Titan Announces Another Record Year for Production and Safety, Provides 2024 Guidance and Update on Kilbourne Graphite Target

February 20 2024 - 7:00AM

Titan Mining Corporation (TSX:TI) (“

Titan” or the

“

Company”) is pleased to release preliminary

fourth quarter (“

Q4”) and full year 2023

production results and provide 2024 operating, capital and

exploration expenditure guidance (all dollar figures are in US

dollars, unless otherwise indicated).

2023 Highlights

- Safest year of operations on record

at the Empire State Mine since re-opening, with an injury frequency

rate of 0.7, 70% lower than the national average.

- Produced a record 61.0 million

payable pounds of zinc in 2023, a 16 % increase over the record set

in 2022.

- Announced the discovery of the

Kilbourne graphite trend, an extensively drill tested

graphite-bearing trend located on permitted lands.

Don Taylor, Titan’s President and CEO,

commented, “The operating team at ESM delivered record production

exceeding guidance and producing 61 million payable pounds of zinc

while achieving the best safety performance since the mine

reopened. These are truly remarkable achievements and we expect

this performance to be reflected in our share price as the price of

zinc improves.”

Q4 and Full Year 2023 Preliminary

Production Results & 2024 Production Guidance

Total payable zinc production from the Company’s

Empire State Mine (“ESM”) was 13.9 million pounds in Q4 2023 for

total annual payable production of 61.0 million pounds, exceeding

guidance of 54-58 million pounds. 2023 production is preliminary

and subject to change when the Company releases its Q4 2023 and

audited full-year 2023 financial and operating results in March

2024.

Production guidance for 2024 is estimated

between 56-60 million pounds of payable zinc. C1 Cash

Cost1 for 2024 is estimated between $0.98 and $1.02 per

payable pound and AISC1 is estimated between $1.04 and $1.10 per

payable pound. Both C1 Cash Cost and AISC are highly dependent on

treatment charges which won’t be known with certainty until the end

of H1 2024. Titan estimates that for every $10 per tonne

change to the treatment charge, C1 Cash Cost1 and

AISC1 are impacted by approximately $0.01 per pound

of payable zinc. C1 Cash Cost and AISC guidance for 2024

reflect an estimated annual treatment charge of $175 per

tonne. Taylor continued, “As we enter 2024 market and price

challenges continue with respect to the zinc markets, we are

fortunate at ESM to have operational levers that we can pull to

further cut costs and meet forecasts.”

Exploration expenditures will be focused on

advancing the Kilbourne graphite trend and district targets where

ESM controls more than 80,000 acres of private mineral rights. The

timing and extent of the exploration program is contingent on

positive exploration results. The Company may allocate additional

funds beyond guidance as merited.

|

Production and Cost Guidance |

|

|

Units |

2024 |

|

Payable Production |

|

Zinc |

Mlbs |

56-60 |

|

Cost |

|

C1 cash cost1 |

$/lb |

0.98 - 1.02 |

|

AISC1 |

$/lb |

1.04 - 1.10 |

|

Capital |

|

Sustaining |

$ millions |

3 - 5 |

|

Exploration |

|

ESM |

$ millions |

2 - 3 |

1 C1 Cash Cost and AISC are non-GAAP measures.

Accordingly, these financial measures are not standardized

financial measures under IFRS and might not be comparable to

similar financial measures disclosed by other issuers. For

additional information, see the section titled “Non-GAAP

performance measures” of Titan’s MD&A dated November 14, 2023,

available on SEDAR+ at www.sedarplus.com, which section is

incorporated by reference herein.

Kilbourne Exploration

Update

The Company is pleased to provide an update on

the Kilbourne exploration program first announced on November 2,

2023 (Titan Mining Advances Kilbourne Exploration, With Surface

Trenching And Bulk Sample Identification Underway). A total of 99

samples were collected from 181 ft (55 m) of trenching with bedrock

exposed for later channel sampling in five trenches totaling over

1,000 ft (305 m) of exposed Kilbourne host rock. Drilling began in

December 2023 with eight holes totaling 2,074 ft (632 m) completed

to date. The Company’s Phase 1 drilling program contemplates an

additional 10,000 ft (3,048 m) of drilling. An initial bulk sample

was identified through these exploration activities and collected

in January 2024.

About Titan Mining

Corporation

Titan is an Augusta Group company which produces

zinc concentrate at its 100%-owned Empire State Mine located in New

York state. Titan is built for growth, focused on value and

committed to excellence. For more information on the Company,

please visit our website at www.titanminingcorp.com.

Contact

For further information, please contact:

Investor Relations: Email:

info@titanminingcorp.com

Cautionary Note Regarding

Forward-Looking Information

Certain statements and information contained in

this new release constitute "forward-looking statements", and

"forward-looking information" within the meaning of applicable

securities laws (collectively, "forward-looking statements"). These

statements appear in a number of places in this new release and

include statements regarding our intent, or the beliefs or current

expectations of our officers and directors, including that we

expect Titan’s performance at its Empire State Mine to be reflected

in our share price as the price of zinc improves; production

guidance; C1 Cash Cost guidance; AISC guidance; sustaining and

exploration capital guidance; estimates regarding the impact of

treatment charges on AISC and C1 cash costs; that exploration

expenditures will be focused on advancing the Kilbourne graphite

trend and district targets where ESM controls more than 80,000

acres of private mineral rights; and plans for the remainder of the

Kilbourne exploration program. When used in this news release words

such as “will”, “plans”, “intends” and similar expressions are

intended to identify these forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

the Company can give no assurance that such expectations will prove

to be correct. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to vary materially from those anticipated in such

forward-looking statements, including the risks, uncertainties and

other factors identified in the Company's periodic filings with

Canadian securities regulators. Such forward-looking statements are

based on various assumptions, including assumptions made with

regard to assumptions made regarding the ability to advance

exploration efforts at ESM; the results of such exploration

efforts; the ability to secure adequate financing (as needed); the

Company maintaining its current strategy and objectives; and the

Company’s ability to achieve its growth objectives. While the

Company considers these assumptions to be reasonable, based on

information currently available, they may prove to be incorrect.

Except as required by applicable law, we assume no obligation to

update or to publicly announce the results of any change to any

forward-looking statement contained herein to reflect actual

results, future events or developments, changes in assumptions or

changes in other factors affecting the forward-looking statements.

If we update any one or more forward-looking statements, no

inference should be drawn that we will make additional updates with

respect to those or other forward-looking statements. Readers

should not place undue importance on forward-looking statements and

should not rely upon these statements as of any other date. All

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

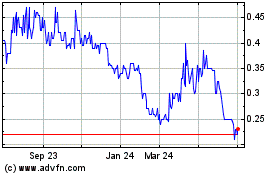

Titan Mining (TSX:TI)

Historical Stock Chart

From Nov 2024 to Dec 2024

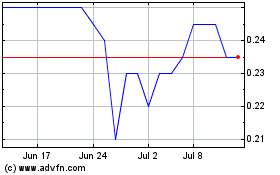

Titan Mining (TSX:TI)

Historical Stock Chart

From Dec 2023 to Dec 2024