- Record Revenue: $43.6M (up 47% YoY and 35%

QoQ)

- Record Gross Profit: $21.8M (up 48% YoY and 39%

QoQ)

- Gross Margin: 50.1%, Cash Balance: $10.3M

- Adjusted EBITDA of $7.4M (up 201% YoY and 72% QoQ)

- Video and Broadband Solutions sales climb 65% YoY to

$27.2M

- Record Content Delivery and Storage sales of $15.0M (up 27%

YoY and 121% QoQ)

Vecima Networks Inc. (TSX: VCM) today reported financial results

for the three and six months ended December 31, 2021.

FINANCIAL HIGHLIGHTS

(Canadian dollars in millions except

percentages, employees, and per share data)

Q2FY22

Q1FY22

Q2FY21

Revenue

$43.6

$32.4

$29.7

Gross Margin

50.1%

48.5%

49.6%

Net Income (Loss)

$1.5

$0.7

$(3.1)

Earnings (Loss) Per Share1

$0.06

$0.03

$(0.14)

Adjusted Earnings (Loss) Per

Share1,2,3,4

$0.06

$0.03

$(0.14)

Adjusted EBITDA2

$7.4

$4.3

$2.5

Cash and Short-term Investments

$10.3

$17.9

$20.8

Employees

497

492

466

1 Based on weighted average number of

shares outstanding.

2 Adjusted Earnings Per Share and Adjusted

EBITDA do not have a standardized meaning under IFRS and therefore

may not be comparable to similar measures provided by other

issuers. See “Adjusted EBITDA and Adjusted Earnings (Loss) Per

Share” below.

3 Earnings and Adjusted Earnings Per Share

include non-cash share-based compensation of $(0.1) million or

$(0.00) per share for the three months ended December 31, 2021, and

$(1.2) million or $(0.05) per share for the three months ended

December 31, 2020. The non-cash share-based compensation primarily

reflects certain performance-based vesting thresholds achieved

under the Company’s Performance Share Unit Plan.

4 Earnings and Adjusted Earnings Per Share

include foreign exchange loss of $(0.1) million or $(0.00) per

share for the three months ended December 31, 2021, and foreign

exchange loss of $(1.2) million or $(0.05) per share for the three

months ended December 31, 2020.

“Vecima’s momentum accelerated to the next level in the second

quarter as surging demand for our industry-leading Entra

Distributed Access Architecture (DAA) and MediaScaleX IPTV

solutions drove year-over-year organic sales growth of 47% and

resulted in consolidated revenue of $43.6 million, the best

quarterly sales result in Vecima’s 33-year history,” said Sumit

Kumar, Vecima’s President and Chief Executive Officer.

“Our phenomenal top-line performance carried through with

leverage to our bottom line, with second quarter adjusted EBITDA

nearly tripling year-over-year to $7.4 million or 17.1% of sales,

gross profit climbing 48% to $21.8 million, and adjusted earnings

per share growing to $0.06. These are significant achievements that

reflect not only the rapidly growing demand for our next-generation

products, but also our disciplined approach to OpEx, inventory and

supply chain management in a period of supply challenges

never-before-seen across the tech sector.”

“As anticipated, second quarter results were led by our Video

and Broadband Solutions segment and a record quarter for our Entra

DAA portfolio,” added Mr. Kumar. “Despite ongoing supply chain

hurdles, Entra revenue grew 130% year-over-year to $18.5 million as

we continued to deploy with a growing roster of Tier 1, 2, and 3

customers. A wide array of broadband service providers have begun

their transition to Distributed Access Architecture, with Vecima’s

pioneering and market-leading DAA technology underpinning the

evolution to the multi-gigabit broadband internet era. Our Content

Delivery and Storage segment added to the momentum, setting a new

quarterly segment record of $15.0 million on robust demand across

the full MediaScaleX IPTV product family.”

“While it was already a ground-breaking quarter for Vecima, I

want to emphasize that the cable and broadcast industries are still

in the early stages of the transformative shift to Distributed

Access Architecture and IPTV. We see significantly greater growth

potential ahead, including multiple investment cycles for our

industry-leading platforms. Accordingly, as we begin to capture the

rewards of the first wave of network transformations, we are

already investing in the next. This includes not only the numerous

new products and feature enhancements we introduced in the second

quarter, but also importantly, future-defining advancements we are

making, such as our recent DOCSIS 4.0 milestone with Charter

Communications. We demonstrated industry-first and leading

multi-gigabit symmetrical broadband speeds over widely-deployed and

highly-leverageable coaxial cable infrastructure, making 10G a

reality.”

“I am pleased to report that we ended the second half in very

strong financial shape, with $10.3 million of cash, working capital

of $42.5 million, and virtually no debt. Our strong balance sheet,

strategic investment in growth inventory, and available liquidity

positions us to continue supporting our rapid growth and

next-generation technology development as we pursue the truly

outstanding opportunities in the worldwide DAA and IPTV markets,”

said Mr. Kumar.

BUSINESS HIGHLIGHTS

Video and Broadband Solutions (VBS)

The VBS segment delivered exceptional revenue performance of

$27.2 million, up 65% year-over-year and 12% quarter-over-quarter

as customers continued to transition to next-generation networks

using Vecima’s platforms.

DAA (Entra family)

- Deployments of next-generation Entra DAA products grew to a

record $18.5 million, up 130% year-over-year and 2%

quarter-over-quarter

- Total customer engagements for Entra increased to 80 MSOs

worldwide, from 77 at the end of Q1 fiscal 2022. Forty-three of

these customers have now ordered Entra products, up from 39 last

quarter

- Selected by GCI, Alaska’s largest telecommunications company,

to deliver multi-gigabit speed to its customers via the Entra 10G

EPON DAA solution

- Chosen by Wyandotte Municipal Services to provide an Entra 10G

EPON network as the cornerstone to this customer’s new

Fiber-to-the-Home (FTTH) offering

- Subsequent to the quarter-end, announced that Liberty Latin

America has selected the Entra Remote MACPHY DAA solution across

its properties to support its expansion to next-generation

ultra-broadband services

- Continued to expand Entra’s leading capabilities for the

future:

- In October, Vecima, in partnership with Charter Communications,

demonstrated the long-term hybrid fiber-coaxial (HFC) network

future with multi-gigabit DOCSIS 4.0. The demonstration achieved

industry-leading >8.5 Gbps downstream and >6 Gbps upstream

with 1.8 GHz DOCSIS 4.0 Frequency Division Duplexing (FDD)

- Launched the industry’s highest capacity Remote MACPHY module,

the Entra EMM324, at SCTE Cable-Tec Expo

- Announced the world’s first commercially available Generic

Access Platform (GAP) node, the EN9000, supporting Remote MACPHY

and 1.8 GHz DOCSIS 4.0 with up to four service groups

- Leveraged input from Vecima’s fast-growing roster of

DAA-deploying customers and engagements to add a broad set of

enhancements and features that further differentiate the Entra DAA

portfolio as customers ramp scale deployments and look to magnify

the many benefits of DAA

- Received high-profile industry recognition underscoring

Vecima’s market-leading position

- Highlighted by world-leading Tier 1 operators in the SCTE

Cable-Tec Expo keynote session as a leading next-generation vendor

and strategic partner, helping to enable the industry’s next leap

in broadband

- Subsequent to the quarter-end, Vecima was recognized by the

Dell’Oro Group as the industry’s market share leader in Remote

MACPHY and Remote Optical Line Terminal FTTH product groups

Commercial Video (Terrace

family)

- Commercial Video sales increased to $8.7M in the second

quarter, up 4% year-over-year and 42% quarter-over-quarter

- Terrace QAM sales grew to $4.9 million, an increase of 61%

year-over-year and 3% quarter-over-quarter, with the lead customer

continuing its scale hospitality program with the platform while

preparing for migration to TerraceIQ

- Terrace family sales contributed solid Q2 revenue of $3.8

million, a quarter-over-quarter increase of 178%

- Introduced additional IP streaming formats and DRM

functionality to our innovative next-generation TerraceIQ platform,

which further broadens support for unique customer-by-customer

needs for IPTV adaptation and distribution in commercial

premises

Content Delivery and Storage (CDS)

- Achieved record CDS sales of $15.0 million, up 27% from $11.8

million in the prior-year period and an increase of 121%

sequentially from $6.8 million in Q1 fiscal 2022

- Significantly expanded systems sales with multiple customers as

operators forge ahead and reap the benefits of IP video deployments

while rolling out to more subscribers:

- Secured largest IPTV network win to date for MediaScaleX

- Won new IPTV customer serving Eastern Canada

- Selected by Buckeye Broadband to replace a legacy Video on

Demand (VOD) network with Vecima’s MediaScaleX, offering a

next-generation IPTV architecture and migration path

- Subsequent to the quarter-end, Breezeline (formerly Atlantic

Broadband), announced that it has chosen MediaScaleX to power its

IPTV video delivery solution and accelerate the next-generation TV

experience to its subscribers

- In January 2022, successfully completed interoperability tests

for MediaScaleX as part of the Streaming Video Alliance (SVA) Open

Caching Initiative. This is a key step to enabling open caching

solutions to distribute over-the-top content at the highest

quality, working with Vecima’s customers and their over 100 million

subscribers worldwide

Telematics

- Multiple additional deployments in high-value verticals, such

as municipal government and moveable asset customers

- Added 12 new customers for the NERO asset tracking platform,

with number of moveable assets being monitored rising significantly

to over 16,000 units

- Achieved trailing 12-month adjusted EBITDA of $1.95M and

adjusted EBITDA margin of 35%

“As we move into the second half, we see a continued escalation

of the high demand for our products, tempered only by the

constraints of ongoing worldwide supply chain issues and materials

shortages,” said Mr. Kumar.

“With the industry’s strongest and most relevant portfolio of

DAA and cable access solutions, expanding relationships with 80

cable operators worldwide, and a growing volume of customer

purchase orders and forecasts providing excellent and high demand

visibility, we expect Entra family product orders to continue to

build through the balance of the year and remain our leading sales

generator in fiscal 2022.”

“In our Content Delivery and Storage segment, demand for our

IPTV solutions remains robust and we anticipate another strong

quarter in Q3. On a full-year basis, we continue to anticipate high

single-digit to low double-digit sales growth from this segment in

fiscal 2022.”

“We once again reiterate our caution that the significant

current global supply chain challenges could temper our growth and

margin potential in the near-term. However, the opportunities in

both the DAA and IPTV markets are enormous and Vecima is

exceptionally well-positioned to capitalize on them over an

expected multi-year cycle of investment into the broadband access

network,” concluded Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a

quarterly dividend of $0.055 per share for the period. The dividend

will be payable on March 28, 2022 to shareholders of record as at

February 25, 2022.

CONFERENCE CALL

A conference call and live audio webcast will be held today,

February 10, 2022 at 1 p.m. ET to discuss the Company’s second

quarter results. Vecima’s unaudited interim condensed consolidated

financial statements and management’s discussion and analysis for

the three and six months ended December 31, 2021 are available

under the Company’s profile at www.SEDAR.com, and at

https://vecima.com/investor-relations/financial-reports/.

To participate in the teleconference, dial 1-800-319-4610 or

1-604-638-9020. The webcast will be available in real time at

http://services.choruscall.ca/links/vecima20220210.html and will be

archived on the Vecima website at

https://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing

integrated hardware and scalable software solutions for broadband

access, content delivery, and telematics. We enable the world's

leading innovators to advance, connect, entertain, and analyze. We

build technologies that transform content delivery and storage,

enable high‑capacity broadband network access, and streamline data

analytics. For more information, please visit our website at

www.vecima.com.

Adjusted EBITDA and Adjusted Earnings (Loss) Per

Share

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share do not

have a standardized meaning under IFRS and therefore may not be

comparable to similar measures provided by other issuers.

Accordingly, investors are cautioned that Adjusted EBITDA or

Adjusted Earnings (Loss) Per Share should not be construed as an

alternative to net income, determined in accordance with IFRS, as

an indicator of the Company’s financial performance or as a measure

of its liquidity and cash flows. For a reconciliation of Adjusted

EBITDA or Adjusted Earnings (Loss) Per Share, investors should

refer to Vecima’s Management’s Discussion and Analysis for the

second quarter of fiscal 2022.

Forward-Looking Statements

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information is generally identifiable by use of the words

“believes”, “may”, “plans”, “will”, “anticipates”, “intends”,

“could”, “estimates”, “expects”, “forecasts”, “projects” and

similar expressions, and the negative of such expressions.

Forward-looking information in this news release includes the

following statements: Vecima’s momentum accelerated to the next

level in the second quarter as surging demand; these are

significant achievements that reflect not only the rapidly growing

demand for our next-generation products, but also our disciplined

approach; as anticipated, second quarter results were led by our

Video and Broadband Solutions segment and a record quarter for our

Entra DAA portfolio; a wide array of broadband service providers

have begun their transition to Distributed Access Architecture,

with Vecima’s pioneering and market-leading DAA technology

underpinning the evolution to the multi-gigabit broadband internet

era; while it was already a ground-breaking quarter for Vecima, the

cable and broadcast industries are still in the early stages of the

transformative shift to Distributed Access Architecture and IPTV;

we see significantly greater growth potential ahead, including

multiple investment cycles for our industry-leading platforms; our

strong balance sheet, strategic investment in growth inventory, and

available liquidity positions us to continue supporting our rapid

growth and next-generation technology development as we pursue the

truly outstanding opportunities in the worldwide DAA and IPTV

markets; as we move into the second half, we see a continued

escalation of the high demand for our products, tempered only by

the contraints of ongoing worldwide supply chain issues and

materials shortages; with the industry’s strongest and most

relevant portfio of DAA and cable access solutions, expanding

relationships with 80 cable operators worldwide, and a growing

volume of customer purchase orders and forecasts providing

excellent and high demand visibility, we expect Entra family

product orders to continue to build through the balance of the year

and remain our leading sales generator in fiscal 2022; in our

Content Delivery and Storage segment, demand for our IPTV solutions

remains robust and we anticipate another strong quarter in Q3; on a

full-year basis, we continue to anticipate high single-digit to low

double-digit sales growth from this segment in fiscal 2022; we once

again reiterate our caution that the significant current global

supply chain challenges could temper our growth and margin

potential in the near-term; the opportunities in both the DAA and

IPTV markets are enormous and Vecima is exceptionally

well-positioned to capitalize on them over an expected multi-year

cycle of investment into the broadband access network.

A more complete discussion of the risks and uncertainties facing

Vecima is disclosed under the heading “Risk Factors” in the

Company’s Annual Information Form dated September 23, 2021, as well

as the Company’s continuous disclosure filings with Canadian

securities regulatory authorities available at www.sedar.com. All

forward-looking information herein is qualified in its entirety by

this cautionary statement, and Vecima disclaims any obligation to

revise or update any such forward-looking information or to

publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future

results, events or developments, except as required by law.

VECIMA NETWORKS INC.

Interim Condensed Consolidated

Statements of Financial Position

(unaudited – in thousands of Canadian

dollars)

As at

December 31, 2021

June 30, 2021

Assets

Current assets

Cash and cash equivalents

$

10,341

$

28,909

Accounts receivable

40,484

28,784

Income tax receivable

648

414

Inventories

24,967

15,578

Prepaid expenses

8,295

3,497

Contract assets

760

516

Total current assets

85,495

77,698

Non-current assets

Property, plant and equipment

15,652

13,854

Right-of-use assets

3,079

3,660

Goodwill

14,763

14,542

Intangible assets

73,932

72,224

Other long-term assets

1,355

1,267

Investment tax credits

24,110

24,344

Deferred tax assets

7,415

7,143

Total assets

$

225,801

$

214,732

Liabilities and shareholders’

equity

Current liabilities

Accounts payable and accrued

liabilities

$

33,030

$

22,259

Provisions

798

1,439

Income tax payable

209

454

Deferred revenue

7,440

7,137

Current portion of long-term debt

1,540

1,617

Total current liabilities

43,017

32,906

Non-current liabilities

Provisions

415

397

Deferred revenue

3,525

2,398

Deferred tax liability

4

4

Long-term debt

3,427

4,107

Total liabilities

50,388

39,812

Shareholders’ equity

Share capital

7,641

7,299

Reserves

3,074

3,407

Retained earnings

164,989

165,312

Accumulated other comprehensive loss

(291)

(1,098)

Total shareholders’ equity

175,413

174,920

Total liabilities and shareholders’

equity

$

225,801

$

214,732

VECIMA NETWORKS INC.

Interim Condensed Consolidated

Statements of Comprehensive Income (Loss)

(unaudited – in thousands of Canadian dollars, except per share

amounts)

Three months

Six months

Periods ended December 31,

2021

2020

2021

2020

Sales

$

43,587

$

29,673

$

75,982

$

56,996

Cost of Sales

21,767

14,964

38,460

29,652

Gross Profit

21,820

14,709

37,522

27,344

Operating expenses

Research and development

8,352

7,044

16,360

13,309

Sales and marketing

4,554

3,474

8,655

6,450

General and administrative

5,498

4,560

10,184

9,253

Share-based compensation

65

1,210

753

1,449

Other expense

13

3

19

-

Total operating expenses

18,482

16,291

35,971

30,461

Operating income (loss)

3,338

(1,582)

1,551

(3,117)

Finance (expense) income

(46)

2

(88)

165

Foreign exchange (loss) gain

(111)

(1,218)

996

(1,440)

Income (loss) before income

taxes

3,181

(2,798)

2,459

(4,392)

Income tax expense (recovery)

1,708

432

244

(367)

Net income (loss) from continuing

operations

1,473

(3,230)

2,215

(4,025)

Net income from discontinued

operations

-

112

-

69

Net income (loss)

$

1,473

$

(3,118)

$

2,215

$

(3,956)

Other comprehensive (loss)

income

Item that may be subsequently reclassed

to net income

Exchange differences on translating

foreign operations

(110)

(1,538)

807

(2,150)

Comprehensive income (loss)

$

1,363

$

(4,656)

$

3,022

$

(6,106)

Net income (loss) per share

Continuing operations - basic

$

0.06

$

(0.14)

$

0.10

$

(0.18)

Discontinued operations - basic

0.00

0.00

0.00

0.00

Total basic net income (loss) per

share

$

0.06

$

(0.14)

$

0.10

$

(0.18)

Continuing operations – diluted

$

0.06

$

(0.14)

$

0.10

$

(0.18)

Discontinued operations – diluted

0.00

0.00

0.00

0.00

Total diluted net income (loss) per

share

$

0.06

$

(0.14)

$

0.10

$

(0.18)

Weighted average number of common

shares

Shares outstanding - basic

23,076,376

22,733,716

23,065,194

22,607,863

Shares outstanding - diluted

23,110,051

22,733,716

23,102,412

22,607,863

VECIMA NETWORKS INC.

Interim Condensed Consolidated

Statements of Change in Equity

(unaudited – in thousands of Canadian

dollars)

Share capital

Reserves

Retained earnings

Accumulated other

comprehensive (loss) income

Total

Balance as at June 30, 2020

$

3,161

$

3,838

$

170,665

$

2,098

$

179,762

Net loss

-

-

(3,956)

-

(3,956)

Other comprehensive loss

-

-

-

(2,150)

(2,150)

Dividends

-

-

(2,500)

-

(2,500)

Shares issued by exercising options

3,016

(783)

-

-

2,233

PSUs settled in common shares

2,498

(2,498)

-

-

-

Withholding taxes on PSUs

(750)

(750)

Share-based payment expense

-

1,449

-

-

1,449

Balance as at December 31, 2020

$

7,925

$

2,006

$

164,209

$

(52)

$

174,088

Balance as at June 30, 2021

$

7,299

$

3,407

$

165,312

$

(1,098)

$

174,920

Net income

-

-

2,215

-

2,215

Other comprehensive income

-

-

-

807

807

Dividends

-

-

(2,538)

-

(2,538)

Shares issued by exercising options

439

(110)

-

-

329

PSUs settled in common shares

976

(976)

-

-

-

Withholding taxes on PSUs

(1,073)

-

-

-

(1,073)

Share-based payment expense

-

753

-

-

753

Balance as at December 31, 2021

$

7,641

$

3,074

$

164,989

$

(291)

$

175,413

VECIMA NETWORKS INC.

Interim Condensed Consolidated

Statements of Cash Flows

(unaudited – in thousands of Canadian

dollars)

Three months

Six months

Periods ended December 31,

2021

2020

2021

2020

OPERATING ACTIVITIES

Net income (loss) from continuing

operations

$

1,473

$

(3,230)

$

2,215

$

(4,025)

Adjustments for non-cash items:

Loss on sale of property, plant and

equipment

13

7

18

9

Depreciation and amortization

4,142

3,806

8,460

7,284

Share-based compensation

65

1,210

753

1,449

Income tax expense (recovery)

(13)

231

481

(346)

Deferred income tax (recovery) expense

1,721

199

(237)

(21)

Interest expense

46

56

96

113

Interest income

-

(59)

(8)

(147)

Net change in working capital

(5,085)

(2,496)

(13,710)

(1,027)

Increase in other long-term assets

(123)

(337)

(83)

(294)

(Decrease) increase in provisions

(679)

32

(656)

43

Increase in investment tax credits

(33)

(29)

(60)

(70)

Income tax received

164

174

164

174

Income tax paid

(304)

(370)

(579)

(494)

Interest received

2

60

10

148

Interest paid

(9)

(11)

(19)

(19)

Cash provided by discontinued

operations

-

269

-

168

Cash provided by (used in) operating

activities

1,380

(488)

(3,155)

2,945

INVESTING ACTIVITIES

Capital expenditures, net

(2,036)

(833)

(2,956)

(1,282)

Purchase of short-term investments

-

(57)

-

(141)

Proceeds from sale of short-term

investments

-

7,082

-

7,421

Deferred development costs

(3,692)

(3,728)

(7,765)

(7,070)

Business acquisition

-

-

-

(6,401)

Cash (used in) discontinued operations

-

(104)

-

(210)

Cash (used in) provided by investing

activities

(5,728)

2,360

(10,721)

(7,683)

FINANCING ACTIVITIES

Principal repayments of lease

liabilities

(380)

(470)

(787)

(824)

Repayment of long-term debt

(83)

(62)

(125)

(125)

Dividends paid

(2,538)

(2,500)

(2,538)

(2,500)

Issuance of shares through exercised

options

-

1,940

329

2,233

Withholding taxes on performance share

units

-

(750)

(1,073)

(750)

Cash used in discontinued operations

-

(21)

-

(42)

Cash used in financing activities

(3,001)

(1,863)

(4,194)

(2,008)

Net (decrease) increase in cash and cash

equivalents

(7,349)

9

(18,070)

(6,746)

Effect of change in exchange rates on

cash

(227)

428

(498)

265

Cash and cash equivalents, beginning of

period

17,917

10,432

28,909

17,350

Cash and cash equivalents, end of

period

$

10,341

$

10,869

$

10,341

$

10,869

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220210005405/en/

Vecima Networks Investor Relations - 250-881-1982

invest@vecima.com

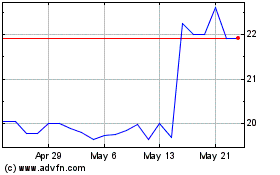

Vecima Networks (TSX:VCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vecima Networks (TSX:VCM)

Historical Stock Chart

From Nov 2023 to Nov 2024