |

|

|

Cash position |

$5,079 |

|

$2,629 |

|

$5,079 |

|

$2,629 |

|

|

Net cash generated (used) |

($624) |

|

$994 |

|

2,449 |

|

(1,366) |

|

|

Total aggregate tonnes sold (MT) |

111,955 |

|

905,487 |

|

1,018,376 |

|

2,948,248 |

|

|

Basic income per common share ($/share) |

$(0.028) |

|

$(0.022) |

|

$(0.074) |

|

$(0.081) |

|

2019 Operational Outlook

Over the next 12 months, the Corporation is

actively addressing and working on various strategic and

operational initiatives relating to the following:

- Obtaining regulatory approvals for

Coffey Lake Public Pit with a planned opening in second half of

2019;

- Conclude the Susan Lake Public Pit

Closure Program (still pending approval by AEP) and agreements with

Oilsands Operators for the transition of overlapping (Mineral

Surface Lease) lands;

- Validate the Montney In-Basin and

Duvernay Basin frac sand deposits (with delineation drilling and

National Instrument 43-101 reports) and submit regulatory

application(s) for development;

- Secure offtake agreements for the

supply of frac sand through AMI Silica Inc and augment with

‘Last-Mile’ delivery solutions for customers;

- Secure financing for AMI’s frac

sand facilities in conjunction with third-party processing

options;

- Establish royalty agreements to

monetize corporate-owned and third-party aggregate pits with

strategic partners;

- Selectively pursue conventional

aggregate companies for acquisition;

- Coordinate sales, transportation

and delivery of third-party aggregates through Aggregates Marketing

Inc using a technology-based platform with improved speed and

pricing.

About Athabasca MineralsThe

Corporation is an integrated aggregates company involved in

resource development, aggregates marketing and midstream

supply-logistics solutions. Business activities include aggregate

production, pit management services, sales from corporate-owned and

third-party pits, acquisitions of sand and gravel operations, and

new venture development. Athabasca Minerals is also the parent

company of Aggregates Marketing Inc. – a midstream business

providing integrated supply and transportation solutions for

industrial and construction markets; AMI Silica Inc – positioned to

become an in-basin supplier of premium domestic frac sand for

Alberta and NE British Columbia; and joint venture owner of the

Montney In-Basin Frac Sand Project and Duvernay Frac Sand Project.

The Corporation also has industrial mineral land exploration

licenses that are strategically positioned for future development

in industrial regions of high potential demand.

For further Information on

Athabasca, please contact:Dean StuartT:

403-617-7609E: dean@boardmarker.net

Robert BeekhuizenT: 780-465-5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

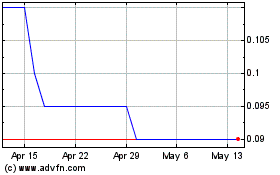

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Nov 2024 to Dec 2024

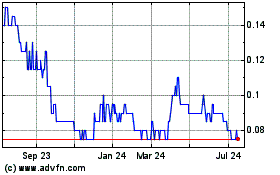

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Dec 2023 to Dec 2024