Rogers Sugar Inc. (the “

Company” or

“

Rogers Sugar”) (TSX: RSI) announced today that it

has increased the size of its previously announced bought deal

public offering (the “

Offering”) to $100,000,000

aggregate principal amount of Eighth Series convertible unsecured

subordinated debentures (the “

Offered

Debentures”), which will be issued at an offering price of

$1,000 per Offered Debenture (the “

Offering

Price”). The Offered Debentures will bear interest at an

annual rate of 6.0% per annum, payable semi-annually on the last

day of June and December commencing on June 30, 2025. The Offered

Debentures will mature on June 30, 2030 (the “

Maturity

Date”).

The Offering is being made through a syndicate

of underwriters co-led by TD Securities Inc. and Scotiabank

(collectively, the “Underwriters”) on a bought

deal basis. The Offered Debentures will be convertible at the

holder’s option into common shares of the Company (the

“Debenture Shares”) at any time prior to 5:00 p.m.

(Montreal time) on the earlier of the business day immediately

preceding the Maturity Date and the business day immediately

preceding the date fixed by the Company for redemption of the

Offered Debentures, at a conversion price of $7.10 per Debenture

Share (the “Conversion Price”). The Offered

Debentures will not be redeemable prior to June 30, 2028. On or

after June 30, 2028 and prior to June 30, 2029, the Offered

Debentures may be redeemed in whole or in part from time to time at

the Company’s option, at a price equal to their principal amount

plus accrued and unpaid interest, provided that the weighted

average trading price of the common shares in the capital of the

Company on the Toronto Stock Exchange (the “TSX”)

for the 20 consecutive trading days ending on the fifth trading day

preceding the date upon which the notice of redemption is given is

at least 125% of the Conversion Price. On or after June 30, 2029

and prior to the Maturity Date, the Offered Debentures may be

redeemed in whole or in part from time to time at the Company’s

option at a price equal to their principal amount plus accrued and

unpaid interest.

The Company has granted to the Underwriters an

option (the “Over-Allotment Option”), exercisable

in whole or in part and at any time up to 30 days after the closing

of the Offering, to purchase up to an additional $15,000,000

aggregate principal amount of Offered Debentures (being up to 15%

of the aggregate principal amount of Offered Debentures sold in the

Offering) at the Offering Price, to cover over-allotments, if any,

and for market stabilization purposes. If the Over-Allotment Option

is exercised in full, the aggregate gross proceeds of the Offering

will be $115,000,000 .

The net proceeds of the Offering will be used to

reduce amounts outstanding under the credit facility of Lantic Inc.

(“Lantic”), a subsidiary of the Company, and for

general corporate purposes.

The Offered Debentures will be offered in each

of the provinces of Canada pursuant to a prospectus supplement to

the Company’s final short form base shelf prospectus dated August

14, 2023 (the “Shelf Prospectus”) that will be

filed by no later than February 12, 2025 (the

“Prospectus Supplement”). The Offering is expected

to close on or about February 19, 2025 and is subject to

certain conditions, including regulatory and TSX approval.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Offered Debentures and the Debenture Shares issuable upon

conversion of the Offered Debentures have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any state securities laws, and accordingly will not be

offered, sold or delivered, directly or indirectly within the

United States of America (“U.S.”), its possessions

and other areas subject to its jurisdiction or to, or for the

account or for the benefit of a U.S. person, except pursuant to

applicable exemptions from the registration requirements. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy securities in the United States,

nor shall there be any sale of the Offered Debentures in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

Delivery of the Prospectus Supplement, and any

amendments to the documents will be provided in accordance with

securities legislation relating to procedures for providing access

to a shelf prospectus supplement and any amendment. The Prospectus

Supplement will be (within two business days of the date hereof),

accessible on SEDAR+ at www.sedarplus.ca. An electronic or paper

copy of the Prospectus Supplement (when filed), and any amendment

to the documents may be obtained without charge, from TD Securities

Inc. at 1625 Tech Avenue, Mississauga, Ontario L4W 5P5 Attention:

Symcor, NPM, or by telephone at (289) 360-2009 or by email at

sdcconfirms@td.com by providing the contact with an email address

or address, as applicable. The Shelf Prospectus, Prospectus

Supplement and the documents incorporated therein contain

important, detailed information about the Company and the proposed

Offering. Prospective investors should read these documents before

making an investment decision.

Cautionary Statement Regarding Forward

Looking Information

All statements, other than statements of

historical fact, contained in this press release including, but not

limited to those relating to the Offering, the expected use of

proceeds, the anticipated closing date of the Offering, and the

receiving of all necessary regulatory approvals, constitute

“forward-looking information” or “forward-looking statements”

within the meaning of certain securities laws, and are based on

expectations, estimates and projections as of the time of this

press release. Forward-looking statements are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by the Company as of the time of such statements, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. These estimates and

assumptions may prove to be incorrect. Many of these uncertainties

and contingencies can directly or indirectly affect, and could

cause, actual results to differ materially from those expressed or

implied in any forward-looking statements. Certain important

estimates or assumptions by the Company in making forward-looking

statements include, but are not limited to, the successful closing

of the Offering, and all requisite regulatory and stock exchange

approvals being obtained. There can be no assurance that these

assumptions will prove to be correct. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements.

Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. The Company does not undertake

any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

About Rogers Sugar Inc.

Rogers Sugar is a corporation established under

the laws of Canada. The Company holds all of the common shares of

Lantic, and its administrative office is in Montréal, Québec.

Lantic has been refining sugar for 135 years and operates cane

sugar refineries in Montreal, Québec and Vancouver, British

Columbia, as well as the only Canadian sugar beet processing

facility in Taber, Alberta. Lantic also operates a distribution

center in Toronto, Ontario. Lantic’s sugar products are mainly

marketed under the “Lantic” trademark in Eastern Canada, and the

“Rogers” trademark in Western Canada and include granulated, icing,

cube, yellow and brown sugars, liquid sugars and specialty syrups.

Lantic owns all of the shares of The Maple Treat Company

(“TMTC”) and its head office is located in

Montréal, Québec. TMTC operates bottling plants in Granby,

Dégelis and St-Honoré-de-Shenley, Québec and in Websterville,

Vermont. TMTC’s products include maple syrup and derived maple

syrup products supplied under retail private label brands in

approximately 50 countries and are sold under various brand names.

The Company’s goal is to offer the best quality sugars and

sweeteners to satisfy its customers.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Mr. Jean-Sébastien CouillardVice President of

Finance, Chief Financial Officer & Corporate SecretaryTel:

(514) 940-4350

investors@lantic.ca Website:

www.lanticrogers.com

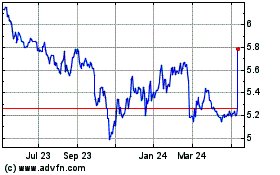

Rogers Sugar (TSX:RSI)

Historical Stock Chart

From Feb 2025 to Mar 2025

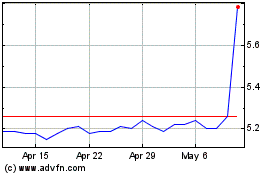

Rogers Sugar (TSX:RSI)

Historical Stock Chart

From Mar 2024 to Mar 2025