Urbana Corporation Announces Updated Management and Advisory Agreement

December 06 2019 - 5:23PM

Urbana Corporation (“Urbana” or the “Corporation”) (TSX & CSE:

URB & URB.A) today announced that it has entered into an

updated management and advisory agreement (the “Updated Management

Agreement”) with its manager, Caldwell Investment Management Ltd.

(“CIM”).

The independent directors of the Corporation

(the “Independent Committee”) acting as a committee of the

Corporation’s Board reviewed and oversaw the negotiation of the

Updated Management Agreement, including the investment management

fees paid to CIM as the investment manager of Urbana thereunder.

The Independent Committee engaged Crosbie & Company Inc., an

independent financial advisory firm, to provide an analysis and

comparison of the investment management fees paid to CIM by Urbana

with arm’s length compensation arrangements for other investment

vehicles in Canada comparable to the Corporation. The Independent

Committee also had independent legal advice.

Following a recommendation of the Independent

Committee, the Board approved the Updated Management Agreement,

pursuant to which, effective January 1, 2020 (i) investment

management fees payable to CIM will increase from 1.5% to 2.0% of

the market value of the Corporation’s investment portfolio; (ii)

with the exception of normal course issuer bid purchases, CIM will

pay a fee to cover all charges for brokerage, trade execution and

other necessary investment-related services rendered directly or

indirectly for the benefit of the Corporation by Caldwell

Securities Ltd. (“CSL”); and (iii) termination requires 12 months

prior notice (previously 60 days), which notice, in the case of

CIM, cannot be provided until 2021. The

Independent Committee determined, based on among other factors

advice from Crosbie & Company Inc. that the updated Management

Agreement is reasonable to the shareholders of

Urbana.

Thomas S. Caldwell, the CEO and President, and a

director, of the Corporation who beneficially owns directly or

indirectly or exercises control or direction over approximately

44.4% of the outstanding Common Shares of the Corporation, is also

the owner of 38.5% of CIM and CSL and Urbana owns 20% of both CIM

and CSL.

A copy of the Updated Management Agreement will

be made available under the Corporation’s profile on SEDAR at

www.sedar.com.

For further information contact:Elizabeth

NaumovskiInvestor Relations(416)

595-9106

enaumovski@urbanacorp.com

Forward-Looking Statements

Certain statements in this news release constitute

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Urbana to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Unless required by

applicable securities law, Urbana does not assume any obligation to

update these forward-looking statements.

150 KING ST. W., SUITE 1702, TORONTO,

ONTARIO M5H 1J9 TEL:

416-595-9106 FAX: 416-862-2498

info@urbanacorp.com www.urbanacorp.com

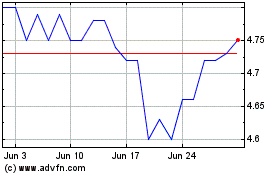

Urbana (TSX:URB.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

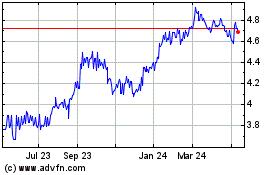

Urbana (TSX:URB.A)

Historical Stock Chart

From Nov 2023 to Nov 2024